Press release

Private Equity Market Poised for Growth Amid Rising Investments and Evolving Strategies

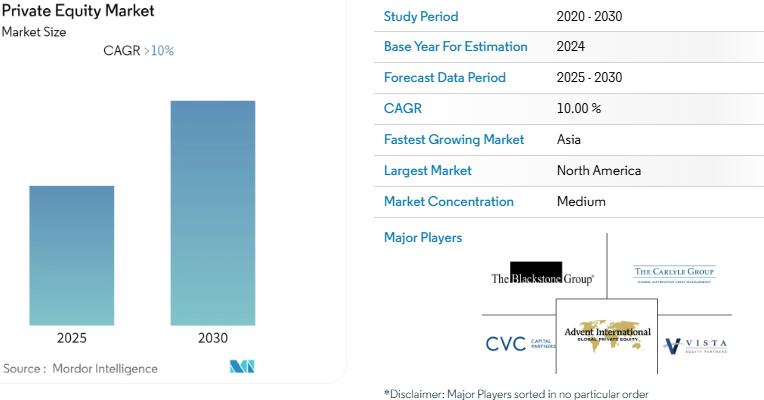

Mordor Intelligence has published a new report on the Private Equity Market, offering a comprehensive analysis of trends, growth drivers, and future projections.The global private equity market is poised for significant expansion, with projections indicating a compound annual growth rate (CAGR) exceeding 10% from 2025 to 2030. This growth trajectory is underpinned by substantial capital availability, a burgeoning need for investment diversification, and a heightened focus on sectors such as technology and healthcare. Additionally, the rise of Special Purpose Acquisition Companies (SPACs) is reshaping investment strategies within the private equity landscape.

Report Overview: https://www.mordorintelligence.com/industry-reports/global-private-equity-market

Key Trends

Expansion of Growth Investments

Recent years have witnessed a notable increase in growth investments, characterized by larger deal sizes and heightened complexity. In 2021, growth investments reached USD 19.6 billion, marking a 61% increase in deal count compared to the previous year. This surge was driven by sectors such as e-commerce, media and entertainment, real estate, and financial services, each recording over USD 1 billion in growth investments.

Emergence of SPACs

The proliferation of SPACs has introduced new dynamics into the private equity market. In 2021, SPAC proceeds nearly doubled from the previous year, reaching USD 143 billion. The number of SPAC mergers also hit new records, with 104 mergers completed in the fourth quarter of 2021. Private equity firms are increasingly sponsoring SPACs, leveraging their financial resources and industry expertise to capitalize on this trend.

Market Segmentation

By Fund Type

Buyout: Involves acquiring a controlling interest in established companies, often to improve their performance and value.

Venture Capital (VCs): Focuses on investing in early-stage startups with high growth potential, particularly in innovative sectors like technology and healthcare.

Real Estate: Investments in property assets, including commercial, residential, and industrial real estate.

Infrastructure: Targets investments in essential services and facilities such as transportation, utilities, and communication networks.

Other: Encompasses distressed private equity, direct lending, and other specialized investment strategies.

By Sector

Technology (Software): A leading sector attracting significant private equity investments due to rapid innovation and scalability.

Healthcare: Gains attention for its resilience and essential nature, with investments spanning pharmaceuticals, medical devices, and healthcare services.

Real Estate and Services: Continues to be a stable investment avenue, offering opportunities in property development and management services.

Financial Services: Includes investments in banking, insurance, and fintech companies, capitalizing on evolving financial landscapes.

Industrials: Covers manufacturing and industrial services, focusing on companies with potential for operational improvements.

Consumer & Retail: Targets businesses in consumer goods and retail sectors, especially those adapting to changing consumer behaviors.

Energy & Power: Involves investments in traditional and renewable energy sources, aligning with global energy transitions.

Media & Entertainment: Focuses on content creation, distribution, and entertainment platforms, driven by increasing digital consumption.

Telecom: Investments in communication service providers and related infrastructure, supporting global connectivity.

Others: Includes sectors like transportation and logistics, which are integral to global trade and supply chains.

By Investments

Large Cap: Investments in companies with substantial market capitalization, often involving significant capital deployment.

