Press release

Investment Banking Market Poised for Transformational Growth Amidst Technological Advancements and Market Expansion"

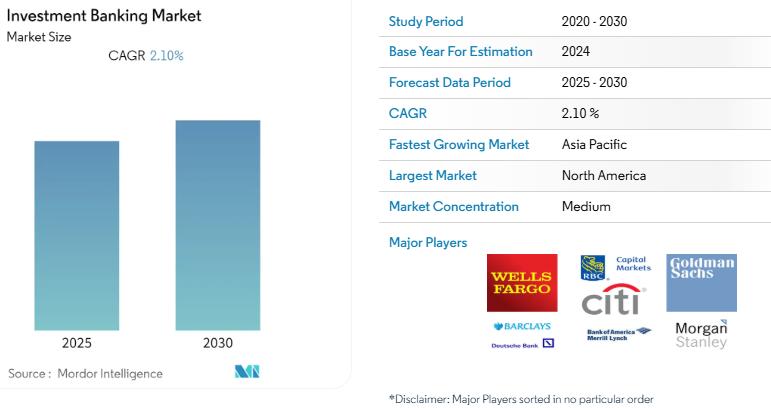

Mordor Intelligence has published a new report on the Investment Banking Market, offering a comprehensive analysis of trends, growth drivers, and future projections.The global investment banking market is reflecting a compound annual growth rate (CAGR) of 2.10% during the forecast period. This surge is attributed to technological advancements, increasing capital requirements, and a robust demand for financial advisory services.

Investment banking serves as a cornerstone of the global financial system, offering a spectrum of services including capital raising, mergers and acquisitions (M&A) advisory, and market research to corporations, governments, and institutions. By acting as intermediaries between entities seeking capital and investors, investment banks facilitate complex financial transactions that drive economic growth and innovation.

Industry has witnessed a transformative shift, propelled by technological integration and evolving market dynamics. The adoption of artificial intelligence (AI), machine learning, and digital platforms has revolutionized traditional banking operations, enhancing efficiency and expanding service offerings. As businesses navigate an increasingly complex financial landscape, the expertise and strategic guidance provided by investment banks have become indispensable.

Report Overview: https://www.mordorintelligence.com/industry-reports/global-investment-banking-industry

Key Trends

Technological Integration and Digital Transformation

The infusion of technology into investment banking has redefined operational paradigms. AI and machine learning are being leveraged for predictive analytics, enabling banks to offer tailored financial solutions and optimize trading strategies. For instance, ING Group's AI platform, KATANA, assists bond traders in making informed decisions by analyzing historical and real-time data, ensuring accurate pricing in bond transactions. This technological shift not only streamlines processes but also enhances client engagement through personalized services.

Surge in Mergers and Acquisitions (M&A) Activity

The global M&A landscape has experienced a resurgence, with 2024 witnessing over $1.43 trillion in deals announced by U.S. companies, marking the highest volume since 2021. This uptick is driven by economic growth, favorable regulatory environments, and strategic corporate realignments. Investment banks play a pivotal role in this arena, providing critical advisory services that encompass valuation, negotiation, and deal structuring, thereby facilitating successful transactions.

Expansion into Emerging Markets

Emerging economies, particularly in the Asia-Pacific region, present lucrative opportunities for investment banks. Rapid economic development, coupled with increasing financial activities, has heightened the demand for sophisticated banking services. Markets such as China and India are at the forefront, with businesses seeking capital to fuel expansion and innovation. Investment banks are capitalizing on this trend by establishing a presence in these regions, offering services tailored to the unique needs of emerging markets.

Market Segmentation

The investment banking market is categorized based on service type, enterprise size, end-user, and geographical regions.

By Service Type:

Mergers & Acquisitions Advisory: Dominating the market due to the escalating number of corporate consolidations and strategic partnerships.

Debt Capital Markets Underwriting: Facilitating debt issuance for entities seeking to raise capital through instruments like bonds.

Equity Capital Markets Underwriting: Assisting companies in equity issuance, including initial public offerings (IPOs) and follow-on offerings.

Financial Sponsor/Syndicated Loans: Providing syndicated loan arrangements to distribute loan exposures among multiple lenders.

By Enterprise Size:

Large Enterprises: Engaging in substantial capital market activities, often requiring complex financial solutions.

Small and Medium-Sized Enterprises (SMEs): Increasingly seeking investment banking services to navigate growth phases and capital requirements.

By End-User:

Corporate Institutions: Predominantly driving demand for capital raising, M&A advisory, and strategic financial planning.

Individuals: Engaging in wealth management and investment advisory services offered by investment banks.

By Geography:

North America: Currently holding the largest market share, attributed to a mature financial ecosystem and a high concentration of investment banking firms.

Asia-Pacific: Projected to exhibit the highest growth rate, driven by economic expansion and increasing financial activities in countries like China and India.

