Press release

Startups Fueling The Surge Driving Growth In The Revenue-Based Financing Market Driver: Leading Transformation in the Revenue-Based Financing Market in 2025

What industry-specific factors are fueling the growth of the revenue-based financing market?The surge in the number of startups is anticipated to fuel the expansion of the revenue-based financing market in the future. Startups are new companies typically initiated by one or more entrepreneurs aiming to take advantage of an identified market need by creating a feasible product, service, or platform. By introducing innovative financial products and platforms that meet the requirements of small businesses, including offering accessible and flexible finance options to assist their growth and boost revenue streams, startups contribute to the development of the revenue-based financing market. For example, in February 2024, Startups.co.uk, a UK's online platform for advice and resources, disclosed that the number of new businesses in 2023 increased by an impressive 19.5%, translating to 39,966 new establishments. This growth also signifies a 6.5% rise from the previous year, 2022. Hence, the escalating number of startups is influencing the growth of the revenue-based financing market.

Get Your Revenue-Based Financing Market Report Here:

https://www.thebusinessresearchcompany.com/report/revenue-based-financing-global-market-report

What Is the projected market size and growth rate for the revenue-based financing market?

The market size of revenue-based financing has experienced substantial growth in the recent times. There's an anticipated escalation from $5.77 billion in 2024 to $9.81 billion in 2025, registering a compound annual growth rate (CAGR) of 70.1%. The significant growth witnessed in the past can be linked to factors such as burgeoning startups, better capital accessibility, robust entrepreneurial ecosystem, risk alleviation measures, and flexible payment options.

Over the forthcoming years, substantial upsurge is anticipated in the market size of revenue-based financing, ascending to $67.88 billion by 2029 with a Compound Annual Growth Rate (CAGR) of 62.2%. Factors influencing the growth in the forecasted years include investor intrigue, growth of impact investing, the state of global economy, market maturation, and the application of data analytics in risk assessment. Noteworthy trends for the estimated period encompass the application of technology in due diligence, collaborations with financial establishments, novelty in contract models, incorporation of blockchain, and the linkage of financing with sustainability.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=12681&type=smp

What are the emerging trends shaping the future of the revenue-based financing market?

The increasing integration of technology is an emerging trend in the revenue-based financing market. The leading companies in the market are concentrated on advancing new technologies, such as financing technology. This is implemented to improve risk assessment and expedite funding procedures. These technologies facilitate more customized financing solutions based on real-time revenue performance. Financing refers to the practice of procuring funds to aid business activities or personal requirements. It encompasses securing capital via loans, investments, or other financial mediums. For example, in June 2023, Amazon, a US-based e-commerce corporation, introduced a flexible financing initiative. This offers personalized repayment plans along with rapid access to capital, thereby helping businesses to efficiently administer their cash flow and exploit growth prospects. Its main objective is to facilitate business growth and innovation, while concurrently alleviating the financial pressure associated with traditional lending methods.

What major market segments define the scope and growth of the revenue-based financing market?

The revenue-based financing market covered in this report is segmented -

1) By Enterprise Size: Micro Enterprises, Small-Sized Enterprises, Medium-Sized Enterprises

2) By Mode: Online, Offline

3) By Industry Vertical: Information Technology And Telecommunication, Healthcare, Media And Enterprises, Banking, Financial Services And Insurance (BSFI), Consumer Goods, Energy And Utilities, Other Industry Verticals

Subsegments:

1) By Micro Enterprises: Revenue Thresholds, Specific Industry Focus

2) By Small-Sized Enterprises: Revenue Thresholds, Industry-Specific Financing Trends

3) By Medium-Sized Enterprises: Revenue Thresholds, Growth Stage Considerations And Funding Needs

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12681

Which region dominates the revenue-based financing market?

North America was the largest region in the revenue-based financing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the revenue-based financing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Which key market leaders are driving the revenue-based financing industry growth?

