Press release

ESG Reporting Software Market to Experience Surge to US$2,667.1 Mn by 2031 - Persistence Market Research

The ESG reporting software market is gaining significant momentum globally as companies increasingly embrace sustainability, ethical governance, and transparency. Fueled by stringent regulations and growing investor demand for non-financial disclosures, organizations are adopting advanced digital platforms to monitor and report their Environmental, Social, and Governance (ESG) metrics with precision and accountability.In 2024, the global market is projected to reach US$ 978.6 million, and it is expected to grow at a 15.4% CAGR, reaching US$ 2,667.1 million by 2031. Cloud-based deployment leads the segment with a 54.3% share, while large enterprises account for 62.4% of the market, driven by their greater capacity for risk assessment and compliance demands. North America dominates globally with a 45% share, thanks to higher sustainability investments and tech-forward corporate governance standards.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/34966

➤ Key Highlights from the Report

➤ The global ESG software market is projected to reach US$ 2,667.1 million by 2031.

➤ Cloud-based solutions are expected to hold 54.3% of the deployment share in 2024.

➤ Large enterprises will dominate the market with a 62.4% share due to higher ESG compliance obligations.

➤ North America will account for 45% of the global market share in 2024.

➤ Regulatory pressure, including the CSRD, continues to push ESG reporting adoption.

➤ AI and big data technologies are enhancing reporting accuracy and decision-making.

Market Segmentation: By Deployment, Type & Organization Size

The ESG reporting software market is segmented by deployment into cloud-based and on-premise solutions. Cloud-based deployment is increasingly favored due to its scalability, reduced upfront infrastructure cost, and ability to manage vast datasets in real time. Leading software providers are optimizing their platforms for cloud usage to offer seamless integration, accessibility, and performance across global teams.

Based on organization size, large enterprises lead the segment due to their complex operations, higher compliance demands, and strategic focus on ESG investments. They increasingly use AI-driven tools for predictive modeling and sustainability risk assessment. On the other hand, SMEs are gradually adopting modular and cost-effective solutions to stay competitive and transparent amid growing regulatory expectations.

Regional Insights

North America, led by the United States, is the most dominant market, contributing around 45% of the global share in 2024. The rise of sustainable investing, ESG compliance laws, and proactive corporate strategies have encouraged widespread adoption. Tech giants like Microsoft and Salesforce are also enhancing ESG platforms to meet real-time compliance needs.

In Europe, strong legislative frameworks such as the EU Taxonomy Regulation and Sustainable Finance Disclosure Regulation (SFDR) have driven ESG software uptake. The region is expected to hold 32.8% of the market in 2024, with key players like SAP and Wolters Kluwer investing in advanced ESG solutions tailored to corporate needs across multiple industries.

Market Drivers

Rising Investor Pressure and Regulatory Compliance

Growing scrutiny from institutional investors, regulatory bodies, and consumers has significantly increased the pressure on companies to demonstrate ESG accountability. Legislative developments like the Corporate Sustainability Reporting Directive (CSRD) have created a structured environment that mandates thorough ESG disclosures. Companies are increasingly required to disclose their climate impact, governance practices, and social responsibilities, making software solutions indispensable for reporting and compliance.

Integration of AI and Data Analytics in ESG Reporting

Technological advancement is another key driver, with AI, big data, and machine learning enhancing the capabilities of ESG reporting platforms. These technologies reduce manual data entry, eliminate duplication, and improve real-time decision-making. Companies like Oracle and KPMG are investing in advanced ESG tools that integrate with existing enterprise systems to automate sustainability tracking and predictive analytics.

Market Restraints

Complexity of ESG Data Standardization

Despite rapid adoption, the lack of unified ESG reporting standards remains a challenge. Different industries and countries have varying frameworks, which makes it difficult for companies to create consistent and comparable reports. Furthermore, high implementation costs and the complexity of integrating ESG metrics with legacy systems discourage many SMEs from adopting these platforms.

Technical & Budgetary Constraints Among SMEs

Small and mid-sized businesses often face resource limitations in hiring ESG professionals or investing in advanced tools. The cost of implementation, combined with a steep learning curve and evolving regulations, can be prohibitive. Additionally, inconsistencies in social and governance metrics make it hard for these businesses to track and report qualitative data effectively.