Europe: Maintaining a significant market presence with established financial centers and a robust regulatory framework.

Rest of the World: Encompassing emerging markets in Latin America, the Middle East, and Africa, presenting new opportunities for market penetration.

Get a Customized Report Tailored to Your Requirements. - https://www.mordorintelligence.com/market-analysis/investment-banking

Key Players

The investment banking sector is characterized by the presence of prominent global institutions that drive market dynamics. Notable players include:

JPMorgan Chase & Co.: Leading the industry with comprehensive services spanning M&A advisory, capital markets, and asset management.

Goldman Sachs Group Inc.: Renowned for its expertise in investment banking, securities, and investment management, catering to a diverse clientele.

Morgan Stanley: Offering a wide array of services including investment banking, wealth management, and institutional securities.

Bank of America Corporation: Through its investment banking arm, BofA Securities, the firm provides robust advisory and capital raising solutions.

Citigroup Inc.: Operating a global network delivering investment banking services across various markets and sectors.

Barclays PLC: A British multinational investment bank with a strong presence in advisory and capital market services.

Credit Suisse Group AG: Providing comprehensive financial services, including investment banking, to clients worldwide.

Deutsche Bank AG: Germany's leading investment bank, offering a broad spectrum of financial services.

UBS Group AG: A Swiss multinational investment bank known for its wealth management and investment banking operations.

HSBC Holdings PLC: Serving a global clientele with a wide range of investment banking and financial services.

These institutions are at the forefront of innovation, continually adapting to market changes and client needs. Their strategic initiatives, technological investments, and expansive service portfolios position them as key drivers of the investment banking industry's growth trajectory.

Conclusion

The investment banking industry stands at a pivotal juncture, poised for substantial growth driven by technological advancements, increasing capital demands, and expanding market opportunities. As businesses and economies navigate the complexities of the modern financial landscape, the role of investment banks becomes increasingly critical. Their ability to provide strategic insights, facilitate capital flows, and drive economic development underscores their indispensable position in the global economy. With a projected market value of USD 433.84 billion by 2034, the investment banking sector is set to embark on a trajectory of sustained expansion and innovation

Industry Related Reports

U.S. Investment Banking Market: The U.S. investment banking market is categorized by product type, including Mergers & Acquisitions, Debt Capital Markets, Equity Capital Markets, Syndicated Loans, and other specialized financial services.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/us-investment-banking-market

India Private Banking Market: The Indian private banking market is divided into key banking sectors, including Retail Banking, Commercial Banking, Investment Banking, and other financial services.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/india-private-banking-market

United Kingdom Retail Banking Market: The report provides insights into the UK banking market share and statistics, segmenting it by product type-including Transactional Accounts, Savings Accounts, Debit Cards, Credit Cards, Loans, and other financial products-as well as by distribution channels, such as Direct Sales and Distributors.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/uk-retail-banking-market

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investment Banking Market Poised for Transformational Growth Amidst Technological Advancements and Market Expansion" here

News-ID: 3873389 • Views: …

More Releases from Mordor Intelligence

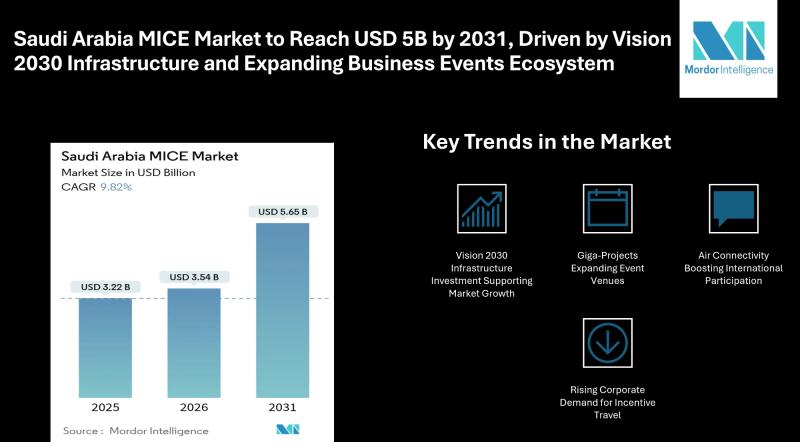

Saudi Arabia MICE Market to Reach USD 5B by 2031, Driven by Vision 2030 Infrastr …

Mordor Intelligence has published a new report on the Saudi Arabia MICE market, offering a comprehensive analysis of trends, growth drivers, and future projections

Saudi Arabia MICE Market Overview

According to Mordor Intelligence, the Saudi Arabia MICE market was valued at USD 3.22 billion in 2025 and is estimated to grow from USD 3.54 billion in 2026 to reach USD 5.65 billion by 2031, registering a CAGR of 9.82%…

