Press release

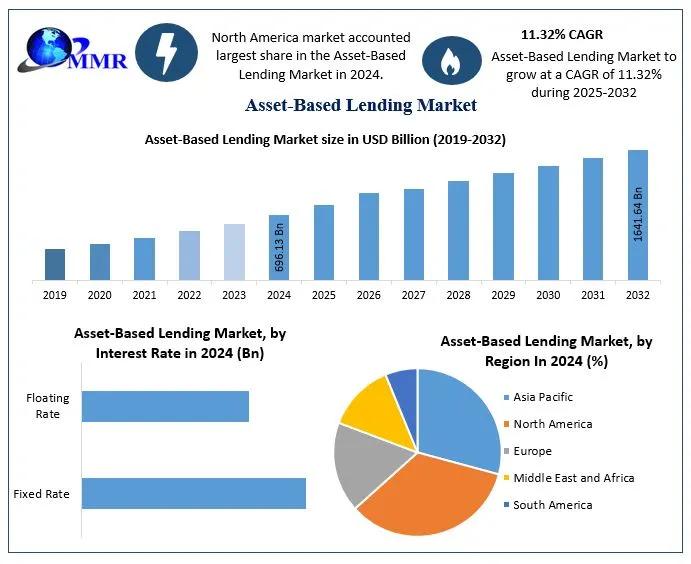

Asset-Based Lending Market Forecasted to Grow at 11.32% CAGR Through 2025-2032

The Asset-Based Lending Market size was valued at USD 696.13 Billion in 2024 and the total Asset-Based Lending revenue is expected to grow at a CAGR of 11.32% from 2025 to 2032, reaching nearly USD 1641.64 Billion.Asset-Based Lending Market Overview:

The Asset-Based Lending Market has witnessed significant expansion over the last decade, buoyed by a growing preference for secured loans amid tightening credit conditions. Traditional financing avenues often fall short for businesses with fluctuating cash flows or unconventional business models, propelling asset-based solutions into mainstream financial strategies. ABL offers companies a means to unlock value from their receivables, inventories, machinery, or real estate assets, ensuring liquidity without diluting ownership.

Global market players are recalibrating their offerings to meet the evolving needs of diverse industries such as manufacturing, retail, logistics, and healthcare. The rise in private equity activity, coupled with greater emphasis on asset monetization, is further accelerating the adoption of asset-based lending. Notably, emerging markets in Asia-Pacific and strategic financial hubs in North America and Europe are becoming hotspots for ABL activities, signaling a shift towards broader, cross-border asset financing landscapes.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/189641/

Asset-Based Lending Market Dynamics:

Multiple factors are propelling the growth of the Asset-Based Lending Market, with one of the primary drivers being businesses' increased need for flexible funding sources. Economic uncertainties, such as inflationary pressures and tightening monetary policies, have made traditional unsecured loans less accessible, nudging businesses toward asset-backed options. Furthermore, the growing sophistication in asset valuation technologies ensures lenders have greater confidence in their collateral assessments, thus promoting higher lending volumes.

However, the market is not without challenges. Regulatory hurdles, varying asset appraisal standards across regions, and the cyclical risk associated with asset-heavy industries can temper market expansion. Despite these obstacles, innovation in risk management frameworks and the diversification of asset classes - from accounts receivable to intellectual property - are helping the market navigate these complexities effectively. The increasing collaboration between banks and fintech firms is also streamlining processes, making ABL more accessible to a broader client base.

Asset-Based Lending Market Outlook and Future Trends

Looking ahead, the Asset-Based Lending Market is poised for substantial growth, driven by digital transformation and globalization of financial services. The proliferation of blockchain and AI technologies in asset verification and loan underwriting is set to redefine industry benchmarks. These tech advancements promise quicker, more secure lending processes, enhancing the overall borrower experience while reducing operational risks for lenders.

Additionally, the market is expected to see a surge in sustainability-linked asset-based lending. As environmental, social, and governance (ESG) metrics gain prominence, lenders are designing ABL products that support green projects or reward companies with sustainable operational models. This trend could unlock a new wave of demand, particularly among mid-sized enterprises aiming to align financing strategies with corporate social responsibility objectives.

