Press release

Tax Tech Market Outlook (2025-2034): Key Trends, Growth Strategies, and Revenue Forecasts

Tax Tech MarketThe global tax tech market was valued at USD 18.25 billion in 2024. It is anticipated to generate an estimated revenue of USD 56.23 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust CAGR of 11.9% over the forecasted timeframe, 2025-2034.

Market Overview

Tax technology refers to the use of software, tools, and digital platforms to manage and streamline tax-related processes within an organization. This field integrates tax functions with technological solutions to automate, optimize, and simplify various tax operations, from compliance and reporting to planning and analytics. Tax technology solutions are relevant across all aspects of a tax operation, including transfer pricing and corporate tax.

By combining tax expertise with technology, tax technology solutions automate and streamline key tax functions such as compliance, reporting, and analytics. This integration is essential for improving efficiency and reducing errors in tax processes within organizations. Looking ahead, the future of tax technology will include advancements like anomaly detection, automated e-invoicing, real-time reporting, and global tax computations.

Get Exclusive Sample Pages of This Report:

https://www.polarismarketresearch.com/industry-analysis/tax-tech-market/request-for-sample

Market Drivers

Rising Regulatory Complexities: The increasing complexity of regulatory frameworks and evolving tax legislation are driving the growth of cross-border transactions. Digital businesses face constant pressure to adapt and comply, as governments frequently update tax regulations to address emerging economic models. According to a February 2025 report from the IMF, innovations in digital payments could significantly reduce cross-border transaction costs by up to 60%, while also increasing transaction volumes, especially for payment-dependent countries, thereby fueling the expansion of the tax technology market.

Growing Demand for Tax Automation: Growing Demand for Tax Automation: The increasing demand for tax automation is driving market opportunities, as businesses increasingly seek to optimize their finance and compliance operations. Traditional tax processes are often time-consuming, prone to errors, and struggle to scale with rising data volumes.

Competitive Landscape

The market is reasonably fragmented with the existence of familiar brands together with regional and local contenders. Some of the prominent players operating in the market include:

• Automatic Data Processing, Inc.

• Avalara, Inc.

• H&R Block, Inc.

• Intuit Inc.

• Ryan, LLC

• SAP SE

• Sovos Compliance, LLC

• TaxAct, Inc.

• Thomson Reuters Corporation

• Vertex, Inc.

• Wolters Kluwer N.V.

• Xero Limited

Inquire more about this Report Before Purchase:

https://www.polarismarketresearch.com/industry-analysis/tax-tech-market/inquire-before-buying

Tax Tech Market Report Highlights

📊 In terms of offering, the solutions segment led the market share in 2024, as organizations increasingly adopted specialized tax software to automate compliance workflows and improve operational efficiency.

📊 Based on industry vertical, the IT & telecom segment is anticipated to experience the highest growth rate, driven by its complex multinational tax structures, high transaction volumes, and increasing need for cross-jurisdictional tax management solutions.

📊 North America accounted for the largest tax tech market revenue share in 2024, supported by its advanced digital ecosystem, concentration of major tax technology providers, and stringent regulatory compliance standards.

📊 The Asia Pacific market is expected to grow at the fastest pace, fueled by accelerating digital transformation, economic expansion, and evolving tax compliance mandates across developing economies.

Geographical Landscape

The tax tech market report offers detailed insights into the market landscape, which is further categorized into sub-regions and specific countries.

North America accounted for the largest share in 2024, owing to its evolved digital framework, robust existence of leading tax technology traders, and high awareness of regulatory conformity needs.

Asia Pacific is projected to witness the fastest growth due to speedy digitalization, augmenting economies, and growing tax conformity needs covering emerging markets.

