Press release

Global Asset-Based Lending Market Outlook 2025-2034: Trends, Innovations, And Future Outlook

The Asset-Based Lending Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Asset-Based Lending Market Size and Projected Growth Rate?

In recent times, there has been a swift expansion in the size of the asset-based lending market. It is projected to escalate from $785.6 billion in 2024 to a whopping $896.12 billion in 2025, progressing at a compound annual growth rate (CAGR) of 14.1%. Factors such as economic downturns, credit difficulties, the necessity for working capital financing, the cyclical characters of industries, corporate restructurings and bounce-backs, and scenarios of abundant assets but deficient cash have contributed to the growth during the historical period.

The market for asset-based lending is projected to witness robust growth in the coming years, with expectations of it reaching $1433.06 billion by 2029, at a CAGR of 12.5%. Factors contributing to this growth within the forecast period include global economic fluctuations, rising demand for unconventional finance options, an increasing role in international transactions, emphasis on optimizing working capital, and industry-specific customizations. Key trends for this period encompass enlargement of international asset-based lending, utilization of Artificial intelligence for credit decisions, partnerships between traditional lenders and fintechs, focus on unconventional collateral types, and incorporation of risk management analytics.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=13118

What Are the Major Segments in the Asset-Based Lending Market?

The asset-based lending market covered in this report is segmented -

1) By Type: Inventory Financing, Receivables Financing, Equipment Financing, Other Types

2) By Interest Type: Fixed Rate, Floating Rate

3) By End User: Large Enterprises, Small And Medium-Sized Enterprises

Subsegments:

1) By Inventory Financing: Raw Material Financing, Finished Goods Financing

2) By Receivables Financing: Invoice Financing, Factoring

3) By Equipment Financing: Heavy Machinery Financing, Office Equipment Financing

4) By Other Types: Real Estate Financing, Vehicle Financing, Intellectual Property Financing

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=13118&type=smp

What Are The Driving Asset-Based Lending Market Evolution?

Growth in the asset-based lending market is likely to be stimulated by the escalating demand for loans. Essentially, a loan involves a financial agreement where one party, commonly a bank or financial institution, lends a specific sum of money or assets to another party. Filled with significant advantages such as flexible financing, improved liquidity, and scalability, asset-based lending is an attractive option when it comes to delivering loans. A UN trade and development report published in April 2024 mentions that since 2022, an uptick in global interest rates has resulted in financial pressure, with the net interest payments of developing countries climbing to $847 billion in 2023, a rise of 26% from 2021. Furthermore, a record 38% or 54 developing countries devoted 10% or more of their revenue toward interest costs. This surge in loan demand effectively propels the overall asset-based lending market growth. Asset-Based Lending Market Driver: Accelerating the Asset-Based Lending Market through Alternative Financing

Which Firms Dominate The Asset-Based Lending Market Segments?

Major companies operating in the asset-based lending market report are JPMorgan Chase and Co., Wells Fargo And Company, HSBC Holdings PLC, Goldman Sachs Group Inc., BMO Harris Bank N.A., Barclays Bank PLC, Hilton-Baird Group, KeyCorp Limited, Huntington Business Credit, Lloyds Bank PLC, BB&T Corporation, CoreVest Finance, Crystal Financial LLC, Triumph Commercial Finance, CIT Group, Bibby Financial Services, Sterling National Bank, Berkshire Bank N.A., White Oak Financial LLC, Porter Capital Corporation, First Capital Federal Credit Union, LSQ Funding Group L.C., Action Capital Corporation, LQD Business Finance LLC, Capital Funding Solutions Inc.

What Trends Are Expected to Dominate the Asset-Based Lending Market in the Next 5 Years?

Leading firms in the asset-based lending market are focusing on creating platforms that utilise cutting-edge technology, such as data analytics, in order to improve decision-making processes, enhance risk evaluations, and streamline the origination of loans. This technology allows for a more effective assessment of borrower's creditworthiness and offers live tracking of assets. Data analytics involves analyzing data to provide valuable insights that aid in decision-making, using methods that decode and interpret data to recognize patterns and trends. For instance, in September 2024, Compass Business Finance, a firm based in the UK, introduced Unlocking Capital Strategic Advantages of Asset-Based Lending. This underscores that asset-based lending (ABL) offers firms flexible capital access by leveraging their assets, which facilitates quicker funding and larger loan amounts. It aids in cash flow management, boosts growth strategies, and ensures financial stability while mitigating risk for lenders.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/asset-based-lending-global-market-report

Which Is The Largest Region In The Asset-Based Lending Market?

North America was the largest region in the asset-based lending market in 2024. The regions covered in the asset-based lending market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Asset-Based Lending Market?

2. What is the CAGR expected in the Asset-Based Lending Market?

3. What Are the Key Innovations Transforming the Asset-Based Lending Industry?

4. Which Region Is Leading the Asset-Based Lending Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Asset-Based Lending Market Outlook 2025-2034: Trends, Innovations, And Future Outlook here

