Press release

Banking as a Service Market to Reach USD 11.7 Billion by 2030 | Persistence Market Research

The Banking as a Service (BaaS) market has witnessed significant growth over the past few years, and the upward trajectory is expected to continue for the foreseeable future. As traditional banking services increasingly move toward digitalization, the demand for BaaS solutions has surged. This market, valued at USD 3.6 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of 18.1%, reaching an impressive USD 11.7 billion by 2030. BaaS is rapidly reshaping the way financial institutions deliver their services, and this growth is driven by several key factors.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/33606

Market Overview and Key Growth Drivers

The Banking as a Service market is evolving at a rapid pace, with an expected CAGR of 18.1% from 2023 to 2030. In 2023, the market stands at USD 3.6 billion, and by 2030, it is expected to reach USD 11.7 billion, reflecting a sharp rise in demand for digital banking solutions. One of the primary drivers behind the market growth is the increasing adoption of cloud computing and digital banking platforms, which offer enhanced flexibility and scalability. These platforms enable financial institutions to streamline their services, reduce costs, and reach a broader customer base, driving their popularity.

The demand for open banking and APIs is another key factor boosting the BaaS market. Open banking allows third-party developers to create applications and services that interact with a bank's systems and customer data, providing customers with more personalized and diverse financial services. As financial institutions increasingly collaborate with fintech companies, the BaaS market is witnessing significant growth. Furthermore, the COVID-19 pandemic accelerated the shift to digital banking, making BaaS solutions even more critical for financial institutions to stay competitive and meet evolving customer expectations.

Key Highlights from the Report

• The global Banking as a Service market is projected to grow at a CAGR of 18.1% from 2023 to 2030.

• The market is expected to increase from USD 3.6 billion in 2023 to USD 11.7 billion by 2030.

• Cloud computing and digital banking adoption are key growth drivers.

• Open banking and API integration play a crucial role in the market's expansion.

• The Asia-Pacific region is anticipated to witness the highest growth during the forecast period.

• Leading players in the BaaS market are continuously innovating and expanding their product offerings.

Market Segmentation

The Banking as a Service market is segmented based on product type, end-user, and application, each of which contributes to the growth and diversification of the market. The product type segmentation includes cloud-based and on-premise solutions. Cloud-based BaaS platforms have emerged as the dominant segment due to their cost-efficiency, scalability, and flexibility. They enable banks and financial institutions to offer a wide range of services without heavy infrastructure investments. On-premise solutions are still used by certain traditional institutions, but the shift to the cloud is expected to continue in the coming years.

In terms of end-users, the market is categorized into banks, fintech companies, and other financial service providers. Banks, particularly traditional financial institutions, are increasingly leveraging BaaS solutions to enhance their service offerings and improve operational efficiency. Fintech companies, which typically operate in digital environments, are adopting BaaS to provide innovative financial products and services. Other financial service providers, such as insurance companies and asset managers, are also exploring BaaS to expand their product portfolios and enhance customer experience.

Regional Insights

The BaaS market is geographically diverse, with different regions experiencing varied growth trajectories. North America is the largest market for Banking as a Service due to the presence of well-established financial institutions and a robust fintech ecosystem. The United States, in particular, has witnessed widespread adoption of cloud-based BaaS platforms by both banks and fintech companies. The high rate of digital transformation and regulatory support for open banking have further propelled the market growth in this region.

In the Asia-Pacific (APAC) region, the BaaS market is poised for rapid growth. Countries such as China, India, and Japan are investing heavily in digital banking solutions, driving demand for BaaS platforms. The growing middle class, the increasing adoption of mobile banking, and the push toward financial inclusion are key factors contributing to the growth of the BaaS market in this region.

Market Drivers

One of the primary drivers of the Banking as a Service market is the increasing demand for digital banking solutions. With more consumers and businesses opting for online and mobile banking, financial institutions are under pressure to enhance their digital offerings. BaaS platforms provide a scalable and efficient way to meet these demands, allowing banks to deliver a variety of services, from payments to loans, seamlessly through digital channels.

Additionally, the rise of open banking is fueling market growth. By enabling third-party developers to create financial products that can integrate with banking systems, open banking enhances the flexibility and accessibility of banking services. This, in turn, drives the adoption of BaaS solutions, as banks look to modernize their infrastructure and provide more tailored services to customers.

Market Restraints

Despite the promising growth prospects, several factors are holding back the widespread adoption of Banking as a Service. One of the key challenges is regulatory compliance. Financial institutions are often required to adhere to strict regulations when dealing with customer data, and integrating third-party services through BaaS platforms can complicate compliance efforts. As a result, banks may hesitate to adopt BaaS solutions without assurances that they meet regulatory requirements.

Another restraint is the lack of standardization across BaaS platforms. With multiple service providers offering different solutions, it can be difficult for financial institutions to select the right platform. This fragmentation in the market could lead to interoperability issues, creating barriers to the seamless delivery of banking services.

