Press release

Letter Of Credit Confirmation Market Size Projected To Reach $5.63 Billion By 2034 With A Cagr Of 5.2%

The Letter Of Credit Confirmation Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].What Is the Letter Of Credit Confirmation Market Size and Projected Growth Rate?

The growth of the letter of credit confirmation market has been consistent in the preceding years. The market value, projected to escalate from $4.38 billion in 2024 to $4.6 billion in 2025, is set to experience a compound annual growth rate (CAGR) of 4.9%. Factors such as the intricate nature of international deals, worries about credit authenticity, regulatory compliance, risks associated with currency exchange, political and economic stability, as well as the expansion of global supply chains, contribute to the growth seen in the historic period.

The market size for the confirmation of letters of credit is predicted to expand considerably in the imminent years. The forecast estimates a rise to $5.63 billion in 2029, with a compound annual growth rate (CAGR) of 5.2%. This growth in the predicted period is due to factors such as the evolving regulatory environment, shifts in trade policy, the rise of alternative financing methods, supply chain resilience efforts, global incidents and economic disturbances. Key trends during the forecast period involve digital transformation, blockchain technology, alternative solutions for trade finance, automation and AI, partnerships between financial institutions and fintechs, and the personalization of confirmation services.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9087

What Are the Different Letter Of Credit Confirmation Market Segments?

The letter of credit confirmation market covered in this report is segmented -

1) By L/C Type: Sight L/Cs, Usance L/Cs

2) By End User: Small Enterprises, Medium-Sized Enterprises, Large Enterprises

Subsegments:

1) By Sight L/Cs: Commercial Sight L/Cs, Standby Sight L/Cs

2) By Usance L/Cs: Commercial Usance L/Cs, Standby Usance L/Cs

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9087&type=smp

What Are the Primary Drivers Shaping the Letter Of Credit Confirmation Market?

The escalation in worldwide commercial activities is projected to push the letter of credit confirmation market's growth. Commercial activities involve the purchase and sale of commodities, goods, and services between different companies, nations, or groups with the primary goal of earning profits. This process comprises the movement of goods and services from one entity to another. The use of a confirmed letter of credit, a widely used instrument in trade finance, ensures a payment guarantee for both importers and exporters, making it more desirable as trade activities expand. For instance, a report from the United Nations Conference on Trade and Development, a Swiss-based intergovernmental body advocating global commerce, revealed that the overall trade value surged by 25% to hit $28.5 trillion in 2021. Additionally, forecasts by the World Trade Organization, a Swiss entity that regulates and promotes international trade, indicate that global merchandise trade volumes will rise by 3.5% in 2022. Consequently, the uptick in worldwide trade activities is fueling the demand for letter of credit confirmations.

Which Companies Are Leading in the Letter Of Credit Confirmation Market?

Major companies operating in the letter of credit confirmation market include Bank of America Corporation, Citigroup Inc., DBS Bank Ltd., JPMorgan Chase & Co., Mizuho Bank Ltd., MUFG Bank Ltd., Scotiabank, Standard Chartered PLC., Sumitomo Mitsui Banking Corporation, The PNC Financial Services Group Inc., CoBank, HSBC Holdings plc., ICICI Bank Group, State Bank of India. Group, Wells Fargo & Company, Barclays Bank PLC, BNP Paribas SA, Credit Agricole SA, Deutsche Bank AG, Industrial and Commercial Bank of China Limited, National Australia Bank Limited, Royal Bank of Canada, Societe Generale SA, The Bank of Tokyo-Mitsubishi UFJ Ltd., The Toronto-Dominion Bank, nion Bank of Switzerland Aktiengesellschaft AG, UniCredit S.p.A., Westpac Banking Corporation, China Construction Bank Corporation

What Are the Major Trends Shaping the Letter Of Credit Confirmation Market?

To maintain their market dominance in the letter of credit confirmation sector, key firms are turning to innovative technology such as blockchain-powered letter of credit (LC) transactions. This financial procedure, makes use of blockchain technology to expedite and bolster the security of international trade operations. For instance, Citi India, a foreign-operating Indian bank, launched its first-ever blockchain-based LC transaction in April 2023. Utilizing Contour, a blockchain-integrated platform that allows banks, corporations, and logistics partners to collaborate securely and immediately on a singular platform, the transaction was completed in just three hours. This represented a significant decrease in processing time, compared to the five to ten day timeframe typically required for the presentation of a letter of credit (LC) document.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/letter-of-credit-confirmation-global-market-report

What Are the Top Revenue-Generating Geographies in the Letter Of Credit Confirmation Market?

