Press release

Bitcoin Exchange Market to Reach New Heights: Projected to Witness Substantial Growth by 2032

✅Overview of the Bitcoin Exchange MarketThe global Bitcoin exchange market is gaining significant traction as digital currency adoption continues to expand across the world. Bitcoin, the first and most dominant cryptocurrency, has transitioned from a niche tech experiment to a globally recognized asset. According to Persistence Market Research projections, the market is on a robust growth trajectory driven by increased institutional investments, growing consumer awareness, and advancements in blockchain infrastructure.

Bitcoin can be traded globally through digital exchanges, enabling users to convert it into fiat currencies like USD or EUR. The price of Bitcoin is decentralized and highly volatile, but this volatility has also fueled speculative interest, leading to a surge in trading volumes. One of the most notable drivers of this market is the increasing trust in decentralized finance (DeFi), which provides autonomy, transparency, and reduced reliance on centralized financial institutions.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/10475

Among all segments, spot trading leads the market in terms of transaction volume, primarily because of its simplicity and the immediate nature of asset ownership. Geographically, North America is the leading region in the Bitcoin exchange market, driven by regulatory clarity, institutional adoption, and the presence of major crypto firms. The U.S., in particular, continues to dominate due to its advanced technological infrastructure and increasing investment inflow from hedge funds and financial institutions.

✅Key Highlights from the Report

➤ Bitcoin exchange platforms are seeing increased retail investor participation, especially in developing markets.

➤ Spot trading holds the largest market share due to its ease of access and lower complexity compared to derivatives.

➤ North America leads the market owing to technological advancements and supportive regulation.

➤ Institutional investments in Bitcoin are significantly rising, contributing to market maturity.

➤ Mobile-based Bitcoin exchanges are gaining popularity due to increased smartphone penetration.

➤ Integration of AI and blockchain analytics is enhancing security and transaction transparency on exchanges.

✅Market Segmentation Analysis

The Bitcoin exchange market can be segmented based on trading type, end-user, and platform. By trading type, the market is divided into spot trading and derivatives trading. Spot trading remains dominant due to its simplicity and real-time ownership of Bitcoin, while derivatives are gaining traction among institutional investors seeking hedging mechanisms. As the derivatives space matures, products like futures and options are expected to become more mainstream.

On the basis of end-user, the market is segmented into retail investors and institutional investors. Retail users form a large share, primarily due to easy mobile access and the appeal of quick returns. However, institutional investors are increasingly entering the market, driven by custodial solutions, regulatory frameworks, and risk-managed products. The platform segment is divided into desktop and mobile-based exchanges, with mobile-based platforms showing accelerated growth due to increasing mobile penetration and user-friendly interfaces that cater to the mass market.

✅Regional Insights

North America leads the global Bitcoin exchange market, backed by strong infrastructure, mature financial markets, and growing institutional participation. In the United States, regulatory efforts by the SEC and CFTC have provided clearer guidelines, encouraging more companies to operate transparently. Major financial institutions are now engaging in crypto services, indicating widespread acceptance and maturity of the market in this region.

Meanwhile, the Asia Pacific region is emerging as a rapidly growing hub for Bitcoin trading. Countries like Japan, South Korea, and Singapore have created conducive environments for crypto innovation through favorable regulatory frameworks. Furthermore, rising digital adoption and tech-savvy populations in India and Southeast Asia have accelerated the use of mobile-based Bitcoin exchange platforms, contributing to exponential market growth.

✅Market Drivers

The Bitcoin exchange market is primarily driven by growing awareness and acceptance of cryptocurrencies as a legitimate financial asset. Bitcoin's finite supply and decentralized nature make it an attractive hedge against inflation, especially in uncertain economic climates. The rising number of crypto wallets and peer-to-peer platforms has also enhanced access for everyday users. Furthermore, blockchain technology's promise of transparency and immutability has built trust among users and investors.