Key Recent Developments:

Vietnam: Vietnam's financial sector has recently witnessed a growing number of strategic partnerships and mergers focused on expanding asset-based financing. Notably, several Vietnamese banks are collaborating with fintech firms to provide quicker asset-backed loan solutions for SMEs, aiming to address the country's robust entrepreneurial growth.

Thailand: Thailand has seen an uptick in private equity-backed asset-based lending, especially in the manufacturing and logistics sectors. Major banks in Thailand have launched new ABL divisions, aligning with the government's push to boost industrial modernization under the Thailand 4.0 initiative.

Japan: Japanese financial institutions are increasingly engaging in cross-border ABL activities, particularly targeting Southeast Asian markets. In 2024, one of Japan's largest banks announced a $500 million fund dedicated to asset-based lending for international expansions of mid-sized enterprises.

South Korea: In South Korea, asset-based lending saw a significant development with major conglomerates setting up in-house financing arms to facilitate structured ABL for their supply chains. This move is seen as a way to strengthen financial stability across the nation's complex manufacturing networks.

Singapore: Singapore continues to cement its status as a hub for innovative ABL solutions. Recently, a leading Singaporean bank launched a blockchain-based asset-backed loan platform, reducing processing times by nearly 40%. This technology-driven move is attracting more multinational clients seeking secure, rapid financing options.

United States: The US remains the largest market for asset-based lending, accounting for more than 60% of global ABL volume. In 2024, major private equity players announced record levels of asset-backed financing for leveraged buyouts (LBOs), signaling strong investor confidence in secured lending instruments amid economic recalibration.

Europe: Europe's ABL market has shown robust resilience, with the UK, Germany, and France leading the way. Recent M&A activity highlights an aggressive expansion strategy among European lenders, with numerous cross-border acquisitions aimed at strengthening ABL service portfolios across the continent.

Asset-Based Lending Market Segmentation

by Type

Inventory Financing

Receivables Financing

Equipment Financing

Others

by Interest Rate

Fixed Rate

Floating Rate

by End User

Large Enterprises

Small and Medium-sized Enterprises

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/189641/

Some of the current players in the Asset-Based Lending Market are:

1.Lloyds Bank

2.Barclays Bank PLC

3. Hilton-Baird Group

4. JPMorgan Chase & Co

5. Berkshire Bank

6.White Oak Financial, LLC

7.Wells Fargo

8. Porter Capital

9.Capital Funding Solutions Inc.

10.SLR Credit Solutions

11.Fifth Third Bank

12.HSBC Holdings plc

12. SunTrust Banks, Inc. (now part of Truist Financial Corporation)

13. Santander Bank, N.A.

14.KeyCorp

15.BB&T Corporation (now part of Truist Financial Corporation)

16. Goldman Sachs Group, Inc.

For additional reports on related topics, visit our website:

♦ IT Service Management Market I https://www.maximizemarketresearch.com/market-report/global-it-service-management-market/53106/

♦ Edge AI Market https://www.maximizemarketresearch.com/market-report/edge-ai-market/190417/

♦ Industrial Internet of Things (IIoT) Market https://www.maximizemarketresearch.com/market-report/global-industrial-iot-market/11373/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market Forecasted to Grow at 11.32% CAGR Through 2025-2032 here

