Press release

IBN Technologies Encourages U.S. Taxpayers to Take Action for Bigger 2024 Tax Refunds

As the 2025 tax season approaches, taxpayers must take a strategic approach to maximize refunds and stay compliant amid evolving tax laws. Understanding eligible deductions and credits can help individuals keep more of their earnings, while businesses must navigate complex regulations to avoid overpaying. Optimizing tax filings, staying informed on policy changes, and seeking expert guidance can reduce liabilities, prevent penalties, and secure financial stability.MIAMI, Florida, February 17, 2025 - As tax season 2025 [https://www.ibntech.com/article/us-tax-filing-2025-guide/?pr=ABnewswire] approaches, financial experts are calling on U.S. taxpayers to take proactive steps to secure maximum refunds while ensuring compliance with the ever-changing tax landscape. The complexity of federal and state tax regulations continues to present challenges, as varying tax burdens across states impact individuals and businesses differently.

IRS data highlights stark contrasts in state-level tax contributions, with California taxpayers contributing 13.3% of federal revenue, followed by New York at 12.7% and Texas at 8.2%. These differences create a confusing system for filers, leading to missed deductions and unclaimed tax credits, including the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC). Experts emphasize that understanding state-specific policies is key to optimizing tax refunds and maintaining compliance.

To Maximize Your Tax Refund: Optimize EITC & CTC for Bigger Savings! Click Here! [https://outlook.office365.com/book/IBNFinanceAccountingServices@ibntech.com/]

"With the ever-changing tax landscape, taxpayers must remain vigilant and proactive, state-by-state tax variations add complexity, but with the right strategies and professional guidance, individuals and businesses can optimize their filings, minimize liabilities, and maximize refunds." said Ajay Mehta, CEO of IBN Technologies.

State-Level Business Tax Regulations Increase Complexity

Businesses must also adapt to shifting state tax regulations. While the federal corporate tax rate remains at 21%, state-imposed levies add an additional burden. New Jersey, for example, imposes a corporate tax rate of 9%, while Pennsylvania's corporate net income tax rate, currently at 8.49%, is set to decrease annually until reaching 4.99% by 2031. Given these variations, businesses must engage in strategic tax planning to ensure they are not overpaying.

Small business owners operating as S Corporations and Partnerships [https://www.ibntech.com/ebook/form-1120s-usa-tax-return/?pr=ABnewswire] must allocate income carefully to avoid unnecessary tax burdens. Taking advantage of tax-saving measures such as depreciation benefits and research and development (R&D) credits can significantly impact financial health. Meanwhile, non-profits and trusts must ensure compliance with IRS regulations to maintain tax-exempt status and maximize financial efficiency.

"As global tax regulations tighten, both businesses and individuals must prepare for new compliance requirements, being informed and proactive about state and federal tax law changes is crucial to avoiding penalties and safeguarding financial well-being" says Ajay Mehta.

IBN Technologies has established itself as a reliable partner for individuals and businesses seeking to navigate complex tax regulations. By offering personalized tax solutions, the firm assists clients in understanding state-specific tax policies, optimizing their filings, and ensuring compliance with evolving federal laws. With expertise spanning domestic and international tax matters, IBN Technologies provides cutting-edge strategies that minimize liabilities and maximize potential refunds.

Target Audience: Businesses, Entrepreneurs, and Individuals Seeking Tax Optimization

The evolving tax landscape affects a diverse group of taxpayers. Entrepreneurs, small business owners, high-income individuals, and expatriates must remain ahead of policy changes to avoid unexpected tax burdens. Whether handling payroll tax compliance, managing international tax obligations, or identifying savings strategies, taxpayers must approach financial planning with a strategic mindset.

With tax deadlines looming, financial experts urge individuals and businesses to seek professional guidance. Filing mistakes, missed deductions, and non-compliance can result in financial penalties and lost refund opportunities. Taxpayers are encouraged to seek expert guidance to ensure their filings are optimized. IBN Technologies provides comprehensive tax services, including compliance management, tax preparation, and refund optimization, helping taxpayers maximize their financial benefits while adhering to legal requirements.

