Press release

Impact Of Increased Demand For High-Yield Investments On Collateralized Loan Obligations: An Emerging Driver Transforming The Collateralized Loan Obligation Market Landscape

The Collateralized Loan Obligation Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Projected Growth of the Collateralized Loan Obligation Market?

The collateralized loan obligation market has experienced rapid growth in recent years. It will increase from $1413.75 billion in 2024 to $1615.41 billion in 2025, reflecting a CAGR of 14.3%. This growth can be attributed to the increasing desire for sustainable investments, a higher number of prospective trading partners, more trace trading, and rising demand for alternative investment products.

The collateralized loan obligation market will grow to $2718.41 billion by 2029, with a CAGR of 13.9%. Factors like increased demand for governance-compliant CLOs and growth in leveraged loan markets contribute to this. Trends include innovation in CLO structures, developments in blockchain, and machine learning.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18538

What Are the Different Collateralized Loan Obligation Market Segments?

The collateralized loan obligation market covered in this report is segmented -

1) By Type: Investment Grade, Non-Investment Grade, Equity Investment Grade

2) By Investor Base: Bank, Asset Manager, Insurance And Pensions, Hedge Funds, Other Investor Bases

3) By Sector: Technology, Healthcare, Services, Financial, Industrials, Housing, Food And Beverages, Paper And Packaging, Transportation, Other Sectors

Subsegments

1) By Investment Grade: Senior Tranches, Mezzanine Tranches

2) By Non-Investment Grade: Subordinated Tranches, Junior Tranches

3) By Equity Investment Grade: Equity Tranches With Investment Grade Rating, Equity Tranches With Higher Yield

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18538&type=smp

What Are the Primary Drivers Shaping the Collateralized Loan Obligation Market?

The growing demand for high-yield investments is expected to drive the growth of the collateralized loan obligation (CLO) market. Investors seeking higher returns are increasingly turning to high-yield investments, which offer greater potential rewards, albeit with higher risk. CLOs provide a way to enhance investment returns and diversify portfolios. For example, the Bureau of Economic Analysis reported a significant rise in foreign direct investment in the US in 2022, reflecting a broader interest in high-yield investment opportunities and CLOs.

Which Companies Are Leading in the Collateralized Loan Obligation Market?

Major companies operating in the collateralized loan obligation market are JPMorgan Chase & Co., Wells Fargo & Company, Citigroup Inc., Prudential Financial Inc., Morgan Stanley, BNP Paribas S.A., Mitsubishi UFJ Financial Group Inc., Deutsche Bank AG, Barclays PLC, BlackRock Inc., Credit Suisse Group AG, Blackstone Inc., Jefferies Financial Group Inc., Ares Management Corporation, Neuberger Berman Group LLC, RBC Capital Markets LLC, Natixis S.A., HPS Investment Partners LLC, Conning Inc., CIFC Asset Management LLC, Brigade Capital Management LP, GreensLedge Capital Markets LLC, Panagram Structured Asset Management LLC

What Trends Are Expected to Dominate the Collateralized Loan Obligation Market in the Next 5 Years?

Companies in the collateralized loan obligation market are innovating new structures, such as exchange-traded funds (ETFs), to optimize risk-return profiles. For example, in July 2023, Panagram Structured Asset Management, LLC, a US-based investment advisor, launched two CLO ETFs: the Panagram AAA CLO ETF (CLOX) and the Panagram BBB-B CLO ETF (CLOZ). These funds provide investors with diversified exposure to CLOs while targeting different credit ratings and investment strategies.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/collateralized-loan-obligation-global-market-report

What Are the Top Revenue-Generating Geographies in the Collateralized Loan Obligation Market?

North America was the largest region in the collateralized loan obligation market in 2024. The regions covered in the collateralized loan obligation market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Collateralized Loan Obligation Market?

2. What is the CAGR expected in the Collateralized Loan Obligation Market?

3. What Are the Key Innovations Transforming the Collateralized Loan Obligation Industry?

4. Which Region Is Leading the Collateralized Loan Obligation Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Impact Of Increased Demand For High-Yield Investments On Collateralized Loan Obligations: An Emerging Driver Transforming The Collateralized Loan Obligation Market Landscape here

News-ID: 4034983 • Views: …

More Releases from The Business Research Company

In-Depth Examination of Segments, Industry Developments, and Key Players in the …

