Press release

Banking as a Service Market to Reach USD 16.9 Billion by 2032, Growing at a CAGR of 18.8% (2025-2032) | Persistence Market Research

The Banking as a Service (BaaS) market is one of the fastest-growing sectors in the global financial industry, offering a platform for businesses to provide banking services without having to build their own infrastructure. The global market for BaaS is projected to grow substantially, with an estimated value of USD 16.9 billion by 2032, growing at a compound annual growth rate (CAGR) of 18.8% between 2025 and 2032. This impressive growth can be attributed to several key factors, including the increasing adoption of digital banking, the demand for financial inclusion, and the shift toward a more customer-centric approach to financial services.In recent years, the emergence of technology-driven financial services, particularly in the form of BaaS platforms, has revolutionized the banking landscape. BaaS allows companies to offer a wide range of financial services such as payments, lending, and savings, without the need for heavy infrastructure investments. This has made it easier for fintech startups, non-financial businesses, and even traditional banks to provide innovative financial products to their customers. The growing reliance on digital channels and the demand for seamless, integrated financial services across various platforms are expected to drive the market's expansion during the forecast period.

✅ Overview of the Market and Key Growth Drivers

The BaaS market is currently valued at USD 5.1 billion in 2025 and is forecast to grow at a robust CAGR of 18.8%, reaching USD 16.9 billion by 2032. The growth of the market is primarily driven by the rapid adoption of digital banking solutions, the proliferation of mobile payments, and the increasing number of partnerships between banks and fintech companies. These collaborations are enabling businesses to offer banking services without needing to acquire complex banking licenses or infrastructure.

A key growth driver is the shift towards financial inclusion and the demand for banking services in emerging economies. BaaS platforms provide an efficient way to extend banking services to underserved populations, especially in regions with limited access to traditional banking infrastructure. Furthermore, the flexibility and scalability of BaaS models allow companies to expand their service offerings quickly, increasing their competitive edge in a fast-evolving digital financial landscape. Geographically, North America and Europe dominate the market due to the region's established fintech ecosystem and high levels of digital adoption. However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period due to the rapid digitization of financial services and rising mobile payment adoption.

✅ Key Highlights from the Report:

➤ The global Banking as a Service market is projected to grow from USD 5.1 billion in 2025 to USD 16.9 billion by 2032.

➤ The market is expected to grow at a CAGR of 18.8% between 2025 and 2032.

➤ The increasing demand for financial inclusion is a key driver of the BaaS market's expansion.

➤ Partnerships between banks and fintech companies are facilitating the growth of the BaaS ecosystem.

➤ North America and Europe are expected to dominate the BaaS market in the coming years.

➤ Asia-Pacific is anticipated to exhibit the highest growth rate in the BaaS market during the forecast period.

✅ Market Segmentation

The Banking as a Service market can be segmented based on deployment mode, service type, and end-user. In terms of deployment mode, the market is primarily divided into cloud-based and on-premises solutions. Cloud-based platforms dominate the market due to their scalability, cost-efficiency, and ease of deployment. These platforms allow businesses to access a wide range of banking services through APIs, providing them with the flexibility to scale up or down based on customer demand.

In terms of service type, the market is segmented into core banking, payments, lending, and others. Core banking services, which include account management and transaction processing, dominate the market, driven by the growing need for businesses to offer essential banking functionalities. Payment services are also experiencing significant growth as the demand for seamless, real-time payment solutions increases across industries. As for the end-users, the BaaS market serves various industries, including fintech startups, traditional banks, e-commerce platforms, and other businesses looking to offer integrated financial services. The flexibility of BaaS solutions allows businesses of all sizes to tap into banking services without incurring the high costs typically associated with building an internal banking infrastructure.

✅ Regional Insights

North America

North America is a dominant region in the Banking as a Service market, accounting for a significant share of the global market. The region is home to several established players in the fintech and banking sectors, creating a highly competitive environment for BaaS solutions. The U.S. has been a front-runner in adopting digital banking services, with companies leveraging BaaS platforms to deliver innovative financial products such as digital wallets, instant loans, and peer-to-peer lending services. As the adoption of digital financial services continues to rise, North America is expected to maintain a significant market share during the forecast period.

