Press release

Rising Demand For Homeownership Fuels Growth In The Loan Broker Market: A Significant Driver Propelling The Loan Brokers Market In 2025

The Loan Brokers Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Loan Brokers Market Size and Projected Growth Rate?

The loan brokers market is experiencing rapid growth, with a projected increase from $287.26 billion in 2024 to $328.22 billion in 2025, at a CAGR of 14.3%. This growth is driven by the rising demand for homeownership, growth in the housing market, changes in financial regulations, increasing transparency in lending practices, and fluctuations in housing prices.

The loan brokers market is expected to see rapid growth, projected to reach $555.12 billion by 2029 at a CAGR of 14.0%. This growth is driven by changes in lending regulations, property value fluctuations, consumer borrowing behaviors, and new laws impacting loan processes. Major trends include the adoption of digital platforms, blockchain for enhanced security and transparency, greater data privacy regulations, and increased preference for online and mobile services.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=17188

What Are the Major Segments in the Loan Brokers Market?

The loan brokers market covered in this report is segmented -

1) By Component: Products, Services

2) By Enterprise Size: Large Enterprise, Small And Medium-Sized Enterprises

3) By Application: Home Loans, Commercial And Industrial Loans, Vehicle Loans, Loans To Governments, Other Applications

4) By End User: Businesses, Individuals

Subsegments:

1) By Products: Mortgage Products, Personal Loan Products, Business Loan Products, Auto Loan Products

2) By Services: Loan Consultation Services, Loan Origination Services, Loan Processing Services, Loan Negotiation Services

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=17188&type=smp

What Are The Driving Loan Brokers Market Evolution?

The growing demand for homeownership is expected to drive the loan broker market. With factors like low mortgage rates, remote work, and rising rental costs, more people are seeking to buy homes. Loan brokers play a key role in helping buyers navigate the complex mortgage market. The US Census Bureau reported a slight increase in homeownership in 2023, further driving the demand for loan broker services.

Which Firms Dominate The Loan Brokers Market Segments?

Major companies operating in the loan brokers market are Macquarie Group Limited, Social Finance Inc.(SoFi), Credit Karma Inc., Quicken Loans LLC, United Wholesale Mortgage, Guild Mortgage, American Pacific Mortgage Corp., LendingTree Inc., Lendio Inc., BlueVine Inc., Balboa Capital Corp., Funding Circle Ltd., Avant LLC, OnDeck Capital Inc., Rapid Finance Pvt. Ltd., Fundbox Inc., Credibly LLC, National Business Capital & Services, Fundera Inc., LendStreet Financial Inc., QuarterSpot Inc.

What Are the Major Trends Shaping the Loan Brokers Market?

Leading entities in the loan broker market such as LoanDepot are prioritizing the development of innovative solutions like digital verification processes to simplify and hasten the loan validation process for potential homeowners. Utilizing technology for electronic confirmation of a loan applicant's financial background and identification expedites and eases the loan validation process. To illustrate, in December 2023, the US-based mortgage firm LoanDepot rolled out MelloNow, an entirely automated underwriting system that transforms loan processing through instantaneous borrower conditions generation. Its state-of-the-art digital verification engine quickly reviews credit histories, identifies potential fraud, and confirms income and employment data at the time of purchase. This groundbreaking technology eliminates the typical holdups and complications associated with traditional loan assessment and approval methods. Fast-tracking these procedures not only boosts the lending process but also elevates the overall standard of loans, delivering a more effective, secure, and dependable underwriting experience for lenders and borrowers alike.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/loan-brokers-global-market-report

Which Is The Largest Region In The Loan Brokers Market?

Asia-Pacific was the largest region in the loan brokers market in 2023. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the loan brokers market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Loan Brokers Market?

