Press release

Rising Natural Disasters Propel Expansion In Crop Reinsurance Market: A Significant Driver Propelling The Crop Reinsurance Market In 2025

The Crop Reinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Crop Reinsurance Market Size and Projected Growth Rate?

The Crop Reinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Crop Reinsurance Market Size and Projected Growth Rate?

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12516

What Are the Major Segments in the Crop Reinsurance Market?

The crop reinsurance market covered in this report is segmented -

1) By Type: Crop Yield Reinsurance, Crop Price Reinsurance, Crop Revenue Reinsurance

2) By Application: Multi-Peril Crop Insurance (MPCI), Crop Hail, Livestock, Forestry

3) By Distribution Channel: Banks, Insurance Companies, Brokers And Agents, Other Distribution Channels

Subsegments:

1) By Crop Yield Reinsurance: Multi-Peril Crop Yield Reinsurance, Single-Peril Crop Yield Reinsurance, Weather-Based Yield Reinsurance

2) By Crop Price Reinsurance: Price-Triggered Reinsurance, Commodity Price Index Reinsurance

3) By Crop Revenue Reinsurance: Yield And Price Combined Reinsurance, Revenue Protection Reinsurance, Area-Based Revenue Reinsurance

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=12516&type=smp

What Are The Driving Crop Reinsurance Market Evolution?

The surge in natural disasters is predicted to drive the expansion of the crop reinsurance market. These natural disasters are extreme occurrences in the natural world which lead to extensive destruction, damage, and loss of lives. They are typically due to natural phenomena rather than human actions, including earthquakes, floods, hurricanes, and wildfires. Crop reinsurance offers monetary protection to crop insurers against losses stemming from these natural disasters and aids farmers or agricultural bodies whose crops have been adversely affected or annihilated by these events. For example, the International Federation of Red Cross and Red Crescent Societies, a humanitarian aid organization based in Switzerland, reported in May 2023 stating in the period of 2020-2021, 710 disasters due to natural phenomena impacted over 220 million people, resulting in over 30,000 deaths. Additionally, Forbes Media LLC, a media organization based in the US, reported in January 2023, that the US witnessed 18 climatic disasters in 2022, inflicting damages worth over $1 billion and claiming 474 lives. Consequently, the escalation in natural disasters is fuelling the development of the crop reinsurance market.

Which Firms Dominate The Crop Reinsurance Market Segments?

Major companies operating in the crop reinsurance market include Munich Re Group, Swiss Reinsurance Company Ltd., Tokio Marine Holdings Inc., Chubb Group of Insurance Companies, Zurich Insurance Group Ltd., Sompo Holdings Inc., Hannover Re Group, SCOR SE, Allianz SE, Aon PLC, Everest Re Group Ltd., Axa XL, Arch Capital Group Ltd., Korean Reinsurance Co, American Financial Group Inc., PartnerRe Ltd., AXIS Capital Group, Lloyds of London, Hudson Insurance Group, MS Amlin AG, African Reinsurance Corporation, ProAg, Farmers Mutual Hail Insurance Company of Iowa, AgriLogic Insurance Services, Rain and Hail Insurance Service Inc., AgriSompo North America, National Crop Insurance Services, Gallagher Re

What Trends Are Expected to Dominate the Crop Reinsurance Market in the Next 5 Years?

Major corporations involved in the crop reinsurance sector are leveraging strategic collaborations to deliver advanced parametric reinsurance services which boost risk administration and reinforce farmers' ability to weather losses tied to climate changes. Essentially, strategic collaborations involve companies maximizing each other's capabilities and resources for shared success and gains. For example, in June 2023, a fintech firm based in the US, Arbol Inc., established a partnership with The Institutes RiskStream Collaborative, also US-based. Together, they unveiled dRe, an innovative parametric reinsurance platform powered by blockchain technology that streamlines claims procedures and guarantees swift payouts. This state-of-the-art system takes advantage of smart contracts and confirmed weather data to elevate transparency and competence in dealing with severe storm disaster transactions, thereby revolutionizing the field of parametric insurance.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/crop-reinsurance-global-market-report

Which Is The Largest Region In The Crop Reinsurance Market?

North America was the largest region in the crop reinsurance market in 2024. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the crop reinsurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Crop Reinsurance Market?

