Press release

Global Enterprise Asset Leasing Market Outlook 2025-2034: Trends, Innovations, And Future Outlook

The Enterprise Asset Leasing Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Enterprise Asset Leasing Market Size and Projected Growth Rate?

The enterprise asset leasing market size has grown rapidly in recent years. It will grow from $1103.27 billion in 2024 to $1239.52 billion in 2025 at a compound annual growth rate (CAGR) of 12.3%. The growth in the historic period can be attributed to cost efficiency, regulatory compliance, operational flexibility, expansion into new markets, and increasing adoption across industries.

The enterprise asset leasing market is projected to grow rapidly, reaching $1951.56 billion by 2029, at a CAGR of 12.0%. This expansion is driven by growth in emerging markets, a shift towards subscription-based models, a greater focus on cybersecurity for leased assets, and innovations in lease financing. Major trends include the integration of renewable energy and sustainable technologies, the use of AI and IoT for asset management, growth in leasing specialized industrial equipment, adoption of blockchain for transparent lease agreements, and a focus on cybersecurity measures.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18597

What Are the Major Segments in the Enterprise Asset Leasing Market?

The enterprise asset leasing market covered in this report is segmented -

1) By Asset Type: Commercial Vehicles, Machinery And Industrial Equipment, Real Estate, Information Technology (IT) Equipment, Other Asset Types

2) By Leasing Type: Operating Lease, Financial Lease

3) By Enterprise Size: Large Enterprises, Small And Medium Enterprises

4) By Industry Vertical: Transportation And Logistics, Manufacturing, Construction, Information Technology (IT) And Telecommunications, Government And Public Sector, Other Industry Verticals

Subsegments:

1) By Commercial Vehicles: Leasing Of Trucks And Lorries, Leasing Of Vans And Light Commercial Vehicles, Leasing Of Heavy-Duty Vehicles, Leasing Of Refrigerated Vehicles, Leasing Of Electric Commercial Vehicles

2) By Machinery And Industrial Equipment: Leasing Of Construction Equipment, Leasing Of Agricultural Machinery, Leasing Of Manufacturing Equipment, Leasing Of Material Handling Equipment, Leasing Of Mining And Excavation Equipment

3) By Real Estate: Leasing Of Office Spaces, Leasing Of Industrial And Warehouse Properties, Leasing Of Retail Spaces, Leasing Of Residential Properties For Corporate Use, Leasing Of Mixed-use Properties

4) By Information Technology (It) Equipment: Leasing Of Computers And Workstations, Leasing Of Servers And Data Center Equipment, Leasing Of Networking Equipment, Leasing Of Office Electronics, Leasing Of Software And It Infrastructure

5) By Other Asset Types: Leasing Of Aircraft, Leasing Of Marine Vessels, Leasing Of Healthcare Equipment, Leasing Of Tools And Equipment For Specialized Industries, Leasing Of Renewable Energy Equipment

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18597&type=smp

What Are The Driving Enterprise Asset Leasing Market Evolution?

The increasing demand for commercial vehicles is anticipated to accelerate the growth of the enterprise asset leasing market in the coming years. Commercial vehicles are used to transport goods or passengers for business purposes and play a crucial role in sectors like logistics, transportation, construction, and public services. The demand for these vehicles is driven by factors such as urbanization, industrial growth, and the increasing need for goods and services. Enterprise asset leasing supports the commercial vehicle sector by offering flexible financing options that allow businesses to acquire and maintain fleets without hefty upfront costs. For instance, in April 2023, the International Energy Agency (IEA) reported that nearly 66,000 electric buses and 60,000 medium- and heavy-duty trucks were sold worldwide in 2022, accounting for 4.5% and 1.2% of global sales, respectively. China led the market with 54,000 electric buses and 52,000 trucks, making up 80% and 85% of global sales, respectively. Therefore, the rising demand for commercial vehicles is driving the enterprise asset leasing market.

Which Firms Dominate The Enterprise Asset Leasing Market Segments?

Major companies operating in the enterprise asset leasing market are General Electric Company, John Deere Financial, BNP Paribas SA, Komatsu Financial LP, Liebherr-International Deutschland GmbH, Wells Fargo & Company, Orix Corporation, LeasePlan Corporation N.V., United Rentals Inc., Deutsche Leasing AG, Fifth Third Bank, Ashtead Group plc, Bohai Leasing Co. Ltd., Herc Rentals Inc., Caterpillar Financial Services Corporation, CIT Group Inc., De Lage Landen International BV, Maxim Crane Works L.P., Ahern Rentals Inc., Marlin Business Services Corp., BlueLine Rental, Mitsubishi HC Capital Inc., Mexarrend S.A.P.I. de C.V., ICBC Financial Leasing Co. Ltd

What Trends Are Driving Growth in The Enterprise Asset Leasing Market?

