Press release

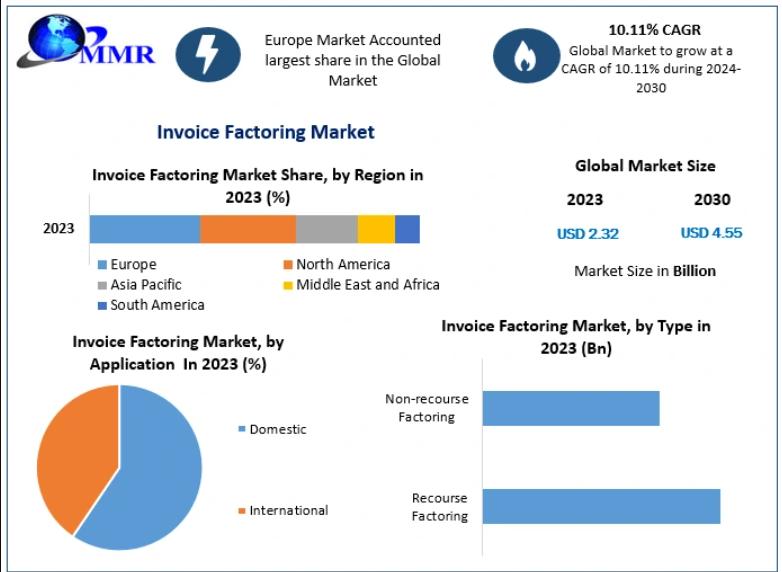

Invoice Factoring Market to Double by 2030, Reaching USD 4.55 Billion at 10.11% CAGR

Invoice Factoring Market Poised for Significant Growth Amid Technological Advancements and Expanding SME SectorThe worldwide invoice factoring market is experiencing a strong growth trend, fueled by technology advancements, surge in the growth of small and medium-sized enterprises (SMEs), and rising cross-border trade. This press release explores market estimations, growth drivers, opportunities, recent trends within the U.S. market, major market segments, competitive scenario, and regional analyses with a special focus on the USA, UK, Germany, France, Japan, and China.

Important points to note are: Click here to obtain a PDF sample copy of this report :https://www.maximizemarketresearch.com/request-sample/168342/

Market Estimation, Growth Drivers, and Opportunities

As of 2023, the market for invoice factoring globally was around $2.32 billion and is expected to grow to $4.55 billion by 2030 with a compound annual growth rate (CAGR) of 10.11% over the forecast period (2024-2030).

There are various reasons behind this expected growth:

Technological Upgrades: Incorporation of artificial intelligence (AI) and machine learning (ML) in factoring operations has added efficiency, risk evaluation, and speed of operation. Technologies like automated invoices with distinctive numbers, intelligent contract functionalities, and transaction security management are transforming the sector.

MAXIMIZEMARKETRESEARCH.COM

SME Growth: International spread of SMEs has increased the need for affordable financing mechanisms. Invoice factoring provides these businesses with timely cash flow through the conversion of outstanding invoices to working capital, thus facilitating their growth and survival.

Cross-Border Trade: Increased international trade activities require accommodative financing options. Factoring offers companies that are involved in cross-border activities the liquidity necessary to remain competitive in global markets.

U.S. Market Trends and Investments in 2024

In 2024, the U.S. invoice factoring market saw important developments:

Digital Platforms: Adoption of digital factoring platforms was seen to increase significantly, with quicker approval times and more convenient terms. Fintech innovations have facilitated easier access to factoring services for SMEs, making the financing process simpler.

AI Integration: Businesses integrated AI into credit scoring and risk evaluation, improving decision-making accuracy and operational efficiency.

Regulatory Support: Government policies of supporting SMEs and financial inclusion have strengthened the factoring business, creating an environment for its growth.

Market Segmentation and Dominant Segments

Market for invoice factoring is classified by type, size of the organization, category, and industry. The greatest market shares fall under the segments of:

By Type: Recourse factoring is the one that prevails, where the factor can take payment from clients in case the debtors do not pay up, thus keeping risk at a minimum.

By Organization Size: Large companies have the biggest market share today, given their huge invoice volumes and well-established credit histories.

By Category: Domestic factoring is in the lead, since firms tend to like conducting business in familiar regulatory and economic environments.

By Application: The manufacturing industry is the largest consumer of factoring services, using them to manage cash flows and keep businesses running through vast supply chains.

Details insights on this market, request for methodology here :https://www.maximizemarketresearch.com/request-sample/168342/

Competitive Analysis

The world invoice factoring market is moderately fragmented, with major players using strategies like new product launches, investments, collaborations, and mergers and acquisitions to increase their market share. The top five companies, by market share, are:

China Construction Bank (CCB): In December 2019, CCB launched a platform for factoring and trading services, increasing its presence in the factoring market.

BNP Paribas: Invested in digital platforms to automate factoring services, improving client accessibility and operational efficiency.

Deutsche Bank: Aiming to incorporate blockchain technology to improve transparency and security in factoring transactions.

HSBC: Invested in artificial intelligence-based risk assessment tools to enhance the accuracy and speed of credit assessments.