2. What is the CAGR expected in the Crop Reinsurance Market?

3. What Are the Key Innovations Transforming the Crop Reinsurance Industry?

4. Which Region Is Leading the Crop Reinsurance Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Natural Disasters Propel Expansion In Crop Reinsurance Market: A Significant Driver Propelling The Crop Reinsurance Market In 2025 here

News-ID: 3996929 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

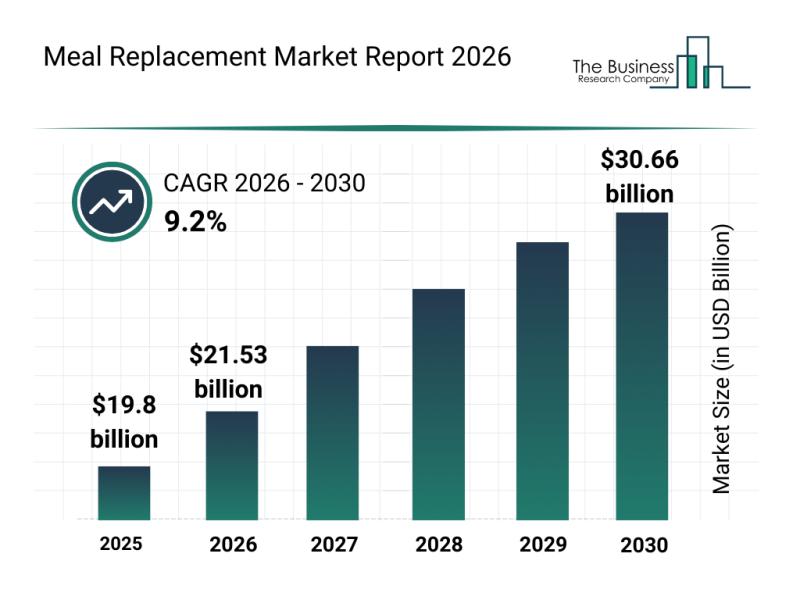

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

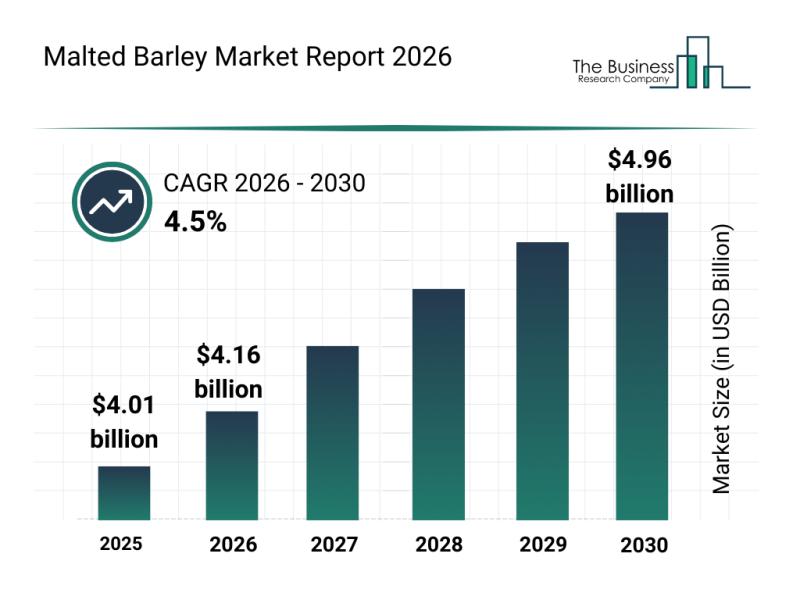

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

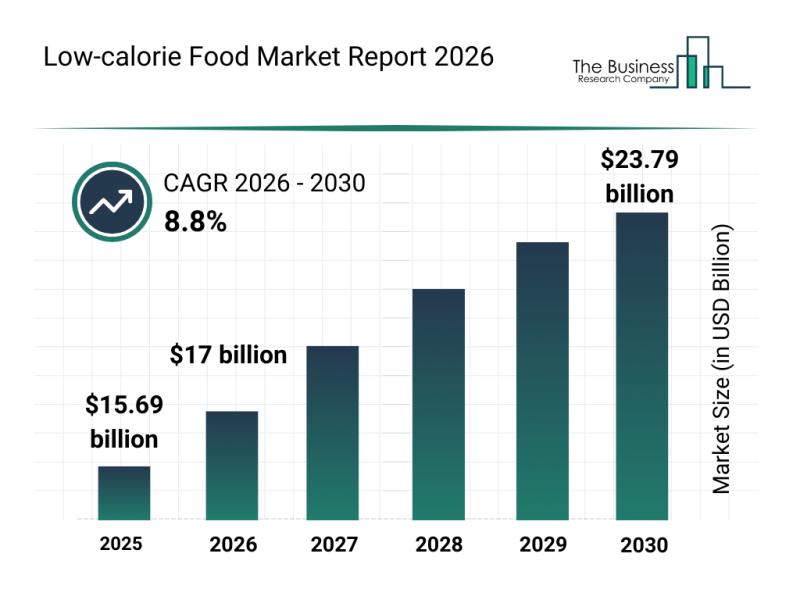

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

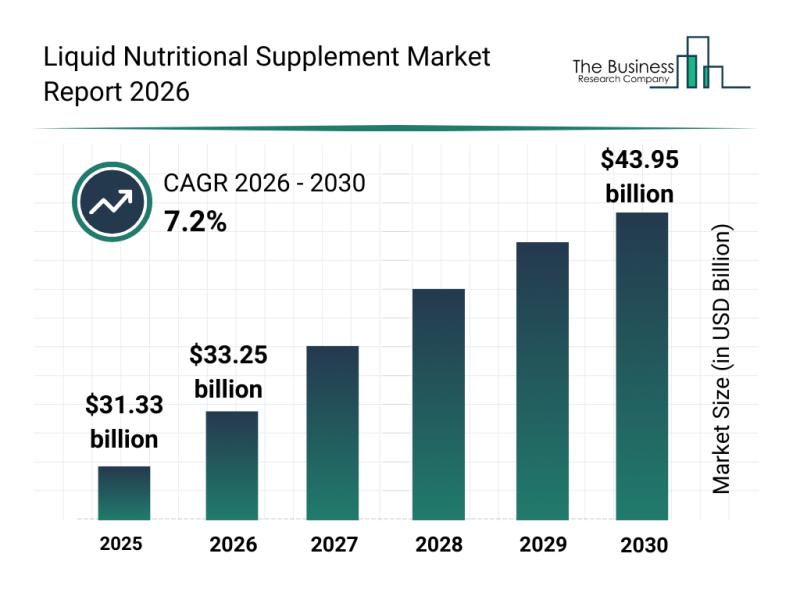

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for Reinsurance

Reinsurance Services Market SWOT Analysis by Key Players Hannover Re, Korean Rei …

The Latest research coverage on Reinsurance Services Market provides a detailed overview and accurate market size. The study is designed considering current and historical trends, market development and business strategies taken up by leaders and new industry players entering the market. Furthermore, study includes an in-depth analysis of global and regional markets along with country level market size breakdown to identify potential gaps and opportunities to better investigate market status,…

Crop Reinsurance Market Is Booming So Rapidly | Munich Reinsurance, Swiss Reinsu …

The Crop Reinsurance Market study with 65+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyze futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2029. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that…