Institutional adoption is another critical driver. Big players such as Tesla, MicroStrategy, and financial institutions like Goldman Sachs have entered the space, signaling that Bitcoin is transitioning into a mainstream investment asset. Additionally, the launch of Bitcoin ETFs and custodial services has provided traditional investors with secure access to crypto markets.

✅Market Restraints

Despite its promising outlook, the Bitcoin exchange market faces several restraints. Chief among them is regulatory uncertainty. Many countries still lack comprehensive frameworks for digital currencies, leading to sudden policy shifts that can disrupt trading activities. For instance, outright bans or restrictions on crypto trading in countries like China have affected global liquidity and investor confidence.

Another restraint is the issue of cybersecurity. Hacking incidents, exchange outages, and thefts have made headlines in recent years, eroding consumer trust. Many exchanges still operate with inadequate security protocols, putting users' assets at risk. Additionally, Bitcoin's price volatility remains a major concern, deterring risk-averse investors from entering the market.

✅Market Opportunities

The Bitcoin exchange market is ripe with opportunities, especially with ongoing innovation in financial technologies. The integration of artificial intelligence and machine learning in crypto trading platforms is improving security, transaction speed, and market analysis. These technologies are helping traders make more informed decisions while reducing the risk of fraud.

Additionally, expansion into developing regions presents a huge growth avenue. Africa and Latin America, for example, are seeing increased Bitcoin adoption due to unstable local currencies and limited access to traditional banking. Bitcoin exchanges can play a transformative role in these regions by offering financial inclusion through digital means. Partnerships with fintech companies and localized mobile platforms can further accelerate growth.

For Customized Insights on Segments, Regions, or Competitors, Request Personalized Purchase Options @ https://www.persistencemarketresearch.com/request-customization/10475

✅Frequently Asked Questions (FAQs)

➤ How Big is the Bitcoin Exchange Market?

➤ Who are the Key Players in the Global Market for Bitcoin Exchange?

➤ What is the Projected Growth Rate of the Bitcoin Exchange Market?

➤ What is the Market Forecast for Bitcoin Exchange Market for 2032?

➤ Which Region is estimated to dominate the Bitcoin Exchange Industry through the Forecast Period?

✅Company Insights

✦ Binance

✦ Coinbase

✦ Kraken

✦ Bitfinex

✦ Bitstamp

✦ eToro

✦ Huobi Global

✦ OKX

✦ Gemini Trust Company

✦ Crypto.com

✦ Bybit

✦ KuCoin

✅Recent Developments

■ Coinbase announced the launch of its international exchange platform to offer derivatives trading outside the U.S., increasing its global reach.

■ Binance introduced a new AI-driven trading bot designed to assist users in making optimized spot trading decisions.

The Bitcoin exchange market continues to evolve rapidly, driven by innovation, increased accessibility, and growing interest from both individual and institutional investors. With technological integration and regulatory frameworks maturing, the market is poised for sustained growth in the years ahead.

✅Explore the Latest Trending "Exclusive Article" @

• https://www.linkedin.com/pulse/cooling-fabrics-market-overview-key-developments-pr-news-sync-yxg1f/

• https://medium.com/@apnewsmedia/cooling-fabrics-market-growth-drivers-and-restraints-a1ffd1be66cc

• https://industrywire.news.blog/2025/05/21/cooling-fabrics-market-emerging-trends-shaping-the-industry/

• https://webrankmedia.blogspot.com/2025/05/cooling-fabrics-market-size-forecast.html

• https://vocal.media/stories/cooling-fabrics-market-competitive-landscape-and-key-players

✅Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

✅About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bitcoin Exchange Market to Reach New Heights: Projected to Witness Substantial Growth by 2032 here

