Press release

FINRA CAIS (Customer Account Information System): Ensuring Seamless Compliance, Comprehensive Data Management, Regulatory Adaptability, and Long-Term Success with Capital Market Solutions' Reliable and Scalable RSMS Platform

In today's highly regulated financial environment, maintaining compliance is essential. The Financial Industry Regulatory Authority's Customer Account Information System (FINRA CAIS) ensures transparency and data accuracy. For firms navigating these requirements, a reliable compliance solution is crucial. Capital Market Solutions (CMS) offers the RSMS platform, a robust tool designed to simplify compliance, streamline data management, and reduce operational risks."At Capital Market Solutions, we prioritize seamless compliance and efficient data management. Our RSMS platform empowers firms to confidently meet FINRA CAIS requirements."

Ensure Smooth Compliance with FINRA CAIS: https://capmarketsolutions.com/cais/

Understanding FINRA CAIS:

The Customer Account Information System (CAIS) is FINRA's centralized system for collecting, validating, and storing essential customer account information. It enhances transparency, ensures data accuracy, and supports regulatory oversight. Firms that submit accurate data on time demonstrate compliance, minimize risks, and maintain market integrity.

The Challenges of Compliance:

Firms face challenges like managing large data volumes, maintaining consistency, and adhering to regulatory updates. Missteps in data reporting can lead to penalties and reputational damage.

Maintaining compliance requires constant monitoring, efficient data management, and prompt response to changes. Without the right tools, firms risk non-compliance, fines, and operational inefficiencies. This is where Capital Market Solutions' RSMS platform makes a difference.

How RSMS Simplifies FINRA CAIS Compliance:

The RSMS platform streamlines data management, enhances compliance workflows, and reduces the risk of errors. Here's how RSMS benefits your firm:

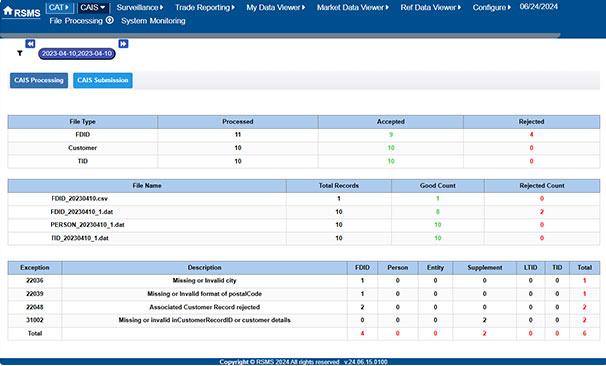

1. Efficient Data Management: Collect, validate, and submit data with ease.

2. Real-Time Monitoring: Track compliance progress and identify issues instantly.

3. Accurate Data Validation: Detect and resolve discrepancies before submission.

4. Custom Dashboards: Gain actionable insights from intuitive dashboards.

5. Scalable Solution: Adapt effortlessly to growing data requirements.

Book Your Personalized Demo Today: https://capmarketsolutions.com/book-a-demo

Unlock Real-Time Insights with RSMS:

No more manual processes or delays. RSMS delivers real-time insights, enabling your compliance team to proactively manage data, address potential issues, and respond quickly to regulatory inquiries.

By centralizing compliance data, the RSMS platform provides users with a single source of truth, enhancing decision-making capabilities and eliminating discrepancies. Firms can minimize the risk of reporting errors, ensuring accurate data submission to FINRA.

Stay Ahead of Regulatory Changes:

Regulations are ever-evolving. With RSMS, you stay compliant without disruption. The platform is prepared to adapt to future regulatory updates, ensuring you're always a step ahead.

RSMS is designed to grow with your business, supporting both small and large financial institutions. Its flexible architecture ensures seamless integration with your existing systems, minimizing disruption during implementation.

Seamless Integration and Customization:

Every firm has unique compliance needs. RSMS offers customizable features, allowing firms to tailor dashboards, reports, and workflows to their requirements. Its user-friendly interface ensures your compliance team can navigate the platform effortlessly.

Customer Support You Can Rely On:

At Capital Market Solutions, we're committed to supporting your compliance journey. Our expert team offers dedicated assistance, from onboarding to ongoing maintenance, ensuring you maximize the platform's benefits.

Get in Touch with Our Experts: https://capmarketsolutions.com/contact-us/

Partner with Capital Market Solutions:

Compliance doesn't have to be complicated. With RSMS, firms can streamline their processes, reduce operational risks, and maintain regulatory excellence. Our platform is built to support your firm's compliance goals, ensuring confidence in every regulatory submission.

Contact Us:

Joseph Chafatinos

Email: sales@capmarketsolutions.com

Website: https://capmarketsolutions.com/

About Us:

Capital Market Solutions (CMS) is a leader in regulatory, compliance, and reporting solutions for financial institutions such as investment banks, broker-dealers, and hedge funds. Our RSMS platform, featuring dedicated modules like CAT and CAIS, simplifies data management, reporting, and monitoring, enhancing operational efficiency and mitigating risks.

Our expert team stays up-to-date with ever-evolving regulations, ensuring CMS solutions are always aligned with the latest standards. Trusted for excellence, we provide firms with the tools they need to meet regulatory requirements, empowering them to make informed decisions and thrive in a complex financial landscape.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release FINRA CAIS (Customer Account Information System): Ensuring Seamless Compliance, Comprehensive Data Management, Regulatory Adaptability, and Long-Term Success with Capital Market Solutions' Reliable and Scalable RSMS Platform here

News-ID: 3937929 • Views: …

More Releases from Capital Market Solutions

Simplifying SEC Compliance in the Cloud Age with RSMS Vault

For broker-dealer compliance teams, meeting SEC Rule 17a-4 requirements is only half the battle. The rule extends beyond basic record retention-it demands immutable WORM (Write Once, Read Many) storage, supervisory oversight, and support for special provisions such as HOLD. The challenge is clear: how can firms ensure their systems are not only secure and auditable, but also efficient and sustainable-without drowning in manual oversight and fragmented processes?

