Press release

Risk Management Market : An Detailed Analysis And Overview

Introduction:Risk management is the process of identifying, assessing, and mitigating potential threats or uncertainties that may affect an organization's objectives. It involves strategies and techniques to minimize the impact of financial, operational, strategic, compliance, and security risks. Organizations across industries are increasingly adopting risk management solutions to protect their assets, ensure regulatory compliance, and enhance decision-making processes. The growing complexity of business operations, increasing cyber threats, regulatory changes, and unpredictable market conditions are driving the demand for advanced risk management tools and services. The market includes a range of solutions such as enterprise risk management (ERM), financial risk management, compliance management, and operational risk management.

Market Size:

The global risk management market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 16.8% in the forecast period of 2023 to 2030 and is expected to reach USD 23,441.00 million by 2030. Increasing demand for R&D activities is expected to drive market growth.

https://www.databridgemarketresearch.com/reports/global-risk-management-market

Some of the major players operating in the global risk management market are Risk Logic Inc., RISKPARTNER, RiskVersity, JVB & Co., Cymune, Riskinsight Consulting Pvt. Ltd., Risk Solutions International, LEA, Riskpro India Ventures Private Limited, ICON Risk, ERM EXCHANGE, and CEERISK among others.

Market Share:

The risk management market is highly competitive, with several key players dominating the industry. Major companies include SAP SE, IBM Corporation, SAS Institute Inc., Oracle Corporation, ServiceNow, Inc., Resolver Inc., Aon PLC, MetricStream, Inc., LogicManager, Inc., and RiskWatch International LLC. SAP SE holds a significant market share with its comprehensive risk management solutions that cater to various industries. IBM Corporation offers advanced risk management and compliance solutions powered by artificial intelligence (AI) and machine learning (ML), giving it a competitive edge. SAS Institute Inc. is known for its data analytics and risk management platforms, widely used in the financial sector. Oracle Corporation provides cloud-based risk management solutions, offering flexibility and scalability to enterprises. ServiceNow, Inc. offers integrated risk management solutions designed to enhance operational resilience and regulatory compliance. MetricStream, Inc. is a leading player in governance, risk, and compliance (GRC) solutions, capturing a significant market share. The market share distribution is influenced by factors such as technological capabilities, product innovation, pricing strategies, and customer base.

Market Trends:

The risk management market is evolving with several key trends shaping its growth. The increasing adoption of cloud-based risk management solutions is transforming the industry, offering scalability, flexibility, and cost-efficiency. The growing use of artificial intelligence (AI) and machine learning (ML) in risk management is enhancing threat detection, predictive analytics, and decision-making processes. The rising focus on regulatory compliance and data privacy is driving demand for compliance management solutions. The expansion of cybersecurity risk management solutions is becoming a top priority due to the increasing frequency of data breaches and cyberattacks. The increasing integration of risk management with business intelligence and data analytics is improving risk assessment and mitigation strategies. The adoption of automated risk management platforms is streamlining workflows and reducing manual efforts. The growing emphasis on enterprise risk management (ERM) frameworks is promoting a holistic approach to managing risks across organizations. The increasing use of blockchain technology in risk management is enhancing transparency, security, and data integrity. The expansion of third-party risk management solutions is addressing the growing reliance on external vendors and partners. The rising demand for real-time risk monitoring and reporting is driving the adoption of advanced analytics tools.

Market Growth:

The risk management market is experiencing steady growth, driven by the increasing awareness of organizational risks and the need for effective mitigation strategies. The growing complexity of business operations, including globalization and digital transformation, is fueling market expansion. The rising number of data breaches, financial frauds, and regulatory changes is boosting the demand for advanced risk management solutions. The increasing adoption of GRC platforms is driving market growth by providing integrated risk, compliance, and audit management capabilities. The expanding use of risk management solutions in the financial services industry, including banks, insurance companies, and investment firms, is contributing to market growth. The growing focus on operational risk management in industries such as healthcare, manufacturing, and energy is driving the adoption of customized risk solutions. The rising demand for real-time risk assessment and predictive analytics is accelerating the growth of AI-powered risk management platforms. The increasing investments in cybersecurity risk management solutions by government agencies and enterprises are fueling market expansion. The growing trend of outsourcing risk management services is boosting market growth, particularly among small and medium-sized enterprises (SMEs).