Market Opportunities

Blockchain Integration to Enhance Transparency

The application of blockchain technology in ESG reporting offers a new frontier for accountability. Immutable data ledgers ensure transparency, data traceability, and prevent tampering, which are key concerns in sustainability reporting. Blockchain-backed ESG software can significantly increase investor confidence and satisfy regulatory audits more efficiently.

Linking ESG with EHS and Risk Management Tools

The convergence of ESG software with Environment, Health & Safety (EHS) and risk management platforms opens up new possibilities for holistic compliance and strategy implementation. By unifying these solutions, businesses can align sustainability goals with operational and risk objectives. Companies like Sphera and IBM are leading the way with integrated platforms that offer a 360-degree view of corporate responsibility and performance.

➤ Frequently Asked Questions (FAQs)

➤ How Big is the ESG Reporting Software Market in 2024?

➤ Who are the Key Players in the Global ESG Reporting Software Market?

➤ What is the Projected Growth Rate of the ESG Software Market Through 2031?

➤ What is the Market Forecast for ESG Reporting Software by 2032?

➤ Which Region is Estimated to Dominate the ESG Software Industry Through the Forecast Period?

✦ Company Insights

Here are the key players actively shaping the ESG reporting software landscape:

✦ Datamaran

✦ EcoVadis

✦ NAVEX Global, Inc.

✦ OneTrust, LLC

✦ Refinitiv

✦ SAS Institute Inc.

✦ Sustainalytics

✦ TruValue Labs

✦ Verisk 3E

✦ Wolters Kluwer N.V.

✦ Nasdaq

✦ PWC

✦ Diligent

✦ Sphera

✦ Accuvio

Conclusion: A Sustainable Path Forward

The global ESG reporting software market is positioned for sustained growth, driven by the intersection of regulation, technology, and market expectations. As investors and consumers increasingly value transparency and accountability, businesses must act proactively to integrate ESG software into their strategic planning. From AI-powered platforms to blockchain-integrated solutions, the next wave of innovation is set to redefine how companies measure and communicate their impact on the planet and society.

Looking ahead, the convergence of ESG, EHS, and risk management tools will create powerful ecosystems for sustainable business. Companies that leverage these innovations early will not only ensure compliance but also gain a competitive edge in a rapidly evolving global marketplace.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ESG Reporting Software Market to Experience Surge to US$2,667.1 Mn by 2031 - Persistence Market Research here

News-ID: 4004014 • Views: …

More Releases from Persistence Market Research

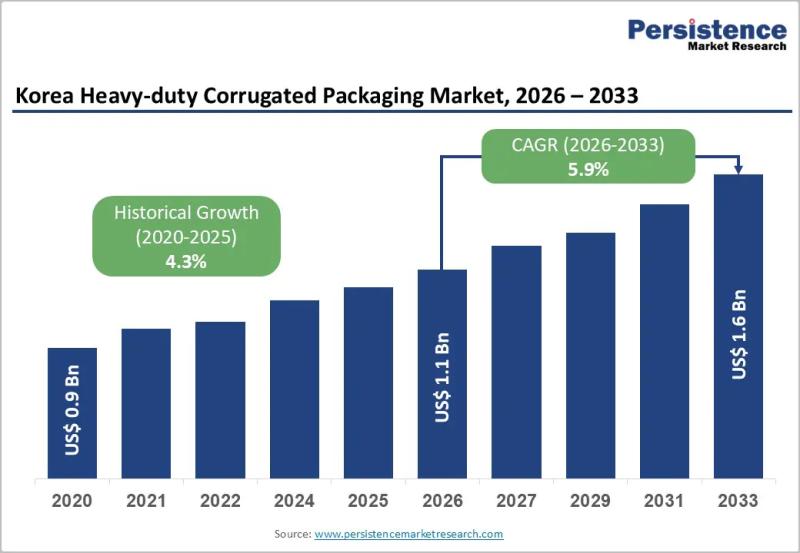

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…