Press release

Private Equity Market Expansion Driven by Capital Inflows and Investment Diversification

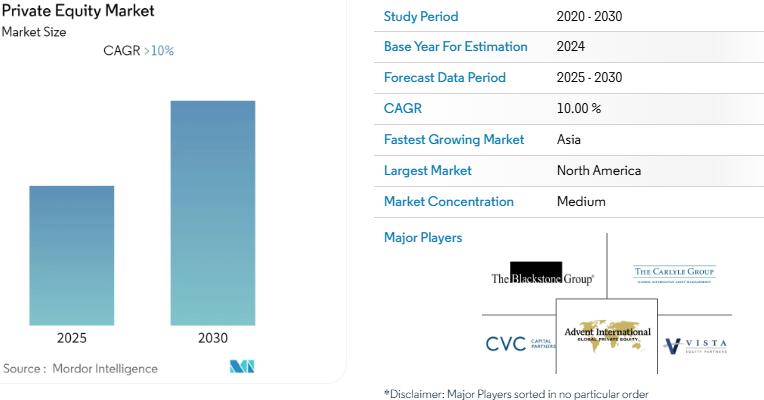

Mordor Intelligence has published a new report on the Private Equity Market, offering a comprehensive analysis of trends, growth drivers, and future projections.The global private equity market is on a trajectory of significant growth, with projections indicating it will exceed USD 1 trillion by 2030. This expansion is underpinned by an ample availability of capital and a rising demand for investment diversification. Private equity involves investments in private companies or the acquisition of public companies, leading to their delisting. Investors are attracted to this asset class due to its potential for substantial returns through strategic management and long-term value creation.

Report Overview: https://www.mordorintelligence.com/industry-reports/global-private-equity-market

Key Trends Driving Market Growth

Growth Investments Becoming Larger and More Complex

In recent years, there has been a notable increase in the scale and complexity of growth investments within the private equity sector. For instance, in 2021, growth investments reached USD 19.6 billion, a 14% decrease compared to 2020. However, it's important to note that 2020's figures were significantly influenced by substantial deals totaling USD 15.1 billion in RIL group companies. When adjusted for these one-off transactions, 2021's growth investments were nearly 2.5 times higher than the adjusted value of USD 7.8 billion in 2020 and more than double the figures from preceding years. This surge was driven by an increase in both the number of deals and the average deal size, with 187 deals recorded in 2021-61% higher than in 2020-and an average deal size of USD 105 million, reflecting a nearly 50% increase compared to earlier years. Key sectors attracting over USD 1 billion in growth investments included e-commerce, media and entertainment, real estate, and financial services.

Emergence of Special Purpose Acquisition Companies (SPACs)

The rise of SPACs has significantly influenced the private equity landscape. In 2021, SPAC proceeds nearly doubled from the previous year, reaching USD 143 billion compared to 2020's USD 73 billion. The number of SPAC mergers also hit new records every quarter in 2021, peaking at 104 in the fourth quarter. Although the pace slowed in early 2022, the average redemption rate for SPAC mergers increased to 80% in the first two months of 2022, up from about 50% in 2021 and 20% in 2020. Looking ahead, private equity firms are expected to sponsor more SPACs, leveraging their financial resources, networks, and industry expertise to capitalize on this investment vehicle's popularity.

Market Segmentation

The private equity market is diverse, encompassing various fund types, sectors, investment sizes, and geographical regions:

By Fund Type:

Buyout: Acquisition of companies, often involving restructuring to enhance value.

Venture Capital (VCs): Investments in early-stage startups with high growth potential.

Real Estate: Investments focused on property assets.

Infrastructure: Capital allocated to infrastructure projects.

Other: Includes distressed private equity and direct lending.

By Sector:

Technology (Software): Investments in software and tech companies.

Healthcare: Capital directed toward healthcare services and products.

Real Estate and Services: Investments in property and related services.

Financial Services: Capital allocated to financial institutions and services.

Industrials: Investments in manufacturing and industrial sectors.

Consumer & Retail: Capital directed toward consumer goods and retail businesses.

Energy & Power: Investments in energy production and distribution.

Media & Entertainment: Capital allocated to media and entertainment industries.

Telecom: Investments in telecommunications companies.

Others: Includes sectors like transportation.

By Investment Size:

Large Cap: Investments in large-scale companies.

Upper Middle Market: Capital directed toward upper mid-sized firms.

Lower Middle Market: Investments in smaller mid-sized companies.

Real Estate: Capital allocated specifically to real estate ventures.

By Geography:

North America: Currently the largest market, driven by a well-established private equity ecosystem.

Asia: Identified as the fastest-growing market, with increasing private equity activities.

Europe, Latin America, Middle East & Africa: Regions experiencing varied growth rates influenced by local economic conditions and regulatory environments.

