Press release

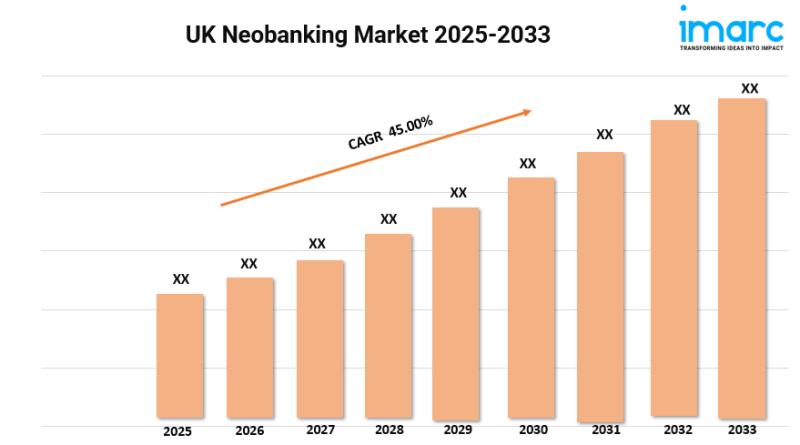

UK Neobanking Market Size to Hit USD 182.32 Billion by 2033 | Grow CAGR by 45.00%

UK Neobanking Market OverviewBase Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 45.00% (2025-2033)

The UK neobanking sector has experienced rapid growth. This growth comes from people wanting digital-first financial solutions. According to the latest report by IMARC Group, the UK neobanking market size reached USD 6.44 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 182.32 billion by 2033, exhibiting a growth rate (CAGR) of 45.00% during 2025-2033.

Download a sample copy of the Report: https://www.imarcgroup.com/uk-neobanking-market/requestsample

UK Neobanking Trends and Drivers:

The UK neobanking sector has experienced rapid growth. This growth comes from people wanting digital-first financial solutions. Neobanks, such as Monzo, Starling, and Revolut, have changed banking. They provide easy-to-use apps, instant spending insights, and cheap international transactions. Open banking rules allow neobanks to establish connections with third-party services without difficulty. This improves features such as budgeting tools and investment options. Younger people, especially Gen Z and Millennials, like neobanks. They enjoy their modern designs and ethical branding. Many also choose accounts that focus on sustainability. Neobanks have grown their ecosystems by partnering with fintechs and e-commerce platforms. These partnerships offer benefits such as cashback and integrated savings vaults. However, challenges persist, including profitability concerns and regulatory scrutiny over anti-money laundering compliance. Neobanks are facing more competition. So, they are expanding into lending and wealth management. This helps them gain more market share. This shows its strong potential. Consumer trust in digital-only banks is increasing. FCA oversight helps build this trust. Neobanks are becoming a key part of modern finance, even with economic uncertainties.

Neobanks are transforming the UK financial landscape. They use technology to better serve consumer needs. Artificial intelligence and machine learning will be key to their strategies. These tools provide personalized financial advice and help detect fraud. AI chatbots answer customer questions in real time, reducing costs. Embedded finance is a major trend. This means banking services blend into non-financial platforms like retail apps. Neobanks team up with brands to offer smooth payment options. Regulatory sandboxes allow testing of new products. For example, they can test accounts that support cryptocurrency. These accounts attract tech-savvy users. Yet, economic challenges like inflation and rising interest rates threaten neobanks' low-fee models. Some are launching premium subscriptions. These offer features like travel insurance or higher savings rates. Neobanks face tough competition for new customers. So, they invest heavily in marketing and referral programs. They are popular with small businesses that need flexible banking. Neobanks are growing fast, but they face challenges. They find it hard to expand globally and still meet local regulations.

Buy Full Report: https://www.imarcgroup.com/checkout?id=29774&method=1060

UK Neobanking Industry Segmentation:

The report has segmented the market into the following categories:

Account Type Insights:

● Business Account

● Savings Account

Application Insights:

● Enterprises

● Personal

● Others

Regional Insights:

● London

● South East

● North West

● East of England

● South West

● Scotland

● West Midlands

● Yorkshire and The Humber

● East Midlands

● Others

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=29774&flag=C

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Key highlights of the Report:

● Market Performance (2019-2024)

● Market Outlook (2025-2033)

● COVID-19 Impact on the Market

● Porter's Five Forces Analysis

● Strategic Recommendations

● Historical, Current, and Future Market Trends

● Market Drivers and Success Factors

● SWOT Analysis

● Structure of the Market

● Value Chain Analysis

● Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UK Neobanking Market Size to Hit USD 182.32 Billion by 2033 | Grow CAGR by 45.00% here

News-ID: 4010670 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Neobanks

Why Are Fintechs and Neobanks Pushing eSIMs? A Comprehensive Analysis by PayRate …

In recent years, the rapid adoption of eSIM technology by fintechs and neobanks has raised eyebrows. Once seen as the domain of telecom providers, eSIMs are now being bundled with banking services in what appears to be a curious convergence of finance and telecom. On the surface, this seems like an evolution in customer convenience, but beneath the glossy marketing, is there a deeper strategy at play?

The Rise of eSIMs:…

Neobanks Market Growth Probability, Leading Vendors and Future Scenario By 2024- …

Neobanks Market was valued at $ billion in 2023, and is projected to reach $ trillion by 2032, growing at a CAGR of 17.3% from 2024 to 2032. Neobanks are financial institutions that digitally offer a wide range of banking and financial services. Neobanks operate exclusively online without any physical infrastructure. Neobanks rely on the use of fintech to provide banking services.

In order to form NeobanksMarket research report, market analysts…

Neobanks Market Growth Probability, Leading Vendors and Future Scenario By 2024- …

Neobanks Market was valued at $ billion in 2023, and is projected to reach $ trillion by 2032, growing at a CAGR of 17.3% from 2024 to 2032. Neobanks are financial institutions that digitally offer a wide range of banking and financial services. Neobanks operate exclusively online without any physical infrastructure. Neobanks rely on the use of fintech to provide banking services.

In order to form NeobanksMarket research report, market…

Neobanks Market: Industry Future Developments, Revenue and Top Companies Analysi …

The Neobanks market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development prospects.…

Neobanks Market Outlook 2021: Big Things are Happening

Worldwide Neobanks Market In-depth Research Report 2021, Forecast to 2026 is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Worldwide Neobanks Market. Some of the key players profiled in the study are Atom Bank, Movencorp, Simple…

Neobanks Market Experience a Revolutionary growth | Atom Bank, Movencorp, Simple …

The ‘ Neobanks market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Neobanks market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Neobanks market size forecast, market data & Graphs…