Press release

Electronic Warfare Market Report 2025 Edition: Industry Market Size, Share, Trends, and Competitor Analysis

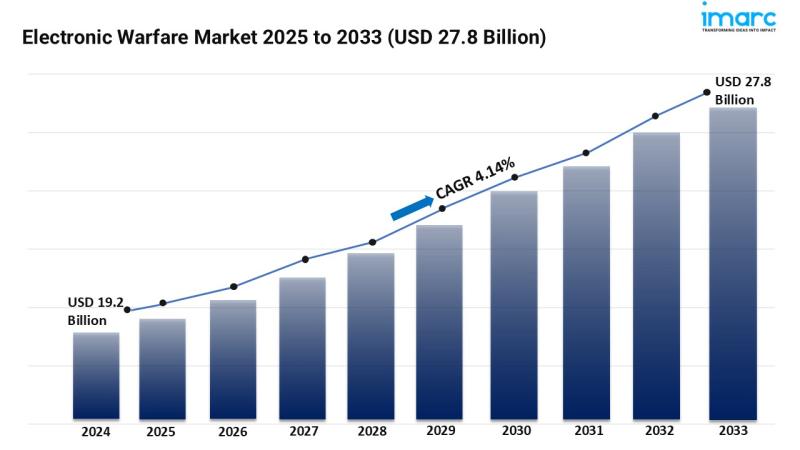

Market Overview:The electronic warfare market is experiencing rapid growth, driven by technological advancements driving growth, geopolitical tensions fueling demand, and integration across platforms. According to IMARC Group's latest research publication, "Electronic Warfare Market Report by Product (EW Equipment, EW Operational Support), Equipment (Jammer, Countermeasure System, Decoy, Directed Energy Weapon, and Others), Capacity (Electronic Protection, Electronic Support, Electronic Attack), Platform (Land, Naval, Airborne, Space), and Region 2025-2033", The global electronic warfare market size reached USD 19.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.14% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/electronic-warfare-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Factors Affecting the Growth of the Electronic Warfare Industry:

● Technological Advancements Driving Growth

The electronic warfare (EW) market experiences rapid growth because of advances in technology. Electronic threats have evolved into a more complex and advanced form. Three major EW market drivers include sophisticated radars coupled with complex communication systems and expanding drone and cyber warfare capabilities. Current EW solutions need improvement to meet present defense requirements.

The military tactics of electronic warfare systems now implement artificial intelligence (AI) together with machine learning (ML) capabilities. EW systems help organizations detect threatening situations and recognize their sources and enact accurate response strategies at high speed. Fighters using these systems have better capabilities in dynamic EM environments. Smaller and more efficient components within the EW domain enable their integration with various platforms. The technology includes UAVs together with soldier systems and naval vessels.

New technology requirements between competitors increase the competitive pressure within the market. The market's businesses carry out continuous innovation efforts to develop next-generation EW technology which confronts emerging threats. The requirement for improved situational awareness together with electronic protection has become essential for contemporary military operations. Advanced EW technology adoption rates are increasing because of these elements which direct market evolution.

● Geopolitical Tensions Fueling Demand

The growing military tensions across the globe and defense budget increases have driven the expansion of the electronic warfare market. The defense of innovative security threats requires nations to establish absolute control of the electromagnetic spectrum space. Advanced EW systems require investment because they determine the survival and operational effectiveness of military forces operating in air and land and sea domains. The areas experiencing unsettled political conditions and border conflicts experience increasing need for both offensive and defensive electronic warfare systems. Advanced military technology distribution among multiple actors makes electronic warfare countermeasures vital for protection against electronic attacks. Growing security threats worldwide and regional conflicts drive military organizations to implement EW equipment acquisitions and perform system improvements as well as conduct novel research and development to preserve their technological dominance. The essential role of electromagnetic spectrum dominance in contemporary warfare ensures geopolitical conflicts will maintain their influence on the electronic warfare market during future years.

● Integration Across Platforms

The increase in focus on EW platform integration defines a major electronic warfare trend. Warfare in modern times demands systematic operations between different units. The integration of EW systems requires effective performance within networked environments where information is shared to cultivate one consolidated electronic battlespace visualization. The need requires EW solutions to function across aircraft systems and naval vessels while being suitable for ground vehicles and cyber domains.

EW systems require an open platform design which allows simple integration and future expands across different military forces. Such improvements help both operational effectiveness and minimize logistical difficulties. Electronic warfare and cyber warfare integration demands the development of unified solutions. The solutions combined efforts to protect against threats through electromagnetic and cyber spectrum operating conditions.

Software-defined radios and open architecture systems together with data fusion technologies receive promotion through this trend. Today's military forces gain improved electronic warfare functionality due to these developments.

Buy Full Report: https://www.imarcgroup.com/checkout?id=4805&method=1670

Leading Companies Operating in the Global Electronic Warfare Industry:

● Aselsan A.S

● BAE Systems plc

● Elbit Systems Ltd.

