Press release

Factoring Services Market to Grow to US$ 5,680 Bn by 2031 - Persistence Market Research

IntroductionThe global factoring services market has shown significant growth over the last few years, driven by the increasing demand for flexible and alternative financing options, particularly among small and medium-sized enterprises (SMEs). Factoring, a financial service where businesses sell their receivables (invoices) to a third-party financial institution, or "factor," at a discounted rate in exchange for immediate working capital, has become an essential part of the financial ecosystem. The market is expected to continue its upward trajectory, with an estimated valuation of US$5,680 billion by 2031, growing at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2031.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/34659

Market Overview

In 2024, the market for factoring services is projected to be valued at US$3,725 billion, and the growth is primarily driven by the increasing adoption of fintech solutions, advancements in blockchain technology, and the globalization of commerce. These technological advancements make factoring services more accessible and efficient for businesses, particularly SMEs that struggle to access traditional credit sources.

The European market dominates the global factoring services landscape, accounting for 65% of the global share. Domestic factoring services, as opposed to international factoring, are expected to hold the largest market share during the forecast period, with SMEs continuing to be the primary beneficiaries of these services.

Key Market Trends

1. Increased Adoption of Fintech Solutions

The rise of fintech has significantly altered the financial services landscape. SMEs, which often find it difficult to obtain loans from traditional banking institutions, increasingly rely on fintech firms to access factoring services. The automation of financial processes, including payment and invoicing systems, through fintech solutions has enabled businesses to speed up cash flow cycles while reducing the complexity of traditional financing options.

For example, companies like International Fintech, which provide automated solutions for mass payments and financial services, are expanding the accessibility of factoring services to a wider range of businesses. These fintech solutions, by offering low-cost mass payment services, allow SMEs to increase their return on investment (ROI) and make their operations more cost-efficient.

2. Utilization of Blockchain Technology

Blockchain technology is transforming the factoring services market by improving the security, transparency, and efficiency of transactions. The integration of blockchain in factoring reduces the risk of fraud and enhances transaction reliability through decentralized and encrypted smart contracts.

Ethereum, NEO, Hyperledger, and R3CORDA are some of the open blockchain platforms used in the factoring process. Blockchain provides a more secure way to handle sensitive financial data between sellers, buyers, and factors, ensuring trust in the transaction process.

3. Technological Advancements in Artificial Intelligence (AI) and Machine Learning

AI and machine learning are increasingly being incorporated into factoring services to streamline operations. These technologies help companies assess creditworthiness, detect fraud, and automate invoice management. They also enable more accurate predictions of buyer defaults and improve risk management strategies, ensuring greater security and profitability for factoring firms.

Market Dynamics

Market Drivers

1. SMEs and the Demand for Alternative Financing

SMEs are a major driver of growth in the factoring services market. Many small businesses face challenges in securing financing through traditional banks, prompting them to look for alternative financing options such as factoring. Factoring allows SMEs to access working capital without incurring debt, making it an attractive solution for companies in need of quick cash flow.

2. Globalization and Evolving Trade Patterns

The increasing globalization of trade has led to more cross-border transactions and, consequently, a growing need for international factoring services. Companies engaged in international trade often require factoring to manage credit risk and ensure liquidity, which further drives the demand for factoring services.

3. Technological Integration and Automation

Advances in fintech, blockchain, and AI are helping streamline the factoring process, improving its accessibility, speed, and efficiency. These technologies also enhance the ability to manage risks associated with receivables and streamline the factoring process, making it more attractive to businesses.

Market Restraints

1. Regulatory Challenges

The factoring services market faces significant regulatory hurdles, as the legal framework governing factoring differs widely across countries. Complex and varying regulations in different regions make it difficult for factoring companies to operate efficiently across borders. Moreover, compliance with these regulations requires significant investment in legal and administrative processes, which may hinder market expansion.

2. Economic Fluctuations

Economic downturns can pose challenges to factoring companies, as they are highly dependent on the creditworthiness of businesses. During economic recessions or financial instability, defaults on invoices may increase, affecting the profitability of factoring companies. However, despite the risks, factoring services may still see increased demand during economic slowdowns as businesses seek alternative financing options.

Market Segmentation

By Factoring Type

1. Domestic Factoring (68% Market Share)

Domestic factoring services dominate the market due to geographical limitations and legal constraints associated with international factoring. These services are particularly beneficial for SMEs operating in emerging economies, where access to traditional financing is often limited.

