Press release

Rising Cyber Threats Propel Growth in Payment Security Market: IMARC Forecasts Robust Expansion Through 2033

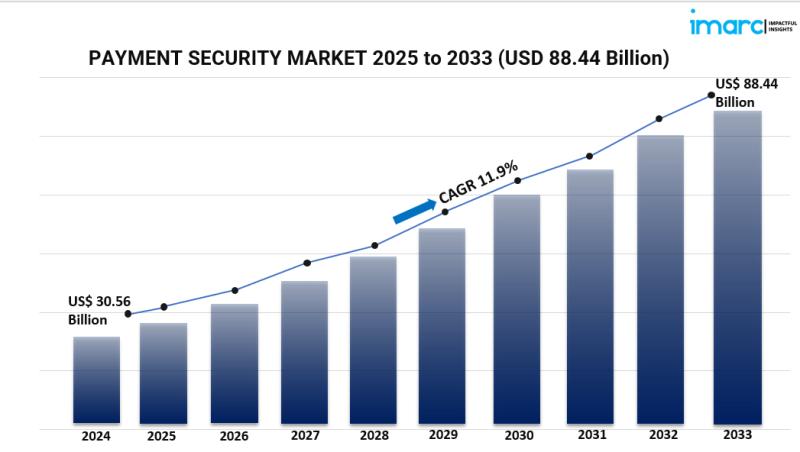

Market OverviewThe global payment security market is experiencing significant growth, driven by the surge in digital transactions and the escalating need for robust cybersecurity measures. Valued at USD 30.56 billion in 2024, the market is projected to reach USD 88.44 billion by 2033, growing at a CAGR of 11.91% from 2025 to 2033. This expansion is fueled by the proliferation of e-commerce, mobile payments, and the adoption of advanced technologies like AI and biometric authentication, which enhance fraud detection and transaction security. As cyber threats become more sophisticated, businesses are prioritizing payment security to protect sensitive data and maintain consumer trust.

________________________________________

Study Assumption Years

• Base Year: 2024

• Historical Years: 2019-2024

• Forecast Years: 2025-2033

________________________________________

Payment Security Market Key Takeaways

• Market Size & Growth: The payment security market was valued at USD 30.56 billion in 2024 and is expected to reach USD 88.44 billion by 2033, exhibiting a CAGR of 11.91% during the forecast period.

• Regional Dominance: North America leads the market, holding over 35.0% share in 2024, driven by increased digital payments, rising cyber threats, and stringent regulations.

• Platform Preference: POS-based platforms dominate with a 57.6% market share in 2024, offering secure and seamless payment experiences across various industries.

• Enterprise Size: Large enterprises account for 67.8% of the market in 2024, leveraging substantial resources to implement advanced payment security solutions.

• End-User Segment: Retail and e-commerce sectors lead with a 26.5% market share in 2024, necessitating robust security measures to protect customer data amid increasing online transactions.

• Technological Advancements: Integration of AI, ML, and biometric authentication enhances fraud detection and strengthens authentication processes, contributing to market growth.

• Regulatory Compliance: Adherence to standards like PCI-DSS and data protection regulations propels the adoption of comprehensive payment security solutions.

Request for a sample copy of this report : https://www.imarcgroup.com/payment-security-market/requestsample

________________________________________

Market Growth Factors

1. Technology improvements bolstering security protocols

The payment security environment is being completely transformed by the incorporation of sophisticated technologies including artificial intelligence (AI), machine learning (ML), and biometric authentication. By examining transaction patterns and spotting abnormalities suggestive of fraudulent activity, artificial intelligence and machine learning algorithms enable real-time fraud detection. Secure and user-friendly verification procedures are made available by biometric authentication techniques including facial recognition and fingerprint. These inventions not only increase security but also enhance user experience, so building trust and promoting digital payment method acceptance. To remain ahead of possible security breaches as cyber threats change, ongoing technical developments are imperative.

