Press release

Australia ATM Market Size, Share, Trends and Forecast by 2025-2033

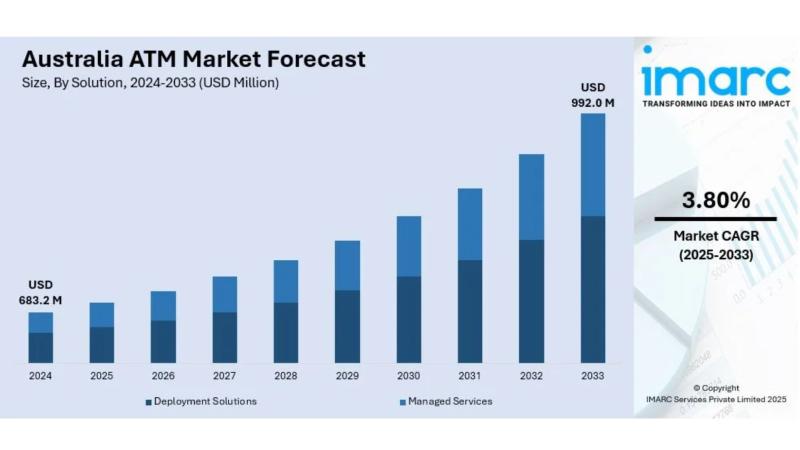

The latest report by IMARC Group, titled "Australia ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033," provides a comprehensive analysis of the market's growth drivers, segmentation, and competitive landscape.The Australia ATM market size reached USD 683.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 992.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033.

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 683.2 Million

Market Forecast in 2033: USD 992.0 Million

Market Growth Rate (2025-2033): 3.80%

Request For Sample Report:

https://www.imarcgroup.com/australia-atm-market/requestsample

Australia ATM Market Overview

The Australian ATM landscape is changing consumer habits are shifting toward digital or contactless payments. The growing uptake of mobile wallets, online banking and tap and go payments has meant ATM withdrawals and cash-based transactions have fallen, particularly in metropolitan areas characterised by greater access to all forms of digital payment options. That said, ATMs will always be an important cash access point for consumers living in rural and remote communities.

Most banks and fintechs are investing in digital payment infrastructure and enhancing mobile banking offerings by putting in place protections around cyber security. This all adds up to a changing market, characterised by continued consolidation and delivery methods that are perhaps becoming a more sophisticated service of fewer multi-functional ATMs.

Australia ATM Market Trends and Drivers

The Trend of Moving Towards Cash-Free Transactions:

Increasingly, Australians are using mobile wallets/digital payments more than ever, with over 500 million mobile wallet payments valued at $20 billion in one month during 2024. This has resulted in a decrease in cash withdrawals from ATMs, particularly in metropolitan areas.

The Use of Smart and Multifunction ATMs:

The decline in traditional ATM usage is accompanied with an increase in the demand for smart ATMs with cash deposit features, biometric authentication, cardless withdrawals and real-time bill payments. These machines support customer convenience and help meet the demands of customers who wish to use a combination of the digital and physical banking approach.

Improved Security and Technology:

New ATMs are now a far cry from the ATMs of the 1990s, and have all the anti-skimming technology, facial recognition, and encryption based authentication to reduce fraud. With the increased intelligence of automation, AI and big-data and analytics can be used for predictive maintenance, to enhance user experience and improve ageing technology.

Geographic Representation:

As the use of ATM's declines in metropolitan areas, ATM's are still prominently used in rural and remote communities to access cash on a daily basis. Financial institutions are continuing to address the best way to optimize ATM networks to deliver cash access to all community members in Australia.

Browse full report with TOC & all list of figure: https://www.imarcgroup.com/australia-atm-market

Australia ATM Market Segmentation

By Solution:

• Deployment Solutions (Onsite ATMs, Offsite ATMs, Work Site ATMs, Mobile ATMs)

• Managed Services

By Screen Size:

• 15" and Below

• Above 15"

By Application:

• Withdrawals

• Transfers

• Deposits

By ATM Type:

• Conventional/Bank ATMs

• Brown Label ATMs

• White Label ATMs

• Smart ATMs

• Cash Dispensers

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Australia ATM Market News

Recent developments include the integration of advanced security features, expansion of smart ATM capabilities, and the continued optimization of ATM networks to meet both digital and physical banking needs. Financial institutions are leveraging technology to reduce operational costs, enhance customer experience, and maintain accessibility in less urbanized areas.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Strategic Recommendations

5. Market Drivers and Success Factors

6. SWOT Analysis

7. Value Chain Analysis

8. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information not currently within the scope of the report, customization is available.

