Press release

Understanding the Aircraft Insurance Market: Trends, Challenges, and Growth Potential and Forecast 2025-2032

The aircraft insurance market is a crucial component of the global aviation industry, offering financial protection against potential risks that come with operating and owning aircraft. Whether it's commercial airlines, private jet owners, cargo carriers, or drone operators, every sector within aviation requires tailored insurance coverage to mitigate liabilities, protect assets, and ensure compliance with regulatory standards.Over the years, the aircraft insurance market has evolved in response to emerging technologies, global economic changes, and shifts in travel patterns. In this blog, we explore the current landscape of the aircraft insurance market, key drivers of growth, notable challenges, and the future outlook for insurers and stakeholders.

Discover In-Depth Insights: Get Your Free Sample of Our Latest Report Today@ https://www.stellarmr.com/report/req_sample/Aircraft-Insurance-Market/1969

The Scope of Aircraft Insurance

Aircraft insurance is a specialized branch of insurance that provides coverage for damage to aircraft, liability for passenger injuries, environmental damage, and damage caused by third-party property. Policies vary depending on the type of aircraft, its usage, the region of operation, and the operator's safety record.

Common types of coverage include:

Hull Insurance: Covers physical damage to the aircraft.

Liability Insurance: Protects against third-party claims for bodily injury or property damage.

Passenger Liability Insurance: Covers injury or death of passengers.

Ground Risk Insurance: Provides protection while the aircraft is on the ground, including during maintenance or storage.

Each of these coverages plays a vital role in protecting stakeholders from the financial repercussions of accidents, natural disasters, or technical malfunctions.

Market Drivers and Trends

The aircraft insurance market is influenced by a variety of factors, from global travel demand to technological advancements. One of the most significant drivers is the resurgence of air travel post-pandemic. As airlines restore and expand their fleets, the need for comprehensive insurance coverage has returned, boosting demand across regions.

Additionally, the growth of private aviation and the rise of unmanned aerial vehicles (UAVs), commonly known as drones, have opened new segments in the market. These newer technologies, particularly in drone delivery services and aerial photography, require insurance solutions tailored to unique operational risks.

Another trend shaping the market is the digital transformation within insurance itself. Insurtech solutions are enabling faster underwriting, data-driven risk assessment, and streamlined claims processing. Advanced analytics, artificial intelligence, and satellite data are being used to offer more accurate premium calculations and customized policies.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.stellarmr.com/report/Aircraft-Insurance-Market/1969

Regional Insights

The aircraft insurance market is globally diversified, with North America and Europe leading in terms of market share due to their large commercial fleets and well-established aviation infrastructure. Asia-Pacific is experiencing rapid growth, driven by expanding low-cost carriers, rising middle-class air travel, and increasing aircraft purchases by regional airlines.

Emerging economies are also fueling market expansion, especially as governments invest in airport infrastructure and local aviation companies expand their services. This geographic diversification offers significant opportunities for global insurers to penetrate new markets and build long-term relationships with local operators.

Challenges in the Aircraft Insurance Market

Despite its growth, the aircraft insurance market faces a number of challenges. One of the biggest concerns is rising costs due to the increasing complexity and value of modern aircraft. Newer aircraft, such as the latest generation of commercial jets or advanced business aircraft, involve higher repair and replacement costs, which directly impact premiums.

There is also heightened scrutiny over cybersecurity risks in aviation. As aircraft become more connected and reliant on software systems, insurers are beginning to evaluate the potential for cyberattacks that could compromise safety. This emerging threat is prompting discussions about including cyber coverage within aviation policies.

Another ongoing challenge is managing risk in the face of unpredictable weather events, geopolitical tensions, and fluctuating fuel prices. All these variables contribute to operational uncertainty and can influence insurance claims and policy structures.

Moreover, underwriting remains a complex task, especially for insurers dealing with high-risk operators or new aviation technologies. Inconsistent regulations across countries and regions further complicate the global insurance landscape.

Discover In-Depth Insights: Get Your Free Sample of Our Latest Report Today@ https://www.stellarmr.com/report/req_sample/Aircraft-Insurance-Market/1969

The Future of Aircraft Insurance

Looking ahead, the aircraft insurance market is expected to grow steadily, driven by technological integration, rising global air traffic, and evolving risk management practices. Insurers will need to adapt by offering more flexible, usage-based policies that align with customer needs and usage patterns.

