Press release

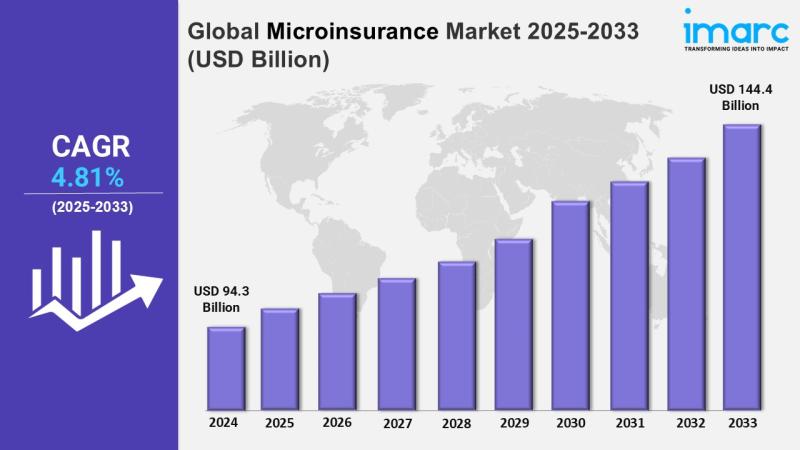

Microinsurance Market Edition 2025: Industry Size Projected to Reach USD 144.4 Billion by 2033, CAGR of 3.68%

As indicated in the latest market research report published by IMARC Group, titled "Microinsurance Market Report by Product Type (Property Insurance, Health Insurance, Life Insurance, Index Insurance, Accidental Death and Disability Insurance, and Others), Provider (Microinsurance (Commercially Viable), Microinsurance Through Aid/Government Support), Model Type (Partner Agent Model, Full-Service Model, Provider Driven Model, Community-Based/Mutual Model, and Others), and Region 2025-2033," this report provides an in-depth analysis of the industry, featuring insights into the global microinsurance market trends. It encompasses competitor and regional analyses, as well as recent advancements in the market.How Big is the Microinsurance Market?

The global microinsurance market size reached USD 94.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 144.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.81% during 2025-2033.

Request Free Sample Report: https://www.imarcgroup.com/microinsurance-market/requestsample

Global Microinsurance Market Dynamics:

Financial Inclusion and Poverty Reduction:

In terms of developing and helping diverse communities, microinsurance has proved to be extremely advantageous, fostering financial dependence and eliminating poverty. This particular insurance plans aimed at those who are economically disadvantaged reduces the burden placed on individuals who are faced with unexpected circumstances like natural disasters, illnesses or even.

These communities are able to maintain their economic activity as well as improve their health and education. Furthermore, microinsurance can assist in reducing poverty by taking care of the needs of the most vulnerable people and thereby reducing the likelihood of them having to resort to illegal and exploitation-based ways of borrowing while improving their financial stability and viability.

Technological Advancements:

The expansion in the micro insurance industry is driven by technological advancements which allows it to connect with many more people and streamlining the processes in an cost-effective manner. The growing use of mobile communication, specifically the use of mobile phones or mobile-based money services has enabled micro insurance companies to connect with customers in rural and difficult regions.

Platforms that operate on mobile permit insurance companies to have an expanded market to sell their services, decrease the number of distribution agencies and reduce the administrative costs. Additionally, the use of data analysis as well as artificial intelligence (AI) aids insurers to develop strategies to understand the needs of consumers, improve their products to meet specific needs of clients, and develop strategies to offer loans and to insure under a new world. These changes and advances are accelerating the development of microinsurance and expanding its market.

Growing Awareness and Demand:

As global awareness as well as demand for these is growing, the growth within the marketplace is more evident. In addition, the need for insurance protection from low-income earners is growing as they become cognizant of the many benefits insurance protection can bring. There is growing support for the need for microinsurance by civil societies, the government and other stakeholders in the economic system, and also informing potential clients about the value proposition that it can provide.

Natural disasters or climate changes, as well as other unexpected events are changing the way insurance is conducted and causing more demand for different choices of coverage. The growing awareness and demand is generating optimism for microinsurance market, which is growing faster and embracing developments that are more consumer focused.

Contact Out Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=1370&flag=C

Global Microinsurance Market Trends:

There are significant shifts that affect the outlook in the world of microinsurance. The most significant shift in market is the desire for and increasing demand for customer-centricity. It is also logical to note the growing demand for insurance companies that employ the concept of customer-centric planning to comprehend the preferences, needs and preferences of a particular client. Another interesting trend is the growing focus on collaborations and partnerships.

Microinsurance companies are working with government agencies and charitable organisations microfinance institutions, as well as tech companies to expand their capabilities and improve service delivery and improve satisfaction of customers. These partnerships tap into the resources of different stakeholders and assist in the development and distribution of the most cutting-edge, low-cost microinsurance products.

Top Microinsurance Market Leaders:

The report has also analysed the competitive landscape of the market along with the profiles of the key players.