Ask analyst for customized report :https://www.imarcgroup.com/request?type=report&id=31663&flag=E

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

About Us

IMARC Group is a leading market research and consulting company that delivers strategy, research, and business intelligence solutions worldwide. We help organizations identify market opportunities, benchmark industry performance, and drive transformative growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia ATM Market Size, Share, Trends and Forecast by 2025-2033 here

News-ID: 4011943 • Views: …

More Releases from IMARC Services Private Limited

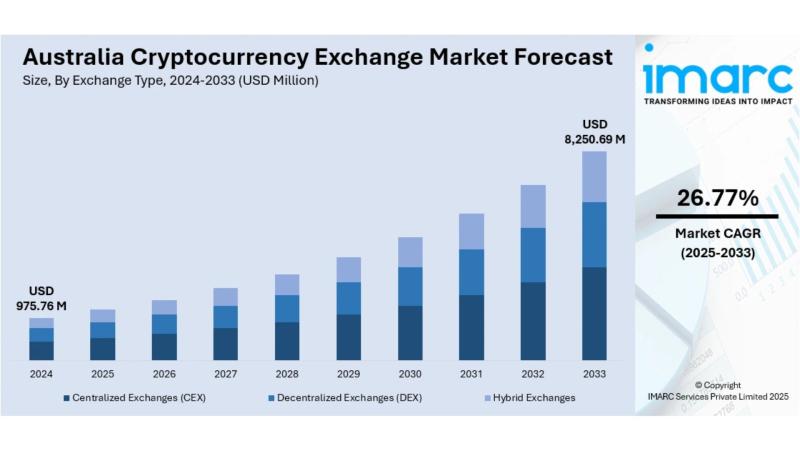

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

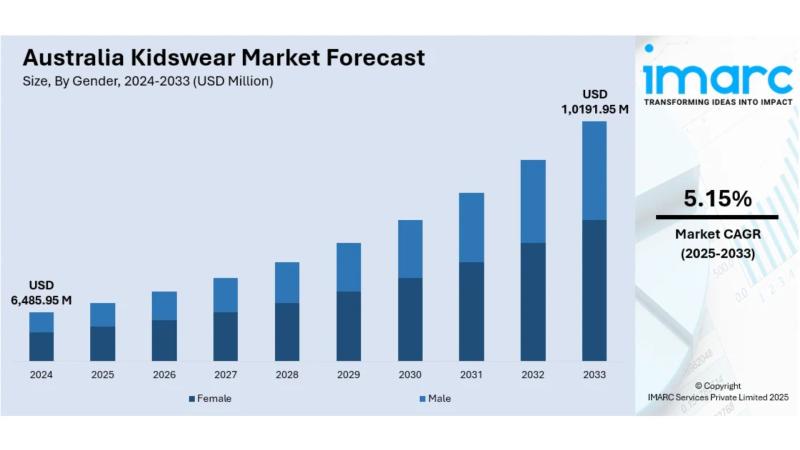

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

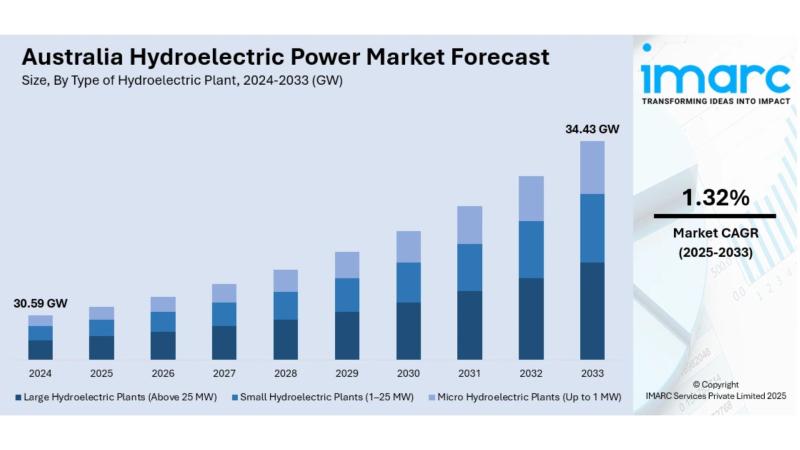

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

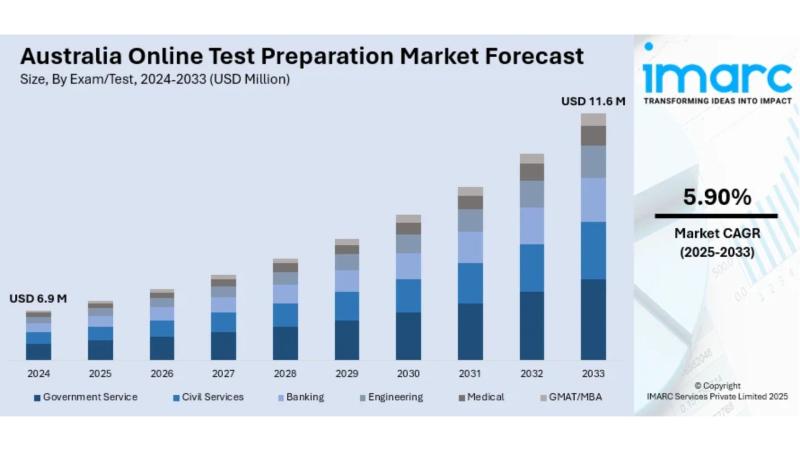

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for ATM

ATM Managed Services Market Expands: AI, Cloud & ATM-as-a-Service Drive Transfor …

ATM Managed Services Market size was valued at USD 10.5 Billion in 2024 and is projected to reach USD 16.2 Billion by 2033, exhibiting a CAGR of 5.2% from 2026 to 2033.

What are the potential factors contributing to the growth of the ATM Managed Services Market?

The ATM Managed Services Market is experiencing growth due to several key factors. The increasing demand for cost-effective banking operations is a major driver, as…

Prominent Automatic Teller Machine (ATM) Security Market Trend for 2025: Innovat …

"Which drivers are expected to have the greatest impact on the over the automatic teller machine (atm) security market's growth?

The surge in automated teller machine (ATM) fraud incidents is projected to fuel the expansion of the automated teller machine (ATM) security market in the future. An ATM is a specific type of computerized device that allows individuals to conduct a range of banking activities without requiring human assistance or a…