Asia-Pacific

The Asia-Pacific region is poised to witness the fastest growth in the BaaS market, driven by the rapid digital transformation of financial services. Countries such as China, India, and Southeast Asian nations are experiencing a surge in mobile payments, digital banking, and financial technology adoption. The region has a large unbanked population, and BaaS platforms provide an efficient solution to extend banking services to underserved areas. Additionally, the rise of fintech startups in the region is creating new opportunities for BaaS providers to collaborate with non-traditional financial institutions, further fueling market growth.

Market Drivers

Several factors are contributing to the rapid expansion of the Banking as a Service market. The primary driver is the growing need for financial inclusion, especially in emerging economies where access to traditional banking services is limited. BaaS platforms enable businesses to offer essential banking services like payments, savings, and loans to underserved populations, which is driving market adoption in these regions. Additionally, the rise of mobile and digital payments is pushing businesses to adopt more flexible, integrated solutions, which are made possible through BaaS models.

Another key driver is the increased collaboration between traditional banks and fintech companies. These partnerships allow banks to leverage fintech's agility and technology while offering their financial expertise and customer base. The ability to provide a wider range of services, such as digital wallets, payment solutions, and lending products, is making BaaS platforms more appealing to businesses in various industries. This trend is also helping banks reach new customer segments and expand their service offerings with lower costs and faster implementation.

Market Restraints

Despite the promising growth of the BaaS market, certain challenges could potentially hinder its expansion. One significant restraint is the regulatory uncertainty surrounding BaaS solutions in various regions. In many countries, the regulatory framework for BaaS is still evolving, and businesses may face compliance challenges as they navigate differing rules and requirements. This could slow down the adoption of BaaS platforms, particularly in regions with strict financial regulations.

Additionally, cybersecurity concerns are a major challenge in the BaaS market. As more financial services are digitized, the risk of cyberattacks and data breaches increases. BaaS providers must implement robust security measures to protect sensitive customer data and maintain trust in their platforms. The increasing complexity of cybersecurity threats and the need to adhere to stringent data privacy laws could impose additional costs and operational challenges on BaaS providers.

Market Opportunities

The BaaS market presents several opportunities for growth, particularly in the areas of financial inclusion and mobile payment solutions. As more consumers and businesses turn to digital platforms for their financial needs, BaaS providers have the opportunity to expand their services to a broader customer base. In emerging markets, the ability to offer mobile-based banking services can unlock significant growth potential. Furthermore, advancements in blockchain technology could present new opportunities for BaaS platforms, allowing them to offer more secure and efficient financial services, such as cross-border payments and smart contracts.

Another opportunity lies in the increasing demand for embedded finance solutions, where financial services are seamlessly integrated into non-financial applications. BaaS platforms are uniquely positioned to take advantage of this trend, enabling companies in industries such as e-commerce, insurance, and transportation to embed financial products directly into their offerings. This creates a new revenue stream for BaaS providers and expands the use cases for their platforms.

✅ Reasons to Buy the Report:

→ Comprehensive analysis of the market's growth potential and key trends influencing the BaaS market.

→ Insights into the market's segmentation, including service types, end-users, and deployment models.

→ Regional analysis providing an understanding of the dominant markets and growth opportunities.

→ Detailed analysis of the drivers, restraints, and opportunities shaping the future of the BaaS market.

→ Expert forecasts and recommendations to help businesses navigate the rapidly evolving BaaS ecosystem.

✅ Key Players

The key players in the global Banking as a Service market include:

✦ Finastra

✦ Solarisbank AG

✦ Marqeta Inc.

✦ Railsbank

✦ GPS (Global Payments)

Recent Developments:

■ Finastra has announced a strategic partnership with multiple fintech startups to enhance its BaaS offerings, focusing on mobile payment solutions and digital wallets.

■ Solarisbank has expanded its presence in Europe and Asia by offering API-based banking services to fintech firms and e-commerce platforms, fueling its market growth.

