Press release

Transforming the Collateralized Loan Obligation Market in 2025: Impact Of Increased Demand For High-Yield Investments On Collateralized Loan Obligations

What Is the Expected Size and Growth Rate of the Collateralized Loan Obligation Market?The size of the collateralized loan obligation market has significantly expanded in the past few years. The forecasts show that it will rise from $1413.75 billion in 2024 to $1615.41 billion in 2025, with a compound annual growth rate (CAGR) of 14.3%. The surge during the historic phase can be attributed to factors such as the growing inclination towards sustainable investments, a surge in potential trading partners, a rise in trace trading, and increased demand for alternative investment goods.

Expectations for the collateralized loan obligation market forecast a swift expansion in the upcoming years. The market size is projected to skyrocket to $2718.41 billion by 2029 with a compound annual growth rate (CAGR) of 13.9%. This surge in growth for the prediction period can be credited to a greater demand for collateralized loan obligations that comply with governance, expanding leveraged loan markets, increasing private debt, a boost in trace trading, and heightened foreign exchange trade volume. The forecast period is set to witness a number of prominent trends, including revolutionary technologies, creativity in collateralized loan obligation structures, advancements in the realms of blockchain and machine learning, high-tech products, and the evolution of regulatory compliance tools.

What Are the Primary Growth Drivers for the Collateralized Loan Obligation Market?

The surge in demand for investments that yield higher returns is projected to spur the expansion of the collateralized loan obligation (CLO) market in the future. These high-yield investments include financial tools or opportunities that potentially yield higher gains compared to conventional investments, although the risk involved is typically greater. The rise in high-yield investment demand is linked to factors like low interest rates on traditional savings, investors pursuing higher revenue, and favorable economic scenarios that promote riskier investments for potentially bigger rewards. High-yield investments contribute to collateralized loan obligations by offering superior returns, augmented cash flow, and diversification, which in turn enhances the overall performance and risk-return composition of the CLO. For instance, data from the Bureau of Economic Analysis, a US government agency, show that foreign direct investment (FDI) in the United States spiked by $216.8 billion in July 2023, bringing it to a total of $5.25 trillion by the end of 2022, an increase from $5.04 trillion in 2021. Consequently, the escalating demand for high-yield investments is fueling the growth of the collateralized loan obligation market.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18538&type=smp

Which Leading Companies Are Shaping the Growth of the Collateralized Loan Obligation Market?

Major companies operating in the collateralized loan obligation market are JPMorgan Chase & Co., Wells Fargo & Company, Citigroup Inc., Prudential Financial Inc., Morgan Stanley, BNP Paribas S.A., Mitsubishi UFJ Financial Group Inc., Deutsche Bank AG, Barclays PLC, BlackRock Inc., Credit Suisse Group AG, Blackstone Inc., Jefferies Financial Group Inc., Ares Management Corporation, Neuberger Berman Group LLC, RBC Capital Markets LLC, Natixis S.A., HPS Investment Partners LLC, Conning Inc., CIFC Asset Management LLC, Brigade Capital Management LP, GreensLedge Capital Markets LLC, Panagram Structured Asset Management LLC

What Are the Major Trends Shaping the Collateralized Loan Obligation Market?

Leading entities in the collateralized loan obligation market are looking to create unique collateralized loan obligation configurations, such as exchange-traded funds, to tailor risk-return strategies, aligning with changing market needs and investment approaches. Exchange-traded funds (ETFs) are types of investment funds that allow investors to attain diversified exposure to a set of CLOs, structured finance products consisting of collective corporate loans. For instance, in July 2023, a US-based company named Panagram Structured Asset Management, LLC, which operates as an investment management company, launched two active collateralized loan obligation (CLO) ETFs, the Panagram AAA CLO ETF (CLOX) and the Panagram BBB-B CLO ETF (CLOZ). The purpose of these was to provide investors with a liquid replacement to conventional fixed-income investments, leveraging the rising collateralized loan obligation (CLO) market. The CLOX is structured to target AAA and AA-rated CLO bonds, focusing on safeguarding capital and offering steady monthly revenue with an expense ratio of 0.20%. Conversely, CLOZ aims at BBB and BB-rated CLO bonds, pursuing higher returns while still concentrating on capital safeguarding, coupled with an expense ratio of 0.50%.

What Are the Key Segments of the Collateralized Loan Obligation Market?

