Press release

LPG Price Trend Q1 2025: Updated Price Index, Chart & Forecast

North America LPG Prices Movement Q1 2025:LPG Prices in the United States:

LPG Prices in the US saw significant volatility in the first quarter of 2025, reaching a peak of 835 USD/MT in March. Extreme cold weather boosted heating demand, while strong export demand and fluctuating domestic consumption further contributed to price fluctuations. These factors, including drawdowns in inventories, caused sharp price movements. The LPG Prices Trend during this period aligns with the broader seasonal and logistical influences, as seen in the Liquified Petroleum Gas Prices Trend.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/liquified-petroleum-gas-pricing-report/requestsample

Note: The analysis can be customized to meet the specific requirements of the customer.

APAC LPG Prices Movement Q1 2025:

LPG Prices in China:

LPG Prices China experienced notable volatility in Q1 2025, reaching 671 USD/MT in March. Initial oversupply of butane and propane led to price drops, but rising winter heating demand and increased consumption by the petrochemical sector supported a rebound. Crude oil price shifts and low inventory levels also played a role. Overall, the LPG Prices Trend reflected dynamic market conditions, aligning with broader Liquified Petroleum Gas Prices Trend patterns across the region.

Regional Analysis: The price analysis can be extended to provide detailed LPG price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

MEA LPG Prices Movement Q1 2025:

LPG Prices in Saudi Arabia:

LPG Prices Saudi Arabia witnessed significant fluctuations in Q1 2025, peaking at 623 USD/MT by March. Early in the quarter, an oversupply of butane and propane exerted downward pressure on prices. However, strong seasonal demand for propane drove a mid-quarter rebound, despite falling crude oil prices. The LPG Prices Trend in the region reflected this volatility, aligning with broader Liquified Petroleum Gas Prices Trend patterns influenced by shifting supply and demand.

Regional Analysis: The price analysis can be expanded to include detailed LPG price data for a wide range of European countries:

Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries.

Latin America LPG Prices Movement Q1 2025:

LPG Prices in Brazil:

LPG Prices Brazil experienced notable fluctuations during Q1 2025, reaching 750 USD/MT in March due to a sharp rise in seasonal heating demand, particularly for propane, as temperatures dropped. Compounding the issue were significant logistical challenges and export disruptions, which tightened supply and heightened price volatility. These factors strongly influenced the LPG Prices Trend and reflected broader Liquified Petroleum Gas Prices Trend patterns observed in the South American energy market.

Regional Analysis: The price analysis can be extended to provide detailed LPG price information for the following list of countries.

Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries.

FAQ of Liquified Petroleum Gas (LPG) Prices and Forecast:

What factors caused LPG price fluctuations in Q1 2025?

Seasonal demand, supply chain complexities and crude oil price movements also led to fluctuations in LPG prices in selected markets.

How did seasonal demand impact LPG prices in Q1 2025?

Higher demand for heating fuels, notably propane, in the colder months lifted LPG prices in places such as China, Saudi Arabia and Brazil.

What were the primary causes of LPG price volatility in Brazil during Q1 2025?

LPG price shifts in Brazil were caused mainly by demand seasons (women...) for propane and some export issues in the supply chain.

Why did LPG prices drop early in Q1 2025 in regions like Saudi Arabia?

LPG prices fell sharply at the beginning of the quarter due to oversupply of butane and propane, combined with a reduction in butane and propane demand at the start of the period.

How do changes in supply and demand affect LPG prices according to the LPG Prices Forecast Chart?

Within the LPG Prices Forecast Chart it is suggested supply and demand variations (e.g., higher consumption rates during high-demand seasons, supply chain disruptions, etc.) are key for price dynamics.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22509&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, "LPG Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition," presents a detailed analysis of LPG price trend, offering key insights into global LPG market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines LPG demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release LPG Price Trend Q1 2025: Updated Price Index, Chart & Forecast here

News-ID: 4015911 • Views: …

More Releases from IMARC Group

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

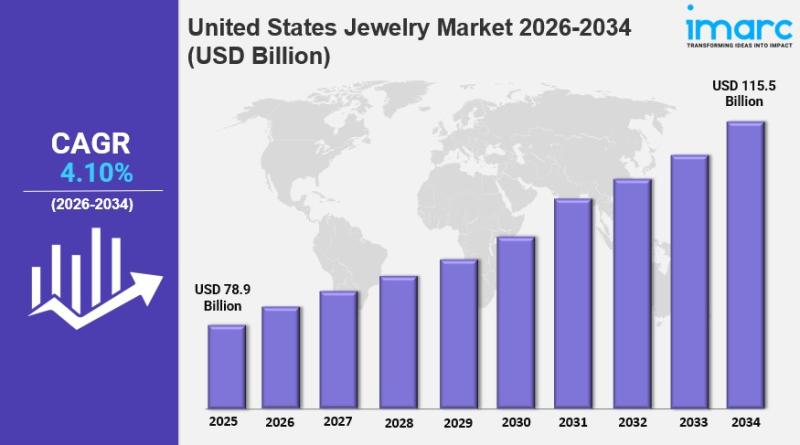

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for LPG

Aluminium LPG Cylinder Market

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲-

The aluminium LPG cylinder market is experiencing significant growth due to various factors that enhance its adoption across residential, commercial, and industrial sectors. One of the main growth drivers is the increasing demand for liquefied petroleum gas (LPG) as an energy source due to its efficiency and cleanliness compared to traditional fuels like wood and coal. Aluminium cylinders are particularly preferred in the storage and transportation of…

LPG Price Trend: Comprehensive Market Insights

Liquefied Petroleum Gas (LPG), a versatile and efficient energy source, is widely used for residential, industrial, and transportation purposes. Understanding the LPG Price Trend is essential for businesses, suppliers, and consumers to optimise procurement strategies, manage energy costs, and anticipate market fluctuations. This article explores the factors influencing LPG prices, historical data, market dynamics, forecasts, regional insights, and procurement resource strategies.

Latest LPG Price Trends

The LPG market has experienced significant price…

Global LPG Tanker Market Expected to Reach US$ 289.72 Mn. by 2030: Rising Demand …

The LPG tanker market, valued at US$ 201.82 million in 2023, is anticipated to witness substantial growth, with total revenue projected to reach nearly US$ 289.72 million by 2030, growing at a CAGR of 5.3% from 2024 to 2030. This growth is driven by several factors, including the increasing demand for LPG as a clean and efficient fuel source, particularly in residential, commercial, and industrial applications. Additionally, the expanding use…

LPG Tanker Market May See a Big Move | Major Giants Dorian LPG, Pertamina, Navig …

The latest study released on the Global LPG Tanker Market by AMA Research evaluates market size, trend, and forecast to 2027. The LPG Tanker market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in…

France LPG Market Growth Driven by Low Upfront Cost of LPG Boilers

A number of factors such as the low upfront cost and less storage space required by LPG boilers and the massive government support toward new energy vehicles will help the French LPG market demonstrate a CAGR of 2.1% between 2020 and 2030. According to P&S Intelligence, the market was valued at $7,691.2 million in 2020, and it will generate $9,480.3 million revenue by 2030. Additionally, the rising public awareness regarding…

Global Bio LPG Market Poised to Offer Sustainable Solution for Soaring Demand fo …

The global Bio LPG demand is expected to rise during the forecast period as it is an ideal energy solution that helps in reducing the emissions of CO2 by 80%. Consumers are increasingly adopting it as it is derived from plant and vegetable residues and municipal waste. A recent report published by Fairfield Market Research predicts that the global Bio LPG market is expected to reach US$1,020.32 Mn by 2025…