Press release

Global AI Model Risk Management Market to Hit USD 18.89 Billion by 2030, Leading PLayer - Amazon Web Services, Oracle & Microsoft

AI Model Risk Management Market Overview and InsightsThe AI Model Risk Management Market is anticipated to grow steadily during the forecast period [2025-2030], with a base year of [2024]. This growth is driven by evolving technologies, changing consumer preferences, and expanding applications across various industries.

Our market research reports deliver in-depth analysis and strategic insights to help businesses navigate changing market conditions, seize growth opportunities, and make data-driven decisions. The report provides comprehensive coverage of:

• Target Market Identification

• Consumer Behavior & Preferences

• Competitive Landscape Analysis

• Market Size, Share, and Forecasting

• Segment-Level Insights

• Actionable Recommendations for Strategy Development

[Stay informed about USA tariff changes with expert insights and timely information.]

Request Sample Report Today! https://www.marknteladvisors.com/query/request-sample/ai-model-risk-management-market.html

What's Driving AI Model Risk Management Market Growth?

Rapid Adoption in BSFI Industry Driving Demand- The increasing adoption of AI in the BFSI industry is largely fueling the market demand. AI is being utilized by financial institutions for purposes including fraud detection, credit risk determination, and compliance with regulations. This transition in the sector began post-2020. These models can analyze the transactional behavior, social media usage, and geolocation data of the borrower to predict their creditworthiness. Further, these can detect anomalies also in their transactional data to detect if any fraudulent activity is done by the borrower. These models can run algorithms to compare policies, regulations, and operating procedures in banking institutions. However, the complexity and opacity of AI models pose a risk of biased algorithms and noncompliance with regulations, leading to data breaches.

As per the US Treasury Department, the use and testing of AI technologies has increased in about 78% of financial institutions for fraud detection and risk management. This creates a higher market demand as these organizations are required to follow compliance standards, which necessitate AI model risk management. Also, major institutions like JP Morgan Chase are using over 300 AI models in production that create a substantial need for model risk oversight. AI is becoming a core in financial operations, making AI model risk management a necessity while fueling the market growth globally.

AI Model Risk Management Market Size, Share & Revenue

The size of AI Model Risk Management market was valued at USD 10.2 billion in 2024, and it and is projected to reach USD 18.89 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 10.79% during the forecast period 2025-2030.

Time Frame Covered in the Report:

• Historical Years: [2020-2023]

• Base Year: [2024]

• Forecast Period: [2025-2030]

Key Players in the AI Model Risk Management Market

Prominent AI Model Risk Management companies contributing to market development include:

• Alteryx

• Amazon Web Services

• DataBricks

• Delteck

• International Business Machines Corporation

• Congruity360

• Wolters Kluwer N.V.

• LogicManager

• LogicGate

• Oracle

• Microsoft

• ModelOp

• SAS Institute

• UpGuard

• Others

These players are investing in innovation, expanding their geographical footprint, and adapting to dynamic market needs.

Access the Full Report in One Click! https://www.marknteladvisors.com/research-library/ai-model-risk-management-market.html

("Engage with our team using your official business email to unlock full access and priority support.")

AI Model Risk Management Industry Segment and Geographical Breakdown

By Risk Type

> Security Risk

> Ethical Risk

> Operational Risk

By Offering

> Software

>> By Type

>>> Model Management

>>> Bias Detection

>>> Explainable AI Tools

>>> Others

>> By Deployment Mode

>>> Cloud

>> On-Premises

> Services

>> Professional Services

>> Consulting & Advisory

>> Integration & Deployment

>> Support & Maintenance

>> Training & Education

>> Managed Services

By Application

> Fraud Detection and Risk Reduction

> Data Classification and Labelling

> Sentiment Analysis

> Model Inventory Management

> Customer Segmentation and Targeting

> Regulatory Compliance Monitoring

> Others

By End User

> BFSI

> Retail & E-commerce

> IT & Telecom

> Manufacturing

> Healthcare & Life Sciences

> Media & Entertainment

> Government and Public Sector

> Others

By Region

> North America

> South America

> Europe

> Middle East & Africa

> Asia Pacific

Growth Challenge in the AI Model Risk Management Market:

Cybersecurity Risks Impeding Market Growth- Cybersecurity threats have become a top concern in the global market. The growing incorporation of AI across industries has created new threats, mainly from hackers targeting vulnerabilities in AI systems. For instance, the 2025 cyberattack on several Australian superannuation funds revealed out-of-date digital defenses that resulted in massive financial losses. Approximately USD 500,000 was lost by 4 members as a result of credential stuffing attacks from the accounts of 600 members, which underlines the importance of strong AI-powered security controls.

Moreover, the emergence of generative AI models such as ChatGPT, FraudGPT, and WormGPT has enabled cybercriminals to create realistic phishing lures and influence public opinion with deepfakes. These rising threats highlight the need for strong AI risk management strategies that secure systems and ensure reliable, safe AI operations in the ongoing complex risk landscape. This will remain a major concern during the forecasted period.