Agriculture Reinsurance Market Is Booming Worldwide : Agroinsurance, Swiss Reins …

The Latest Released Agriculture Reinsurance market study has evaluated the future growth potential of Agriculture Reinsurance market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers, challenges,…

Recent Reinsurance Market Investment Activity From Established Companies Are to …

The latest release from WMR titled Reinsurance Market Research Report 2022-2028 (by Product Type, End-User / Application, and Regions / Countries) provides an in-depth assessment of the Reinsurance including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies, key players company profiles, and strategies. Global Reinsurance Market study with 100+ market data Tables, Pie Chat, Graphs & Figures is now released BY WMR. The report presents a complete assessment…

Life Reinsurance Market is Going to Boom | Swiss Re, Munich Reinsurance, Korean …

Advance Market Analytics published a new research publication on “Life Reinsurance Market Insights, to 2026″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Life Reinsurance market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…

Reinsurance Market To See Stunning Growth | Munich, Korean Reinsurance, Swiss

Latest Market Research on “Reinsurance Market” is now released to provide hidden gems performance analysis in recent years and years to come. The study explains a detailed overview of market dynamics, segmentation, product portfolio, business plans, and the latest development in the industry. Staying on top of market trends & drivers is always remain crucial for decision-makers and marketers to hold emerging opportunity.

Get the inside scoop with Sample report https://www.htfmarketreport.com/sample-report/3185812-global-reinsurance-market-26

Know…