Press release

Finance Cloud Market Set to Grow at a 12.6% CAGR, Surpassing USD 102.5 Billion by 2030 | Persistence Market Research

The global finance cloud market is rapidly gaining traction as financial institutions embrace digital transformation at an accelerated pace. Valued at US$44.6 billion in 2023, the market is forecast to reach US$102.5 billion by 2030, expanding at a CAGR of 12.6% over the forecast period. This growth underscores the sector's increasing reliance on cloud technologies to streamline operations, enhance data analytics, and improve customer experience.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/33634

Key growth drivers fueling this surge include the rising demand for real-time data analytics, increasing regulatory compliance needs, and the shift toward cost-efficient, scalable IT infrastructures. Among the various segments, software solutions lead the market due to their role in transforming core banking, risk management, and financial reporting. North America dominates geographically, owing to its advanced financial ecosystem, strong cloud adoption, and early investments in FinTech innovations.

Key Highlights from the Report

• The finance cloud market is expected to grow at a CAGR of 12.6% from 2023 to 2030.

• North America held the largest share in 2023, driven by digital transformation and FinTech proliferation.

• The software segment leads the market due to its widespread use in risk management and customer service.

• Real-time analytics demand is a critical factor accelerating cloud adoption in finance.

• Financial firms are shifting to cloud to comply with evolving regulatory and security standards.

• Cloud solutions offer significant cost savings and scalability, making them attractive to all institution sizes.

Market Segmentation

The finance cloud market can be segmented based on solution type, such as software and services. Software dominates the landscape, with key applications including core banking, financial forecasting, compliance management, and fraud detection. As banks and financial institutions increasingly prioritize automation and real-time decision-making, software solutions offer a robust return on investment and rapid deployment options.

Another segmentation is based on end-users, which includes banks, insurance companies, investment firms, and FinTech startups. Traditional institutions leverage the cloud to modernize legacy systems and streamline compliance. Meanwhile, FinTechs, born in the digital era, depend entirely on cloud-based infrastructures to scale rapidly, introduce innovative financial products, and serve tech-savvy customers.

Regional Insights

North America continues to dominate the finance cloud market, driven by advanced cloud infrastructure, proactive regulatory compliance, and widespread FinTech activity. The U.S., in particular, is home to major cloud service providers and financial institutions that prioritize security, speed, and scalability.

Asia-Pacific is emerging as a high-growth region due to increasing mobile penetration, government digitization initiatives, and growing FinTech ecosystems in countries like China, India, and Singapore. Financial institutions in the region are rapidly moving toward cloud adoption to remain competitive in the evolving digital landscape.

Market Drivers

The increasing need for real-time data analytics is one of the most powerful drivers of finance cloud adoption. In today's data-driven economy, financial firms require instant insights to manage risk, detect fraud, and enhance customer service. Cloud platforms support the rapid deployment of analytical tools, enabling firms to react in real-time to market dynamics.

In addition, digital transformation efforts across traditional banks are intensifying. As financial institutions compete with agile FinTech startups, there's a push to modernize IT infrastructure. Cloud computing provides flexibility, cost savings, and faster go-to-market capabilities, making it indispensable for innovation and growth.

Market Restraints

Despite its advantages, the finance cloud market faces notable restraints, particularly around data security and compliance. Financial data is highly sensitive, and institutions must adhere to strict regulatory frameworks such as GDPR, PCI-DSS, and SOX. Concerns around third-party data management, cross-border data transfers, and cyber threats can slow adoption.

Additionally, legacy system integration poses a challenge. Many large banks operate on outdated infrastructures, and transitioning to cloud-based systems requires significant investments in technology and training. These complexities can delay full-scale cloud migration and impact market momentum.

Market Opportunities

There are ample opportunities within the finance cloud space, especially in emerging markets where banking and financial services are undergoing rapid digitization. Regions like Latin America, Africa, and Southeast Asia represent untapped potential for cloud vendors aiming to cater to underserved financial institutions.

Moreover, the rise of AI-powered cloud solutions presents another growth avenue. Machine learning, predictive analytics, and NLP integrated with cloud services are transforming how banks approach customer experience, fraud detection, and investment strategies-offering a clear competitive advantage to early adopters.

Reasons to Buy the Report

✔ Understand the future growth trajectory of the finance cloud market through detailed data and projections.

✔ Identify key trends shaping the global finance industry's cloud adoption strategies.

✔ Gain insights into top-performing segments and emerging markets for targeted investment.

✔ Evaluate competitive dynamics and market positioning of leading players.

✔ Leverage detailed segmentation and regional analysis for strategic decision-making.

Company Insights

Key players operating in the global finance cloud market include:

• Amazon Web Services (AWS)

• Microsoft Corporation

• Google LLC

• Oracle Corporation

• Salesforce.com, Inc.

• IBM Corporation

• SAP SE

• Workday, Inc.

• Infosys Limited

• Temenos AG

Recent Developments:

• In 2024, Microsoft Azure partnered with a major U.S. bank to develop AI-powered cloud tools tailored for risk and compliance analytics.

• Salesforce Financial Services Cloud introduced a new suite of AI-based personalization features to enhance customer experience for retail banking clients.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Finance Cloud Market Set to Grow at a 12.6% CAGR, Surpassing USD 102.5 Billion by 2030 | Persistence Market Research here

News-ID: 3973351 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

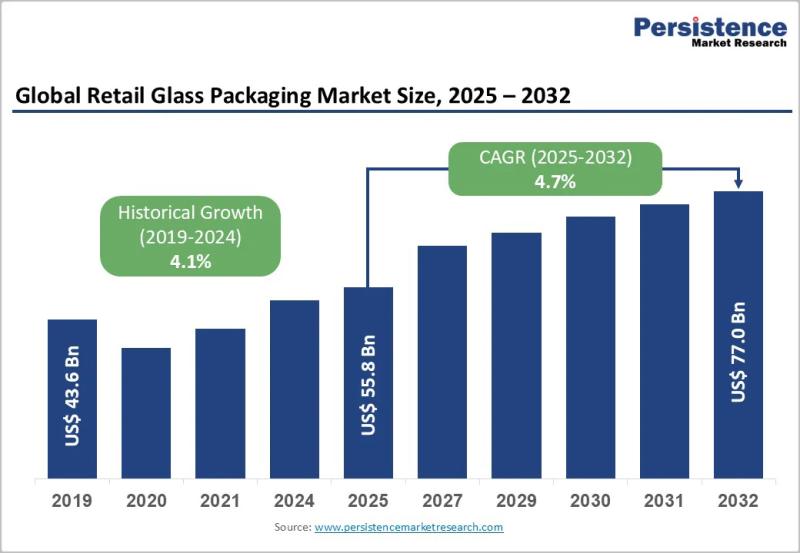

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for FinTech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…