2. Adoption Driven by Regulatory Compliance

Organizations are required to put strong payment security policies into practice under strict legal systems including GDPR, a data protection law, and the Payment Card Industry Data Security Standard (PCI-DSS). Obeying these rules safeguards sensitive client data and lowers the chance of data breaches. Non-compliance can bring considerable penalties and reputational damage, therefore companies must invest in sophisticated security measures. The emphasis on regulatory compliance serves as a major motivator for the general acceptance of payment security systems across several sectors.

3. growing demand for safe digital transactions

The exponential development of e-commerce and mobile payment systems has resulted in a rising volume of digital transactions, which call for safe payment methods. Consumer financial information is given to internet platforms with the expectation of frictionless and secure transaction experiences. To satisfy these expectations and guard against cyber threats, businesses are implementing encryption, tokenization, and real-time fraud detection systems. Growing cross-border e-commerce increases the need for safe digital transactions, therefore creating a demand for payment security systems that can function well across several geographic areas and regulatory settings.

________________________________________

Market Segmentation

By Component:

• Solution:

o Encryption: Transforms sensitive payment data into secure codes during transmission, preventing unauthorized access.

o Tokenization: Replaces sensitive data with unique tokens, minimizing the risk of data breaches.

o Fraud Detection and Prevention: Utilizes AI and ML to monitor transactions and detect fraudulent activities in real-time.

• Service: Encompasses support and maintenance services ensuring the effective implementation of payment security solutions.

By Platform:

• Web-based: Secures online transactions conducted through browsers and web applications.

• POS-based: Ensures secure in-person transactions at point-of-sale terminals, integrating encryption and tokenization technologies.

By Enterprise Size:

• Small and Medium-sized Enterprises: Adopt scalable and cost-effective payment security solutions to protect customer data and comply with regulations.

• Large Enterprises: Invest in comprehensive security infrastructures, leveraging advanced technologies to safeguard extensive transaction volumes.

By End User:

• BFSI: Banks and financial institutions require stringent security measures to protect sensitive financial data.

• Government and Utilities: Implement secure payment systems to protect citizen data and ensure service continuity.

• IT and Telecom: Secure billing and payment processes for digital services and subscriptions.

• Healthcare: Protect patient payment information and comply with health data regulations.

• Retail and E-Commerce: Ensure secure online and in-store transactions, enhancing customer trust.

• Media and Entertainment: Safeguard subscription and pay-per-view transactions.

• Travel and Hospitality: Secure booking and payment systems for travelers.

• Others: Includes education, logistics, and other sectors requiring secure payment solutions.

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

________________________________________

Regional Insights

North America dominates the payment security market, accounting for over 35.0% share in 2024. This leadership is attributed to the region's advanced digital infrastructure, high adoption of online payment methods, and stringent regulatory frameworks. The presence of major technology firms and financial institutions further propels the demand for sophisticated payment security solutions. Continuous innovation and investment in cybersecurity measures ensure the region maintains its leading position in the global market.

________________________________________

Recent Developments & News

The payment security landscape is witnessing significant advancements:

• In January 2025, Bluefin integrated its PCI-validated P2PE gateway with Visa Platform Connect, enhancing global multi-currency payment processing and security.

• Ingenico and Crypto.com partnered in November 2024 to launch a seamless crypto payment solution for merchants worldwide, enabling secure acceptance of cryptocurrency payments.

• Shift4 introduced "Pay with Crypto" in October 2024, allowing businesses to accept cryptocurrency payments globally, both online and at POS terminals.

• Elavon launched the Cloud Payments Interface in June 2024, offering a new API for the hospitality industry to simplify digital and in-person payments with enhanced security.

• Ingenico collaborated with Cybersource in January 2024 to deliver a secure, unified commerce solution, initially targeting the Asia Pacific region.

________________________________________

Key Players

• Bluefin Payment Systems LLC

• Broadcom Inc.

• Cybersource (Visa Inc.)

• Elavon Inc. (U.S. Bancorp)

• Ingenico (Worldline)

• PayPal Holdings Inc.

• SecurionPay

• Shift4 Payments

• Signifyd

• SISA Information Security

• TokenEx

• VeriFone Inc.

________________________________________

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5217&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Cyber Threats Propel Growth in Payment Security Market: IMARC Forecasts Robust Expansion Through 2033 here

News-ID: 4017952 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…