Leading firms in the enterprise asset leasing market are now pivoting towards advanced financing solutions such as comprehensive leasing packages. These packages serve as a more attractive, hassle-free, and cost-efficient way for customers to manage their assets. Such packages provide a full range of services like maintenance, repairs, and insurance under a single lease payment, enhancing convenience for the client. Taking the example of Volvo Construction Equipment, a construction solution firm based out of Sweden, the company introduced a novel leasing option for its electric compact equipment in October 2022. Volvo Financial Services (VFS), available in the US and Canada, provides this comprehensive leasing package. This groundbreaking financing solution simplifies ownership by including charging, maintenance, repairs, and extended coverage, with potential savings up to 15% compared to the cost of individual purchases. The package's main aspects entail an equipment maintenance plan, supplementary repair coverage exceeding the factory warranty, optional physical damage insurance in the US, and the option to include a charger in the lease terms, leading to a unified monthly payment.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/enterprise-asset-leasing-global-market-report

Which Is The Largest Region In The Enterprise Asset Leasing Market?

North America was the largest region in the enterprise asset leasing market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the enterprise asset leasing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Enterprise Asset Leasing Market?

2. What is the CAGR expected in the Enterprise Asset Leasing Market?

3. What Are the Key Innovations Transforming the Enterprise Asset Leasing Industry?

4. Which Region Is Leading the Enterprise Asset Leasing Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Enterprise Asset Leasing Market Outlook 2025-2034: Trends, Innovations, And Future Outlook here