Customization will be key. As the market diversifies with everything from electric aircraft to autonomous drones entering the scene, traditional insurance models will need to evolve. Collaborative efforts between insurers, manufacturers, and aviation authorities will be critical to designing policies that cover these innovations while managing potential risks.

Sustainability is also beginning to influence aviation insurance. As the industry aims for carbon neutrality, insurers may start offering incentives or tailored coverage to operators using greener technologies or sustainable fuel.

Related Reports:

Submarines Market https://www.stellarmr.com/report/Submarines-Market/1990

Food Truck Services Market https://www.stellarmr.com/report/Food-Truck-Services-Market/1991

Conclusion

The aircraft insurance market is at a transformative stage. It stands at the intersection of traditional aviation risk management and modern technological advancement. As the global aviation sector continues to evolve, insurers who can balance innovation with risk control will be best positioned to lead in this dynamic space.

Would you like a version of this blog formatted with SEO keywords or headlines for LinkedIn publishing?

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

sales@stellarmr.com

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Understanding the Aircraft Insurance Market: Trends, Challenges, and Growth Potential and Forecast 2025-2032 here

News-ID: 3994115 • Views: …

More Releases from Stellar Market Research. PVT. LTD

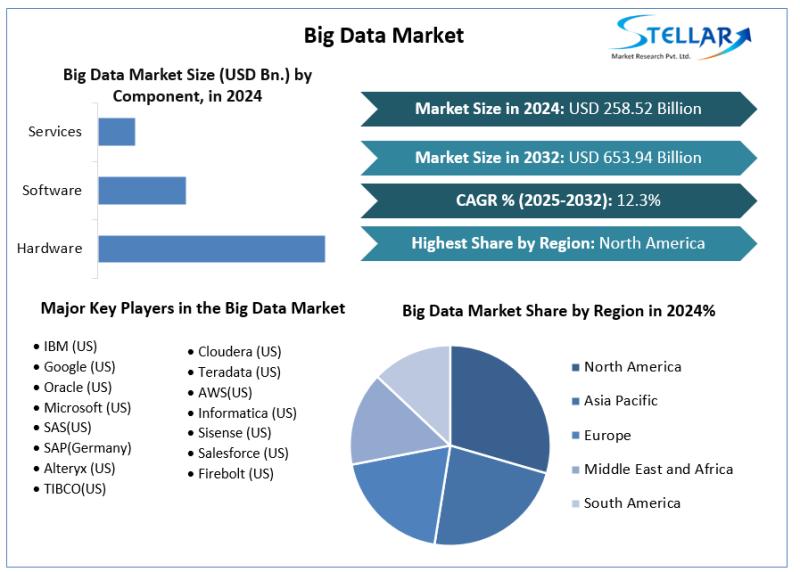

Big Data Market Expected To Reach USD 258.52 Billion 2032, at CAGR of 12.3% To F …

Big Data Market is expected to reach USD 653.94 Bn. in 2032 from USD 258.52 Bn. in 2024 at CAGR of 12.3 % during the forecast period.

Big data has moved from a technical concept to a core business asset. Organizations across industries now rely on massive volumes of structured and unstructured information to guide decisions improve customer experience and optimize operations. The big data market covers software platforms cloud…

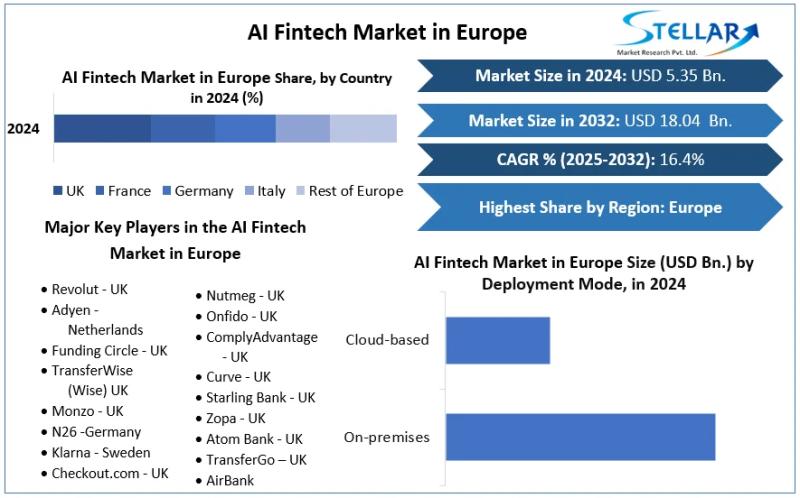

AI Fintech Market Projected To Reach USD 18.04 Billion 2032, at a CAGR of 16.40% …

The AI Fintech Market size in Europe was valued at USD 5.35 Billion in 2024 and the total AI Fintech Market size in Europe is expected to grow at a CAGR of 16.40% from 2025 to 2032, reaching nearly USD 18.04 Billion.