News-ID: 3976280 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

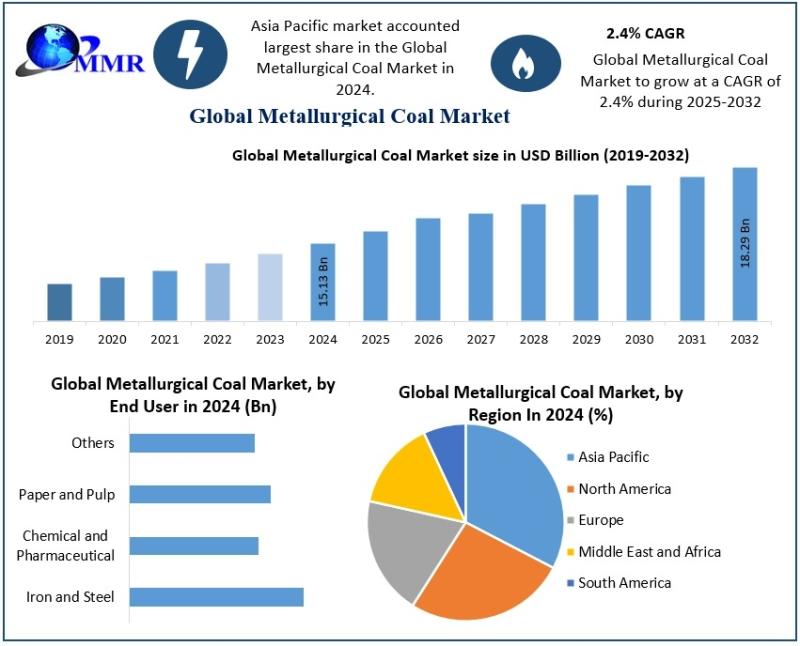

Metallurgical Coal Market Trends Shaping the Future of Steel and Infrastructure

The Metallurgical Coal Market size was valued at USD 15.13 Billion in 2024 and the total Metallurgical Coal revenue is expected to grow at a CAGR of 2.4% from 2025 to 2032, reaching nearly USD 18.29 Billion.

Metallurgical Coal Market Overview:

The Metallurgical Coal Market is deeply connected to the performance of the global steel sector, as metallurgical coal is an essential raw material used in blast furnace operations. Steel remains indispensable…

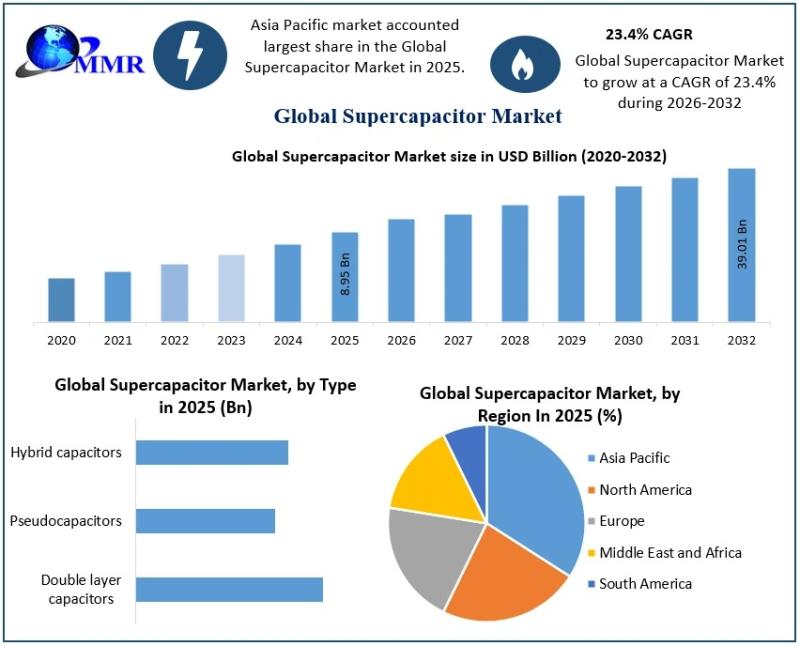

Supercapacitor Market Shows Strong Momentum as Energy Storage Innovation Acceler …

The Supercapacitor Market size was valued at USD 8.95 Billion in 2025 and the total Supercapacitor revenue is expected to grow at a CAGR of 23.4% from 2025 to 2032, reaching nearly USD 39.01 Billion by 2032.