Resources:

IBN Technologies https://www.ibntech.com/article/us-tax-filing-2025-guide/ [https://www.ibntech.com/article/us-tax-filing-2025-guide/?pr=ABnewswire]

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Media Contact

Company Name: IBN Technologies LLC

Contact Person: Pradip

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=ibn-technologies-encourages-us-taxpayers-to-take-action-for-bigger-2024-tax-refunds]

Phone: +1844-644-8440

Address:66, West Flagler Street Suite 900 Miami, FL, USA 33130

City: Miami

State: Florida

Country: United States

Website: https://www.ibntech.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release IBN Technologies Encourages U.S. Taxpayers to Take Action for Bigger 2024 Tax Refunds here

News-ID: 3872290 • Views: …

More Releases from ABNewswire

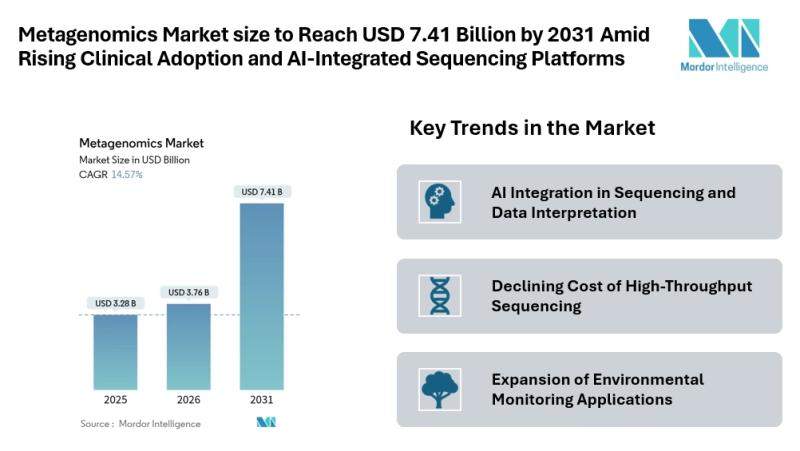

Metagenomics Market size to Reach USD 7.41 Billion by 2031 Amid Rising Clinical …

Mordor Intelligence has published a new report on the metagenomics market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Metagenomics Market Overview

According to Mordor Intelligence, the metagenomics market size [https://www.mordorintelligence.com/industry-reports/metagenomics-market?utm_source=abnewswire] is projected to grow from USD 3.28 billion in 2025 to USD 3.76 billion in 2026, reaching USD 7.41 billion by 2031, at a CAGR of 14.57% during the forecast period. The rising use of artificial intelligence in…

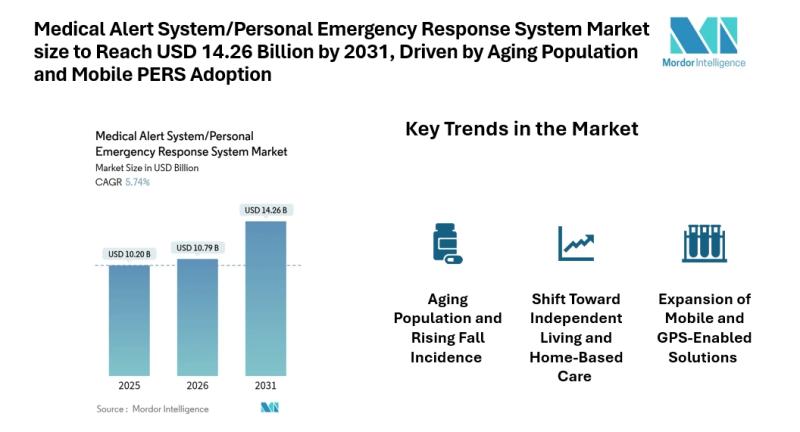

Medical Alert System/Personal Emergency Response System Market size to Reach USD …

Mordor Intelligence has published a new report on the medical alert system/personal emergency response system market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the medical alert system/personal emergency response system market size [https://www.mordorintelligence.com/industry-reports/medical-alert-system-personal-emergency-response-system-market?utm_source=abnewswire] is estimated at USD 10.79 billion in 2026, projected to reach USD 14.26 billion by 2031, registering a CAGR of 5.74% during the forecast period.