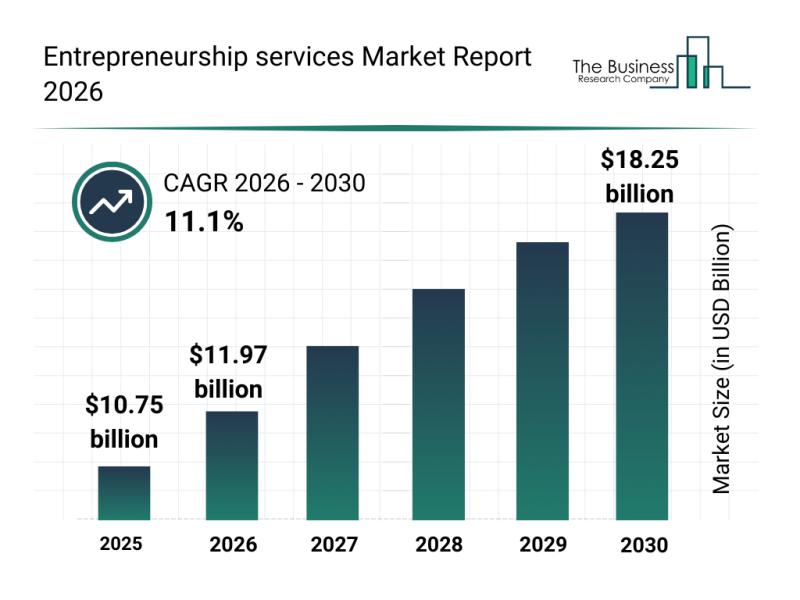

The entrepreneurship services sector is experiencing significant momentum as the global startup landscape evolves rapidly. Driven by technological advancements and increasing support for new ventures, this market is set to expand substantially over the coming years. Let's explore the current market valuation, key players, emerging trends, and various service segments shaping this dynamic industry.

Projected Growth and Market Size of the Entrepreneurship Services Market

The entrepreneurship services market is poised…

Competitive Analysis: Key Market Leaders and Emerging Companies in the Electroni …

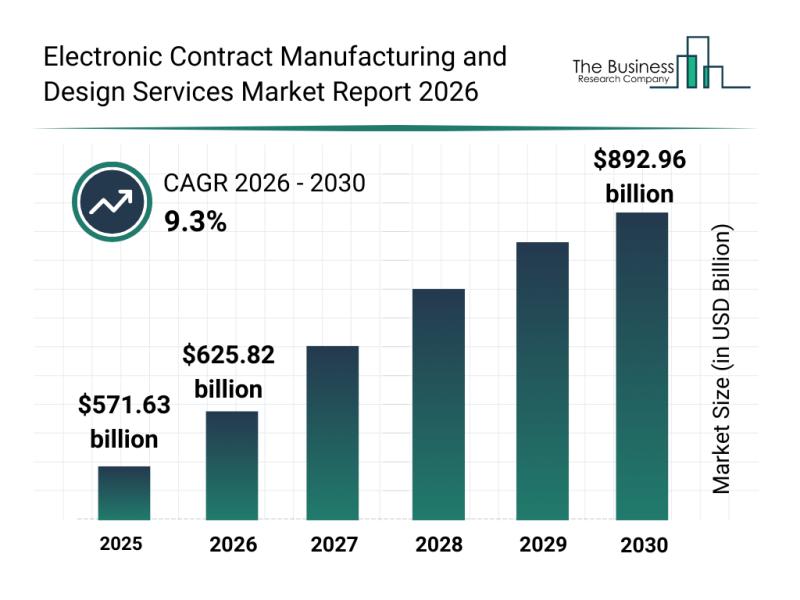

The electronic contract manufacturing and design services sector is set for remarkable expansion in the coming years. Driven by rapid technological advancements and evolving industry demands, this market is poised to reach new heights by 2030. Understanding its future valuation, key players, and emerging trends offers valuable insight into how this industry is shaping the global electronics landscape.

Projected Market Valuation and Growth of the Electronic Contract Manufacturing and Design Services…

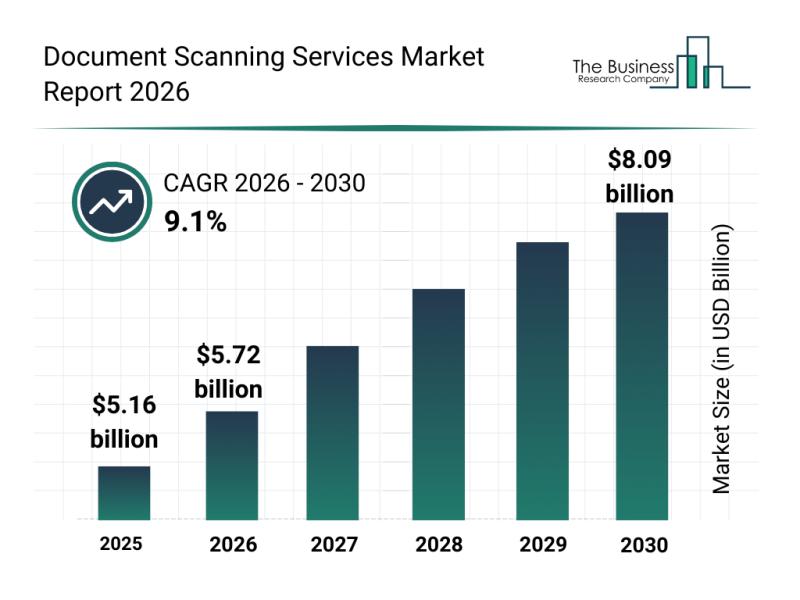

Document Scanning Services Market Overview: Major Segments, Strategic Developmen …

The demand for efficient document management solutions is reshaping how organizations handle vast volumes of paper records. As businesses increasingly prioritize digital transformation, the document scanning services market is gaining significant traction. This sector is evolving rapidly, driven by technological advancements and changing operational needs, setting the stage for promising growth ahead.