2. What is the CAGR expected in the Loan Brokers Market?

3. What Are the Key Innovations Transforming the Loan Brokers Industry?

4. Which Region Is Leading the Loan Brokers Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Demand For Homeownership Fuels Growth In The Loan Broker Market: A Significant Driver Propelling The Loan Brokers Market In 2025 here

News-ID: 4039353 • Views: …

More Releases from The Business Research Company

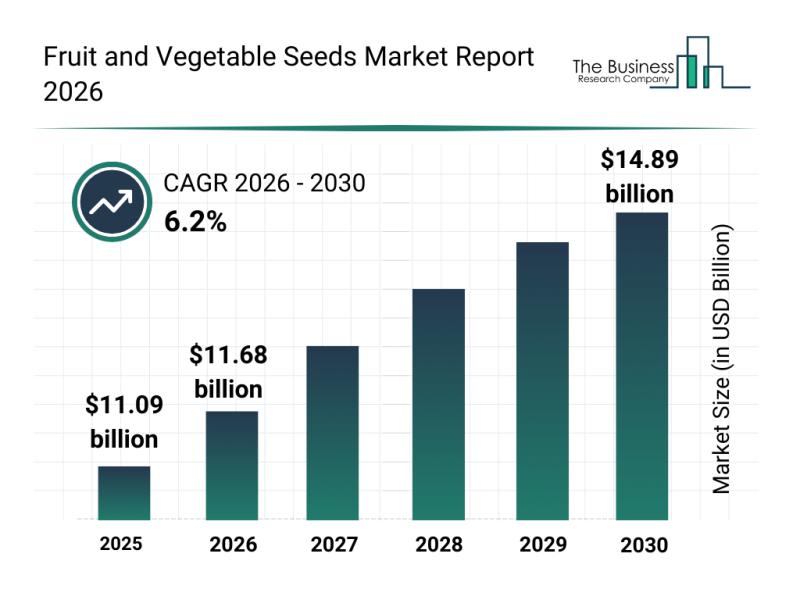

Emerging Sub-Segments Transforming the Fruit and Vegetable Seeds Market Landscap …

The fruit and vegetable seeds market is positioned for notable expansion over the coming years as agricultural practices evolve to meet new challenges and consumer demands. Driven by advances in biotechnology and growing environmental concerns, this market is set to reach significant valuation milestones by 2030. Below is an overview of its expected growth, leading players, emerging trends, and market segmentation.

Projected Growth and Market Size of the Fruit and Vegetable…

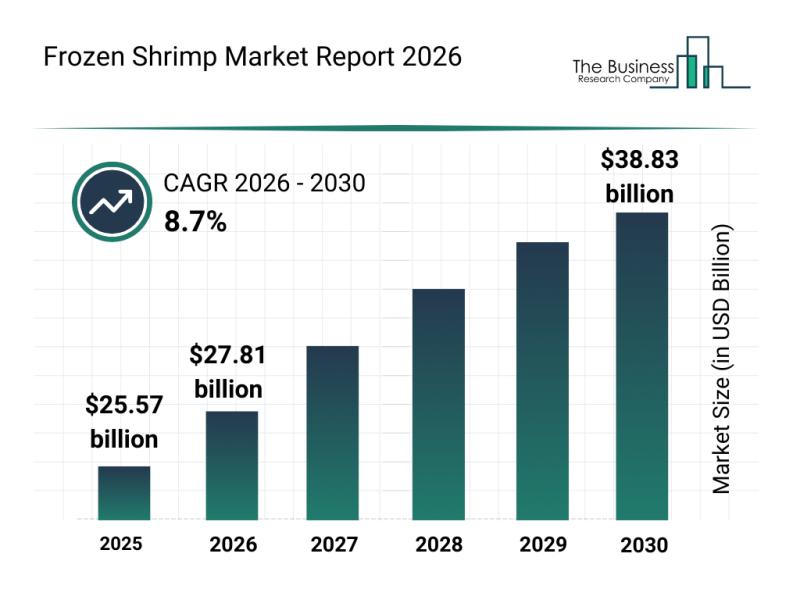

Emerging Growth Patterns Driving Expansion in the Frozen Shrimp Market

The frozen shrimp market is on track for substantial expansion as demand for convenient and sustainable seafood options continues to rise globally. Advances in production, logistics, and regulatory frameworks are shaping the industry's trajectory, while new product innovations and growing consumer awareness are opening fresh avenues for growth. Let's explore the current market size, key players, trends, and segmentation within this evolving sector.

