Press release

Global Lending And Payments Market to Reach $17569.09 Billion by 2029, Growing at 7.2% CAGR

What Is the Expected Size and Growth Rate of the Lending And Payments Market?There has been a robust growth in the lending and payments market size over the past few years. The market is projected to expand from $12326.44 billion in 2024 to $13296.7 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 7.9%. The historic period's growth has been spurred by economic development, the proliferation of banking and financial institutions, consumer demand, and the regulatory environment.

The market size of lending and payments is projected to experience robust growth in the coming years, reaching $17569.09 billion in 2029, with a compound annual growth rate (CAGR) of 7.2%. The upswing during the forecast period can be traced back to factors such as digital transformation, fintech disruption, financial inclusion, the advent of blockchain and cryptocurrency, data analytics, and artificial intelligence. The future trends for the forecast period are forecasted to be peer-to-peer lending, mobile and contactless payments, open banking, embedded finance, and sustainable and ethical finance.

What Factors Are Fueling Growth in the Lending And Payments Market?

Artificial Intelligence is increasingly becoming significant in the payments industry due to its numerous uses that permit companies to analyze data to enhance the customer experience. It entails the creation of computer systems capable of executing tasks that require human intellect. Payments companies can boost operational efficiency via AI, including decreasing processing times, producing error-less insights, and amplifying automation. A multitude of banking and non-banking entities employ AI applications to track payment transactions from one end, the payment message, to the other end, the payment gateway. For instance, AI-powered chatbots, capable of comprehending customer language, are getting leveraged by payments firms since these can address customer inquiries instantly. AI's machine learning aspect is put to substantial use in enhancing fraud detection and curbing fraudulent transactions. For instance, in a recent adoption study by the Economist Intelligence Unit, it was revealed that 54% of organizations involved in financial services implemented AI for payments to solidify customer connections.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=1886&type=smp

Which Leading Companies Are Shaping the Growth of the Lending And Payments Market?

Major companies operating in the lending and payments market include China Construction Bank, Agricultural Bank Of China, JPMorgan Chase & Co., Bank of China, Industrial and Commercial Bank of China, Bank of America Corporation, Banco Santander, Citi Group, Wells Fargo & Company, State Bank of India, Klarna Inc., Funding Circle, Advanced Financial Services Private Limited, Visa Payments Limited, Mastercard Inc., Tencent Holdings Limited, Ant Financial Service Group Co. Ltd., PayPal Payments Pvt Ltd., Square Capital LLC., Coinbase Global Inc., Social Finance Inc., Coinbase Global Inc., Robinhood Markets Inc., Venmo, Affirm Inc., Afterpay Australia Pty Ltd., LendingClub Bank., Camden Town Technologies Pvt Ltd., Kabbage Inc., On Deck Capital Inc., Avant LLC., Upstart Network Inc., Lendio.

What Are the Major Trends Shaping the Lending And Payments Market?

The traction that alternative lending is gaining can be attributed to its service of providing loans to individuals and businesses rejected by traditional banking platforms. This surge in popularity is largely due to the fact that offering commercial loans to small businesses is considered unviable by standard banks. Relying on contemporary technologies like big data, alternative lenders amass data-driven insights to expedite the lending process. This method enables alternative lenders to profit from loans that are typically deemed unprofitable by traditional lenders. Lending Club and OnDeck are prime examples of such alternative lenders.

What Are the Key Segments of the Lending And Payments Market?

The lending and payments market covered in this report is segmented -

1) By Type: Lending, Cards, Payments

2) By Lending Channel: Offline, Online

3) By End User: B2B, B2C

Subsegments:

1) By Lending: Personal Loans, Mortgages, Auto Loans, Student Loans, Business Loans, Peer-to-Peer (P2P) Lending

2) By Cards: Credit Cards, Debit Cards, Prepaid Cards, Charge Cards

3) By Payments: Digital Payments, Mobile Payments, E-wallets, Bank Transfers, Point Of Sale (POS) Payments, Online Payment Gateways

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/lending-and-payments-global-market-report

Which Region Dominates the Lending And Payments Market?

Western Europe was the largest region in the lending and payments market in 2023. Asia-Pacific was the second largest region in the lending and payments market. The regions covered in the lending and payments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

What Is Covered In The Lending And Payments Global Market Report?