Market Opportunities

The growth of financial inclusion presents a significant opportunity for the Banking as a Service market. With millions of people around the world lacking access to traditional banking services, BaaS offers a cost-effective way to provide financial services to underserved populations. By leveraging mobile networks and cloud-based platforms, financial institutions can reach customers in remote areas, driving market expansion.

Moreover, the rise of blockchain technology and cryptocurrencies creates new opportunities for BaaS providers to offer innovative financial services. Banks and fintech companies can integrate blockchain-based solutions into their BaaS platforms to enhance transparency, security, and efficiency in financial transactions, opening up new revenue streams.

Reasons to Buy the Report

✔ Understand the projected market growth of Banking as a Service, with a CAGR of 18.1% by 2030.

✔ Gain insights into the key drivers, restraints, and opportunities shaping the market.

✔ Discover the leading players and their strategies for success in the BaaS market.

✔ Learn about regional market trends and the leading regions for growth.

✔ Get access to valuable market data, including segmentation based on product type and end-user.

Frequently Asked Questions

1. How Big is the Banking as a Service Market?

2. Who are the Key Players in the Global Banking as a Service Market?

3. What is the Projected Growth Rate of the Banking as a Service Market?

4. What is the Market Forecast for Banking as a Service for 2032?

5. Which Region is Estimated to Dominate the Banking as a Service Industry through the Forecast Period?

Company Insights

The key players in the global Banking as a Service market include:

• Solarisbank

• Synapse

• Finastra

• Railsbank

• Marqeta

• Galileo

Recent Developments:

1. Railsbank recently expanded its platform capabilities, offering new features for automated compliance and enhanced fraud detection.

2. Marqeta launched a new set of APIs that enable financial institutions to provide more customized banking products through their BaaS offerings.

Conclusion

The Banking as a Service market is poised for remarkable growth, driven by digital transformation, open banking initiatives, and the increasing demand for flexible, scalable financial services. With North America leading the charge and the Asia-Pacific region emerging as a strong contender, the BaaS market presents numerous opportunities for both established players and newcomers. Understanding the market drivers, restraints, and opportunities is crucial for stakeholders looking to navigate this rapidly evolving landscape.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking as a Service Market to Reach USD 11.7 Billion by 2030 | Persistence Market Research here

News-ID: 3936045 • Views: …

More Releases from Persistence Market Research

India Aluminum Beverage Can Market Size to Reach US$ 0.8 Bn by 2032 - Persistenc …

The India aluminum beverage can market is undergoing a significant transformation, driven by changing consumer lifestyles, rising urbanization, and a noticeable shift toward sustainable and convenient packaging formats. Aluminum beverage cans are increasingly preferred across carbonated soft drinks, energy drinks, sports beverages, alcoholic drinks, and ready-to-drink juices due to their lightweight structure, portability, fast chilling properties, and superior recyclability. In India, where on-the-go consumption is accelerating rapidly, aluminum cans are…

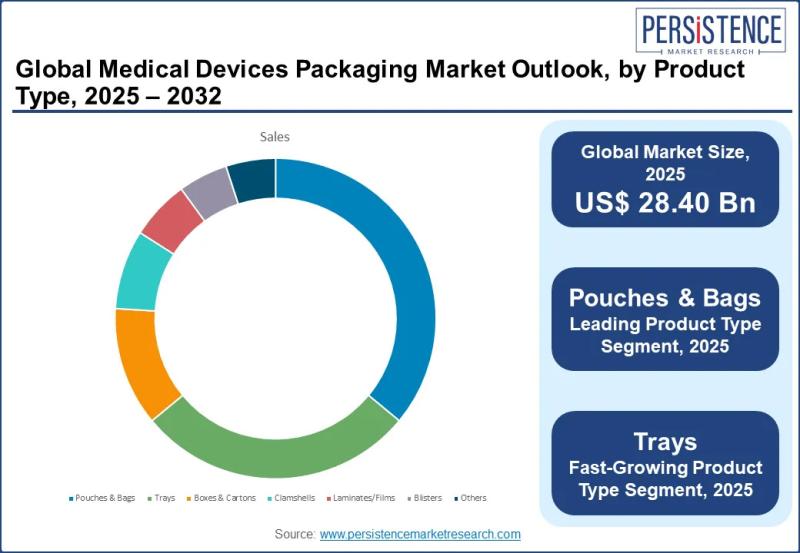

Medical Devices Packaging Market Size to Reach US$ 41.57 Billion by 2032 - Persi …

The medical devices packaging market plays a vital role within the global healthcare ecosystem, acting as a protective and regulatory bridge between manufacturers and end users. Medical device packaging refers to specialized materials and formats designed to safeguard medical instruments, implants, diagnostic tools, and consumables throughout storage, transportation, and clinical use. These packaging solutions are engineered to maintain sterility, prevent contamination, ensure ease of handling, and comply with strict regulatory…

