Press release

Lending Market Forecast 2025-2034: Evaluating Growth Factors, Segments, and Emerging Trends

How Are the key drivers contributing to the expansion of the lending market?The lending market is expected to be driven forward by the increase in the number of small businesses. These are privately owned entities that have a smaller workforce and produce less revenue than larger corporations. The lending industry helps these businesses, whether they are just starting or expanding, by providing loans, which also assists consumers. This stimulates new investment and bolsters economic demand. For instance, the US Small Business Administration (SBA), a federal government agency focused on small businesses, revealed in August 2022 that the count of small businesses in the US had risen to 33.2 million - an increase of 700,000 from 2021. As a result, the growth in the number of small businesses is lending momentum to the lending market.

Get Your Lending Market Report Here:

https://www.thebusinessresearchcompany.com/report/lending-global-market-report

What growth opportunities are expected to drive the lending market's CAGR through 2034?

In recent times, there has been considerable growth in the size of the lending market. It is projected to swell from $11285.93 billion in 2024 to $12165.09 billion in 2025- a compound annual growth rate (CAGR) of 7.8%. Several factors can explain the growth experienced in the historical phase, and these include robust economic growth in developing markets, increased internet usage, a surge in consumer spending, an uptick in construction activities, and an escalation in the issuance of vehicle loans.

The size of the lending market is projected to experience substantial expansion in the upcoming years, growing to a massive $15985.39 billion in 2029, with a compound annual growth rate (CAGR) of 7.1%. The expected growth in this forecast period is largely due to the spread of blockchain across diverse sectors and an increase in higher education. It is predicted that key trends in this forecast period will include investments in technologies to provide alternative lending services to enhance profit margins, the utilization of digital technologies to expedite commercial loan approvals and subsequently improve customer satisfaction. An increased focus on participation lending will aim to minimize risks and maximize profitability. Investment in laaS platforms is set to capitalize on their growing popularity, and the incorporation of artificial intelligence in operations will aim to boost cost and time efficiency.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3575&type=smp

How are the latest trends influencing the growth of the lending market?

Leading businesses in the lending market are utilizing innovative systems, such as cryptocurrency lending platforms, to maintain their market dominance. These crypto lending platforms are web-based interfaces that promote the lending and borrowing of cryptocurrencies. To illustrate, Coinbase Global Inc., an American company that manages bitcoin exchange platforms, launched a crypto lending platform in September 2023. This lending program was crafted to offer institutions greater financial independence and opportunity, aligning with Coinbase's goal of revolutionizing the financial system using crypto. The program permits institutions to loan digital assets to Coinbase using standardized conditions for a product that is eligible for a Regulation D exemption.

Which growth-oriented segments of the lending market are leading the industry's development?

The lending market covered in this report is segmented -

1) By Type: Corporate Lending, Household Lending, Government Lending

2) By Interest Rate: Fixed Rate, Floating Rate

3) By Lending Channel: Offline, Online

Subsegments:

1) By Corporate Lending: Business Loans (Secured And Unsecured), Commercial Real Estate Loans, Lines Of Credit For Businesses

2) By Household Lending: Personal Loans (Secured And Unsecured), Mortgage Loans (Home Purchases And Refinancing), Auto Loans And Financing

3) By Government Lending: Public Sector Loans (For Infrastructure Projects), Student Loans And Educational Financing, Small Business Loans Backed By Government Programs

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=3575

What regions are leading the charge in the lending market?

Western Europe was the largest region in the lending market in 2024. Asia-Pacific was the second-largest region in the lending market. The regions covered in the lending market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

What companies are at the forefront of innovation in the lending market?

Major companies operating in the lending market include China Construction Bank Corporation, Agricultural Bank of China, Bank of China ltd, JPMorgan Chase & Co. (JPM), Citi Group, Bank of America (BoA), Wells Fargo & Co., BNP Paribas, Lending Kart, WeLab, Industrial and Commercial Bank of China Limited, HSBC, Royal Bank of Scotland, Barclays, Lloyds Banking Group, Standard Chartered, Santander, Nationwide Building Society, Schroders, Close Brothers, Coventry Building Society, Deutsche Bank, Commerzbank, KFW Bankgruppe, DZ Bank, UniCredit Bank AG, NRW bank, Norddeutsche Landesbank, Credit Agricole, Danske Bank A/S, Midas Corporación Financiera S.A, European Investment Bank, Mitsubishi UFJ Financial Group, Bank of Montreal, Royal Bank of Canada (RBC), Business Development Bank of Canada, Borrowell Inc, Clearbanc, CreditSnap Inc, Dealnet Capital, Itáu Unibanco, Caixa Econômica, Celulosa argentina, Ternium argentina, Banco (BCP), BBVA Continental, Scotiabank Peru, Interbank, Red Capital, Maalem Finance Company, MoneyDila, Abu Dhabi Finance, BeeHive, Tarya, Blender, eloan.co.il, CITI, Standard Bank Group, FirstRand, ABSA Group, Nedbank Group, National Bank of Egypt, Attijariwafa Bank, Groupe Banques Populaire

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/sample.aspx?id=3575&type=smp

What Is Covered In The Lending Global Market Report?