Market Demand:

The demand for risk management solutions is rising globally due to the increasing need for effective risk assessment, regulatory compliance, and incident response. The growing reliance on digital technologies and cloud-based platforms is driving the demand for cybersecurity risk management. The increasing focus on financial risk management, driven by market volatility and economic uncertainties, is boosting demand. The rising adoption of operational risk management solutions in industries such as manufacturing, energy, and logistics is contributing to market growth. The growing emphasis on third-party risk management is driving demand for vendor assessment and monitoring solutions. The expanding use of AI and ML-based risk management platforms is increasing market demand, particularly for predictive analytics and threat detection. The rising number of data privacy regulations and compliance requirements is fueling the need for compliance management solutions. The increasing demand for automated risk assessment and reporting tools is driving market expansion. The growing use of business continuity and disaster recovery solutions is boosting demand for risk management services. The rising awareness of environmental, social, and governance (ESG) risks is driving the adoption of sustainability-focused risk management solutions.

Factors Driving Growth:

Several factors are driving the growth of the risk management market. The rising frequency of cyber threats and data breaches is fueling the demand for cybersecurity risk management solutions. The increasing complexity of regulatory frameworks and compliance requirements is boosting market growth. The growing adoption of cloud-based solutions and digital transformation initiatives is driving demand for flexible and scalable risk management platforms. The expansion of financial services, including banking, insurance, and investment, is increasing the need for financial risk management. The rising use of AI, ML, and data analytics in risk assessment is enhancing the accuracy and efficiency of risk management solutions. The growing reliance on third-party vendors and outsourcing is driving the demand for third-party risk management solutions. The increasing focus on enterprise-wide risk management (ERM) frameworks is promoting a comprehensive approach to risk mitigation. The rising demand for real-time risk monitoring and reporting is accelerating the adoption of advanced analytics tools. The expansion of industry-specific risk management solutions is catering to the unique needs of different sectors, such as healthcare, energy, and manufacturing. The growing awareness of the importance of business continuity and disaster recovery is driving demand for resilient risk management strategies.

Conclusion:

The risk management market is witnessing significant growth, driven by the increasing need for effective risk assessment, regulatory compliance, and incident response. The market is characterized by the widespread adoption of cloud-based solutions, AI-powered analytics, and real-time monitoring platforms. Major players are investing in innovation, offering advanced risk management tools and services to meet the evolving needs of organizations. With continuous advancements in technology, increasing regulatory requirements, and rising cybersecurity concerns, the risk management market is expected to experience substantial growth in the coming years.

Browse Reports :

https://solidblogs3.blogspot.com/2025/03/rangefinder-market-size-share-trends.html

https://solidblogs3.blogspot.com/2025/03/redox-flow-battery-market-size-share.html

https://solidblogs3.blogspot.com/2025/03/semiconductor-process-control-equipment.html

https://solidblogs3.blogspot.com/2025/03/remote-work-security-market-analysis_27.html

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Risk Management Market : An Detailed Analysis And Overview here

News-ID: 3941814 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

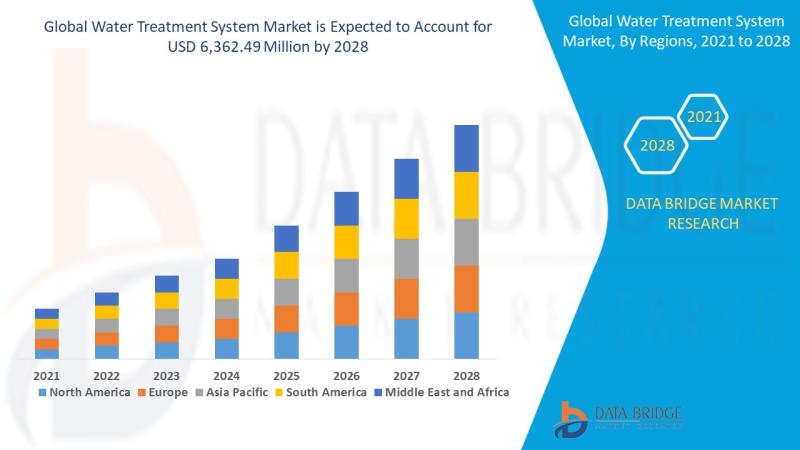

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Risk

The Risk Side of Crypto Trading: Safety Tips + Risk Management

The Risk Side of Crypto Trading: Safety Tips + Risk Management

Cryptocurrency trading can be exciting, fast-moving, and potentially profitable. But it also carries serious risks that many beginners underestimate.

From dramatic price swings in Bitcoin to rapid market shifts in Ethereum, crypto markets are among the most volatile financial environments in the world.

If you're entering crypto trading - especially short-term or automated trading - understanding the risk side is not optional.

In…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…