Frozen Shrimp Market Size and Growth Outlook Through…

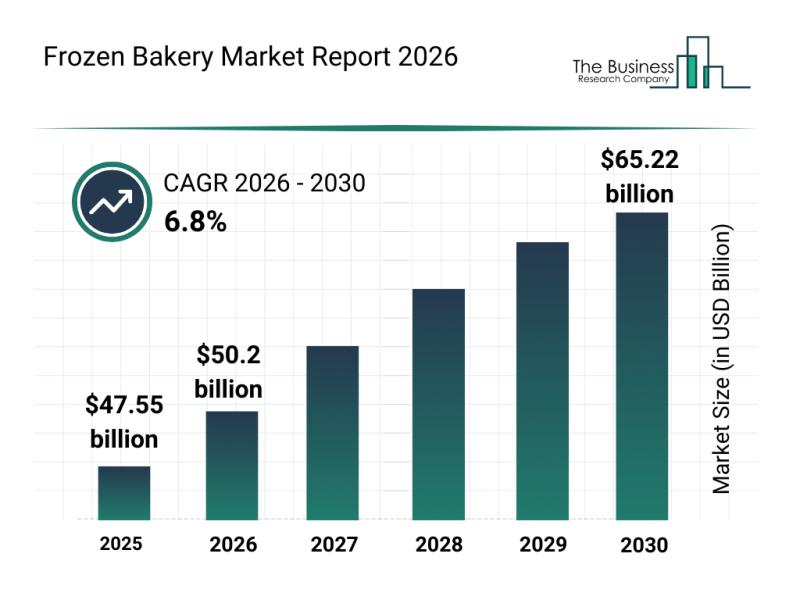

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Fr …

The frozen bakery market is poised for impressive expansion over the coming years, driven by evolving consumer lifestyles and shifting preferences. As convenience and quality become increasingly important, this sector is adapting with innovative offerings and enhanced distribution methods. Let's explore the market size projections, key players, notable trends, and the main segments shaping the future of frozen bakery products.

Forecasted Growth and Size of the Frozen Bakery Market

The…

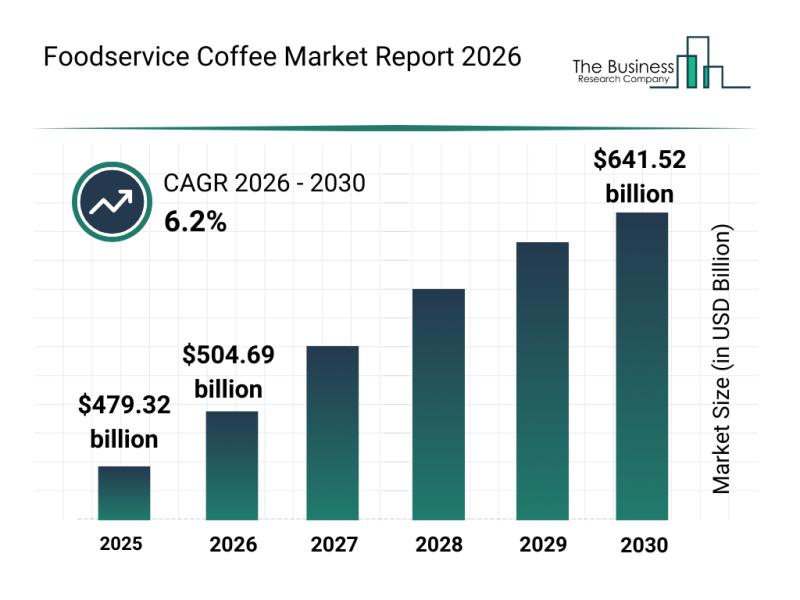

Key Players and Competitive Dynamics in the Foodservice Coffee Market

The foodservice coffee sector is poised for impressive expansion over the coming years, driven by evolving consumer preferences and technological advancements. As coffee culture continues to flourish globally, this market is adapting rapidly to meet new demands. Let's explore the current market size, influential players, and emerging trends shaping the future of foodservice coffee.

Forecasted Market Size and Growth Trajectory of the Foodservice Coffee Market

The foodservice coffee market is…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…