Asia-Pacific was the largest region in the letter of credit confirmation market in 2024. The regions covered in the letter of credit confirmation market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Letter Of Credit Confirmation Market?

2. What is the CAGR expected in the Letter Of Credit Confirmation Market?

3. What Are the Key Innovations Transforming the Letter Of Credit Confirmation Industry?

4. Which Region Is Leading the Letter Of Credit Confirmation Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Letter Of Credit Confirmation Market Size Projected To Reach $5.63 Billion By 2034 With A Cagr Of 5.2% here

News-ID: 3980445 • Views: …

More Releases from The Business Research Company

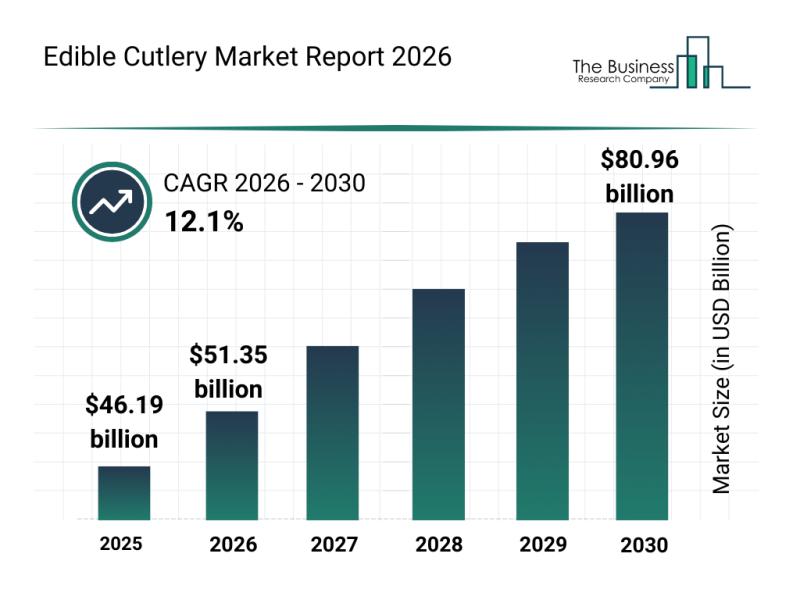

Top Players and Market Competition in the Edible Cutlery Industry

The edible cutlery market is gaining substantial traction as consumers and businesses alike seek sustainable alternatives to traditional disposable utensils. Driven by environmental concerns and rising demand for eco-friendly dining solutions, this market is set to expand rapidly in the coming years. Here's a detailed look at its growth prospects, key players, emerging trends, and market segmentation.

Forecasted Expansion and Key Drivers in the Edible Cutlery Market

The edible cutlery…

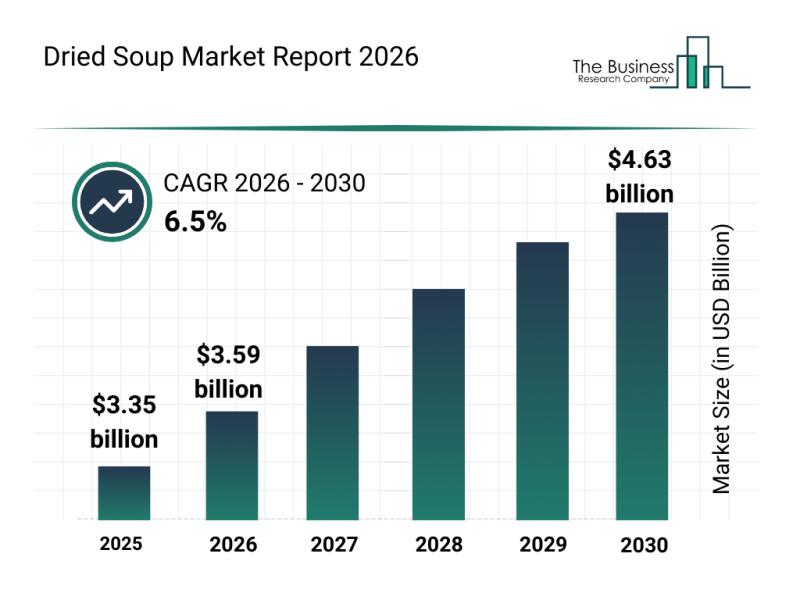

Emerging Sub-Segments Transforming the Dried Soup Market Landscape

The dried soup market is on track for significant expansion in the coming years, driven by evolving consumer preferences and advancements in food technology. This sector is increasingly catering to the demand for convenient, healthy, and sustainable meal solutions, which is fueling its growth and innovation.