Schedule a Consultation with Our Experts! https://www.marknteladvisors.com/query/talk-to-our-consultant/ai-model-risk-management-market.html

Table of Contents: AI Model Risk Management

• Table 1: Market Size & Analysis by Revenues (USD Million)

• Table 2: Market Share & Analysis by Risk Type

• Table 3: Security Risk

• Table 4: Ethical Risk

• Table 5: Operational Risk

• Table 6: Market Size & Forecast by Offering (USD Million)

• Table 7: Market Size & Forecast by Deployment Mode (USD Million)

• Table 8: Market Size & Forecast by Application (USD Million)

• Table 9: Market Size & Forecast by End User (USD Million)

• Table 10: Market Size & Analysis by Region (USD Million)

• Table 11: North America AI Model Risk Management Market Size & Analysis (USD Million)

• Table 12: South America AI Model Risk Management Market Size & Analysis (USD Million)

• Table 13: Europe AI Model Risk Management Market Size & Analysis (USD Million)

• Table 14: Middle East & Africa AI Model Risk Management Market Size & Analysis (USD Million)

• Table 15: Asia Pacific AI Model Risk Management Market Size & Analysis (USD Million)

• Table 16: Global AI Model Risk Management Market Value Chain Analysis

• Table 17: Company Profiles Overview

"Report Delivery Format: Market research reports from MarkNtel Advisors are available in PDF, Excel, and PowerPoint formats. Once payment is successfully processed, the report will be delivered to your email address within 24 hours"

Similar Report Topics

https://www.prnewswire.com/news-releases/global-hemp-fiber-market-to-surpass-usd-36-billion-by-2030-redefining-the-future-of-sustainable-materials-reports-markntel-advisors-302455313.html

https://www.marknteladvisors.com/research-library/global-artificial-intelligence-in-fintech-market.html

Contact Us:

MarkNtel Advisors LLP

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

For Sales Enquiries: sales@marknteladvisors.com

About US:

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global AI Model Risk Management Market to Hit USD 18.89 Billion by 2030, Leading PLayer - Amazon Web Services, Oracle & Microsoft here

News-ID: 4023154 • Views: …

More Releases from MarkNtel Advisors LLP

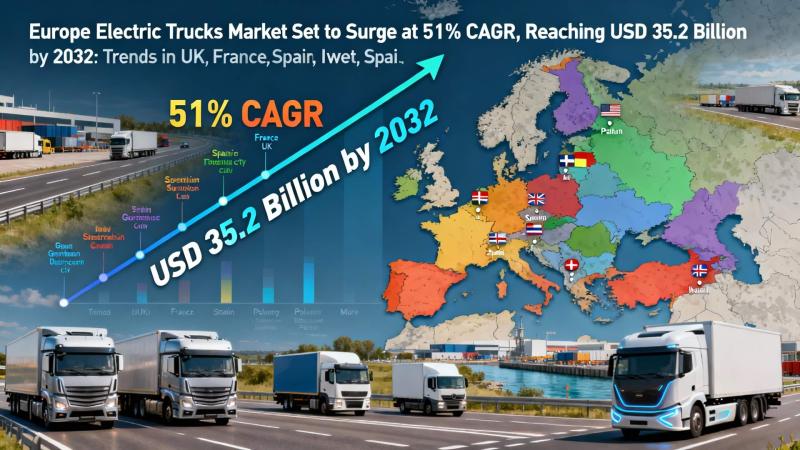

Europe Electric Trucks Market Set to Surge at 51% CAGR, Reaching USD 35.2 Billio …

Latest Research Report of European Electric Trucks Market Size and CAGR

According to MarkNtel Advisors latest market research report data, the Europe Electric Trucks Market is projected to grow from USD 1.96 billion in 2025 to USD 35.2 billion by 2032, registering a remarkable CAGR of 51.07%. Growth is primarily driven by stringent EU emission standards, expansion of high-capacity charging networks, and fleet electrification by major OEMs like Volvo Trucks and…

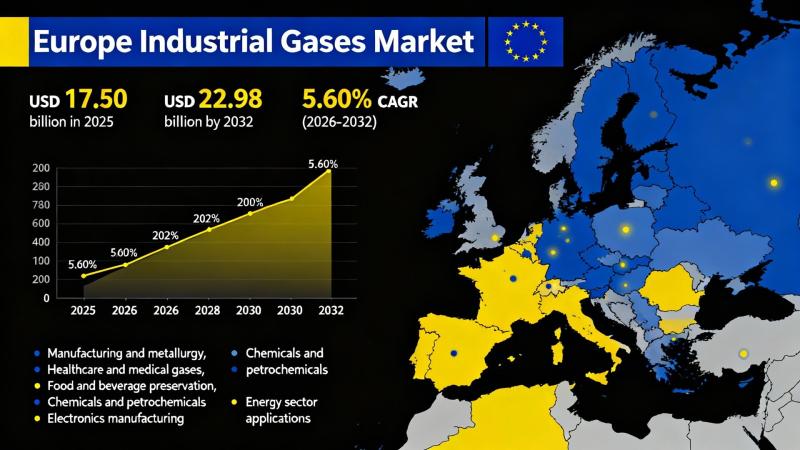

Europe Industrial Gases Market Expected to Reach Nearly $22.98 Billion by 2032: …