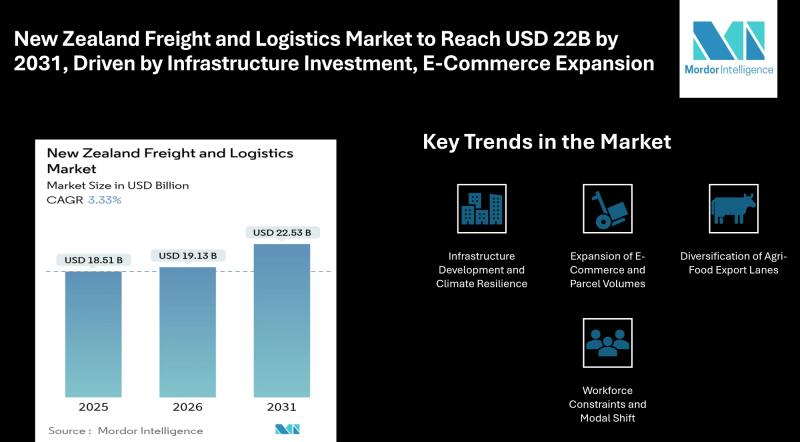

New Zealand Freight and Logistics Market to Reach USD 22.53 Billion by 2031, Dri …

Mordor Intelligence has published a new report on the New Zealand freight and logistics market, offering a comprehensive analysis of trends, growth drivers, and future projections

Overview of the New Zealand Freight and Logistics Market

The New Zealand freight and logistics market is projected to reach USD 22.53 billion by 2031, growing from USD 19.13 billion in 2026, at a CAGR of 3.33%. The steady rise reflects continued infrastructure…

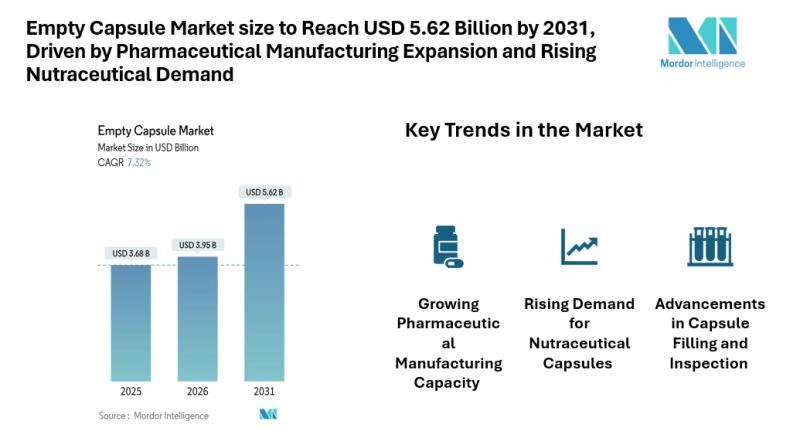

Empty Capsule Market size to Reach USD 5.62 Billion by 2031, Driven by Pharmaceu …

Mordor Intelligence has published a new report on the empty capsule market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the empty capsule market size was valued at USD 3.95 billion in 2026, projected to reach USD 5.62 billion by 2031, growing at a CAGR of 7.32% during the forecast period. The steady rise in the empty capsule market reflects higher…

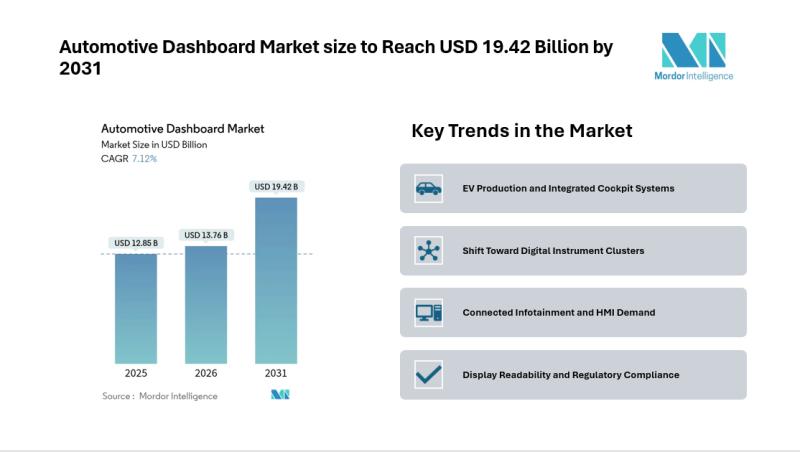

Automotive Dashboard Market size to Reach USD 19.42 Billion by 2031 Amid Rising …

Automotive Dashboard Market Overview

According to Mordor Intelligence, the automotive dashboard market is projected to grow from USD 12.85 billion in 2025 to USD 13.76 billion in 2026 and is forecast to reach USD 19.42 billion by 2031, registering a CAGR of 7.12% during the forecast period. The rising shift toward fully digital cockpits, stronger global safety regulations for display readability, and increasing electric vehicle production are shaping the…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…