Press release

In-Depth Analysis of the Loan Brokers Market: Growth Opportunities, Key Trends, and Forecast 2025-2034

What market dynamics are playing a key role in accelerating the growth of the loan brokers market?The rising demand for homeownership is expected to drive the growth of the loan broker market. Homeownership, whether through direct purchase or mortgage financing, is becoming more desirable due to low mortgage rates, the rise in remote work, the need for stability, and increasing rental costs. Loan brokers assist potential buyers in navigating the mortgage market. For instance, according to the United States Census Bureau, the homeownership rate in the U.S. increased slightly from 65.6% in Q1 2023 to 65.7% in Q4 2023. Thus, the growing demand for homeownership is contributing to the growth of the loan broker market.

Get Your Loan Brokers Market Report Here:

https://www.thebusinessresearchcompany.com/report/loan-brokers-global-market-report

How will the growth rate of the loan brokers market shape industry trends by 2034?

The loan brokers market will expand from $287.26 billion in 2024 to $328.22 billion in 2025 at a CAGR of 14.3%, driven by increasing homeownership demand, regulatory changes, greater transparency in lending, and housing market fluctuations.

The loan brokers market is anticipated to reach $555.12 billion by 2029 at a CAGR of 14.0%. Growth is influenced by regulatory changes, fluctuations in property values, evolving lending laws, consumer credit score variations, business expansions, and capital investments. Key trends include digital platform adoption, blockchain-enhanced security and transparency, stricter financial data regulations, increased mobile service preference, and technological innovations.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=17188&type=smp

What trends are poised to drive the future success of the loan brokers market?

Companies in the loan broker market are focused on creating advanced solutions, like digital verification processes, to speed up and simplify the loan approval process. Digital verification allows for electronic verification of a borrower's financial information and identity, making the approval process quicker and more efficient. For instance, in December 2023, LoanDepot, a US-based mortgage lender, launched MelloNow, a fully automated underwriting engine that revolutionizes loan processing by instantly generating borrower conditions. This advanced system analyzes credit reports, detects fraud, and validates income and employment data during the loan application process, reducing delays and enhancing the overall loan evaluation.

Which primary segments of the loan brokers market are driving growth and industry transformations?

The loan brokers market covered in this report is segmented -

1) By Component: Products, Services

2) By Enterprise Size: Large Enterprise, Small And Medium-Sized Enterprises

3) By Application: Home Loans, Commercial And Industrial Loans, Vehicle Loans, Loans To Governments, Other Applications

4) By End User: Businesses, Individuals

Subsegments:

1) By Products: Mortgage Products, Personal Loan Products, Business Loan Products, Auto Loan Products

2) By Services: Loan Consultation Services, Loan Origination Services, Loan Processing Services, Loan Negotiation Services

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=17188

Which geographical regions are pioneering growth in the loan brokers market?

Asia-Pacific was the largest region in the loan brokers market in 2023. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the loan brokers market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Who are the influential players reshaping the loan brokers market landscape?

Major companies operating in the loan brokers market are Macquarie Group Limited, Social Finance Inc.(SoFi), Credit Karma Inc., Quicken Loans LLC, United Wholesale Mortgage, Guild Mortgage, American Pacific Mortgage Corp., LendingTree Inc., Lendio Inc., BlueVine Inc., Balboa Capital Corp., Funding Circle Ltd., Avant LLC, OnDeck Capital Inc., Rapid Finance Pvt. Ltd., Fundbox Inc., Credibly LLC, National Business Capital & Services, Fundera Inc., LendStreet Financial Inc., QuarterSpot Inc.

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/customise?id=17188&type=smp

What Is Covered In The Loan Brokers Global Market Report?

•Market Size Forecast: Examine the loan brokers market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the loan brokers market for a structured understanding.

•Key Players Overview: Analyze major players in the loan brokers market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the loan brokers market.

•Segment Contributions: Evaluate how different segments drive overall growth in the loan brokers market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the loan brokers market.

•Industry Challenges: Identify potential risks and obstacles affecting the loan brokers market.