Europe Industrial Gases Market: Trends, Insights, and Future Outlook

The Europe Industrial Gases Market is seeing robust growth, driven by increasing demand across key sectors such as petrochemicals, healthcare, and steelmaking. Innovations in hydrogen production and carbon capture technologies are prominent factors influencing market dynamics. A shift towards renewable and low-carbon sources presents significant opportunities amid growing environmental regulations. Additionally, the rise in energy costs is reshaping the landscape for industrial…

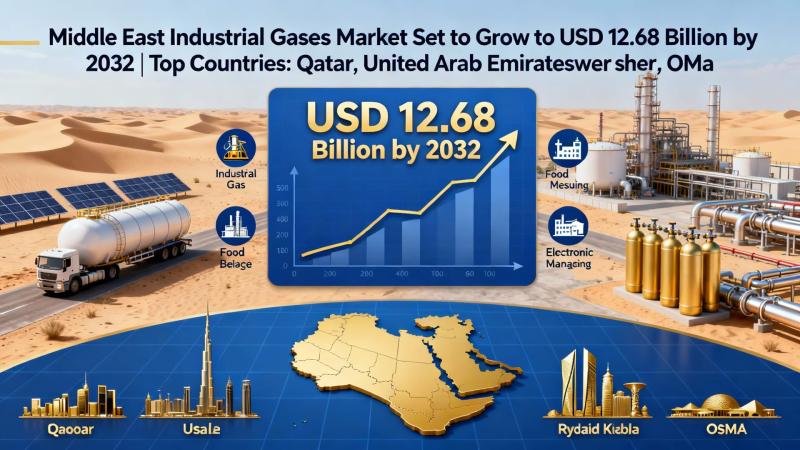

Middle East Industrial Gases Market Set to Grow to USD 12.68 Billion by 2032 | T …

The Middle East Industrial Gases Market is forecasted to expand from USD 10.06 billion in 2025 to USD 12.68 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.72% during the period of 2026 to 2032. The primary drivers fueling this growth are the increasing demand for hydrogen and the robust expansion of the petrochemical industry, which necessitates high-purity gases for various applications such as chemical synthesis and…

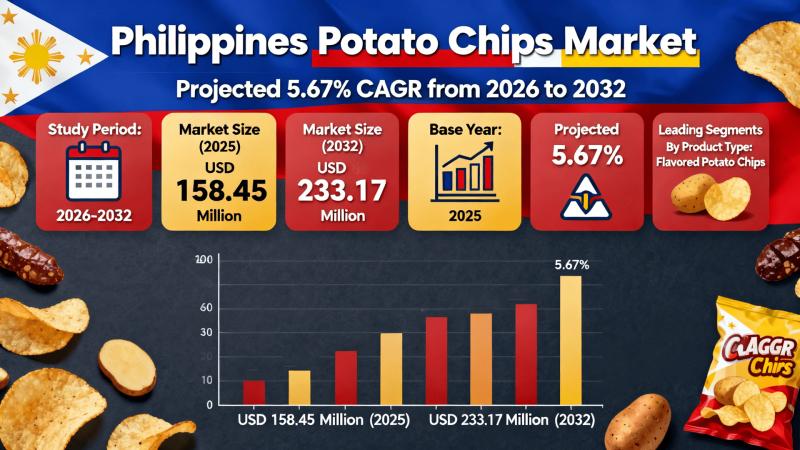

Potato Chips Market in Philippines Set to Grow to USD 233.17 Million by 2032 as …

The Philippines Potato Chips Market is entering a significant growth phase, projected to expand from USD 158.45 million in 2025 to USD 233.17 million by 2032, with a robust compound annual growth rate (CAGR) of 5.67%. Key growth drivers include government initiatives aimed at bolstering local potato production and the rising popularity of flavored varieties among consumers.

Philippines Potato Chips Market Growth Outlook:

As snack food preferences evolve, the Philippines Potato Chips…

More Releases for Risk

RiskWatch Launches Risk Management Software: Streamlined Risk Assessments and In …

RiskWatch International, a leading provider of compliance and risk management solutions, has announced the launch of its comprehensive Risk Management Software. This user-friendly platform empowers organizations of all sizes to proactively identify, assess, and mitigate risks, fostering a culture of resilience and success.

RiskWatch Risk Management Software delivers a robust suite of features, including:

● Comprehensive Risk Templates: Build a customized library of risk templates tailored to your specific needs, encompassing…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…