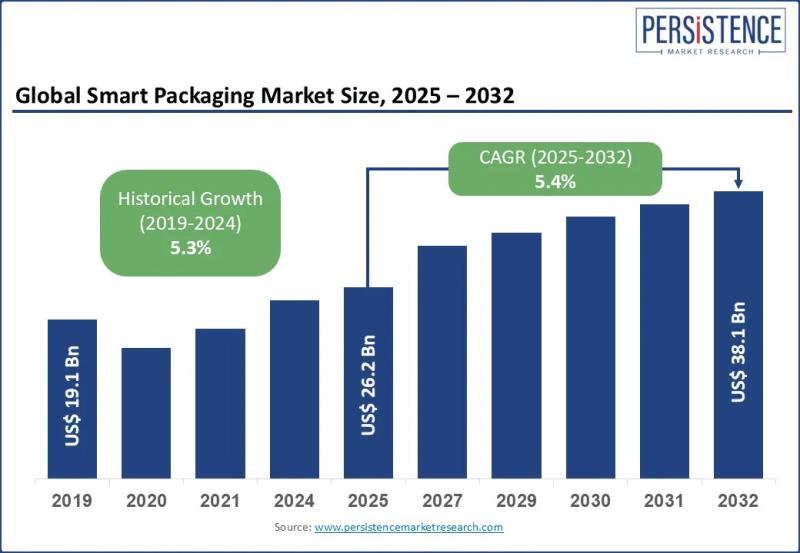

Smart Packaging Market Size Valued at US$ 26.2 Bn in 2025, Projected to Reach US …

The smart packaging market is rapidly transforming the global packaging landscape by integrating advanced technologies with traditional packaging materials to deliver enhanced functionality, traceability, and consumer engagement. Smart packaging refers to packaging systems embedded with features such as sensors indicators QR codes RFID tags and data tracking mechanisms that monitor product condition authenticity and movement across the supply chain. These solutions are increasingly adopted as businesses shift from passive containment…

Football Equipment Market Set for Strong Global Growth Through 2032

The global football equipment market continues to display resilient growth driven by rising participation in football across all age groups, expanding commercial opportunities, and technological advancements in sports gear. The industry is expected to grow from an estimated US$ 18.7 billion in 2025 to approximately US$ 24.1 billion by 2032, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

➤ Download Your Free Sample & Explore Key…

More Releases for BaaS

Key Factor Supporting Banking-As-A-Service (BaaS) Market Development in 2025: Th …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Banking-As-A-Service (BaaS) Market Size By 2025?

The market size of banking-as-a-service (BaaS) has seen a significant increase in recent times. This upward trend is projected to continue, as the market's worth is expected to rise from $716 billion in 2024 to a staggering $842.44 billion…

Global Blockchain As A Service Baas Platform Market Size by Application, Type, a …

USA, New Jersey- According to Market Research Intellect, the global Blockchain As A Service Baas Platform market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Blockchain as a Service (BaaS) platform market is set to experience substantial growth from 2025 to 2032, with a strong…

Global Battery As A Service (BaaS) Market Size by Application, Type, and Geograp …

USA, New Jersey- According to Market Research Intellect, the global Battery As A Service (BaaS) market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Battery as a Service (BaaS) market is witnessing rapid growth, driven by the global transition toward sustainable mobility and clean energy…

BaaS Market Size, Share, Growth, Trends, Opportunities Analysis Report

The global BaaS Market size to grow from USD 632 million in 2020 to USD 11,519 million by 2026, at a Compound Annual Growth Rate (CAGR) of 62.2% during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=246499192

Increasing demand for BaaS due to COVID-19 outbreak, growing need for supply chain transparency across verticals, and rising demand for enhanced security are major growth factors for the market. Increasing integration of blockchain and IoT,…

Backend-as-a-Service (BaaS) Market Report Up to 2031

Visiongain has published a new report on Backend-as-a-Service (BaaS) Market Report to 2031: Forecasts by type (Consumer BaaS, Enterprise BaaS), by organization size (Small & Medium-sized Enterprises, Large Enterprises), by services (Data Integration, Identity & Access Management, Support & Maintenance, Others). PLUS Profiles of Leading Backend-as-a-Service (BaaS) Companies and Regional and Leading National Market Analysis. PLUS COVID-19 Recovery Scenarios.

Backend-as-a-Service (BaaS) is an alternative approach that uses software development kits (SDKs)…

Game BaaS Market VALUATION TO BOOM THROUGH 2030

(United States, OR Poland) The Game BaaS Market report is composed of major as well as secondary players describing their geographic footprint, products and services, business strategies, sales and market share, and recent developments among others. Furthermore, the Game BaaS report highlights the numerous strategic initiatives such as product launches, new business agreements and collaborations, mergers and acquisitions, joint ventures, and technological advancements that have been implemented by the major…