By Regional Outlook (Revenue, USD Billion, 2020-2034)

🔹 North America

» US

» Canada

🔹 Europe

» Germany

» UK

» France

» Italy

» Spain

» Russia

» Netherlands

» Rest of Europe

🔹 Asia Pacific

» China

» India

» Japan

» South Korea

» Indonesia

» Malaysia

» Vietnam

» Australia

» Rest of Asia Pacific

🔹 Latin America

» Argentina

» Brazil

» Mexico

» Rest of Latin America

🔹 Middle East & Africa

» UAE

» Saudi Arabia

» Israel

» South Africa

» Rest of Middle East & Africa

Explore The Complete Report:

https://www.polarismarketresearch.com/industry-analysis/tax-tech-market

Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020-2034)

• Solutions

• Services

By Deployment Mode Outlook (Revenue, USD Billion, 2020-2034)

• Cloud-Based

• On-Premises

By Tax Type Outlook (Revenue, USD Billion, 2020-2034)

• Direct Tax

• Indirect Tax

By Organization Size Outlook (Revenue, USD Billion, 2020-2034)

• Large Enterprises

• SMEs

By Industry Vertical Outlook (Revenue, USD Billion, 2020-2034)

• BFSI

• IT & Telecom

• Retail & E-Commerce

• Manufacturing

• Healthcare & Life Sciences

• Government & Public Sector

• Energy & Utilities

• Others

More Trending Reports by Polaris Market Research:

Logistics Robot Market:

https://www.polarismarketresearch.com/industry-analysis/logistics-robot-market

Food and Beverage Industry Pumps Market:

https://www.polarismarketresearch.com/industry-analysis/food-and-beverage-industry-pumps-market

Natural Disaster Management Market:

https://www.polarismarketresearch.com/industry-analysis/natural-disaster-management-market

Brain-Computer Interface (BCI) Gaming Market:

https://www.polarismarketresearch.com/industry-analysis/brain-computer-interface-gaming-market

Leading Top 5 Companies Innovating in System on Chip (SoC) Market in 2025:

https://www.polarismarketresearch.com/blog/leading-top-5-companies-innovating-in-system-on-chip-soc-market-in-2025

Contact:

Likhil G

8 The Green Ste 19824,

Dover, DE 19901,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Follow Us: LinkedIn | Twitter

About Polaris Market Research & Consulting, Inc:

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR's clientele spread across different enterprises. We at Polaris are obliged to serve PMR's diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR's customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR's customers.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Tech Market Outlook (2025-2034): Key Trends, Growth Strategies, and Revenue Forecasts here

News-ID: 4024739 • Views: …

More Releases from Polaris Market Research & Consulting

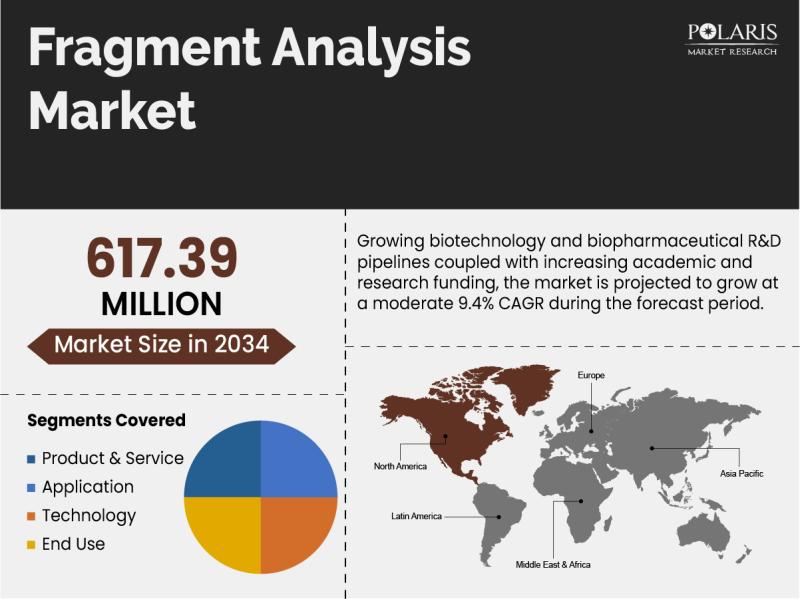

Fragment Analysis Market Size Projected to Reach USD 617.39 Million by 2034, Gro …

Global Fragment Analysis Market is currently valued at USD 275.72 Million in 2025 and is anticipated to generate an estimated revenue of USD 617.39 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 9.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034.