• Market Size Forecast: Examine the lending market size across key regions, countries, product categories, and applications.

• Segmentation Insights: Identify and classify subsegments within the lending market for a structured understanding.

• Key Players Overview: Analyze major players in the lending market, including their market value, share, and competitive positioning.

• Growth Trends Exploration: Assess individual growth patterns and future opportunities in the lending market.

• Segment Contributions: Evaluate how different segments drive overall growth in the lending market.

• Growth Factors: Highlight key drivers and opportunities influencing the expansion of the lending market.

• Industry Challenges: Identify potential risks and obstacles affecting the lending market.

• Competitive Landscape: Review strategic developments in the lending market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lending Market Forecast 2025-2034: Evaluating Growth Factors, Segments, and Emerging Trends here

News-ID: 3902431 • Views: …

More Releases from The Business Research Company

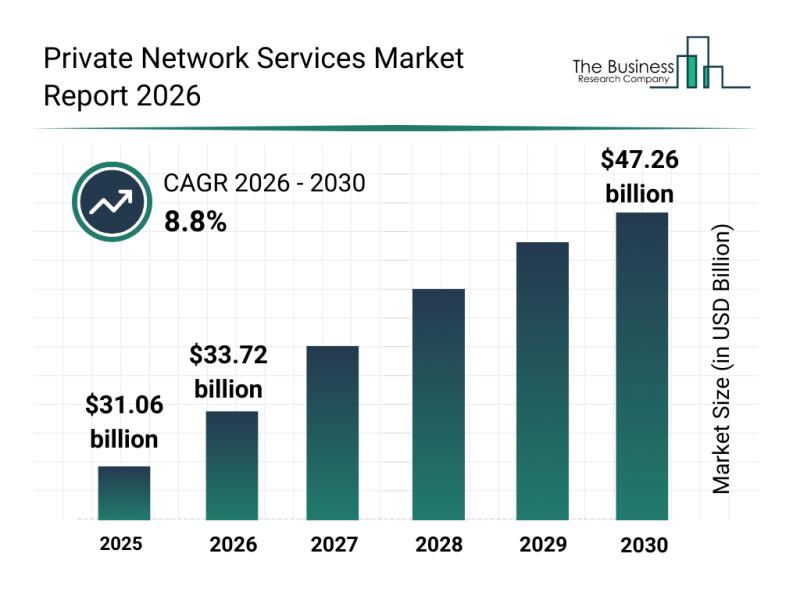

Leading Companies Fueling Innovation and Growth in the Private Network Services …

The private network services sector is set to experience remarkable growth as demand for secure, high-performance connectivity continues to rise across various industries. With advancements in wireless technology and evolving network needs, this market is positioning itself for widespread adoption and innovation over the coming years. Let's explore the market size, key players, driving trends, and segmentation to better understand what lies ahead.

Private Network Services Market Size and Growth Outlook…

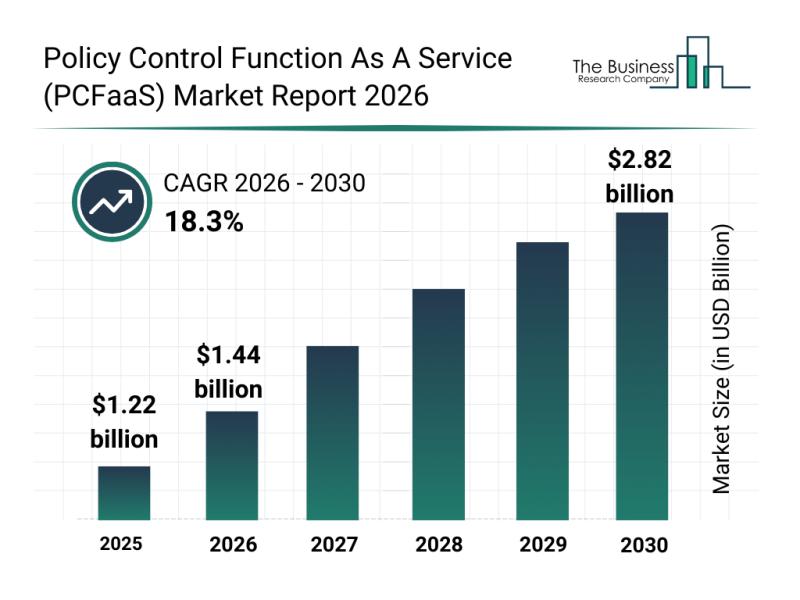

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Po …

The policy control function as a service (PCFaaS) market is on track for substantial expansion over the coming years, driven by technological advancements and increasing demand in telecommunications. This sector is transforming rapidly as operators adapt to next-generation network requirements and cloud-native approaches. Let's delve into the market's expected valuation, key players, emerging trends, and notable segmentations shaping its future.