The collateralized loan obligation market covered in this report is segmented -

1) By Type: Investment Grade, Non-Investment Grade, Equity Investment Grade

2) By Investor Base: Bank, Asset Manager, Insurance And Pensions, Hedge Funds, Other Investor Bases

3) By Sector: Technology, Healthcare, Services, Financial, Industrials, Housing, Food And Beverages, Paper And Packaging, Transportation, Other Sectors

Subsegments

1) By Investment Grade: Senior Tranches, Mezzanine Tranches

2) By Non-Investment Grade: Subordinated Tranches, Junior Tranches

3) By Equity Investment Grade: Equity Tranches With Investment Grade Rating, Equity Tranches With Higher Yield

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/collateralized-loan-obligation-global-market-report

Which Region Dominates the Collateralized Loan Obligation Market?

North America was the largest region in the collateralized loan obligation market in 2024. The regions covered in the collateralized loan obligation market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Collateralized Loan Obligation Global Market Report?

- Market Size Analysis: Analyze the Collateralized Loan Obligation Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Collateralized Loan Obligation Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Collateralized Loan Obligation Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Collateralized Loan Obligation Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18538

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Transforming the Collateralized Loan Obligation Market in 2025: Impact Of Increased Demand For High-Yield Investments On Collateralized Loan Obligations here

News-ID: 3860430 • Views: …

More Releases from The Business Research Company

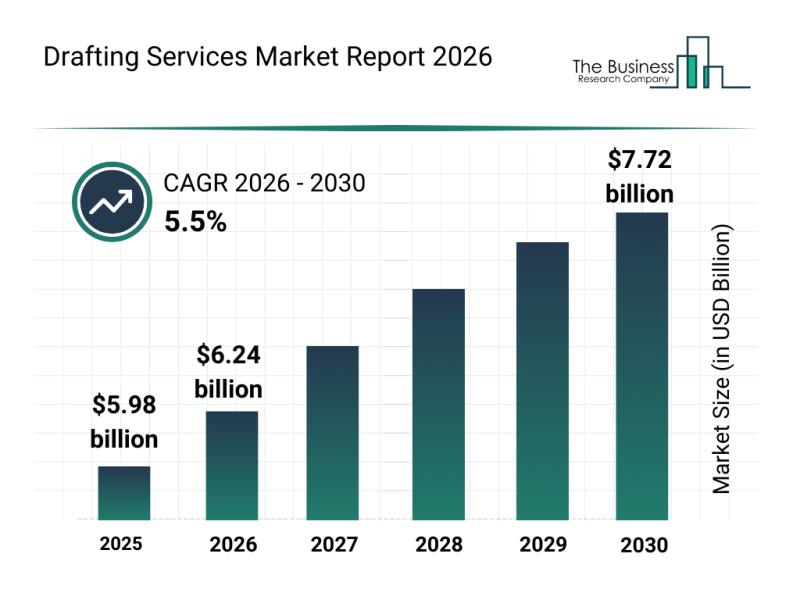

Future Perspective: Key Trends Shaping the Drafting Services Market Until 2030

The drafting services industry is poised for considerable expansion in the coming years as technological advancements and evolving construction needs drive demand. With a wide range of applications across sectors, this market is set to experience steady growth fueled by innovation and increasing adoption of digital tools. Let's explore the current market size, influential factors, key players, emerging trends, and segmentation in this dynamic field.

Projected Growth and Market Size of…

Emerging Sub-Segments Transforming the Digital Rights Management Market Landscap …

The digital rights management (DRM) market is positioned for remarkable expansion in the coming years, driven by technological advancements and increasing concerns over content security. As digital media consumption grows and new platforms emerge, DRM solutions are becoming essential to protect intellectual property and ensure the authorized use of digital assets. Let's explore the current market size, key players, prevailing trends, and the main segments shaping the future of this…

