Press release

Banking-as-a-Service Market Expands with Digital Transformation and Embedded Finance Growth

Mordor Intelligence has published a new report on the Banking-as-a-Service Market, offering a comprehensive analysis of trends, growth drivers, and future projections.The global Banking-as-a-Service (BaaS) market is undergoing significant expansion, driven by the rapid digital transformation of financial services and the increasing adoption of embedded finance solutions. Valued at USD 6.74 billion in 2025, the market is projected to reach USD 21.90 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 26.6% during the forecast period. This growth is attributed to technological advancements, evolving consumer expectations, and strategic collaborations between traditional financial institutions and fintech companies.

Report Overview: https://www.mordorintelligence.com/industry-reports/global-banking-as-a-service-market

Key Trends

Digital Transformation Accelerating BaaS Adoption

Financial institutions are embracing digital transformation to enhance customer experiences and streamline operations. The integration of Application Programming Interfaces (APIs) enables banks to offer their services through third-party platforms, facilitating seamless financial services embedded within non-financial products. This shift not only broadens the reach of banking services but also fosters innovation in product offerings. For instance, the collaboration between banks and fintech firms allows for the development of personalized financial solutions, catering to the specific needs of diverse customer segments.

Rise of Embedded Finance

Embedded finance, which integrates financial services into non-financial platforms, is gaining momentum. This trend allows companies across various industries to offer banking services such as payments, lending, and insurance directly within their ecosystems. The convenience and enhanced user experience provided by embedded finance solutions are driving their adoption, leading to increased demand for BaaS platforms that enable these integrations. For example, e-commerce platforms incorporating payment and lending services can offer customers a seamless purchasing experience, thereby increasing customer retention and revenue streams.

Strategic Partnerships and Ecosystem Expansion

The BaaS landscape is characterized by strategic partnerships between traditional banks, fintech companies, and technology providers. These collaborations aim to leverage each party's strengths-banks' regulatory expertise and trust, fintechs' agility and innovation, and tech firms' technological infrastructure-to deliver comprehensive financial services. Such alliances are expanding the financial ecosystem, enabling the creation of innovative products and services that meet evolving consumer demands. For instance, banks partnering with fintech startups can quickly bring new services to market, enhancing competitiveness and customer satisfaction.

Regulatory Developments Supporting Open Banking

Regulatory frameworks worldwide are increasingly supporting open banking initiatives, which mandate financial institutions to share customer data with third-party providers (with customer consent). This regulatory support fosters a competitive environment, encouraging innovation and the development of customer-centric financial services. BaaS platforms play a crucial role in facilitating compliance with these regulations by providing the necessary infrastructure for secure data sharing and service integration. For example, the Revised Payment Services Directive (PSD2) in Europe has accelerated the adoption of open banking, enabling customers to access a wider range of financial services through authorized third parties.

Market Segmentation

The global BaaS market is segmented based on enterprise size, end users, and regions:

By Enterprise Size:

Large Enterprises: These organizations leverage BaaS platforms to enhance their financial service offerings, improve operational efficiency, and deliver personalized customer experiences.

Small and Medium Enterprises (SMEs): SMEs adopt BaaS solutions to access scalable financial services without the need for significant infrastructure investments, enabling them to compete effectively in the market.

By End Users:

Banks: Traditional financial institutions utilize BaaS to modernize their service delivery, expand their digital footprint, and collaborate with fintech partners to offer innovative solutions.

Fintech Corporations: Fintech companies rely on BaaS platforms to integrate banking services into their offerings, providing customers with seamless and comprehensive financial experiences.

Others: This category includes retailers, telecommunication companies, technology firms, and insurance providers that incorporate banking services into their products to enhance customer engagement and diversify revenue streams.

By Regions:

North America: Leading the market with a robust fintech ecosystem and early adoption of digital banking solutions.

Europe: Characterized by supportive regulatory frameworks like PSD2, fostering open banking and BaaS adoption.