Societe Generale: Focused on sustainable finance by incorporating environmental, social, and governance (ESG) factors into their factoring services.

Browse Full report :https://www.maximizemarketresearch.com/market-report/invoice-factoring-market/168342/

Regional Analysis

USA: There has been rapid take-up of digital platforms and AI adoption, driven by government policy to spur financial inclusion and SME development.

UK: A well-developed financial infrastructure, backed by an encouraging regulatory setting, has ensured a strong factoring market in the UK with widespread take-up by SMEs.

Germany: Advanced manufacturing activities and export-reliant economy fuel demand for factoring solutions, backed by an established finance system.

France: The diversified industrial base and government-friendly policies favoring alternative financing solutions for companies contribute to the French market.

Japan: Japan's emphasis on the integration of new technologies, including AI and machine learning, into factoring systems seeks to improve risk management and efficiency in operations.

China: China's growing manufacturing and export activities, together with government favor through regulatory adjustments to enhance transparency and reduce fraud, have strongly accelerated the factoring industry.

Conclusion

The international invoice factoring market is on the verge of huge growth, facilitated by technological innovation, SME growth, and growing cross-border trade activities. Major growth drivers are the adoption of AI and ML for improving operational efficiency, friendly government policies supporting financial inclusion, and growing adoption of digital platforms streamlining factoring processes. Firms that take advantage of these opportunities and transform with changing market forces are positioned to take advantage of the expected growth of the invoice factoring industry.

Related Reports :

♦ Global Smart Card Reader Market https://www.maximizemarketresearch.com/market-report/global-smart-card-reader-market/64265/

♦ Global Semiconductor Production Equipment Market https://www.maximizemarketresearch.com/market-report/semiconductor-production-equipment-market/13458/

♦ Global Emergency Spill Response Market https://www.maximizemarketresearch.com/market-report/global-emergency-spill-response-market/36305/

♦ Global Source Measure Unit Market https://www.maximizemarketresearch.com/market-report/global-source-measure-unit-market/8362/

♦ Global Ultrasonic Gas Leak Detector Market https://www.maximizemarketresearch.com/market-report/global-ultrasonic-gas-leak-detector-market/78574/

♦ Global Wireless Fire Detection Systems Market https://www.maximizemarketresearch.com/market-report/global-wireless-fire-detection-systems-market/35021/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Invoice Factoring Market to Double by 2030, Reaching USD 4.55 Billion at 10.11% CAGR here

News-ID: 3914490 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for SME

SME Insurance - Market Size | Valuates Reports

SME Insurance - Market Size | Valuates Reports

The global market for SME Insurance was estimated to be worth US$ 18010 million in 2023 and is forecast to a readjusted size of US$ 24100 million by 2030 with a CAGR of 4.2% during the forecast period 2024-2030

View Sample Report

https://reports.valuates.com/request/sample/QYRE-Auto-3D7510/China_SME_Insurance_Market_Report_Forecast_2021_2027

Report Scope

This report aims to provide a comprehensive presentation of the global market for SME Insurance, focusing on the total sales revenue, key…

SME Force Automation Market Investment Analysis

The SME force automation market is expected to witness market growth at a rate of 15.20% in the forecast period of 2021 to 2028. Data Bridge Market Research report on SME force automation market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rising adoption of cloud sales force automation (SFA) software is escalating…

UK SME Insurance Market Report- Competitor Dynamics | Insurers can challenge the …

The research study contains an in detail descriptive overview and analysis of the UK SME Insurance Market, a summary of the UK SME Insurance Market shares constituted by each component, the annual growth of each sector, and the revenue potential of the section. In addition, UK SME Insurance Market production and consumption data are used to determine the geographical features.

Get FREE PDF Sample of the Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=4430784

AXA and…

INDIA: Big March for SME

In keeping with recent and ongoing changes in the business landscape, business is focusing on mobility rather than stability, and the service business has evolved accordingly. Globalization is the buzzword as geographic boundaries cease to exist. Business is competing for opportunities in an international arena. Because the world is connected in a single unit, any crisis in one part of the world has repercussions in other parts, too.

Small and medium-sized…

IndiaMART.com Pushes for Cohesive SME Ecosystem through SME Learning Series

Partners with Smallenterpriseindia.com for the Series

Series aims to bring clear understanding of Finance, HR, IT, Communication, Marketing & other business verticals to SMEs

Roadshows in Delhi, Ghaziabad, Gurgaon, Bangalore & Vadodara receive huge response

New Delhi, 28th May, 2011: Small and Medium Enterprises (SMEs) have been playing a vital role in growth and development of Indian economy. They are credited with generating million of job opportunities every year along with contributing a…

IndiaMART.com Plans Massive SME Awareness Campaign

To be launched in 2-3 weeks, campaign's theme centers on boosting awareness amongst SMEs on the need to go online

- Educate buyers & suppliers on how they can leverage Internet for 24X7 global presence, cost-effective marketing & B2B matchmaking

- Highlight catalyzing role of B2B e-marketplaces like IndiaMART.com in growth of SMEs

- Nation-wide drive to be launched across newspapers, magazines, online, radio, electronic & outdoor media

New Delhi,…