Press release

Key Influencer in the Specialty Insurance Market 2025: Specialty Insurance Market Thrives Amidst Escalating Natural Disasters Driver

What industry-specific factors are fueling the growth of the specialty insurance market?The specialty insurance market is predicted to expand due to an increase in natural disasters. These disasters include atmospheric, geological, and hydrological origins events which can lead to casualties, property destruction, and socio-environmental upheaval. In anticipating such catastrophic events such as hurricanes or earthquakes, specialty insurance offers bespoke coverage spanning a vast array of damages. This includes coverage for real and personal property for captives, business income, and reducing financial jeopardy. As of March 2022, a report from the Fair Tech Institute, a non-profit organization based in Singapore, suggests that the yearly instances of natural disasters may surge by 37% from 2025 to 2029. Hence, the uptick in natural disasters underpins the growth of the specialty insurance market.

Get Your Specialty Insurance Market Report Here:

https://www.thebusinessresearchcompany.com/report/specialty-insurance-global-market-report

What Is the projected market size and growth rate for the specialty insurance market?

The dimension of the specialty insurance market has expanded swiftly in the previous years, escalating from $98.85 billion in 2024 to an estimated $109.25 billion in 2025, demonstrating a Compound Annual Growth Rate (CAGR) of 10.5%. The traction gained during the historical period can be associated with the need for risk reduced solutions, modifications in regulations, the influence of globalization, development of new industries, and prevailing litigation tendencies.

Anticipations for the specialty insurance market size indicate a swift enlargement in the coming years, with projections showing it expanding to $164.25 billion by 2029 at a compound annual growth rate (CAGR) of 10.7%. This accelerated expansion throughout the forecast period can be traced back to aspects like emerging cyber security risks, the effects of climate change, readiness for pandemics, advancements in technology, progress in the healthcare sector, and transformations in the legal environment. The forecast period also signals predominant trends like bespoke insurance solutions specifically for the cannabis* industry, a surge in demand for space insurance in the aerospace sector, niche coverage for fine arts and collectibles, the rise in insurance for renewable energy ventures, and an enhanced concentration on employee benefits liability coverage.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9198&type=smp

What new trends are reshaping the specialty insurance market and its opportunities?

One notable trend gaining traction in the specialty insurance sector is the adoption of advanced technology. Shifts in business models have led insurance firms to take advantage of modern digital tools to enhance their operations and develop product lines tailored to specific client needs, which significantly drives the growth of specialty insurance. For example, in November 2022, Kingstone Insurance, a company based in the US, unveiled the Sure AI Assistant, a tool powered by artificial intelligence aimed at overhauling the claims procedure. Utilizing a natural language model, the Sure AI Assistant leverages data from actual insurance claim calls to assist policyholders in smoothly navigating their claims process. Moreover, this AI assistant proves particularly effective during a natural disaster when quick claim filing is crucial and call volumes skyrocket.

What major market segments define the scope and growth of the specialty insurance market?

The specialty insurance market covered in this report is segmented -

1) By Type: Marine, Aviation And Transport (Mat), Political Risk And Credit Insurance, Entertainment Insurance, Art Insurance, Livestock And Aquaculture Insurance, Other Types

2) By Distribution Channel: Brokers, Non-Brokers

3) By End User: Business, Individuals

Subsegments:

1) By Marine, Aviation, And Transport (MAT): Marine Cargo Insurance, Marine Hull Insurance, Aviation Insurance, Transit Insurance, Logistics And Freight Insurance

2) By Political Risk And Credit Insurance: Country Risk Insurance, Expropriation Insurance, Currency Inconvertibility Insurance, Trade Credit Insurance, Political Violence Insurance

3) By Entertainment Insurance: Film Production Insurance, Event Cancellation Insurance, Liability Insurance For Productions, Equipment Insurance, Cast Insurance

4) By Art Insurance: Fine Art Insurance, Museum And Exhibition Insurance, Valuation And Appraisal Insurance, Collection Insurance, Auction Insurance

5) By Livestock And Aquaculture Insurance: Livestock Mortality Insurance, Aquaculture Production Insurance, Disease And Health Coverage, Feed And Supply Insurance

6) By Other Types: Cyber Insurance, Environmental Liability Insurance, Professional Liability Insurance, Contingency Insurance

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9198

Which region dominates the specialty insurance market?

