Press release

UK Mortgage Market Projected to Reach USD 117.07 Billion by 2033

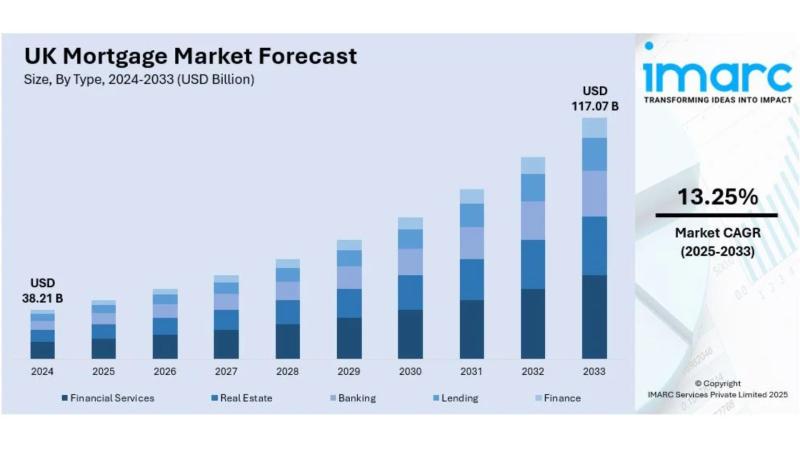

The latest report by IMARC Group, titled "UK Mortgage Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033," offers a comprehensive analysis of the UK mortgage market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The UK mortgage market size reached USD 38.21 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 117.07 Billion by 2033, exhibiting a growth rate (CAGR) of 13.25% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 38.21 Billion

Market Forecast in 2033: USD 117.07 Billion

Market Growth Rate 2025-2033: 13.25%

UK Mortgage Market Overview

The UK mortgage market is witnessing strong growth due to increasing economic stability, favorable government policies, growing urbanization, and innovations in mortgage lending technology. The growth of the market is also strengthened by efforts directed at lowering interest rates and enabling ownership of homes among a wider section of the population.

Request For Sample Report:

https://www.imarcgroup.com/uk-mortgage-market/requestsample

UK Mortgage Market Trends and Market Drivers

Rising Economic Growth and Stability:

The robust UK economy makes consumers spend substantial amounts of money, including buying houses. The IMF estimates that the GDP of the UK will grow by 0.7% in 2024, compared to 0.5% in 2023. This growth in the economy has a positive effect on the mortgage market through consumer confidence and purchasing power.

Government Housing Policies and Schemes:

Government policies such as Help to Buy, Shared Ownership, and Stamp Duty relief have played a vital role in supporting homeownership. These schemes offer financial support in the form of equity loans, reduced deposits, or tax relief, helping first-time buyers and low-income families to access the housing market. For example, the Help to Buy scheme has greatly enhanced the availability of newly developed homes for a wider number of prospective buyers.

Innovative Lending Strategies:

In August 2024, Lloyds Banking Group said it will permit new customers to borrow as much as 5.5 times their annual household income, more than the usual limit. The step will help make first-time buyers home owners, improving the development of the UK mortgage market.

UK Mortgage Market Segmentation

1. By Type

• Fixed-Rate Mortgages

• Variable-Rate Mortgages

• Tracker Mortgages

• Others

2. By Application

• Residential

• Commercial

• Others

3. By Region

• England

• Scotland

• Wales

• Northern Ireland

Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/uk-mortgage-market

UK Mortgage Market News

August 2024: Lloyds Banking Group announced that it would allow new buyers to take out loans worth up to 5.5 times their household annual income, higher than the traditional maximum. This initiative aims to support first-time buyers in purchasing new homes, thereby enhancing the UK mortgage market growth.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32004&flag=E

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UK Mortgage Market Projected to Reach USD 117.07 Billion by 2033 here

News-ID: 4003065 • Views: …

More Releases from IMARC Group

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

Australia Reverse Logistics Market Projected to Reach USD 21,448.0 Million by 20 …

Market Overview

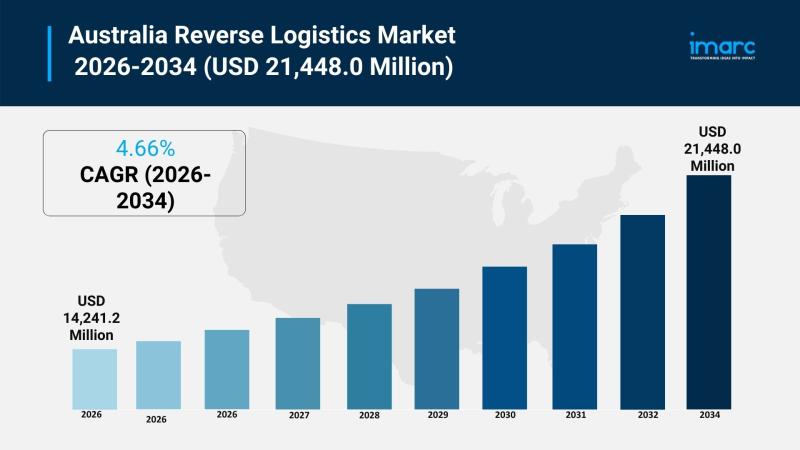

The Australia reverse logistics market size reached USD 14,241.2 Million in 2025 and is projected to reach USD 21,448.0 Million by 2034, growing at a CAGR of 4.66% during 2026-2034. This expansion is driven by the rise in e-commerce platforms, environmental sustainability efforts, and the integration of advanced technologies in logistics operations. The market encompasses return types, services, end users, and regional segments across Australia. For more details, visit…

Global Hummus Market Report 2026-2034: Growth, Trends, Packaging, Channels & Reg …

The global hummus market size reached USD 4.7 Billion in 2025 and is anticipated to reach USD 9.1 Billion by 2034, reflecting a CAGR of 7.50% during the forecast period 2026-2034. This growth is driven by increasing lifestyle diseases, rising health-conscious consumers, and escalating demand for plant-based proteins. The popularity of hummus as a substitute for traditional condiments further supports market expansion.

Study Assumption Years

Base Year: 2025

Historical Period: 2020-2025

Forecast Period:…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…