Asia-Pacific: The fastest-growing region, driven by a large unbanked population, increasing smartphone penetration, and proactive regulatory initiatives.

Latin America: Experiencing growth due to rising fintech activities and demand for inclusive financial services.

Middle East & Africa: Emerging market with potential, supported by digital transformation efforts and financial inclusion programs.

Get a Customized Report Tailored to Your Requirements. - https://www.mordorintelligence.com/market-analysis/banking-as-a-service

Key Players

The BaaS market comprises several key players driving innovation and competition:

Solaris SE: A European BaaS provider offering a comprehensive platform that enables companies to integrate digital banking services seamlessly.

BNKBL Ltd: Specializes in delivering modular banking solutions, allowing businesses to customize services according to their specific needs.

Treezor: A French BaaS company providing end-to-end banking services, including payment processing and compliance solutions, to fintechs and enterprises.

MatchMove Pay Pte Ltd: An Asia-Pacific-based firm offering a cloud-based platform that enables digital payments and banking-as-a-service solutions.

Currency Cloud: Focuses on cross-border payments, providing a BaaS platform that allows businesses to offer multi-currency wallets and international payment services.

These companies are at the forefront of the BaaS industry, continually evolving their platforms to meet the dynamic needs of the market and fostering collaborations that drive financial innovation.

Conclusion

The global Banking-as-a-Service market is poised for substantial growth, propelled by digital transformation, the rise of embedded finance, and supportive regulatory environments. As businesses across various sectors recognize the value of integrating financial services into their offerings, the demand for flexible and scalable BaaS solutions is expected to surge.

Industry Related Reports

US Banking-as-a-Service Market: The report examines Banking-as-a-Service (BaaS) companies in the United States and segments the market based on various criteria. By component, it is categorized into Platform and Services, which include Professional Services and Managed Services. Based on type, the market is divided into API-based BaaS and Cloud-based BaaS. By enterprise size, it includes Large Enterprises and Small & Medium Enterprises. Additionally, by end-user, the market is segmented into Banks, Non-Banking Financial Companies (NBFCs) and Fintech Corporations, and Other Industries.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/us-banking-as-a-service-market

Germany Banking-as-a-Service (BaaS) Market: The Germany Banking-as-a-Service (BaaS) Market is categorized based on component, type, enterprise size, and end-user. By component, it is segmented into Platform and Services. Based on type, the market is divided into API-Based BaaS and Cloud-Based BaaS. The enterprise size segment includes Large Enterprises and Small & Medium-Sized Enterprises. Additionally, by end-user, the market is classified into Banks, Fintech Corporations/Non-Banking Financial Companies (NBFCs), and Other End-Users.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/germany-banking-as-a-service-market

Latin America Banking as a Service (BaaS) Market: The market report analyzes Banking-as-a-Service (BaaS) companies in Latin America and is segmented based on component, type, enterprise size, end-user, and country. By component, it is categorized into Platform and Services, including Professional Services and Managed Services. Based on type, the market is divided into API-Based BaaS and Cloud-Based BaaS. The enterprise size segment includes Large Enterprises and Small & Medium Enterprises. By end-user, the market is segmented into Banks, Fintech Corporations/Non-Banking Financial Companies (NBFCs), and Other End-Users. Geographically, the market covers Argentina, Brazil, Chile, Colombia, Mexico, Peru, and the Rest of Latin America.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/latin-america-banking-as-a-service-market

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking-as-a-Service Market Expands with Digital Transformation and Embedded Finance Growth here