•Competitive Landscape: Review strategic developments in the loan brokers market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release In-Depth Analysis of the Loan Brokers Market: Growth Opportunities, Key Trends, and Forecast 2025-2034 here

News-ID: 3926393 • Views: …

More Releases from The Business Research Company

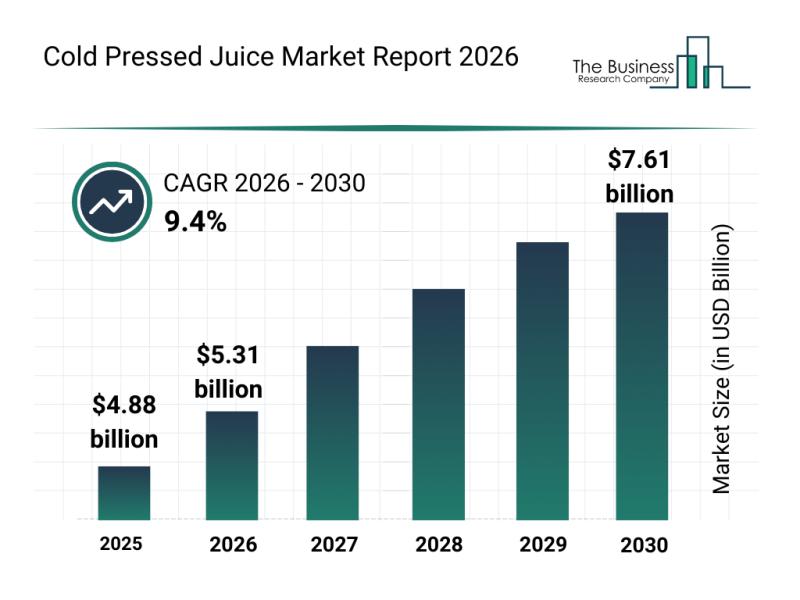

Emerging Sub-Segments Transforming the Cold Pressed Juice Market Landscape

The cold pressed juice market is on the verge of significant expansion as consumers increasingly seek healthier and more functional beverage options. Shifting preferences towards immunity-boosting drinks and sustainability are driving innovation and growth in this sector. Let's explore the current market size, influential players, emerging trends, and segment breakdowns shaping the future of cold pressed juices.

Cold Pressed Juice Market Size and Growth Expectations Through 2030

The market for…

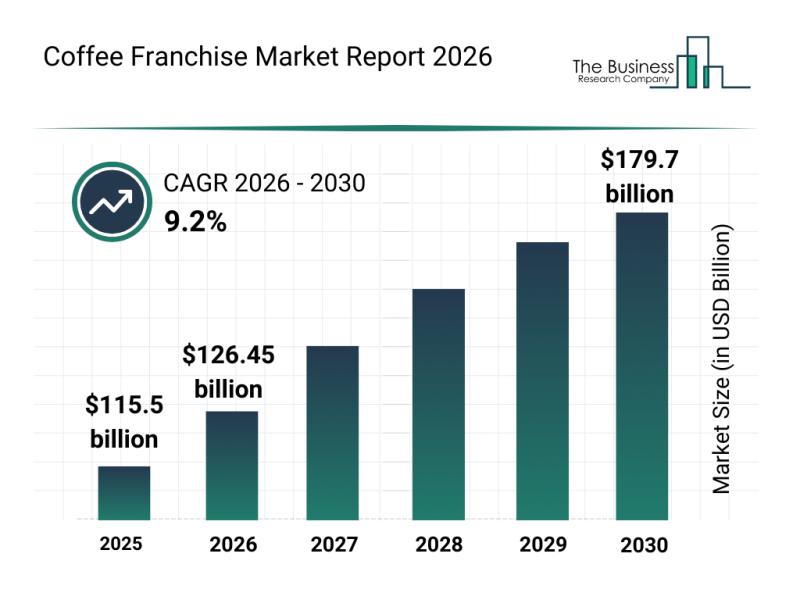

Top Companies and Industry Competition in the Coffee Franchise Market

The coffee franchise industry is positioned for significant expansion in the coming years, driven by evolving consumer preferences and strategic market initiatives. Increasing demand for high-quality coffee experiences and innovative business models is shaping the future landscape. Let's explore the current market size, leading companies, key trends, and major segments that define this dynamic sector.

