Press release

Advanced Risk Analysis with the New Version of UnRisk Excel

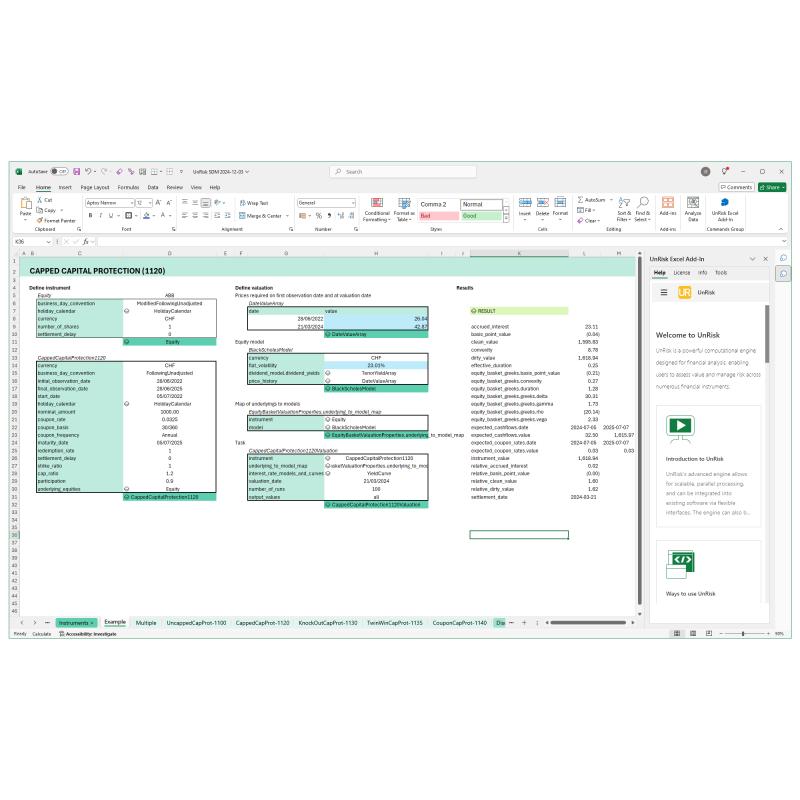

UnRisk announces the updated version of UnRisk Excel. The Microsoft Excel add-in integrates advanced quantitative finance capabilities directly into Excel, enabling robust valuations and risk analyses for all Excel users, without any coding required. With clients such as Moody's, Volksbanken, KPMG, and Raiffeisen Capital Management, UnRisk has established itself as a trusted partner for demanding financial analysis. UnRisk Excel is now available as a free trial for interested users."UnRisk Excel delivers precise valuations and comprehensive risk analytics without technical barriers. It enables fast, transparent analysis of complex financial instruments. That saves time and increases clarity," said Dr. Michael Aichinger, CEO of UnRisk.

With more than 25 years of experience in quantitative finance, UnRisk combines algorithmic and numerical expertise with the familiar Excel interface. The solution is built on the established UnRisk Library - a high-performance C++ engine that provides consistent valuation logic and advanced risk analytics across all asset classes.

UnRisk Excel combines models for a wide range of risk factors, tools for their calibration, and various methods for the valuation and analysis of complex financial instruments. It supports numerous instrument types across all asset classes, including interest rate, equity, FX, and credit derivatives, as well as all structured products according to the EUSIPA classification.

Key Features of UnRisk Excel

The new version combines powerful functions with simple operation. Key benefits at a glance:

• Seamless Excel integration

• Accurate valuations and analysis in a familiar, no-code environment

• Broad selection of models and methods

• Comprehensive set of key figures for financial instruments

• Complete documentation of all methods

• Templates for different instrument types

• Optional modules for xVA, VaR and scenario analysis

Why it Matters Now

Increasing regulatory pressure, rising product complexity, and the demand for transparent valuations pose constant challenges for financial institutions. UnRisk Excel offers an immediately applicable solution for the valuation and risk analysis of complex financial instruments, all within Excel.

Typical Use Cases

UnRisk Excel supports professionals across various areas, including:

• Risk management

• Front office and trading

• Compliance and Regulatory

• Fintechs and Consultants

Live Demo & Free Trial

A free 30-day trial license is available after a short live demo: www.unrisk.com/risikoanalyse-in-excel

uni software plus GmbH

Alice Rottmann (Head of Marketing)

Linzerstraße 2, 4320 Perg, Austria

office@unrisk.com

Press materials: https://uspstation.unisoftwareplus.com/sharing/h4v6DsP2Q

UnRisk is a brand of uni software plus GmbH, specializing in quantitative finance. Since 1997, the Austrian fintech has been developing software for valuation and risk management in financial markets and supporting clients with expert consulting. The team combines deep expertise in financial mathematics, software engineering, and financial analytics. Leading financial institutions rely on UnRisk for tailored, transparent, model-based decision support at the highest professional level.

Further information on UnRisk can be found at www.unrisk.com.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Advanced Risk Analysis with the New Version of UnRisk Excel here

News-ID: 4005705 • Views: …

More Releases for Risk

The Risk Side of Crypto Trading: Safety Tips + Risk Management

The Risk Side of Crypto Trading: Safety Tips + Risk Management

Cryptocurrency trading can be exciting, fast-moving, and potentially profitable. But it also carries serious risks that many beginners underestimate.

From dramatic price swings in Bitcoin to rapid market shifts in Ethereum, crypto markets are among the most volatile financial environments in the world.

If you're entering crypto trading - especially short-term or automated trading - understanding the risk side is not optional.

In…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…