News-ID: 3883183 • Views: …

More Releases from Mordor Intelligence

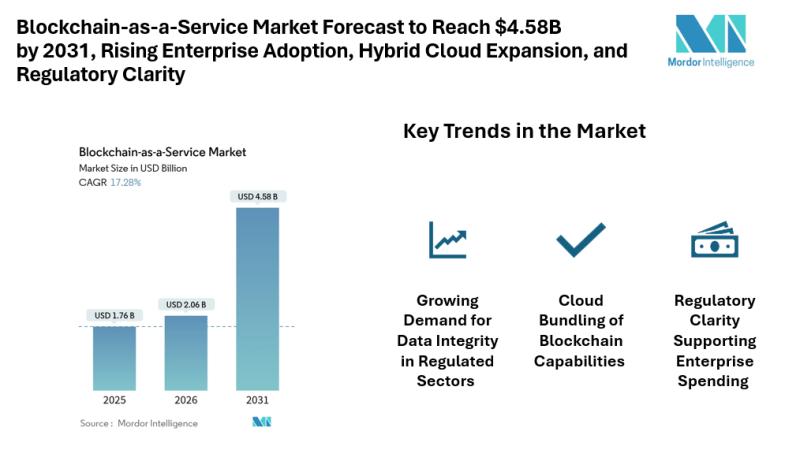

Blockchain-as-a-Service Market Forecast to Reach $4.58B by 2031, Rising Enterpri …

Blockchain-as-a-Service Market Outlook

According to Mordor Intelligence, the blockchain-as-a-service market size is expected to grow from USD 1.76 billion in 2025 to USD 2.06 billion in 2026 and is forecast to reach USD 4.58 billion by 2031, expanding at a CAGR of 17.28% during the forecast period. This blockchain-as-a-service market growth is supported by clearer regulatory frameworks, growing comfort with distributed ledger infrastructure, and deeper integration of blockchain tools within…

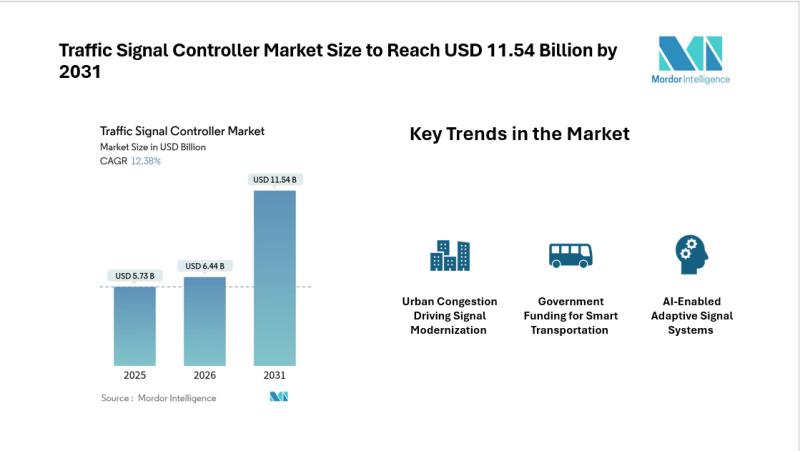

Traffic Signal Controller Market Size to Reach USD 11.54 Billion by 2031 Amid Ri …

Overview

According to Mordor Intelligence, the traffic signal controller market was valued at USD 6.44 billion in 2026 to reach USD 11.54 billion by 2031. The strong performance in the traffic signal controller market size reflects increased spending on urban mobility systems and the need for efficient traffic flow management across growing cities.

Urban congestion, population expansion, and pressure on existing road networks are encouraging governments to upgrade legacy…

Athleisure Market Size to Reach USD 647.21 Billion by 2031, Growth Driven by Per …

Introduction to the Global athleisure market

According to a research report by Mordor Intelligence, the global athleisure market size is projected to grow from USD 415.28 billion in 2026 to USD 647.21 billion by 2031, registering a strong CAGR of 9.28% during the forecast period. The accelerating athleisure market growth reflects rising demand for versatile clothing that blends athletic performance, comfort, and everyday fashion.