Europe was the largest region in the specialty insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global specialty insurance market report during the forecast period. The regions covered in the specialty insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Which key market leaders are driving the specialty insurance industry growth?

Major companies operating in the specialty insurance market include Berkshire Hathaway Specialty Insurance, Allianz Group, AXA SA, Assicurazioni Generali SpA, Zurich Insurance Group Ltd., Nationwide Mutual Insurance Company, American International Group Inc., Chubb Corp, QBE Insurance Group Limited, The People's Insurance Company of China Limited, Manulife Reinsurance Limited, Everest Group Ltd., Markel Group Inc., Fidelity National Financial Inc., W.R. Berkley Corporation, Arch Capital Group Ltd., The Hanover Insurance Group Inc., AXIS Capital Holdings Limited, RenaissanceRe Holdings Ltd., Hiscox Ltd., Munich Reinsurance America Inc., Selective Insurance Group Inc., Tokio Marine HCC, Alleghany Corporation, Argo Group International Holdings Ltd., Lancashire Holdings Limited, Cincinnati Financial Corporation, Aspen Insurance Holdings Limited, Fairfax Financial Holdings Limited, CNA Financial Corporation, Sompo International Holdings Ltd., AmTrust Financial Services Inc., Sirius International Insurance Group Ltd., RLI Corp

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/customise?id=9198&type=smp

What Is Covered In The Specialty Insurance Global Market Report?

•Market Size Forecast: Examine the specialty insurance market size across key regions, countries, product categories, and applications.

•Segmentation Insights: Identify and classify subsegments within the specialty insurance market for a structured understanding.

•Key Players Overview: Analyze major players in the specialty insurance market, including their market value, share, and competitive positioning.

•Growth Trends Exploration: Assess individual growth patterns and future opportunities in the specialty insurance market.

•Segment Contributions: Evaluate how different segments drive overall growth in the specialty insurance market.

•Growth Factors: Highlight key drivers and opportunities influencing the expansion of the specialty insurance market.

•Industry Challenges: Identify potential risks and obstacles affecting the specialty insurance market.

•Competitive Landscape: Review strategic developments in the specialty insurance market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Influencer in the Specialty Insurance Market 2025: Specialty Insurance Market Thrives Amidst Escalating Natural Disasters Driver here