Microinsurance Market Report Segmentation:

Breakup by Product Type:

• Property Insurance

• Health Insurance

• Life Insurance

• Index Insurance

• Accidental Death and Disability Insurance

• Others

Breakup by Model Type:

• Partner Agent Model

• Full-Service Model

• Provider Driven Model

• Community-Based/Mutual Model

• Others

Breakup by Provider:

• Microinsurance (Commercially Viable)

• Microinsurance Through Aid/Government Support

Breakup by Region:

• North America (United States, Canada)

• Europe (Germany, France, United Kingdom, Italy, Spain, Others)

• Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

Note: Should you require specific information not included in the current report, we are pleased to offer customization options to meet your needs.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microinsurance Market Edition 2025: Industry Size Projected to Reach USD 144.4 Billion by 2033, CAGR of 3.68% here

News-ID: 3911415 • Views: …

More Releases from IMARC Group

Helium Production Plant DPR & Unit Setup Cost- 2026: Machinery Requirements, Cap …

Setting up a Helium Production Plant positions investors in one of the most stable and essential segments of the industrial gas and strategic materials value chain, backed by sustained global growth driven by increasing demand from medical imaging, semiconductor manufacturing expansion, advanced scientific research applications, and the ultra-high purity, reliability, irreplaceable advantages of helium across critical technology sectors. As healthcare infrastructure accelerates, semiconductor fabrication intensifies, and space exploration initiatives expand…

Setting Up a Green Hydrogen Plant in India 2026- Complete Cost Model with CapEx, …

What Does It Cost to Set Up a Green Hydrogen Production Plant in India?

Setting up a 300-ton-per-year green hydrogen plant in India requires a carefully mapped investment across CapEx, OpEx, and long-term profitability. Raw material costs - primarily electricity - run between 60 to 70 percent of operating expenditure. Gross margins project between 25 and 30 percent. And capital investment spans electrolyzer procurement, renewable energy infrastructure, utilities, and compliance -…

Pharmaceutical Formulation Manufacturing Plant DPR & Unit Setup - 2026: Business …

Setting up a pharmaceutical formulation manufacturing plant positions investors in one of the most stable and essential segments of the global healthcare value chain, backed by sustained global growth driven by growing prevalence of chronic diseases, pharmaceutical industry expansion, rising demand for patient-centric dosage forms, and the safety, efficacy, stability advantages of finished medicinal products. As global healthcare spending accelerates, chronic and lifestyle diseases increase, and regulatory frameworks increasingly mandate…

Triple Superphosphate (TSP) Manufacturing Plant DPR & Unit Setup 2026: Demand An …

Setting up a triple superphosphate (TSP) manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This essential high-analysis phosphate fertilizer serves field crop agriculture, horticulture, fertilizer blending, and soil nutrient management programs. Success requires careful site selection, efficient phosphate rock processing, stringent safety protocols, reliable raw material sourcing, and compliance with environmental regulations to ensure profitable and sustainable operations.

Market Overview and Growth Potential:

The global…

More Releases for Microinsurance

Microinsurance for Vulnerable Communities Market Is Booming Worldwide | Major Gi …

The latest analysis of the worldwide Microinsurance for Vulnerable Communities market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Microinsurance for Vulnerable Communities market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report…

Digital Microinsurance Market Hits New High | Major Giants BIMA, MicroEnsure, AX …

HTF MI just released the Global Digital Microinsurance Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Digital Microinsurance Market are: BIMA, MicroEnsure, AXA…

Microinsurance Market Size & Share | Growth Report - 2034

According to the report by Expert Market Research (EMR), the global microinsurance market reached a value of USD 82.87 billion in 2024. Aided by the growing demand for accessible and affordable insurance solutions among low-income populations, the market is projected to grow at a CAGR of 6.50% between 2025 and 2034, reaching USD 155.56 billion by 2034.

Microinsurance, a subset of insurance tailored for low-income individuals, provides financial protection against specific…

Government Initiatives Fueling Growth In The Microinsurance Market: Powering Inn …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts

What Is the Expected CAGR for the Microinsurance Market Through 2025?

In the past few years, we have observed significant expansion in the size of the microinsurance market. The market's growth is projected to rise from $95.69 billion in 2024 to $101.82 billion in 2025, experiencing a compound annual…

Government Initiatives Fueling Growth In The Microinsurance Market: A Significan …

The Microinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Microinsurance Market Size and Projected Growth Rate?

In recent times, the microinsurance market has seen impressive growth. The market is projected to expand from $95.69 billion in 2024 to $101.82 billion in 2025,…

Government Initiatives Fueling Growth In The Microinsurance Market Driver: A Maj …

What industry-specific factors are fueling the growth of the microinsurance market?

The microinsurance market is projected to see substantial growth due to increasing government-initiated programs for microinsurance. Government initiatives often consist of projects, policies, or actions instituted by governmental bodies, with the purpose of addressing societal issues, promoting specific interests, or achieving particular outcomes within a specific sector or within society at large. These initiatives often prove beneficial for small business…