2. International Factoring

International factoring involves cross-border transactions and is growing in demand, especially with the increasing globalization of trade and businesses' need to manage the risks associated with foreign receivables.

By Enterprise Size

1. Small and Medium Enterprises (SMEs) (58% Market Share)

SMEs are the largest consumer of factoring services. The inability of SMEs to obtain traditional bank loans and the increasing demand for trade finance have made factoring a critical financing tool for these businesses.

2. Large Enterprises

Large enterprises also utilize factoring services, though to a lesser extent compared to SMEs. These companies often seek factoring for short-term financing needs or to manage credit risks related to their receivables.

By Region

1. Europe (65% Market Share)

Europe remains the dominant region in the factoring services market, with countries like the UK, France, and Germany leading in the adoption of factoring services. The market in Europe benefits from a strong industrial base, particularly in sectors like manufacturing, energy, and agriculture, which are significant consumers of factoring services.

2. North America

North America, particularly the United States, is projected to experience rapid growth, with a CAGR of 10.0% from 2024 to 2031. Companies in North America are increasingly focusing on niche sectors like transportation, staffing, and advertising to provide tailored factoring services.

Competitive Landscape

The global factoring services market is highly competitive, with numerous financial institutions and specialized factoring companies providing a wide range of services. Major players include BNP Paribas, HSBC, Deutsche Bank, and Barclays, as well as specialized factoring companies like Porter Capital and RTS Financial Services.

These companies are leveraging new technologies to enhance their service offerings and gain a competitive edge in the market.

Future Outlook

The factoring services market is poised for continued growth, driven by the expanding global trade, increasing SME participation, and the integration of advanced technologies such as AI, blockchain, and fintech. With the forecasted CAGR of 5.5% from 2024 to 2031, the market is expected to reach US$5,680 billion by 2031, with significant opportunities in emerging markets and sectors requiring specialized financial solutions.

Frequently Asked Questions (FAQs)

1. What is factoring?

2. How does fintech contribute to the growth of the factoring services market?

3. Why is domestic factoring more popular than international factoring?

4. How does blockchain technology enhance factoring services?

5. What are the growth prospects for the factoring services market in North America?

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Factoring Services Market to Grow to US$ 5,680 Bn by 2031 - Persistence Market Research here

News-ID: 3929985 • Views: …

More Releases from Persistence Market Research

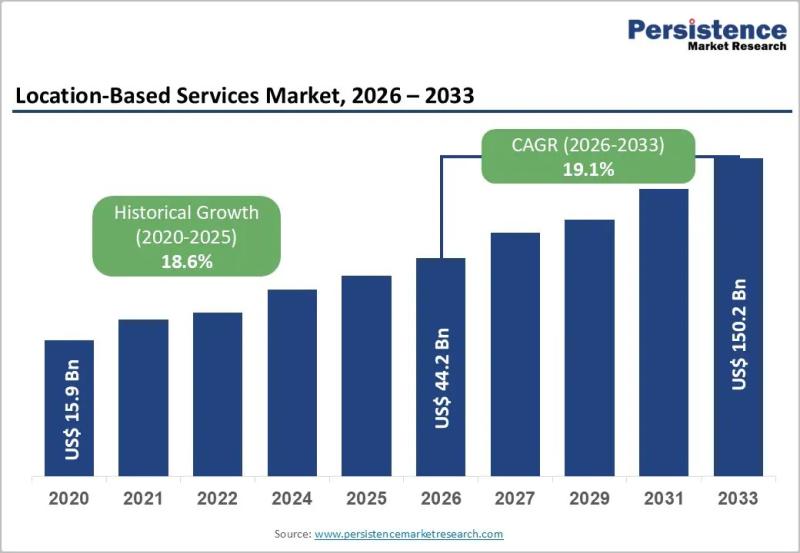

Location-Based Services (LBS) Market Set to Surpass US$150 Billion by 2033 Amid …

The global Location-Based Services (LBS) Market is projected to be valued at US$ 44.2 billion in 2026 and is expected to reach US$ 150.2 billion by 2033, expanding at a remarkable CAGR of 19.1% during 2026-2033. This strong growth trajectory reflects the rapid digitization of industries, increasing smartphone penetration, and advancements in GPS and 5G connectivity. The LBS ecosystem has evolved beyond basic navigation into a sophisticated framework powering real-time…