Major companies operating in the revenue-based financing market include Silvr Co, Wayflyer, Funding Circle Holdings PLC, NerdWallet, Novel Capital, Kapitus, Saratoga Investment Corp, Decathlon Capital Partners LLC, MYOS, Liberis Ltd., FasterCapital, Capchase, GetVantage Tech Pvt Ltd., Lighter Capital Inc., Mercury Financial, Flow Capital Corp., Kruze Consulting, KredX, Timia Capital Corporation, Feenix Venture Partners LLC, Burkland Associates, ArK Kapital, Earnest Capital Ltd., Sabine Capital Partners LLC, Ritmo

Customize Your Report - Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/sample.aspx?id=12681&type=smp

What Is Covered In The Revenue-Based Financing Global Market Report?

• Market Size Forecast: Examine the revenue-based financing market size across key regions, countries, product categories, and applications.

• Segmentation Insights: Identify and classify subsegments within the revenue-based financing market for a structured understanding.

• Key Players Overview: Analyze major players in the revenue-based financing market, including their market value, share, and competitive positioning.

• Growth Trends Exploration: Assess individual growth patterns and future opportunities in the revenue-based financing market.

• Segment Contributions: Evaluate how different segments drive overall growth in the revenue-based financing market.

• Growth Factors: Highlight key drivers and opportunities influencing the expansion of the revenue-based financing market.

• Industry Challenges: Identify potential risks and obstacles affecting the revenue-based financing market.

• Competitive Landscape: Review strategic developments in the revenue-based financing market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Startups Fueling The Surge Driving Growth In The Revenue-Based Financing Market Driver: Leading Transformation in the Revenue-Based Financing Market in 2025 here

News-ID: 3898102 • Views: …

More Releases from The Business Research Company

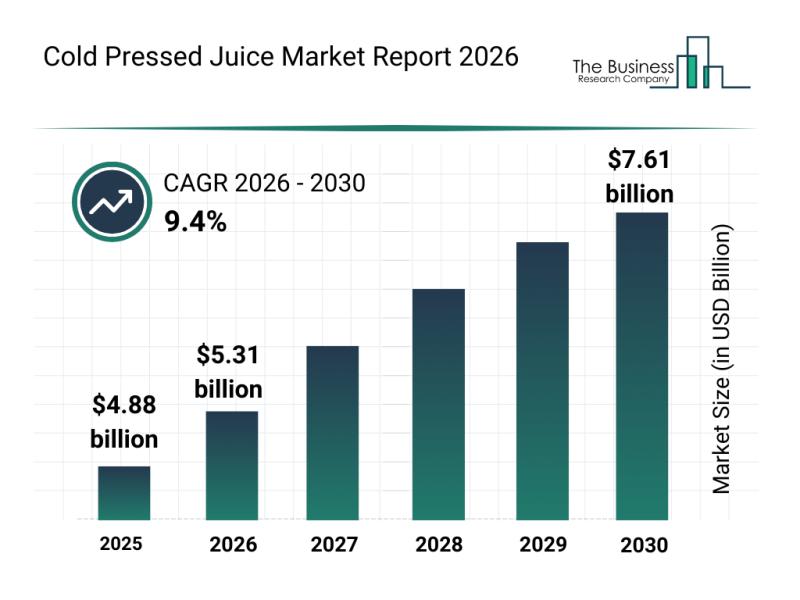

Emerging Sub-Segments Transforming the Cold Pressed Juice Market Landscape

The cold pressed juice market is on the verge of significant expansion as consumers increasingly seek healthier and more functional beverage options. Shifting preferences towards immunity-boosting drinks and sustainability are driving innovation and growth in this sector. Let's explore the current market size, influential players, emerging trends, and segment breakdowns shaping the future of cold pressed juices.