Get a Customized Report Tailored to Your Requirements. - https://www.mordorintelligence.com/market-analysis/private-equity

Key Players in the Private Equity Market

The private equity landscape is characterized by intense competition, with numerous established firms leading the market. Some of the prominent players include:

Advent International: A global private equity firm investing across various sectors and regions.

Apollo Global Management: Known for its investments in credit, private equity, and real assets.

The Blackstone Group Inc.: One of the world's largest private equity firms with diverse investment portfolios.

The Carlyle Group Inc.: Invests in various industries, including aerospace, consumer, and technology.

CVC Capital Partners: Focuses on investments in Europe, Asia, and the Americas across multiple sectors.

These firms leverage their extensive industry expertise, global networks, and substantial capital to identify and invest in opportunities that offer potential

Conclusion

The private equity market is set for substantial growth, driven by capital availability, evolving investment strategies, and the increasing role of technology in deal-making. With expanding opportunities across various sectors and geographies, private equity firms are well-positioned to deliver long-term value and high returns. As investors continue to seek diversification, private equity remains a crucial asset class shaping the future of global finance.

Industry Related Reports

Europe Private Equity Market: The Europe Private Equity Market Report is structured based on investment type, application, and geography. The investment categories include Large Cap, Mid Cap, and Small Cap. Applications are segmented into Early-Stage Venture Capital, Private Equity, and Leveraged Buyouts. Geographically, the market is divided into Italy, Germany, France, Switzerland, the United Kingdom, and the Rest of Europe.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/europe-private-equity-market

US Private Equity Market :The report provides insights into the US Private Equity Market size and its segmentation based on investment type and application. The investment categories include Large Cap, Mid Cap, and Small Cap, while the application segments consist of Add-On, Growth Equity, and Leveraged Buyouts.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/united-states-private-equity-market

Asia-Pacific Private Equity Market: The Asia-Pacific Private Equity Market report is segmented based on investment type and geography. The investment categories include Real Estate, Private Investment in Public Equity (PIPE), Buyouts, and Exits. Geographically, the market is divided into China, India, Japan, Australia, Singapore, Hong Kong, and Other Countries in the region.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/asia-pacific-private-equity-market

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private Equity Market Expansion Driven by Capital Inflows and Investment Diversification here

News-ID: 3869073 • Views: …

More Releases from Mordor Intelligence

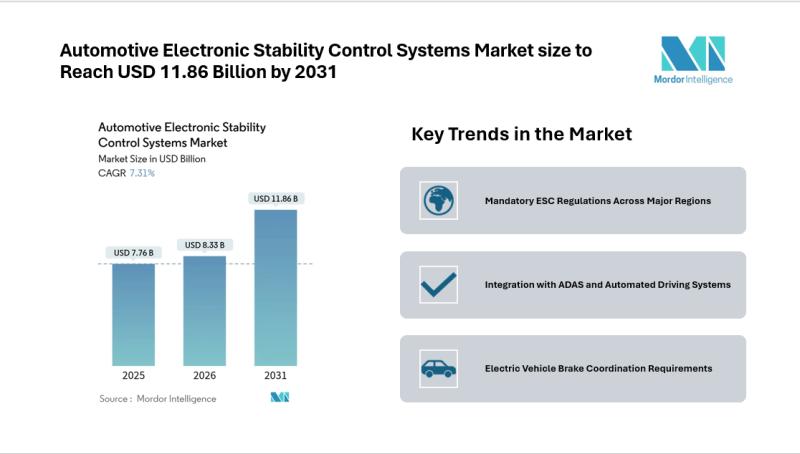

Automotive Electronic Stability Control Systems Market size to Reach USD 11.86 B …

Market Overview

According to Mordor Intelligence, the automotive electronic stability control systems market was valued at USD 8.33 billion in 2026 to reach USD 11.86 billion by 2031, registering a CAGR of 7.31% during the forecast period. The steady rise in demand reflects stricter vehicle safety mandates, wider integration of advanced driver-assistance systems, and the growing complexity of electric vehicle braking systems.

Electronic stability control systems are now considered a core…

Agricultural Machinery Market Size to reach USD 206.93 Billion by 2031 as Mechan …

The global agricultural machinery market size is projected to grow from USD 159.63 billion in 2026 to USD 206.93 billion by 2031, registering a CAGR of 5.33% during the forecast period. The steady agricultural machinery market growth reflects increasing adoption of tractors, planting systems, irrigation equipment, and harvesting machinery across developed and emerging economies.