● General Dynamics Corporation

● Israel Aerospace Industries

● L3Harris Technologies Inc.

● Leonardo S.p.A.

● Lockheed Martin Corporation

● Northrop Grumman Corporation

● Raytheon Technologies Corporation

● Saab AB

● Teledyne Technologies Incorporated

● Textron Inc.

● Thales Group

● The Boeing Company.

Electronic Warfare Market Segmentation:

Breakup by Product:

● EW Equipment

● EW Operational Support

EW Equipment Dominates market with radar jammers, countermeasure systems, and electronic attack systems, driven by rising adversarial electronic sophistication and demand for battlefield dominance.

Breakup by Equipment:

● Jammer

● Countermeasure System

● Decoy

● Directed Energy Weapon

● Others

Jammer (Largest Equipment Segment): Leads equipment category by disrupting enemy radar/communications, with expanding use across land, air, and naval platforms to counter evolving threats.

Breakup by Capability:

● Electronic Protection

● Electronic Support

● Electronic Attack

Electronic Protection (Largest Capacity): Foundational segment using encryption and frequency hopping to secure systems against interception/jamming, ensuring mission-critical resilience.

Breakup by Platform:

● Land

● Naval

● Airborne

● Space

Land (Leading Platform): Largest platform due to ground vehicle/command center investments, addressing urban warfare and hybrid conflict challenges.

Breakup by Region:

● North America (United States, Canada)

● Europe (Germany, France, United Kingdom, Italy, Spain, Others)

● Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

North America holds the largest share in the market segmentation based on region in the market.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=4805&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) 91 120 433 0800

United States: 1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Electronic Warfare Market Report 2025 Edition: Industry Market Size, Share, Trends, and Competitor Analysis here