Cold Pressed Juice Market Size and Growth Expectations Through 2030

The market for…

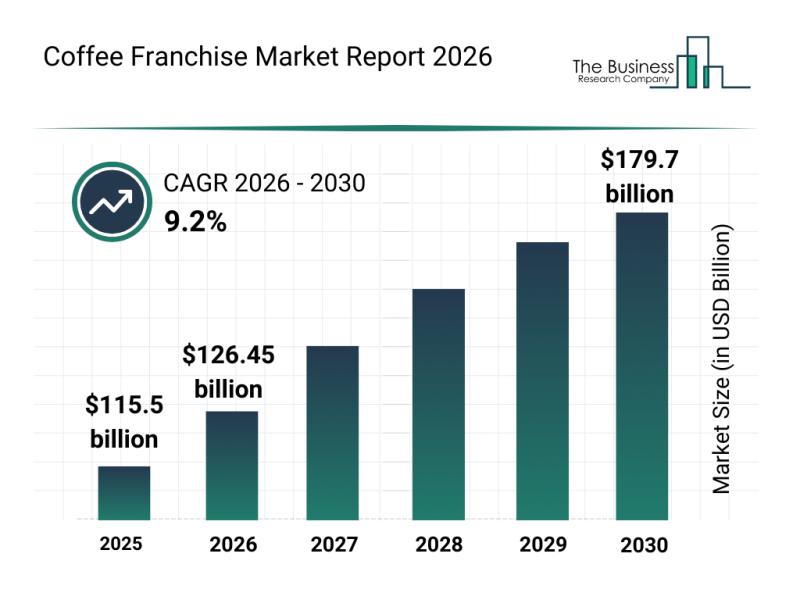

Top Companies and Industry Competition in the Coffee Franchise Market

The coffee franchise industry is positioned for significant expansion in the coming years, driven by evolving consumer preferences and strategic market initiatives. Increasing demand for high-quality coffee experiences and innovative business models is shaping the future landscape. Let's explore the current market size, leading companies, key trends, and major segments that define this dynamic sector.

Projected Growth and Market Size of the Coffee Franchise Market by 2030

The coffee franchise…

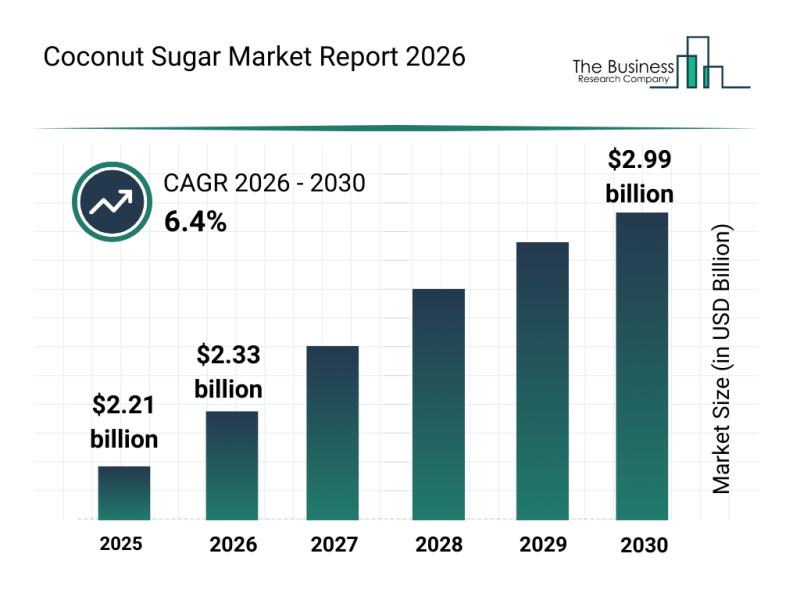

Coconut Sugar Market Overview: Major Segments, Strategic Developments, and Leadi …

The coconut sugar market is gaining significant momentum and is poised for notable expansion over the coming years. Driven by evolving consumer preferences and increasing interest in healthier and sustainable sweeteners, this market presents promising opportunities for businesses and consumers alike. Let's explore the market's size, key players, emerging trends, and segmentation in detail.