Projected Growth and Market Size of the Coffee Franchise Market by 2030

The coffee franchise…

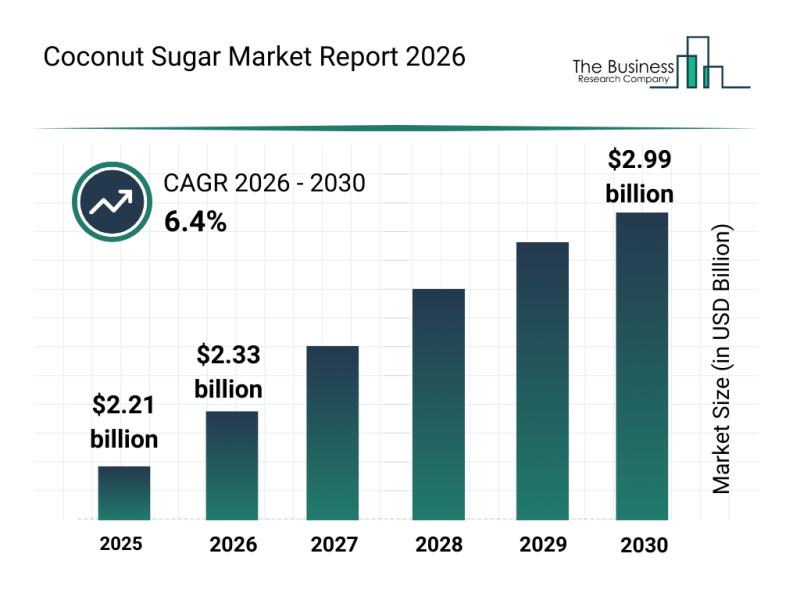

Coconut Sugar Market Overview: Major Segments, Strategic Developments, and Leadi …

The coconut sugar market is gaining significant momentum and is poised for notable expansion over the coming years. Driven by evolving consumer preferences and increasing interest in healthier and sustainable sweeteners, this market presents promising opportunities for businesses and consumers alike. Let's explore the market's size, key players, emerging trends, and segmentation in detail.

Projected Expansion of the Coconut Sugar Market Size Through 2030

The coconut sugar market is forecasted…

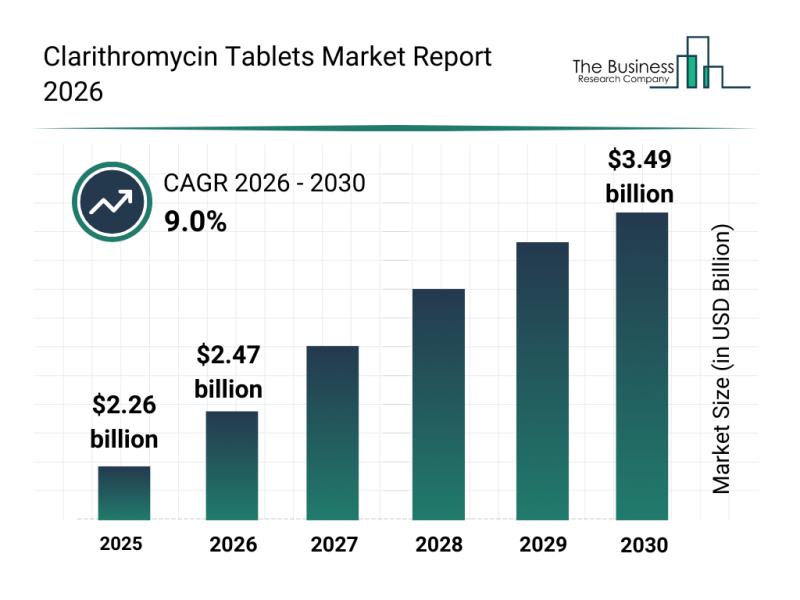

Emerging Sub-Segments Transforming the Clarithromycin Tablets Market Landscape

The clarithromycin tablets market is poised for notable expansion in the coming years, driven by several healthcare and pharmaceutical developments. As demand for effective antibiotic treatments rises globally, this sector is attracting considerable attention from manufacturers and healthcare providers alike. Let's explore the market's size, key players, prevailing trends, and segmentation to understand its current landscape and future potential.

Projected Market Valuation and Growth Trajectory for Clarithromycin Tablets

The clarithromycin…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…