The Banking as a Service market is poised for substantial growth as businesses increasingly embrace digital transformation, financial inclusion, and seamless, integrated financial solutions. With a projected market size of USD 16.9 billion by 2032, the future of BaaS looks bright, offering numerous opportunities for businesses and financial institutions to innovate and thrive.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking as a Service Market to Reach USD 16.9 Billion by 2032, Growing at a CAGR of 18.8% (2025-2032) | Persistence Market Research here

News-ID: 3991821 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

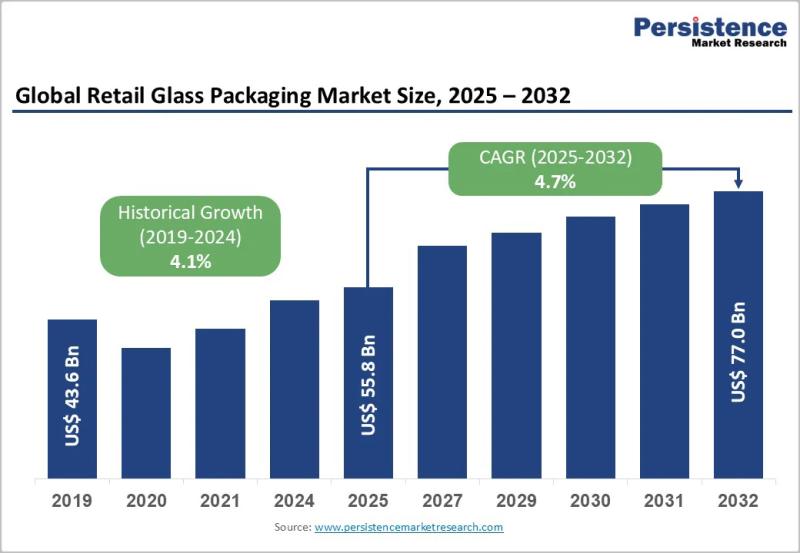

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for BaaS

Key Factor Supporting Banking-As-A-Service (BaaS) Market Development in 2025: Th …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Banking-As-A-Service (BaaS) Market Size By 2025?

The market size of banking-as-a-service (BaaS) has seen a significant increase in recent times. This upward trend is projected to continue, as the market's worth is expected to rise from $716 billion in 2024 to a staggering $842.44 billion…

Global Blockchain As A Service Baas Platform Market Size by Application, Type, a …

USA, New Jersey- According to Market Research Intellect, the global Blockchain As A Service Baas Platform market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Blockchain as a Service (BaaS) platform market is set to experience substantial growth from 2025 to 2032, with a strong…

Global Battery As A Service (BaaS) Market Size by Application, Type, and Geograp …

USA, New Jersey- According to Market Research Intellect, the global Battery As A Service (BaaS) market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Battery as a Service (BaaS) market is witnessing rapid growth, driven by the global transition toward sustainable mobility and clean energy…

BaaS Market Size, Share, Growth, Trends, Opportunities Analysis Report

The global BaaS Market size to grow from USD 632 million in 2020 to USD 11,519 million by 2026, at a Compound Annual Growth Rate (CAGR) of 62.2% during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=246499192

Increasing demand for BaaS due to COVID-19 outbreak, growing need for supply chain transparency across verticals, and rising demand for enhanced security are major growth factors for the market. Increasing integration of blockchain and IoT,…

Backend-as-a-Service (BaaS) Market Report Up to 2031

Visiongain has published a new report on Backend-as-a-Service (BaaS) Market Report to 2031: Forecasts by type (Consumer BaaS, Enterprise BaaS), by organization size (Small & Medium-sized Enterprises, Large Enterprises), by services (Data Integration, Identity & Access Management, Support & Maintenance, Others). PLUS Profiles of Leading Backend-as-a-Service (BaaS) Companies and Regional and Leading National Market Analysis. PLUS COVID-19 Recovery Scenarios.

Backend-as-a-Service (BaaS) is an alternative approach that uses software development kits (SDKs)…

Game BaaS Market VALUATION TO BOOM THROUGH 2030

(United States, OR Poland) The Game BaaS Market report is composed of major as well as secondary players describing their geographic footprint, products and services, business strategies, sales and market share, and recent developments among others. Furthermore, the Game BaaS report highlights the numerous strategic initiatives such as product launches, new business agreements and collaborations, mergers and acquisitions, joint ventures, and technological advancements that have been implemented by the major…