News-ID: 3912634 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

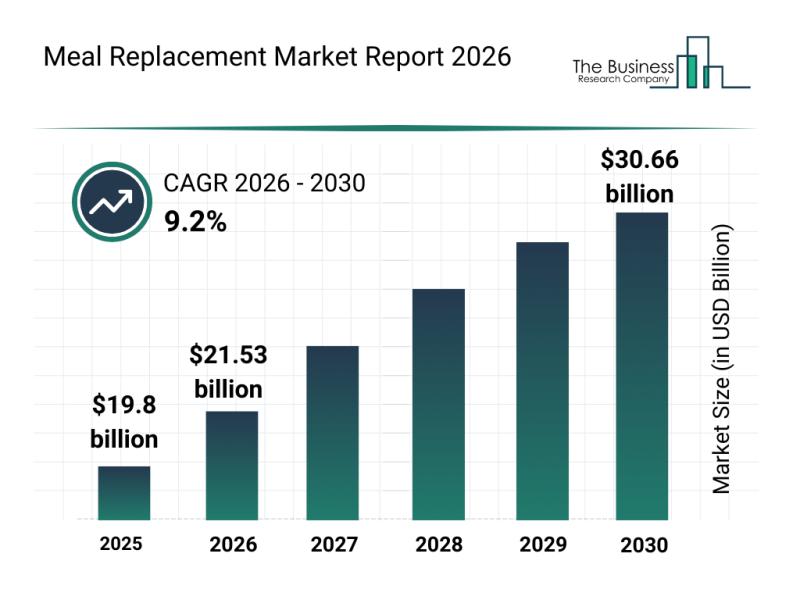

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

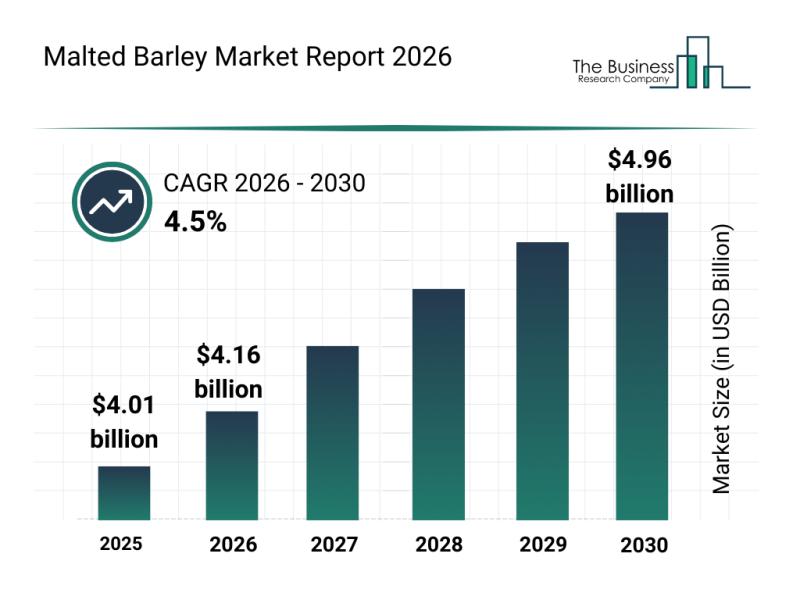

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

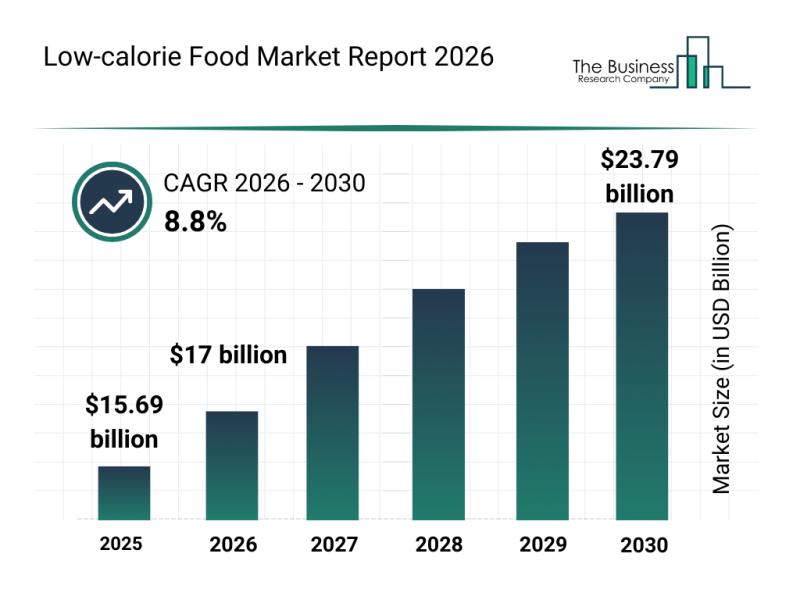

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

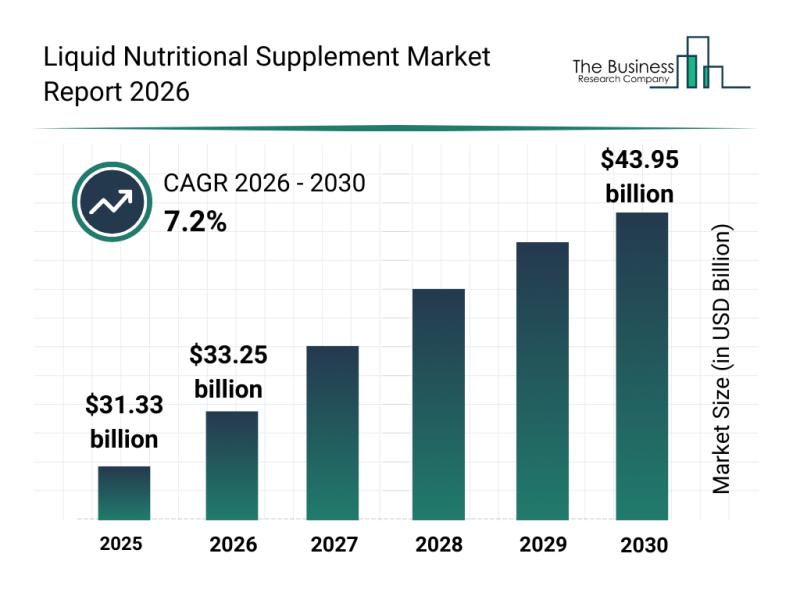

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…