Cocoa Fiber Market to Reach US$696.8M by 2033 at 7.6% CAGR, Driven by Clean-Labe …

The global cocoa fiber market is poised for significant expansion over the forecast period, driven by rising demand for functional food ingredients, clean-label formulations, and sustainable by-product utilization within the cocoa processing industry. The market is expected to grow from US$ 417.3 million in 2026 to approximately US$ 696.8 million by 2033, reflecting a healthy compound annual growth rate (CAGR) of 7.6% from 2026 to 2033. This strong growth trajectory…

Non-Alcoholic Drinks Market to Hit $2,100.4B by 2033 at 8.2% CAGR on Health Tren …

The global non-alcoholic drinks market is entering a transformative growth phase, driven by evolving consumer preferences, rapid product innovation, and expanding distribution networks worldwide. The market is projected to grow from US$ 1,209.8 billion in 2026 to approximately US$ 2,100.4 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 8.2% during the forecast period from 2026 to 2033. This significant expansion underscores the increasing importance of non-alcoholic…

Bamboo Packaging Market to Reach US$ 884.5 Mn by 2033 at 6.5% CAGR Driven by Pla …

According to the latest study by Persistence Market Research, the global bamboo packaging market size is likely to be valued at US$ 569.2 million in 2026 and is expected to reach US$ 884.5 million by 2033, growing at a CAGR of 6.5% between 2026 and 2033. The growth trajectory is strongly supported by the accelerating substitution of plastic-based packaging with renewable fiber alternatives across food and beverage, cosmetics, electronics, and…

More Releases for SME

SME Insurance - Market Size | Valuates Reports

SME Insurance - Market Size | Valuates Reports

The global market for SME Insurance was estimated to be worth US$ 18010 million in 2023 and is forecast to a readjusted size of US$ 24100 million by 2030 with a CAGR of 4.2% during the forecast period 2024-2030

View Sample Report

https://reports.valuates.com/request/sample/QYRE-Auto-3D7510/China_SME_Insurance_Market_Report_Forecast_2021_2027

Report Scope

This report aims to provide a comprehensive presentation of the global market for SME Insurance, focusing on the total sales revenue, key…

SME Force Automation Market Investment Analysis

The SME force automation market is expected to witness market growth at a rate of 15.20% in the forecast period of 2021 to 2028. Data Bridge Market Research report on SME force automation market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rising adoption of cloud sales force automation (SFA) software is escalating…

UK SME Insurance Market Report- Competitor Dynamics | Insurers can challenge the …

The research study contains an in detail descriptive overview and analysis of the UK SME Insurance Market, a summary of the UK SME Insurance Market shares constituted by each component, the annual growth of each sector, and the revenue potential of the section. In addition, UK SME Insurance Market production and consumption data are used to determine the geographical features.

Get FREE PDF Sample of the Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=4430784

AXA and…

INDIA: Big March for SME

In keeping with recent and ongoing changes in the business landscape, business is focusing on mobility rather than stability, and the service business has evolved accordingly. Globalization is the buzzword as geographic boundaries cease to exist. Business is competing for opportunities in an international arena. Because the world is connected in a single unit, any crisis in one part of the world has repercussions in other parts, too.

Small and medium-sized…

IndiaMART.com Pushes for Cohesive SME Ecosystem through SME Learning Series

Partners with Smallenterpriseindia.com for the Series

Series aims to bring clear understanding of Finance, HR, IT, Communication, Marketing & other business verticals to SMEs

Roadshows in Delhi, Ghaziabad, Gurgaon, Bangalore & Vadodara receive huge response

New Delhi, 28th May, 2011: Small and Medium Enterprises (SMEs) have been playing a vital role in growth and development of Indian economy. They are credited with generating million of job opportunities every year along with contributing a…

IndiaMART.com Plans Massive SME Awareness Campaign

To be launched in 2-3 weeks, campaign's theme centers on boosting awareness amongst SMEs on the need to go online

- Educate buyers & suppliers on how they can leverage Internet for 24X7 global presence, cost-effective marketing & B2B matchmaking

- Highlight catalyzing role of B2B e-marketplaces like IndiaMART.com in growth of SMEs

- Nation-wide drive to be launched across newspapers, magazines, online, radio, electronic & outdoor media

New Delhi,…