Projected Expansion of the Coconut Sugar Market Size Through 2030

The coconut sugar market is forecasted…

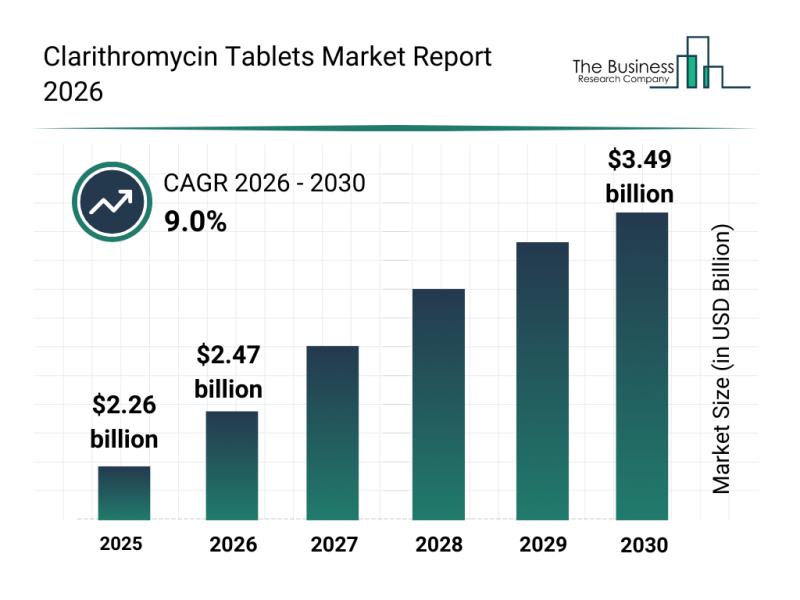

Emerging Sub-Segments Transforming the Clarithromycin Tablets Market Landscape

The clarithromycin tablets market is poised for notable expansion in the coming years, driven by several healthcare and pharmaceutical developments. As demand for effective antibiotic treatments rises globally, this sector is attracting considerable attention from manufacturers and healthcare providers alike. Let's explore the market's size, key players, prevailing trends, and segmentation to understand its current landscape and future potential.

Projected Market Valuation and Growth Trajectory for Clarithromycin Tablets

The clarithromycin…

More Releases for Financing

Financing and digitalization: CONFIDEX builds a networked financing system

Companies rely on system financing instead of individual products

With an integrated financing system, CONFIDEX combines consulting, technology and access to capital directly at the digital interfaces of the industry. Through platform partners and the subsidiary VENDORMAX, a closed financial ecosystem is created that enables financing where investments are made - quickly, transparently and efficiently.

Combining experience and real time

CONFIDEX GmbH has been supporting companies from industry and SMEs in structuring complex…

Education Financing Platforms Market Is Going to Boom | Major Giants MPOWER Fina …

HTF MI just released the Global Education Financing Platforms Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Education Financing Platforms Market are: MPOWER…

Revenue-Based Financing Market Report 2024 - Revenue-Based Financing Market Size …

"The Business Research Company recently released a comprehensive report on the Global Revenue-Based Financing Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Efficient real estate financing: Wandl.Immobilien presents new financing calcula …

Munich, May 23, 2024 - Wandl.Immobilien, a family-run real estate agency that has been successfully selling residential properties in Munich and the surrounding area for over 30 years, has introduced an impressive new addition to its range of services. An innovative real estate financing tool has been added to the extensive portfolio, which now also covers this increasingly important area.

Charting New Territories in real estate financing

The introduction of the new…

Film Marketing & Film Financing

Film Sales Agency TheMovieAgency.com is now offering extra assistance to filmmakers. If you are looking for raising funds for your next feature film or simply looking for assistance in marketing your completed feature film on the road to distribution, The Movie Agency might be able to help you with no upfront fee and no hidden fee!!!

We offer:

Free consultation.

Sourcing investors and future distributors, film buyers.

North American Distribution for the feature…

INVESTOR LOAN FINANCING PRODUCTS NATIONWIDE

We at KIS Lending believe in the art of word of mouth recommendations. Please see below with a variety of programs clients can take advantage of. We can assist in a variety of ways to finance the next home purchase or investment property NATIONWIDE for you or your clients. DSCR is the latest best option for investors.

• RESIDENTIAL FIX & FLIP + BRRRR LOANS: 90% of purchase, 100% of…