The expanding Agricultural Machinery Industry is being reshaped by shrinking agricultural labor forces, precision farming technologies, and…

Blister Packaging Market to Reach USD 33.59 Billion by 2031, Driven by Unit-Dose …

Mordor Intelligence has published a new report on the blister packaging market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Blister Packaging Market Outlook

According to Mordor Intelligence, the blister packaging market was valued at USD 26.28 billion in 2025 and is estimated to grow from USD 27.38 billion in 2026 to reach USD 33.59 billion by 2031, registering a CAGR of 4.18% during the forecast period.…

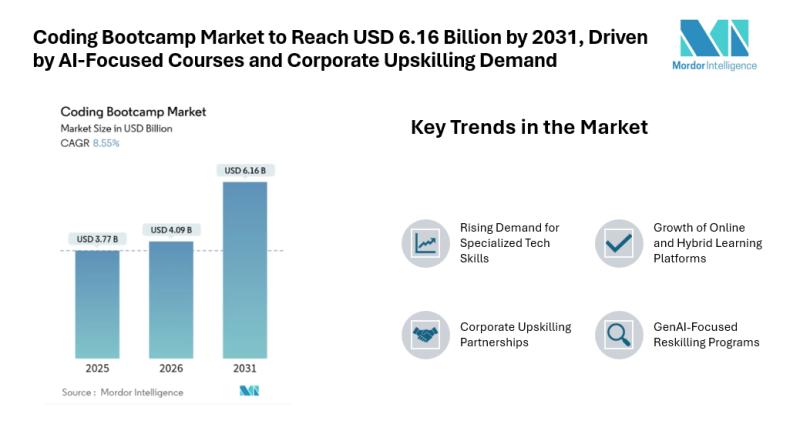

Coding Bootcamp Market to Reach USD 6.16 Billion by 2031, Driven by AI-Focused C …

Mordor Intelligence has published a new report on the coding bootcamp market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Coding Bootcamp Market Outlook

According to Mordor Intelligence, the coding bootcamp market size is expected to grow from USD 3.77 billion in 2025 to USD 4.09 billion in 2026, and further reach USD 6.16 billion by 2031, registering a CAGR of 8.55% during the forecast period. This…

More Releases for Cap

Best Low Cap Crypto: $IONX Chain Presale Named One of the Best Low-Cap Cryptos

In the expansive realm of cryptocurrency, finding the best low cap crypto can be a rewarding pursuit for investors looking to get in early on projects with substantial upside. These undervalued low cap crypto options often fly under the radar but hold the potential for significant returns as they gain traction. One such standout is the IONX Chain presale, which has been named one of the best low-cap cryptos due…

Curved Bill Baseball Cap

Curved Bill Baseball Cap

A popular go to hat for the active lifestyle. A Cotton Twill based Custom Trucker Hat with a Pre Curved Visor and Classic Snapback. From Mountain Top to Point Break this one goes everywhere.

https://wildhatco.com/hats/curved-mesh-baseball-hat.html

1333 E 8th St

Lincoln, NE 68372

WILD Hat Company (Whc) is an up and coming brand of hats, caps, beanies and merch. The Whc headwear brand was launched in order to reach a portion of…

High-Quality Floating Wheel Cap/LED Floating Wheel Cap Product in South Korea

Boswell Korea Co., Ltd. developed the LED emblem and spinning wheel cap for the first time in Korea.

Great Benefits of Bosswell Korea

✔Car dress-up tuning products

✔LED floating wheel cap patent introduction (Korea, USA, Japan, China),

✔Floating wheel cap patent (September 2020)

✔Janine, Spain, introduces NSV in Dubai, floating wheel cap to the world, Reliability Test Pass Test Report

The floating Wheel Cap is the logo of the car manufacturer that stays upright all…

The Klear Cap

The Klear Cap: the UV Light Cap that Self-Cleans Your Reusable Bottle

All around the world, one million plastic bottles are being sold every minute. 90% of Americans report preferring bottled water due to safety and quality, and this concern has likely become even stronger as the pandemic continues.

Reusable water bottles may be friendly towards the environment, but constantly re-using them also poses a health risk: a study conducted in…

Hats Market Statistics 2017 and Competitive Analysis: Chautuan, TTD, Berman, Cap …

Worldwide Market Reports has announced the addition of the “Asia-Pacific Hats Market Report 2017”, The report classifies the Hats Market in a precise manner to offer detailed insights about the aspects responsible for augmenting as well as restraining market growth.

This report studies the Hats market, analyzes and researches the Hats development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the…

Global Hats Market 2017 - Chautuan, TTD, Berman, Cap BAIRY, Henschel, Headwear, …

In this report, the global Hats market is valued at USD XX million in 2016 and is expected to reach USD XX million by the end of 2022, growing at a CAGR of XX% between 2016 and 2022.

Request For Sample Report @ https://www.fiormarkets.com/report-detail/65378/request-sample

Geographically, this report is segmented into several key Regions, with production, consumption, revenue (million USD), market share and growth rate of Hats in these regions, from 2012 to…