Global ATM Market by Types(On-site ATM,Off-site ATM,Work Site ATM,Mobile Site AT …

The global ATM market has the potential to grow with xx million USD with growing CAGR in the forecast period from 2021f to 2026f.

Global ATM Market Overview

This market research report consists of a number of sections that provide data on the current state of the market, industry trends, and future prospects. It also includes analysis of key players and their positions in the market. The increasing adoption…

Contactless ATM (Cardless ATM) Market: Industry Future Developments, Competitive …

The Contactless ATM (Cardless ATM) market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status…

Global Contactless ATM (Cardless ATM) Industry Professional Market Size Survey b …

This report also researches and evaluates the impact of Covid-19 outbreak on the Contactless ATM (Cardless ATM)�industry, involving potential opportunity and challenges, drivers and risks. We present the impact assessment of Covid-19 effects on Contactless ATM (Cardless ATM)�and market growth forecast based on different scenario (optimistic, pessimistic, very optimistic, most likely etc.).

�

Scope of the Report:

The report presents the market outlook for the Indian Phospho Gypsum product from the year 2019…

Global Contactless ATM (Cardless ATM) Market Expected to Witness a Sustainable G …

LP INFORMATION offers a latest published report on Contactless ATM (Cardless ATM) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This intelligence Contactless ATM (Cardless ATM) Market report by LP INFORMATION includes investigations based on the current scenarios, historical records, and future predictions. An accurate data of various aspects such as type, size, application, and end user have been scrutinized…