News-ID: 3984918 • Views: …

More Releases from IMARC Group

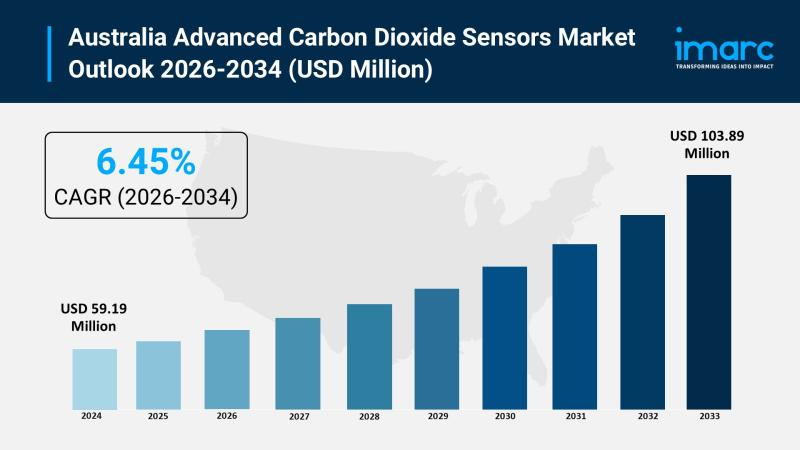

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

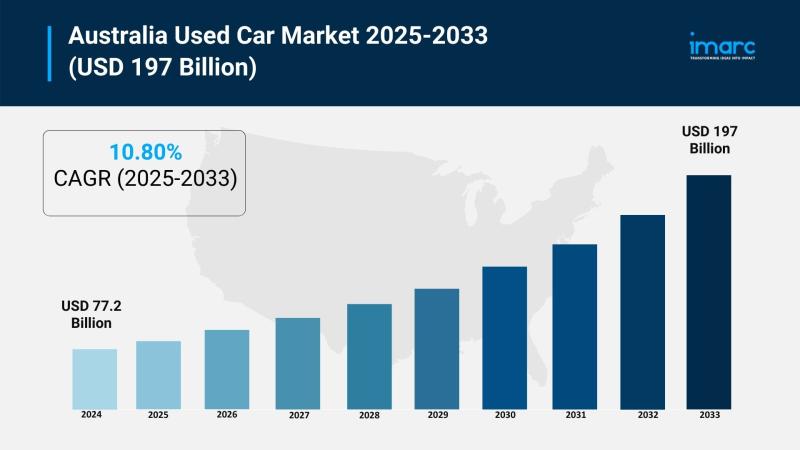

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

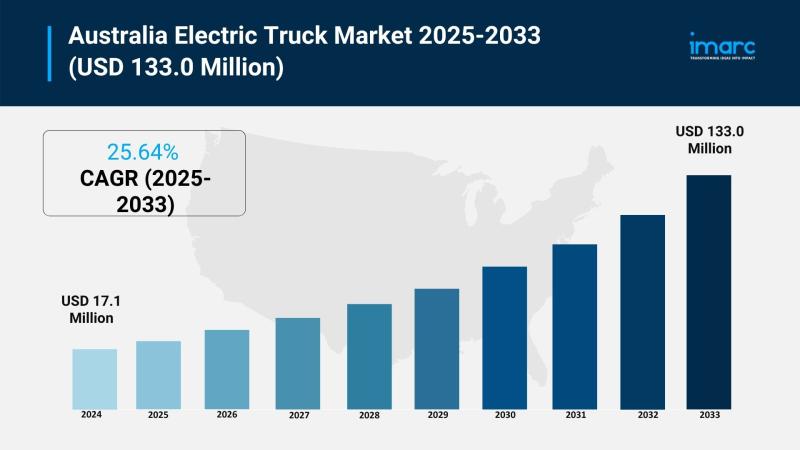

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

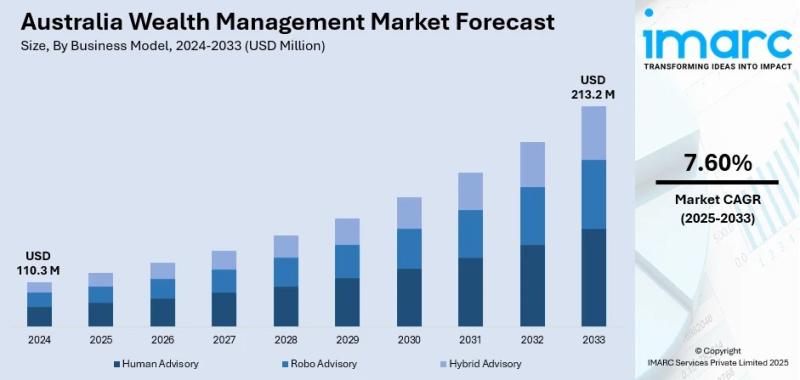

Australia Wealth Management Market Projected to Reach USD 213.2 Million by 2033

Market Overview

The Australia Wealth Management Market reached a size of USD 110.3 Million in 2024 and is projected to grow to USD 213.2 Million by 2033. The market is expected to expand during its forecast period with a CAGR of 7.60% from 2025 to 2033. Key growth factors include rising high-net-worth individuals, digital financial transformation, regulatory reforms like FOFA, and a robust superannuation system. For more details, visit the Australia…

More Releases for Electronic

Revolutionizing Electronic Warfare: The Power of Cognitive Electronic Warfare Sy …

According to the report published by Allied Market Research, " Cognitive Electronic Warfare System Market by Capability (Electronic Attack, Electronic Protection, Electronic Support, Electronic Intelligence) and by Platform (Naval, Airborne, Land, Space): Global Opportunity Analysis and Industry Forecast, 2023-2032 "Cognitive electronic warfare systems are based on learning action frameworks that use machine learning algorithms and artificial intelligence (AI) to mimic human perception of learning, memory, and judgement. Machine learning, being…

Electronic Cigarettes

Electronic Cigarettes are also known as Vaping, which consist of different type of devices that allow the users to inhale an aerosol that might be nicotine, flavoring and other species. Electronic Cigarettes market is expected to mark significant growth over forecasted period owing to increasing technological advancements, change in lifestyle and consists of various flavours and fragrance. There has been significant rise in number of prevalence of adults using e-cigarettes…

Electronic Voting Machine Market 2019-2025| Top key players: Gaurang Electronic …

This report titled as Electronic Voting Machine Market gives a brief about the comprehensive research and an outline of its growth in the market globally. Electronic voting is voting that uses electronic means to either aid or take care of casting and counting votes. Depending on the particular implementation, e-voting may use standalone electronic voting machines or computers connected to the Internet. It may encompass a range of Internet services,…

Electronic Voting Machine Market 2019-2025| Top key players: Gaurang Electronic …

The Electronic Voting Machine Market requires the prevailing regions in the market during the forecast period. Evidence on the region leading the market are some of the facets that are highlighted under this section of the report. A voting machine is a machine used to register and tabulate votes. The first voting machines were mechanical but it is increasingly more common to use electronic voting machines. Traditionally, a voting machine…

Electronic Wrapper Market Segmented By loading types semi-automatic electronic w …

A Revolutionary Product for the Packaging Industry

The electronic wrapper has been a revolutionizing product in the packaging industry. Electronic wrappers are easy to maintain and comfortable for size changes. The steel built electronic wrappers enable easy access for maintenance and cleaning, thus, gaining a considerable customer base from the packaging industries mainly for food and consumer products. An electronic wrapper is an automated machine, which is programmed to perform a…

Wearable Electronic Devices Market,Wearable Electronic Devices Industry, Global …

Latest industry research report on: Global Wearable Electronic Devices Market : Industry Size, Share, Research, Reviews, Analysis, Strategies, Demand, Growth, Segmentation, Parameters, Forecasts

This report studies the global Wearable Electronic Devices market status and forecast, categorizes the global Wearable Electronic Devices market size (value & volume) by manufacturers, type, application, and region. This report focuses on the top manufacturers in United States, Europe, China, Japan, South Korea and Taiwan and other…