In today's highly regulated…

Is Your Firm Ready for CAT Regulatory Audits? How RSMS Simplifies Compliance

Feeling the heat of CAT regulatory audits? You're not alone. Compliance expectations from FINRA and the SEC are becoming more complex, and firms are under constant pressure to prove their Consolidated Audit Trail (CAT) compliance. Timely submissions are no longer enough-regulators want complete, accurate data backed by documented Written Supervisory Procedures (WSPs) and regular comparative reviews.

The reality? Many broker-dealers are still relying on outdated systems, siloed data, and manual processes,…

Elevating Regulatory Reporting: How RSMS Cloud Solutions Create a Competitive Ed …

In today's rapidly evolving financial sector, meeting the strict requirements of Consolidated Audit Trail (CAT) Compliance and Customer Account Information System (CAIS) reporting is no longer just about box-ticking-it's about gaining operational control and reducing risk. The Regulatory Surveillance and Management System (RSMS), built on secure, cloud-based technology, is redefining the standards for efficiency, transparency, and scalability across the industry. Integrations with CAIS-Connect and finely tuned support for FINRA CAT…

Powering Precision in Regulatory Compliance: How the Cloud Transforms RSMS, CAIS …

In a world where regulatory demands evolve relentlessly, financial institutions must move beyond legacy systems. Embracing cloud-based RegTech-especially for Regulatory Surveillance and Management System (RSMS), Customer Account Information System (CAIS), and Consolidated Audit Trail (CAT) Compliance-is no longer optional, it's foundational.

1. Reinventing Oversight with RSMS in the Cloud

https://capmarketsolutions.com/cat/

A cloud-native Regulatory Surveillance and Management System (RSMS) empowers compliance teams with real-time, unified monitoring across CAT and CAIS channels. Firms can:

Automate cross-system…

More Releases for RSMS

Simplifying SEC Compliance in the Cloud Age with RSMS Vault

For broker-dealer compliance teams, meeting SEC Rule 17a-4 requirements is only half the battle. The rule extends beyond basic record retention-it demands immutable WORM (Write Once, Read Many) storage, supervisory oversight, and support for special provisions such as HOLD. The challenge is clear: how can firms ensure their systems are not only secure and auditable, but also efficient and sustainable-without drowning in manual oversight and fragmented processes?

In today's highly regulated…

Is Your Firm Ready for CAT Regulatory Audits? How RSMS Simplifies Compliance

Feeling the heat of CAT regulatory audits? You're not alone. Compliance expectations from FINRA and the SEC are becoming more complex, and firms are under constant pressure to prove their Consolidated Audit Trail (CAT) compliance. Timely submissions are no longer enough-regulators want complete, accurate data backed by documented Written Supervisory Procedures (WSPs) and regular comparative reviews.

The reality? Many broker-dealers are still relying on outdated systems, siloed data, and manual processes,…

Elevating Regulatory Reporting: How RSMS Cloud Solutions Create a Competitive Ed …

In today's rapidly evolving financial sector, meeting the strict requirements of Consolidated Audit Trail (CAT) Compliance and Customer Account Information System (CAIS) reporting is no longer just about box-ticking-it's about gaining operational control and reducing risk. The Regulatory Surveillance and Management System (RSMS), built on secure, cloud-based technology, is redefining the standards for efficiency, transparency, and scalability across the industry. Integrations with CAIS-Connect and finely tuned support for FINRA CAT…

Powering Precision in Regulatory Compliance: How the Cloud Transforms RSMS, CAIS …

In a world where regulatory demands evolve relentlessly, financial institutions must move beyond legacy systems. Embracing cloud-based RegTech-especially for Regulatory Surveillance and Management System (RSMS), Customer Account Information System (CAIS), and Consolidated Audit Trail (CAT) Compliance-is no longer optional, it's foundational.

1. Reinventing Oversight with RSMS in the Cloud

https://capmarketsolutions.com/cat/

A cloud-native Regulatory Surveillance and Management System (RSMS) empowers compliance teams with real-time, unified monitoring across CAT and CAIS channels. Firms can:

Automate cross-system…

Capital Market Solutions Empowers Financial Firms with Scalable, Automated FINRA …

As the financial regulatory landscape accelerates into 2025, Capital Market Solutions (CMS) announces its powerful Regulatory Surveillance and Management System (RSMS)-designed to help financial firms adapt swiftly and confidently to evolving FINRA mandates around CAT and CAIS reporting, exception management, and adherence to Written Supervisory Procedures (WSPs).

Compliance Challenges Demand Smarter Solutions

Financial institutions navigating 2024's escalating regulatory demands are finding that manual workflows and legacy systems are no longer up…

Capital Market Solutions Unveils the Critical Role of Cloud-Based RSMS in Modern …

In an era where financial compliance is under increasing scrutiny, Capital Market Solutions (CMS) has released a new blog post titled "Why a Cloud-Based RSMS Is Critical for Modern Regulatory Reporting". The article offers actionable insights into how broker-dealers and financial firms can stay ahead of evolving regulatory demands using cloud-based platforms like CMS's Regulatory Surveillance and Management System (RSMS).

With the FINRA Consolidated Audit Trail (CAT) and CAIS (Customer and…