Press release

Recurring Payments Market Gears Up for Significant Growth, Surpassing US$ 247.5 Bn by 2031 - Persistence Market Research

The global recurring payments market is projected to grow at a CAGR of 6.4% between 2024 and 2031, rising from US$ 160.3 Bn in 2024 to US$ 247.5 Bn by 2031. This growth is primarily driven by the rising adoption of subscription-based business models, fintech advancements, and increasing digital payment adoption worldwide.Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response):

https://www.persistencemarketresearch.com/samples/34129

Market Definition and Overview

The recurring payments market encompasses automated payment processing for periodic transactions, including subscriptions, memberships, and utility payments. It plays a critical role in supporting businesses with predictable revenue streams and consumers with seamless transaction experiences.

Recurring payments leverage secure payment gateways, subscription management platforms, and financial infrastructure to process monthly, quarterly, or annual payments. This ensures efficient billing cycles, regulatory compliance, and enhanced financial security for businesses across industries such as e-commerce, telecommunications, healthcare, and financial services.

Key Market Growth Drivers

Surge in the Subscription Economy

With businesses increasingly shifting toward subscription-based models, the demand for recurring payments solutions is on the rise. Consumers now prefer subscription services for entertainment, cloud computing, fitness, and software solutions, which are fueling the market's expansion.

Recurring payment platforms enable businesses to offer flexible billing, ensuring customer retention and predictable revenue. As subscription models evolve, automated, secure, and scalable payment solutions will become even more essential.

Fintech Innovations Enhancing Payment Processing

The integration of artificial intelligence, blockchain, and secure payment gateways is transforming the recurring payments landscape. Automated billing, AI-driven fraud detection, and predictive analytics allow businesses to optimize financial processes, reduce payment failures, and improve the customer experience.

Additionally, mobile payments and contactless transactions have accelerated market adoption, making recurring payment solutions more convenient and secure.

Market Restraints

Regulatory Compliance Challenges

The recurring payments market faces regulatory hurdles due to evolving financial regulations, data privacy laws, and compliance standards. Businesses must ensure adherence to guidelines such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation) while maintaining seamless payment processes.

Failure to comply can result in hefty fines and reputational damage, requiring ongoing investments in legal frameworks and secure transaction technologies.

Cybersecurity Threats and Data Privacy Concerns

With the increasing volume of digital transactions, cybersecurity risks have become a major concern. Payment fraud, data breaches, and hacking attempts threaten the integrity of recurring payment systems.

To address these issues, businesses are investing in advanced encryption, tokenization, and fraud prevention mechanisms to protect financial transactions and maintain consumer trust.

Emerging Market Opportunities

Growth of Subscription Management Platforms

As businesses continue to transition to recurring revenue models, the need for subscription management platforms is increasing. These platforms provide automated billing, customer account management, and data analytics to help businesses optimize revenue streams and improve customer engagement.

Subscription platforms with customizable billing cycles, integrated payment gateways, and flexible pricing models will drive further market expansion.

Enhanced Security Solutions for Digital Payments

The rising adoption of recurring payments necessitates advanced security solutions to prevent fraud and unauthorized transactions. AI-driven fraud detection, biometric authentication, and blockchain-based payment systems are key areas of innovation in the market.

Companies investing in cutting-edge security technologies will play a pivotal role in shaping the future of the recurring payments landscape.

Analyst's Perspective

The recurring payments market is set to witness significant expansion, fueled by evolving consumer preferences, advancements in financial technology, and the rise of subscription-based businesses. Consumers increasingly favor automated payment methods for utilities, entertainment, and software services, eliminating the hassle of manual transactions.

For businesses, the recurring payments model offers predictable cash flow, enhanced customer loyalty, and operational efficiency. The market's long-term success will depend on secure payment technologies, compliance with regulatory frameworks, and seamless digital experiences.

Supply-Side Dynamics

The supply-side of the market is influenced by the increasing adoption of subscription models across industries. Companies like SaaS providers, media streaming services, and e-commerce platforms are driving the need for scalable, automated, and flexible payment solutions.

Moreover, regulatory requirements and security standards are pushing payment service providers to innovate and enhance their offerings. AI-driven fraud detection, tokenization, and personalized payment solutions are becoming industry standards.

Competitive Landscape

The recurring payments market is highly competitive, with key players investing in technological advancements, strategic partnerships, and global expansion to maintain their market positions. Some of the leading companies in this space include:

Zoho

Paddle

Chargebee

ReCharge

Zuora

Recurly

Stripe

PayPal

Adyen

Block

Market Segmentation

By Component

Services

Payment Platforms

By Payment Type

Fixed

Variable

By End User

B2B

Subscription-based Businesses

Publication Services

Streaming Services

Cloud Services

Financial Services

E-learning

Utilities

Telecom

Subscription E-commerce

Club Memberships

B2C (SaaS Solutions)

By Region

North America

Europe

East Asia

South Asia & Oceania

Latin America

The Middle East & Africa

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 25.92, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Recurring Payments Market Gears Up for Significant Growth, Surpassing US$ 247.5 Bn by 2031 - Persistence Market Research here

News-ID: 3920790 • Views: …

More Releases from Persistence Market Research

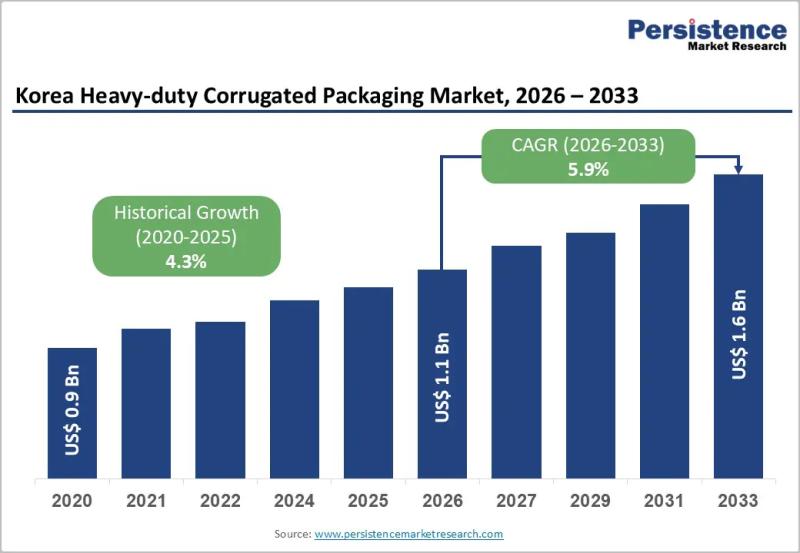

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…