The athleisure market forecast suggests sustained expansion…

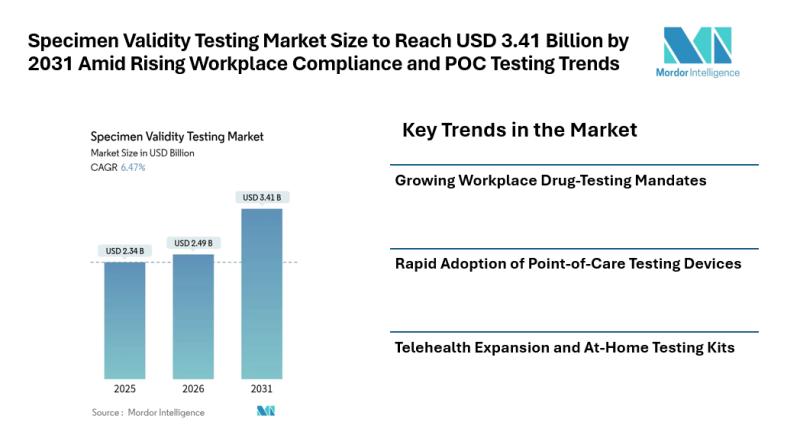

Specimen Validity Testing Market Size to Reach USD 3.41 Billion by 2031 Amid Ris …

Mordor Intelligence has published a new report on the specimen validity testing market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the specimen validity testing market is projected to grow from USD 2.34 billion in 2025 to USD 2.49 billion in 2026 and is forecast to reach USD 3.41 billion by 2031, reflecting steady expansion during the forecast period. The rising focus…

More Releases for BaaS

Key Factor Supporting Banking-As-A-Service (BaaS) Market Development in 2025: Th …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Banking-As-A-Service (BaaS) Market Size By 2025?

The market size of banking-as-a-service (BaaS) has seen a significant increase in recent times. This upward trend is projected to continue, as the market's worth is expected to rise from $716 billion in 2024 to a staggering $842.44 billion…

Global Blockchain As A Service Baas Platform Market Size by Application, Type, a …

USA, New Jersey- According to Market Research Intellect, the global Blockchain As A Service Baas Platform market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Blockchain as a Service (BaaS) platform market is set to experience substantial growth from 2025 to 2032, with a strong…

Global Battery As A Service (BaaS) Market Size by Application, Type, and Geograp …

USA, New Jersey- According to Market Research Intellect, the global Battery As A Service (BaaS) market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Battery as a Service (BaaS) market is witnessing rapid growth, driven by the global transition toward sustainable mobility and clean energy…

BaaS Market Size, Share, Growth, Trends, Opportunities Analysis Report

The global BaaS Market size to grow from USD 632 million in 2020 to USD 11,519 million by 2026, at a Compound Annual Growth Rate (CAGR) of 62.2% during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=246499192

Increasing demand for BaaS due to COVID-19 outbreak, growing need for supply chain transparency across verticals, and rising demand for enhanced security are major growth factors for the market. Increasing integration of blockchain and IoT,…

Backend-as-a-Service (BaaS) Market Report Up to 2031

Visiongain has published a new report on Backend-as-a-Service (BaaS) Market Report to 2031: Forecasts by type (Consumer BaaS, Enterprise BaaS), by organization size (Small & Medium-sized Enterprises, Large Enterprises), by services (Data Integration, Identity & Access Management, Support & Maintenance, Others). PLUS Profiles of Leading Backend-as-a-Service (BaaS) Companies and Regional and Leading National Market Analysis. PLUS COVID-19 Recovery Scenarios.

Backend-as-a-Service (BaaS) is an alternative approach that uses software development kits (SDKs)…

Game BaaS Market VALUATION TO BOOM THROUGH 2030

(United States, OR Poland) The Game BaaS Market report is composed of major as well as secondary players describing their geographic footprint, products and services, business strategies, sales and market share, and recent developments among others. Furthermore, the Game BaaS report highlights the numerous strategic initiatives such as product launches, new business agreements and collaborations, mergers and acquisitions, joint ventures, and technological advancements that have been implemented by the major…