The medical alert system/personal emergency response…

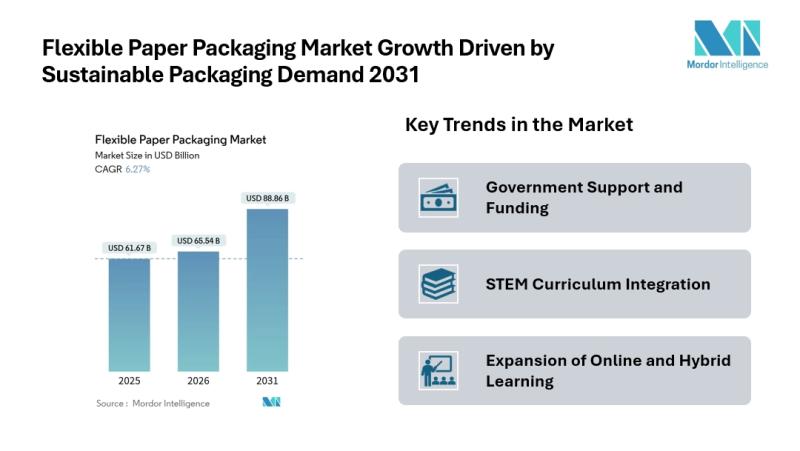

Flexible paper packaging Market to Reach USD 88.86 Billion by 2031 Amid Rising D …

Mordor Intelligence has published a new report on the flexible paper packaging market, offering a comprehensive analysis of trends, growth drivers, and future projections

Flexible paper packaging Market Overview

According to Mordor Intelligence, the market is expected to grow from USD 61.67 billion in 2025 to USD 65.54 billion in 2026 and is forecast to reach USD 88.86 billion by 2031, registering a CAGR of 6.27% during the forecast period. This flexible…

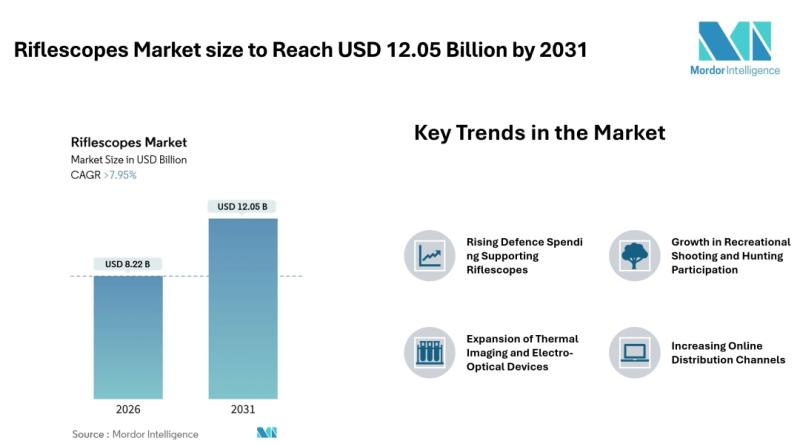

Riflescopes Market size to Reach USD 12.05 Billion by 2031 Driven by Defence Pro …

Mordor Intelligence has published a new report on the riflescopes market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Riflescopes Market Overview

According to Mordor Intelligence, the riflescopes market size [https://www.mordorintelligence.com/industry-reports/riflescopes-market?utm_source=abnewswire] was valued at USD 8.22 billion in 2026 and is projected to reach USD 12.05 billion by 2031, registering a CAGR of greater than 7.95% during the forecast period. The riflescopes market is witnessing steady expansion supported by…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…