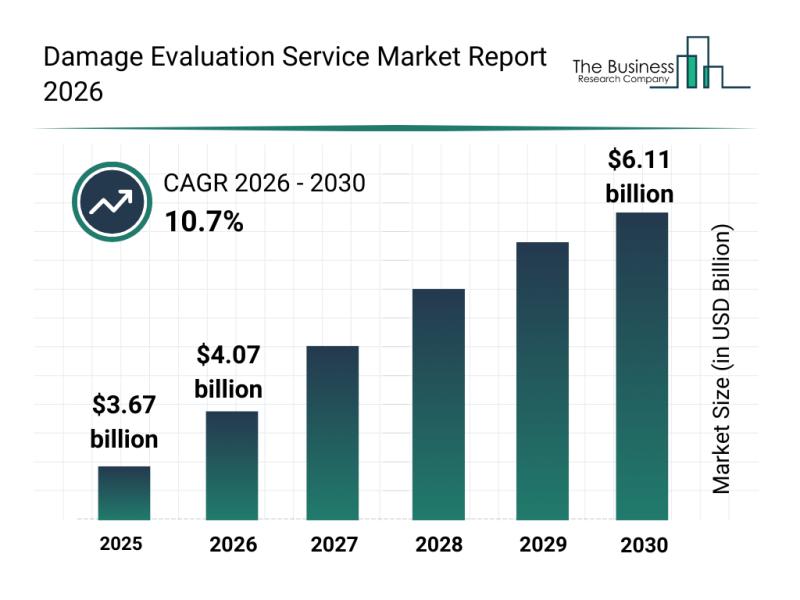

Market Trend Insights: The Impact of Recent Advances on the Damage Evaluation Se …

The damage evaluation service market is on the brink of substantial growth as advancements in technology and increasing demand for efficient damage assessment methods gain momentum. This sector is evolving rapidly with the integration of innovative tools and techniques that enhance accuracy and speed in evaluating damages across various industries.

Forecasted Market Size and Growth Trajectory of the Damage Evaluation Service Market

The damage evaluation service market is projected to…

Corporate Training Market: Segmentation Analysis, Market Trends, and Competitive …

The corporate training sector is on a path of significant growth as organizations increasingly recognize the importance of continuous employee development. With rapid technological advances and shifting workforce needs, this market is expected to expand steadily, driven by innovative solutions and evolving learning preferences. Below, we explore the market's size projections, key players, emerging trends, and segmentation insights to provide a comprehensive overview of the corporate training landscape.

Projected Growth and…

More Releases for Collateralized

Impact Of Increased Demand For High-Yield Investments On Collateralized Loan Obl …

The Collateralized Loan Obligation Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Projected Growth of the Collateralized Loan Obligation Market?

The collateralized loan obligation market has experienced rapid growth in recent years. It will increase from $1413.75 billion in 2024 to $1615.41 billion…

Collateralized Loan Obligation (CLO) Market Outlook 2024: Industry Trends and Fo …

"Gain a competitive edge with up to 30% off in-depth market reports-uncover key trends, growth drivers, and forecasts today!

The new report published by The Business Research Company, titled Bars And Nightclubs Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.

As per the report,…

Collateralized Debt Obligation Market Research Report 2023: CAGR, Industry Needs …

A collateralized debt obligation (CDO) is a type of structured asset-backed security (ABS). Originally developed for the corporate debt markets, over time CDOs evolved to encompass the mortgage and mortgage-backed security ("MBS") markets.

Collateralized Debt Obligation report published by QYResearch reveals that COVID-19 and Russia-Ukraine War impacted the market dually in 2022. Global Collateralized Debt Obligation market is projected to reach US$ 171650 million in 2029, increasing from US$ 130900 million…

Global Collateralized Debt Obligation Market to Witness Growth Acceleration by 2 …

The global collateralized debt obligation market is expected to grow at a CAGR of 4.5% during the forecast period (2022-2028). The market growth can be attributed owing to the rising demand for alternative investment products, an increase in the volume of investible funds, and increased liquidity in global financial markets. Furthermore, the growing use of CDOs by asset management firms and fund managers is fuelling the market growth. A collateralized…

Collateralized Debt Obligation Market Is Booming Worldwide by Citigroup, Natixis …

HTF MI recently introduced Global Collateralized Debt Obligation Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Citigroup, Credit Suisse, Morgan Stanley, J.P. Morgan, Bank of America,…

Global Collateralized Debt Obligation Market Size, Status and Forecast 2022

This report studies the global Collateralized Debt Obligation market, analyzes and researches the Collateralized Debt Obligation development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

Bank of America Merrill Lynch

Citigroup

Goldman Sachs

JPMorgan

Morgan Stanley

Royal Bank of Scotland

Societe Generale

SunTrust Bank

UniCredit

Wells Fargo

Barclays

BNP Paribas

Deutsche Bank

HSBC

To Get Sample Copy of Report visit @ http://www.qyresearchreports.com/sample/sample.php?rep_id=970145&type=E

Market segment by Regions/Countries, this report covers

United States

EU

Japan

China

India

Southeast…