- Market Size Analysis: Analyze the Lending And Payments Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Lending And Payments Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Lending And Payments Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Lending And Payments Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=1886

Learn More About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Lending And Payments Market to Reach $17569.09 Billion by 2029, Growing at 7.2% CAGR here

News-ID: 3871684 • Views: …

More Releases from The Business Research Company

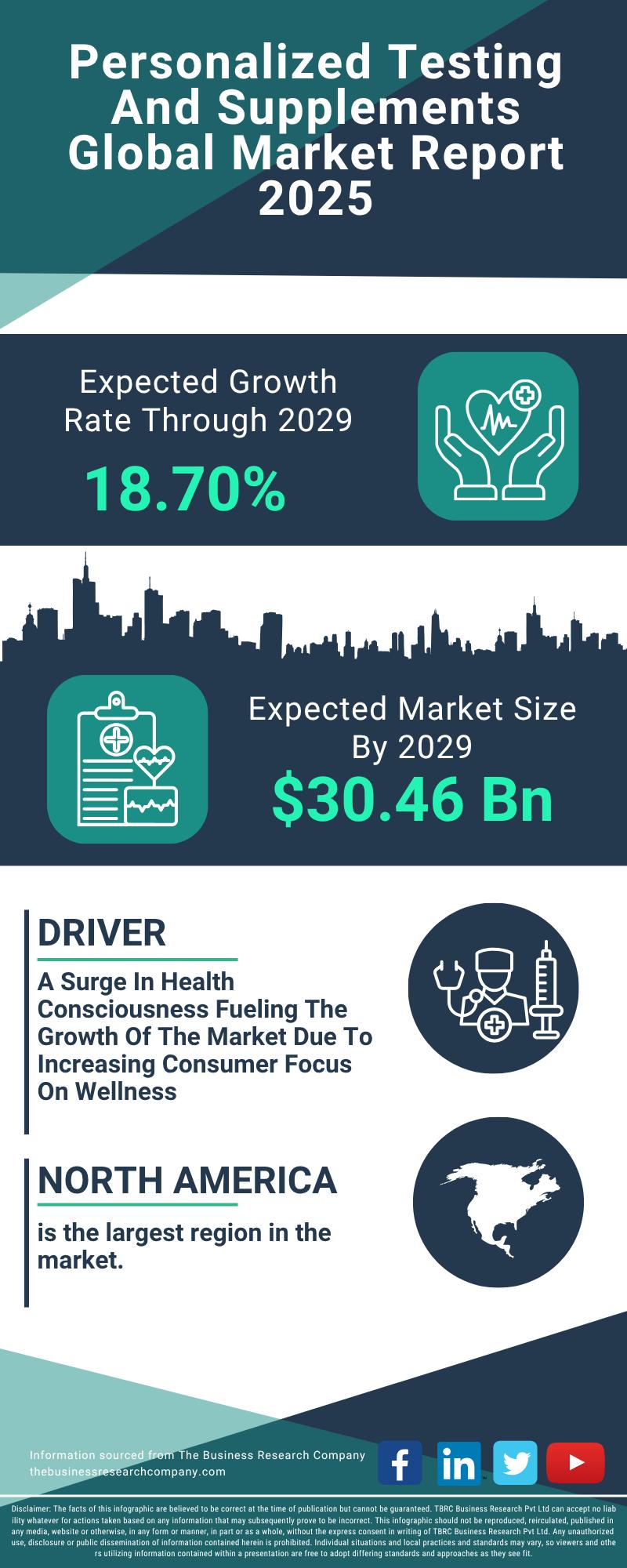

Segment Evaluation and Major Growth Areas in the Personalized Testing and Supple …

The personalized testing and supplements sector is gaining remarkable traction, driven by advancements in technology and a rising consumer focus on tailored health solutions. As more individuals seek customized wellness options, this market is set to experience substantial expansion in the coming years. Here's an in-depth look at its current valuation, key players, significant trends, and the main market segments shaping its future.

Market Valuation and Expansion Forecast for Personalized Testing…

Top Players and Market Competition in the Skin Microbiome Industry

The skin microbiome market is emerging as a significant area of interest due to growing awareness about the critical role of skin health and innovative skincare technologies. As research advances and consumer preferences shift towards more natural and science-backed products, this market is set to undergo substantial growth. Let's explore the current market size, key players, driving factors, and upcoming trends shaping the skin microbiome industry.

Projected Expansion in the Skin…

Key Strategic Developments and Emerging Changes Shaping the Upadacitinib Market …

The upadacitinib market is poised for significant expansion over the coming years, driven by advances in treatment options and increasing awareness of autoimmune diseases. This report delves into the market's current size, key drivers, major players, and the emerging trends shaping its future trajectory.

Steady Growth Expected in Upadacitinib Market Size Through 2029

The market for upadacitinib is projected to reach $2.54 billion by 2029, growing at a robust compound annual…

Analysis of Key Market Segments Driving the Alzheimer's Disease Diagnostic Marke …

The Alzheimer's disease diagnostic sector is rapidly evolving as advancements in technology and healthcare infrastructure open new possibilities for early detection and personalized treatment. With rising awareness and innovative approaches, this market is poised for significant growth in the coming years. Let's explore the current market size, key drivers, leading companies, and emerging trends that are shaping this critical healthcare field.

Projected Market Size and Growth Trends in Alzheimer's Disease Diagnostics…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…