News-ID: 4032346 • Views: …

More Releases from Persistence Market Research

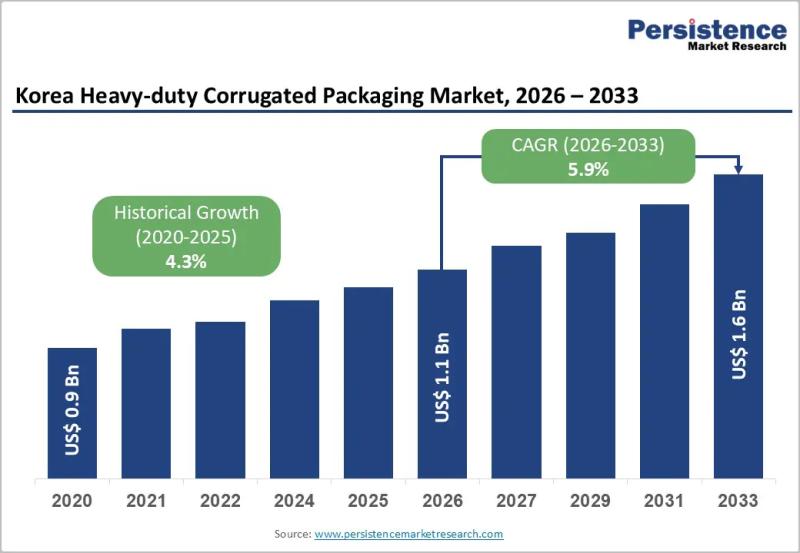

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Bitcoin

Bitcoin Mining and Bitcoin CloudMining Evolve with AI-Optimized Technology

Toronto, Canada - October 2025

With the world shifting towards increased use of digital resources, Hashj establishes the new trend in the sector once again, introducing an improved cloudmining platform with bitcoin. This new system has been revolutionary because anyone can engage in bitcoin mining without technical skills or costly software and hardware. Better still, users can begin to mine immediately without any registration to be given a $118 giveaway…

Loans against Bitcoin for more Bitcoin

Go VIP Worldwide, wholly owned by Matthew Barnes, drew a $100,000 loan from an FDIC Bank against Go VIP Worldwide's Bitcoin holdings on July 29, 2025 and immediately used the entire loan to buy more Bitcoin.

This is significant as Go VIP Worldwide is not a publicly traded company begging Wall Street to beg the public to buy Bitcoin for their publicly traded company, as it appears all the leveraged…

1502.app, LLC Launches 1502, The Bitcoin Messenger, Bitcoin meets mainstream fea …

1502.app, LLC is excited to announce the official launch of 1502, The Bitcoin Messenger, after a successful year of open beta testing. 1502 integrates non-custodial wallets into a private messenger environment and offers additional features for a global audience of freelancers, digital nomads, overseas workers, and small shop owners.

1502 aims to merge daily-life utility with Bitcoin, allowing direct Bitcoin transactions between two parties without any intermediary involvement.

This innovative approach is…

BITCOIN UP REVIEW 2022:IS BITCOIN UP A SAFE INVESTMENT?

Bitcoin Up Review:Despite the fact that it is a complex world, the introduction of trading robots made it easier for newcomers to understand the world of cryptocurrencies. They can open the doors for passionate investors wanting to reap the rewards of these technologies capable of forecasting price movements and making judgments without any human assistance by democratizing the use of these sorts of assets with automated algorithms and artificial intelligence.

Cryptocurrency…

What is Bitcoin? Understanding Bitcoin & Blockchain in 10 Minutes.

Bitcoin's open-source code (software), launched in 2009 by an anonymous developer, or group of developers, that are known only by the pseudonym Satoshi Nakamoto. This ingenious codebase enabled a completely trust-less network between strangers. And both sender and receiver can remain anonymous, if they so desire.

Bitcoin is not printed by a government or issued by a central bank or authority. Bitcoin is created by ingenious open-source code (software) installed on…

Bitcoin Association launches online education platform Bitcoin SV Academy

Bitcoin Association, the Switzerland-based global industry organisation that works to advance business with the Bitcoin SV blockchain, today announces the official launch of Bitcoin SV Academy – a dedicated online education platform for Bitcoin, offering academia-quality, university-style courses and learning materials.

Developed by Bitcoin Association, Bitcoin SV Academy has been created to make learning about Bitcoin – the way creator Satoshi Nakamoto designed it - accessible, accurate and understandable. Courses are…