Supercapacitor Market Overview:

The Supercapacitor Market is gaining significant attention as industries worldwide seek efficient, reliable, and sustainable energy storage solutions. Supercapacitors, also known as ultracapacitors, bridge the gap between conventional capacitors and batteries by…

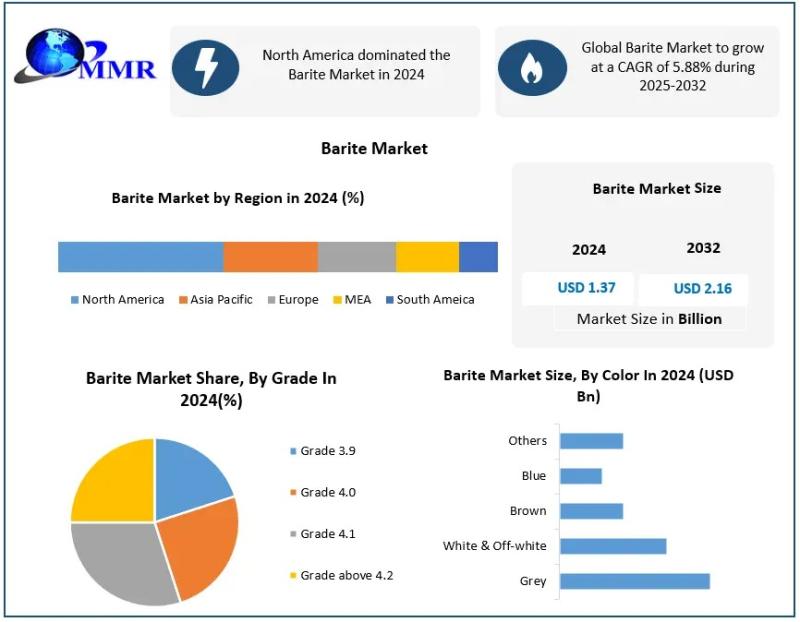

Barite Market Shows Strong Momentum Amid Industrial Expansion and Energy Demand

The Barite Market was valued at USD 1.37 billion in 2024, and total global Barite Market revenue is expected to grow at a CAGR of 5.88% from 2025 to 2032, reaching nearly USD 2.16 billion. Rising demand from the oil & gas industry.

Barite Market Overview:

The Barite Market is structured around diverse applications that depend on the mineral's exceptional physical properties. Barite is primarily used as a weighting agent in drilling…

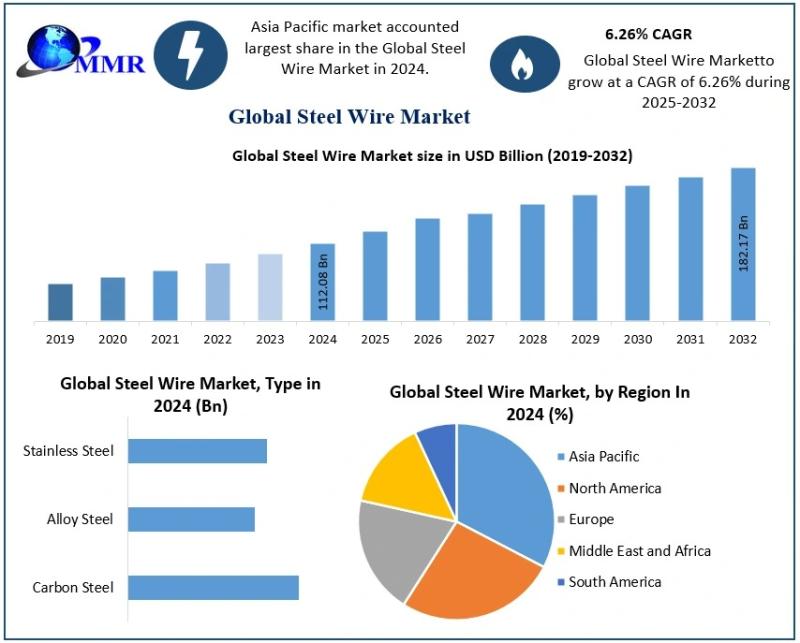

Steel Wire Market Analysis: Key Trends, Dynamics, and Future Outlook

The Steel Wire Market size was valued at USD 112.08 Billion in 2024 and the total Steel Wire revenue is expected to grow at a CAGR of 6.26% from 2025 to 2032, reaching nearly USD 182.17 Billion.

Steel Wire Market Overview:

The Steel Wire Market represents a highly diversified and application-driven industry, supplying essential materials for both heavy and light industrial operations. Steel wire is produced in various forms, including carbon steel…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…