Significant Growth Forecast for the Policy Control Function As A Service…

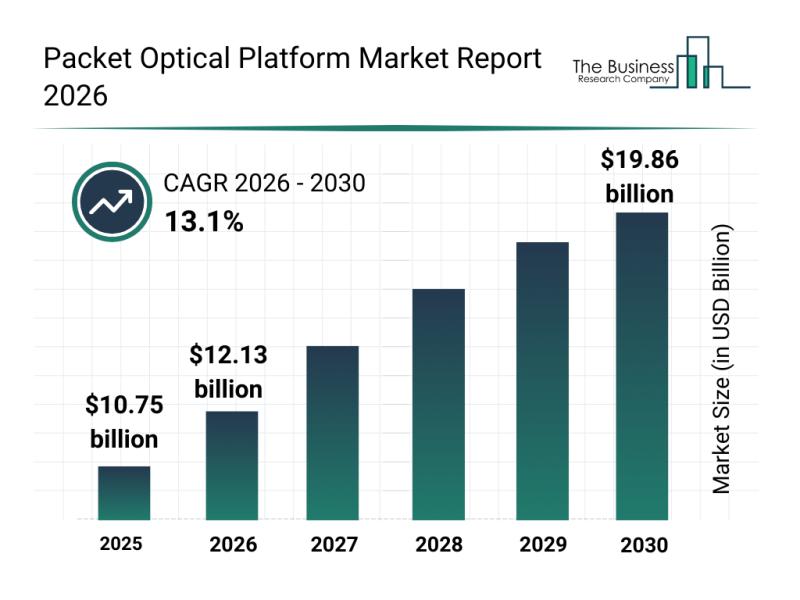

Top Players and Competitive Dynamics in the Packet Optical Platform Market

The packet optical platform market is positioned for significant expansion in the coming years, driven by advances in network technology and increasing demand for high-capacity data transmission. As digital infrastructure evolves, this sector is set to play a crucial role in supporting the growing needs of data centers, telecom providers, and cloud services. Let's explore the market's projected size, key players, emerging trends, and the segments contributing to its growth.

Forecasted…

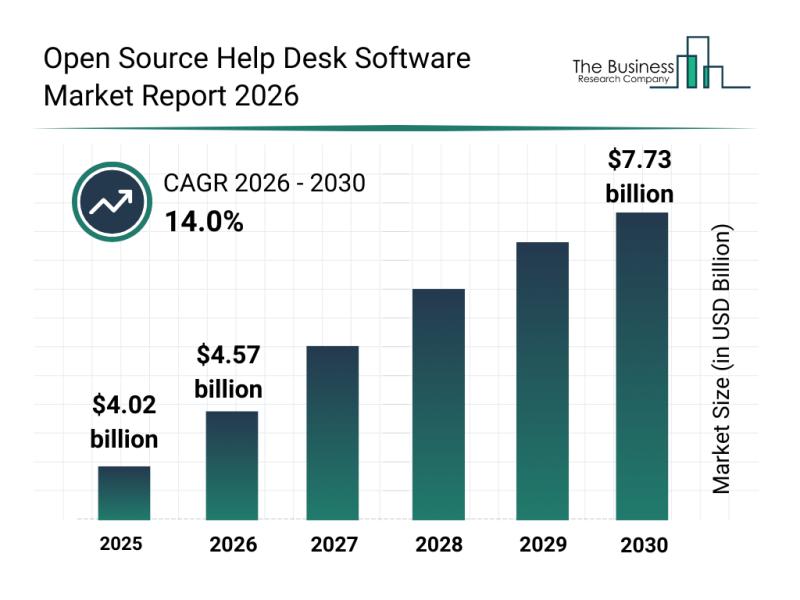

Analysis of Segmentation, Market Trends, and Competitive Landscape in the Open S …

The open source help desk software market is set to experience significant expansion in the coming years, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital customer support, this market is positioned for notable growth through 2030. Below is an in-depth exploration of the market size, leading players, key trends, and segmentation insights.

Projected Market Size and Growth Rate of the Open Source Help Desk Software Market…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…