News-ID: 4020183 • Views: …

More Releases from The Business Research Company

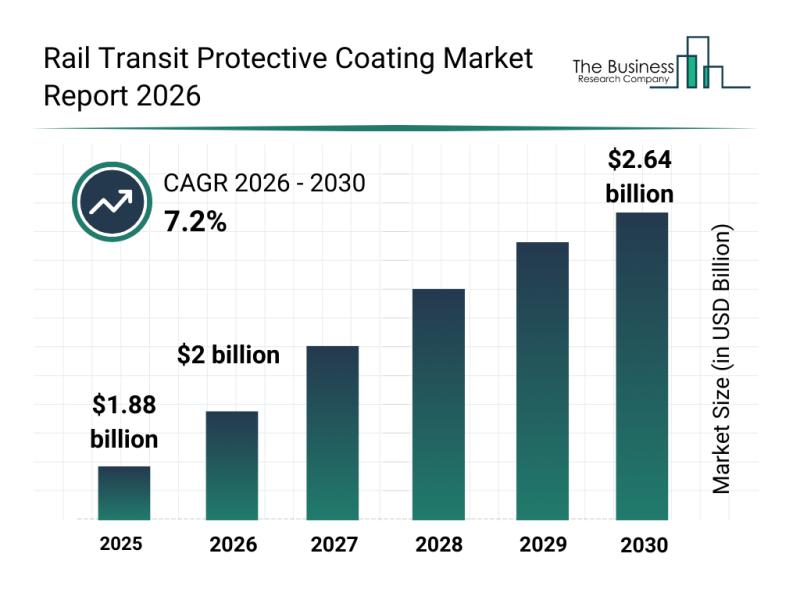

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

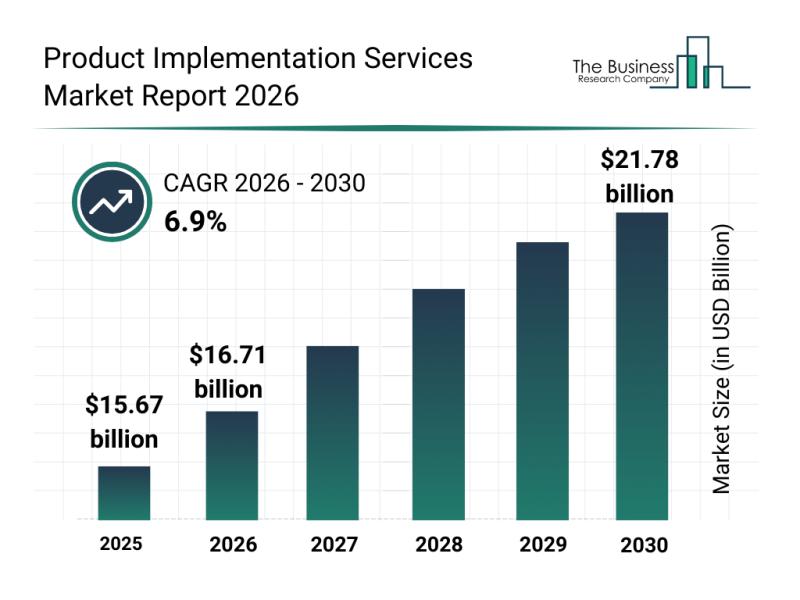

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

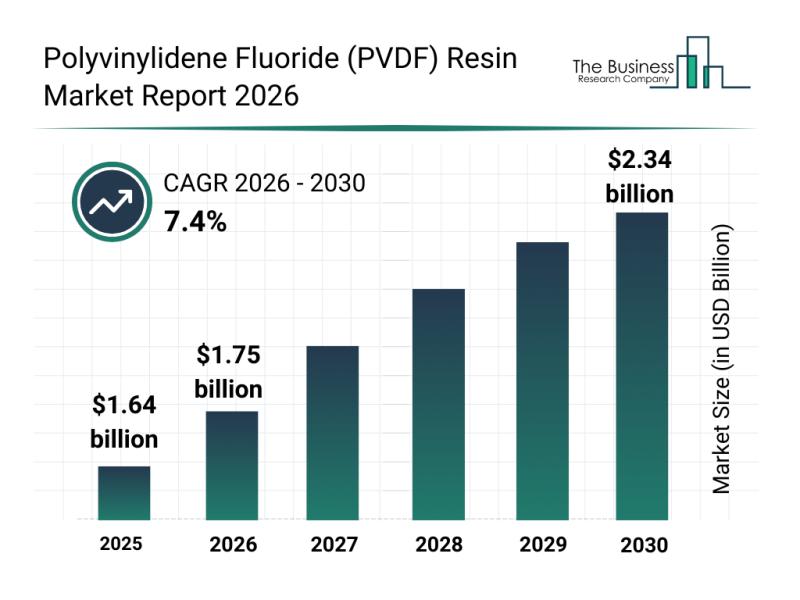

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

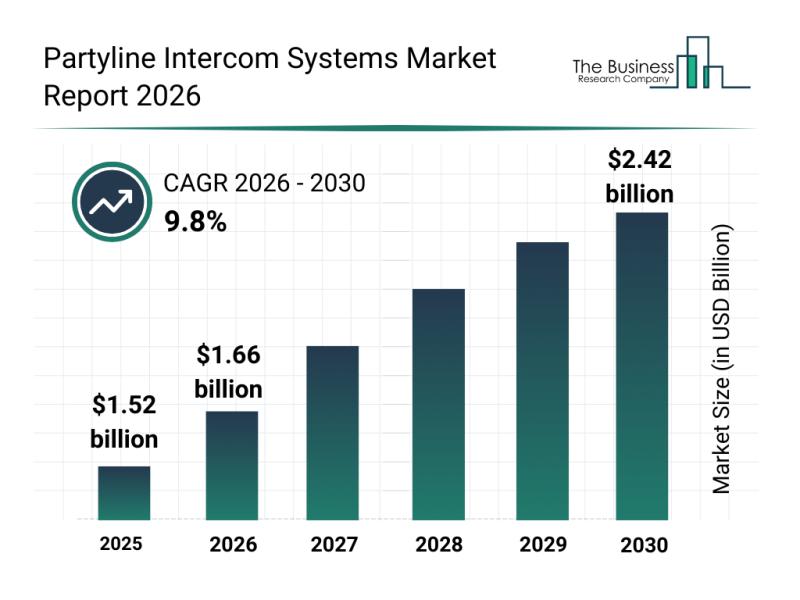

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…