Artificial intelligence is rapidly becoming the backbone of modern financial services, and nowhere is this transformation more visible than in Europe. The region hosts a dense ecosystem of digital…

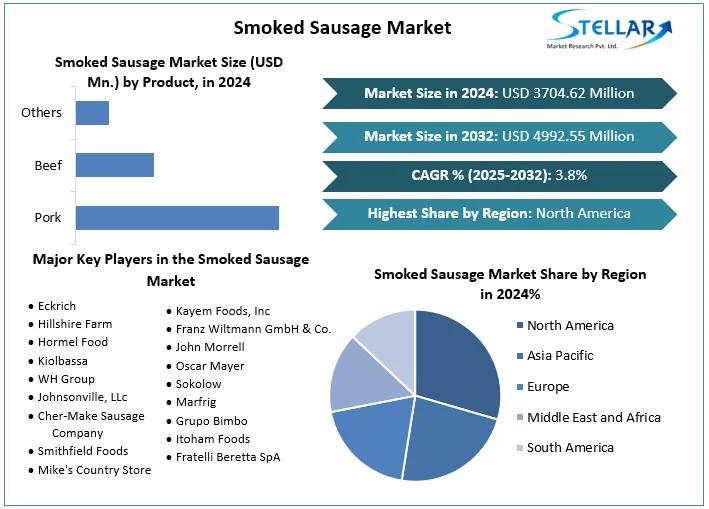

Smoked Sausage Market Tradition Meets Modern Convenience in a Flavor Driven Indu …

The Smoked Sausage Market size was valued at USD 3704.62 Mn. in 2024 and the total Global Smoked Sausage revenue is expected to grow at a CAGR of 3.8% from 2025 to 2032, reaching nearly USD 4992.55 Mn. by 2032.

Smoked sausage has a long culinary history rooted in preservation and flavor, yet today it stands as a modern, globally traded food category shaped by convenience, branding, and evolving consumer tastes.…

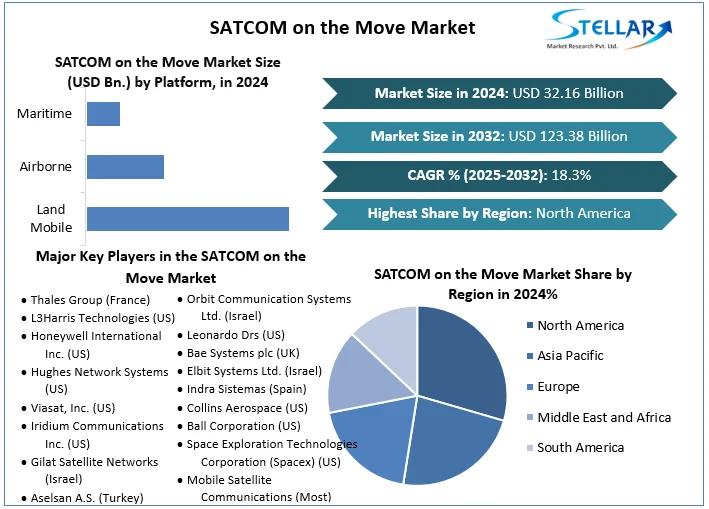

SATCOM on the Move Market Estimated To Grow at a CAGR of 18.3%, Reach USD 123.38 …

The SATCOM on the Move Market size was valued at USD 32.16 Bn. in 2024. The global SATCOM on the Move Market is estimated to grow at a CAGR of 18.3% over the forecast period.

SATCOM on the Move refers to satellite communication systems that provide reliable broadband connectivity to platforms in motion such as aircraft ships trains military vehicles and emergency response units. Unlike fixed satellite links these solutions are…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…