Polaris Market Research recently introduced the latest update on Fragment Analysis Market…

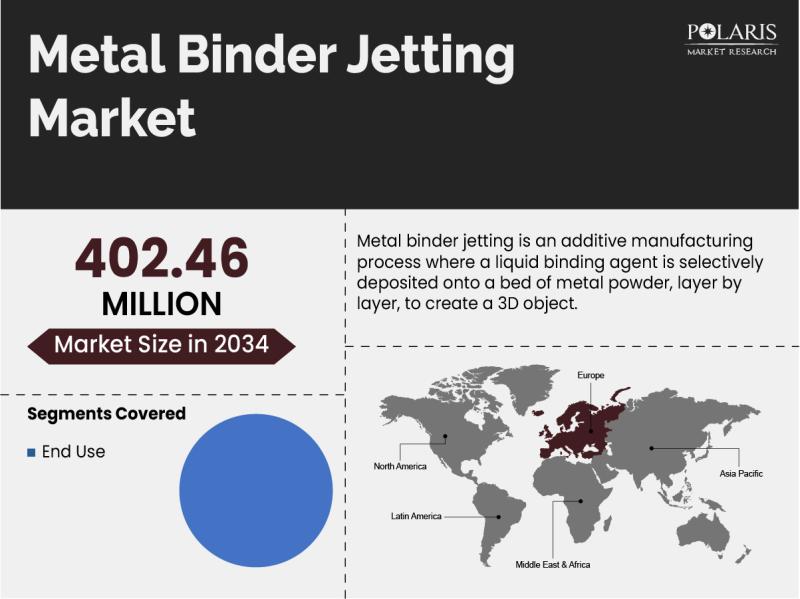

Metal Binder Jetting Market Growth Projected at 10.6% CAGR, Reaching USD 402.46 …

Global Metal Binder Jetting Market is currently valued at USD 147.51 Million in 2024 and is anticipated to generate an estimated revenue of USD 402.46 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 10.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 - 2034.

Polaris Market Research recently introduced the latest update on Metal Binder…

Rigid Food Packaging Market to Reach USD 354.25 Billion by 2034, Growing at a CA …

The quantitative market research report published by Polaris Market Research on Rigid Food Packaging Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Rigid Food Packaging Market size, financial data, and projected future growth. All the…

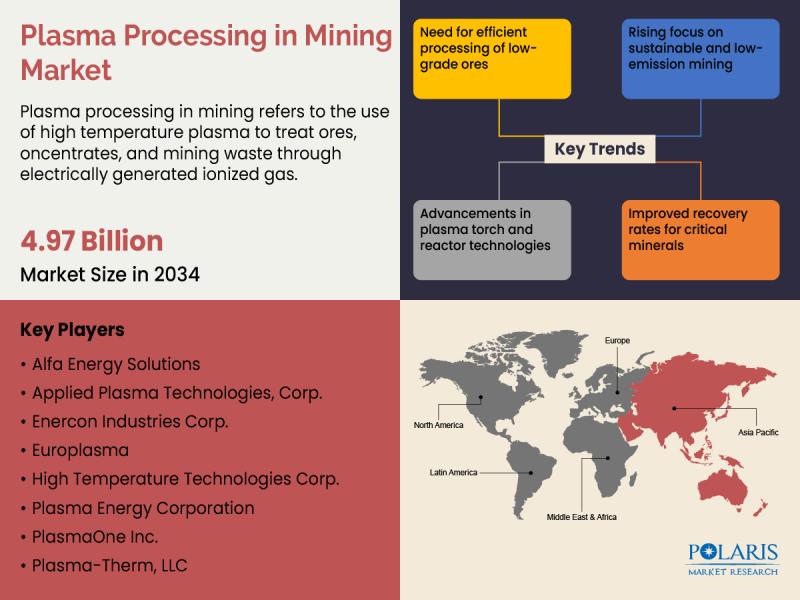

Global Plasma Processing in Mining Market to Reach USD 4.97 Billion by 2034, Reg …

Market Size and Share:

The global plasma processing in mining market is estimated to reach approximately USD 2.62 billion in 2025 and is expected to experience steady growth from 2026 to 2034, expanding at a projected CAGR of 7.4% during the forecast period.

Polaris Market Research has introduced the latest market research report titled Plasma Processing in Mining Market that highlights the major revenue stream for the forecast period. The report contains…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…