News-ID: 4037522 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

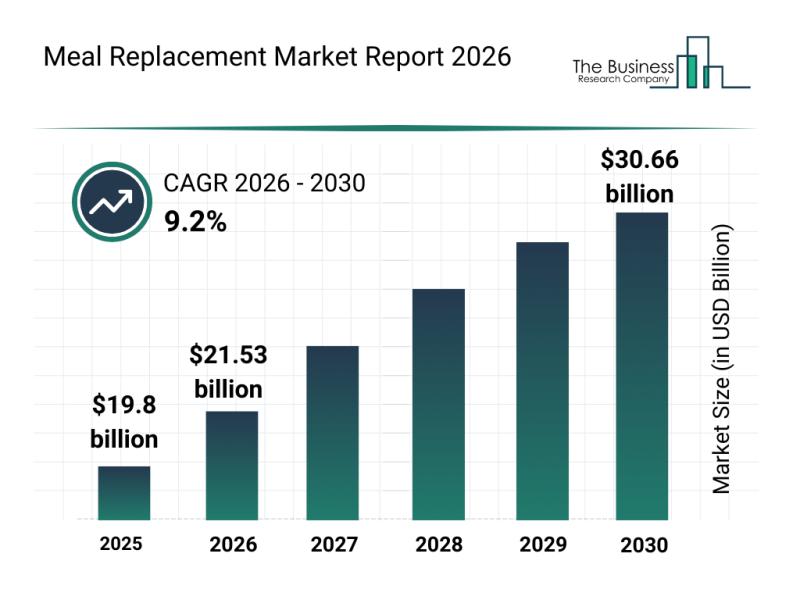

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

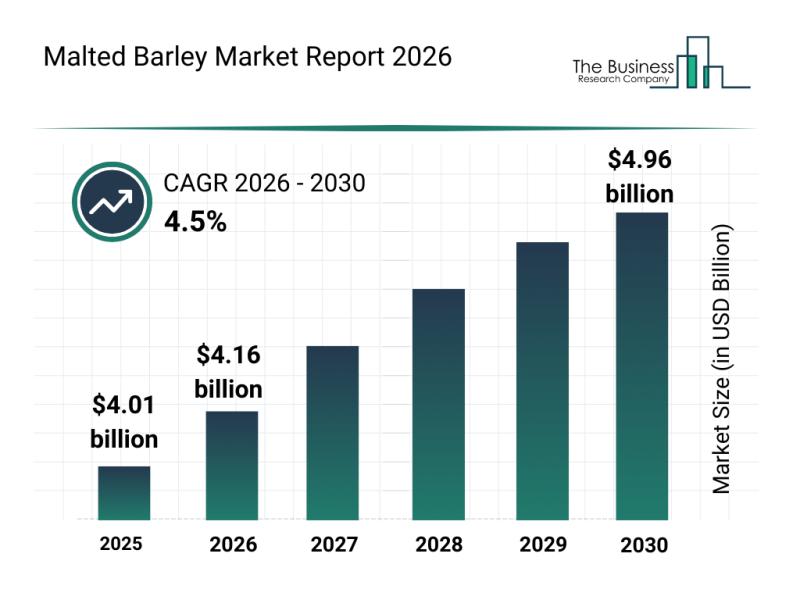

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

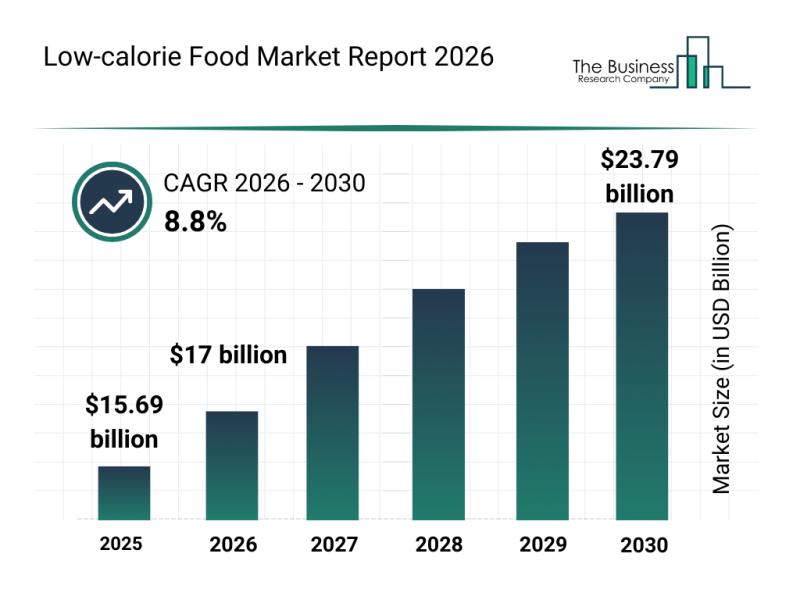

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

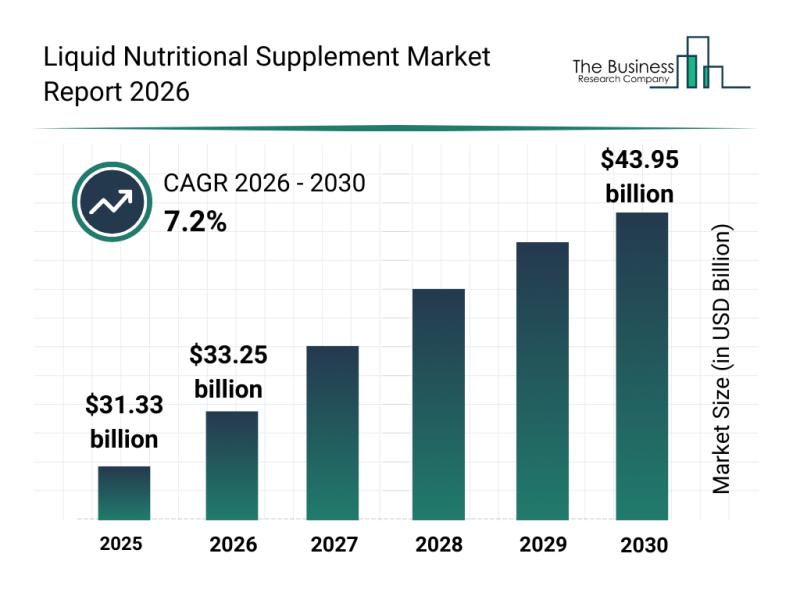

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for Leasing

Financial Leasing Market: A Compelling Long-Term Growth Story | Minsheng Financi …

The latest 94+ page survey report on Financial Leasing Market is released by HTF MI covering various players of the industry selected from global geographies like North America, US, Canada, Mexico, Europe, Germany, France, U.K., Italy, Russia, Nordic Countries, Benelux, Rest of Europe, Asia, China, Japan, South Korea, Southeast Asia, India, Rest of Asia, South America, Brazil, Argentina, Rest of South America, Middle East & Africa, Turkey, Israel, Saudi Arabia,…

Financial Leasing Market 2019 Global Major Players: CDB Leasing, ICBC Financial …

The Global Financial Leasing Industry, 2019-2024 Market Research Report is a professional and in-depth study on the current state of the Global Financial Leasing industry with a focus on the Global market. The report provides key statistics on the market status of the Financial Leasing manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

The report displays significant strategies which are…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=177516

Over the next five years, RRI…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

Oct 2018, New York USA (News) - A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report:…

Financial Leasing Market by Top Key Participant CDB Leasing, ICBC Financial Leas …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Get Sample Copy of this Report @ https://www.researchbeam.com/global-financial-leasing-by-manufacturers-countries-type-and-application-forecast-to-2023-market/request-sample?utm_source=Anil

Scope of the Report:

This report studies the Financial Leasing market…