Document Scanning Services Market Size and Growth Outlook Through 2030

The document scanning services market is poised for…

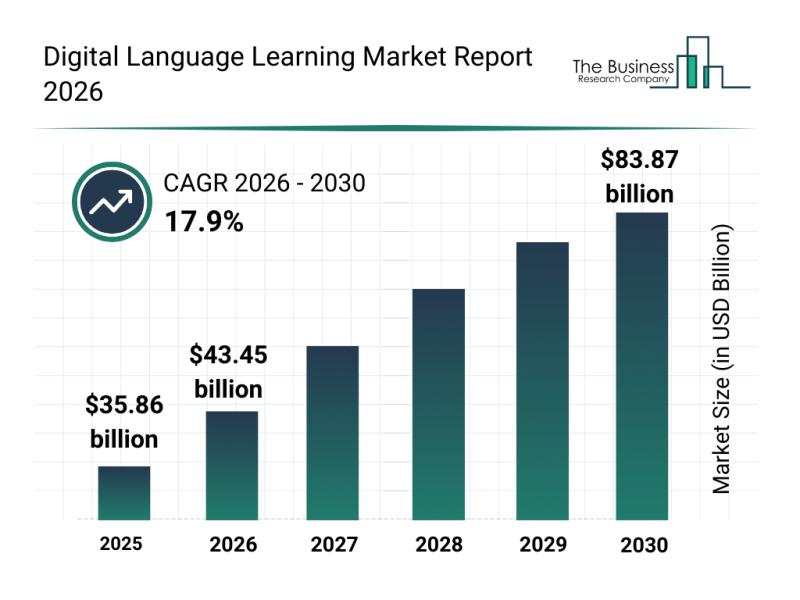

Analysis of Key Market Segments Driving the Digital Language Learning Market

The digital language learning market is on the verge of remarkable expansion as technological advancements and changing learning preferences shape the industry. With a growing emphasis on personalized education and innovative tools, this sector is set to transform how people acquire new languages worldwide. Let's delve into the current market size, key players, emerging trends, and detailed segment outlook to better understand this dynamic field.

Projected Market Size and Growth Trajectory…

More Releases for Collateralized

Transforming the Collateralized Loan Obligation Market in 2025: Impact Of Increa …

What Is the Expected Size and Growth Rate of the Collateralized Loan Obligation Market?

The size of the collateralized loan obligation market has significantly expanded in the past few years. The forecasts show that it will rise from $1413.75 billion in 2024 to $1615.41 billion in 2025, with a compound annual growth rate (CAGR) of 14.3%. The surge during the historic phase can be attributed to factors such as the growing…

Collateralized Loan Obligation (CLO) Market Outlook 2024: Industry Trends and Fo …

"Gain a competitive edge with up to 30% off in-depth market reports-uncover key trends, growth drivers, and forecasts today!

The new report published by The Business Research Company, titled Bars And Nightclubs Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.

As per the report,…

Collateralized Debt Obligation Market Research Report 2023: CAGR, Industry Needs …

A collateralized debt obligation (CDO) is a type of structured asset-backed security (ABS). Originally developed for the corporate debt markets, over time CDOs evolved to encompass the mortgage and mortgage-backed security ("MBS") markets.

Collateralized Debt Obligation report published by QYResearch reveals that COVID-19 and Russia-Ukraine War impacted the market dually in 2022. Global Collateralized Debt Obligation market is projected to reach US$ 171650 million in 2029, increasing from US$ 130900 million…

Global Collateralized Debt Obligation Market to Witness Growth Acceleration by 2 …

The global collateralized debt obligation market is expected to grow at a CAGR of 4.5% during the forecast period (2022-2028). The market growth can be attributed owing to the rising demand for alternative investment products, an increase in the volume of investible funds, and increased liquidity in global financial markets. Furthermore, the growing use of CDOs by asset management firms and fund managers is fuelling the market growth. A collateralized…

Collateralized Debt Obligation Market Is Booming Worldwide by Citigroup, Natixis …

HTF MI recently introduced Global Collateralized Debt Obligation Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Citigroup, Credit Suisse, Morgan Stanley, J.P. Morgan, Bank of America,…

Global Collateralized Debt Obligation Market Size, Status and Forecast 2022

This report studies the global Collateralized Debt Obligation market, analyzes and researches the Collateralized Debt Obligation development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

Bank of America Merrill Lynch

Citigroup

Goldman Sachs

JPMorgan

Morgan Stanley

Royal Bank of Scotland

Societe Generale

SunTrust Bank

UniCredit

Wells Fargo

Barclays

BNP Paribas

Deutsche Bank

HSBC

To Get Sample Copy of Report visit @ http://www.qyresearchreports.com/sample/sample.php?rep_id=970145&type=E

Market segment by Regions/Countries, this report covers

United States

EU

Japan

China

India

Southeast…