Dried Soup Market Size and Growth Outlook

Forecasts indicate that the dried soup market will reach a value of $4.63 billion by 2030, growing…

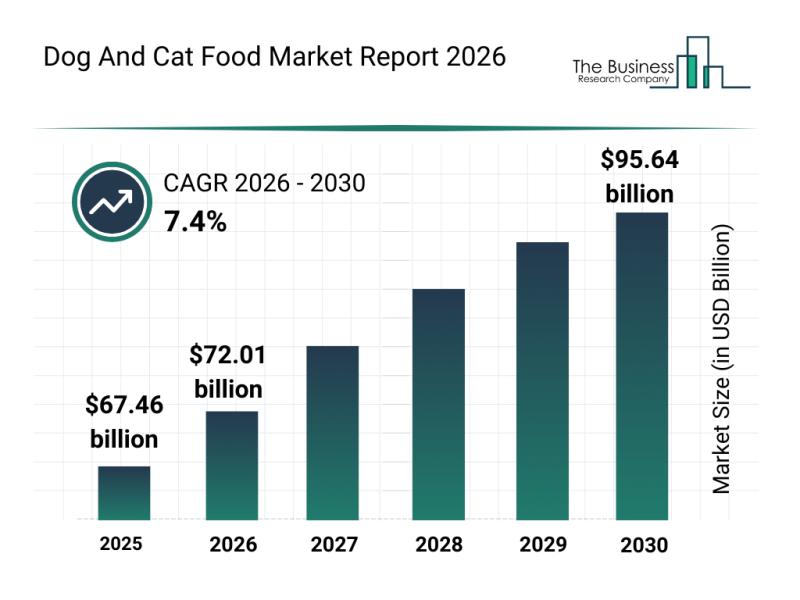

Emerging Growth Patterns Driving Expansion in the Dog and Cat Food Market

The pet food industry for dogs and cats is rapidly evolving, driven by changing consumer preferences and innovation in nutrition. As more pet owners prioritize health and sustainability, the market is set to experience significant growth and transformation. Below is a detailed overview of the current market size, key players, emerging trends, and important segments shaping the dog and cat food sector.

Projected Growth and Market Size of the Dog and…

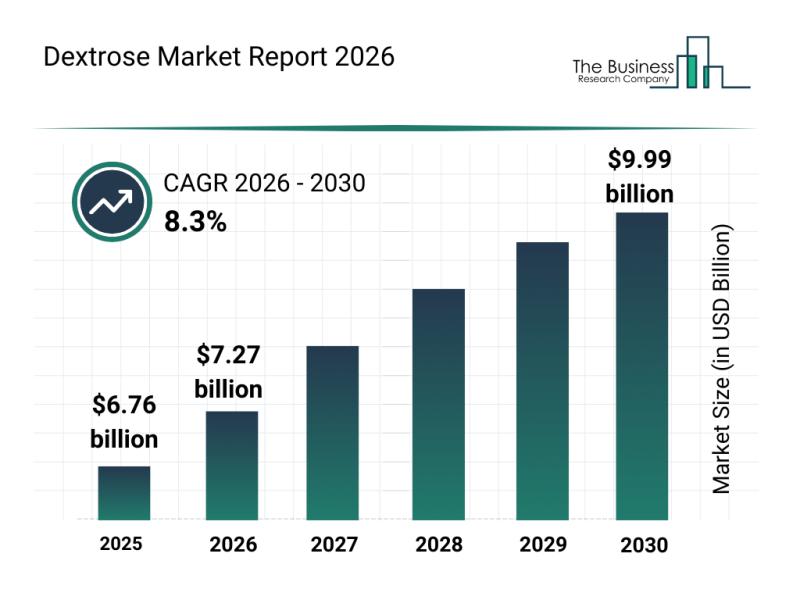

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the De …

The dextrose market is poised for significant development in the coming years, driven by growing applications and increasing consumer demand in various sectors. This overview highlights the market's expected growth trajectory, key players, emerging trends, and major segments shaping the landscape.

Steady Growth Forecast for the Dextrose Market

The dextrose market is projected to reach a value of $9.99 billion by 2030, expanding at a compound annual growth rate (CAGR)…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…