Upper Middle Market: Targets companies that are sizable but not among the largest, offering growth potential with manageable risk.

Lower Middle Market: Focuses on smaller companies with opportunities for expansion and value creation.

Real Estate: Dedicated investments in property assets, spanning various types and geographies.

Get a Customized Report Tailored to Your Requirements. - https://www.mordorintelligence.com/market-analysis/private-equity

Key Players

The private equity market is characterized by intense competition among numerous established firms. Prominent players include:

Advent International: A global firm specializing in buyouts and growth equity investments across various sectors.

Apollo Global Management: Known for its investments in credit, private equity, and real assets, managing a diverse portfolio worldwide.

Blackstone: One of the world's leading investment firms, with a focus on private equity, real estate, and hedge fund solutions.

Carlyle: Operates across multiple industries, offering a range of investment strategies including corporate private equity and real assets.

CVC Capital Partners: Focuses on investments in high-growth companies across various industries and geographies.

These firms leverage their extensive industry expertise and global networks to identify and capitalize on investment opportunities, contributing significantly to the market's growth and dynamism.

Conclusion

The global private equity market is on a robust growth trajectory, driven by ample capital availability, the emergence of SPACs, and targeted investments in high-potential sectors. As the market evolves, firms are expected to continue diversifying their investment strategies, focusing on sectors that offer resilience and growth opportunities. The competitive landscape underscores the importance of strategic agility and sector expertise, positioning leading firms to capitalize on emerging trends and drive sustained value creation.

Industry Related Reports

Middle East and Africa Private Equity Market: The report examines private equity firms in the Middle East and Africa, categorizing the market by industry sector, including utilities, oil & gas, financials, technology, healthcare, consumer goods & services, and others. It is also segmented by investment type, covering venture capital, growth investments, buyouts, and other strategies. Additionally, the market is analyzed by country, focusing on Saudi Arabia, the UAE, Qatar, Kuwait, South Africa, and the rest of the Middle East and Africa.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/middle-east-and-africa-private-equity-market

India Private Equity Market: The industry report analyzes private equity companies in India, segmenting the market based on investment type, including real estate, private investment in public equity (PIPE), buyouts, and exits.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/India-private-equity-market-growth-trends-and-forecast-2020-2025

Asia-Pacific Private Equity Market: The Asia-Pacific Private Equity Market report is categorized by investment type, including real estate, private investment in public equity (PIPE), buyouts, and exits. Additionally, the market is analyzed by country, covering China, India, Japan, Australia, Singapore, Hong Kong, and other nations in the region.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/asia-pacific-private-equity-market

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private Equity Market Poised for Growth Amid Rising Investments and Evolving Strategies here

News-ID: 3868773 • Views: …

More Releases from Mordor Intelligence

Braze Alloys Market Trends Point to USD 3.02 Billion Opportunity by 2030 Across …

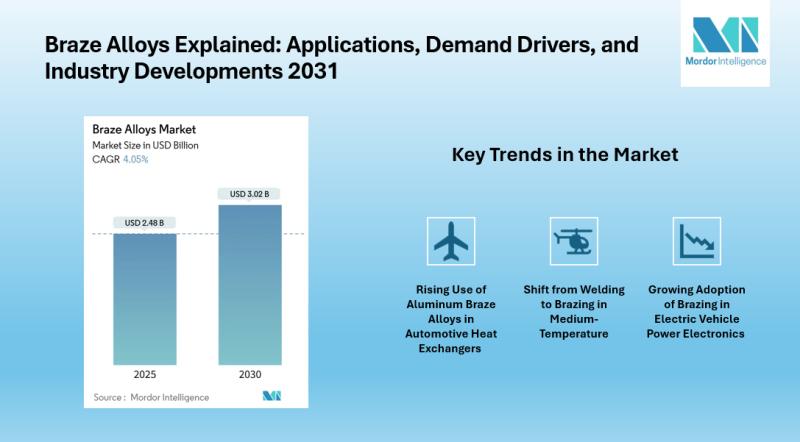

Mordor Intelligence has published a new report on the Braze Alloys Market, offering a comprehensive analysis of trends, growth of drivers, and future projections.

According to Mordor Intelligence, the Braze Alloys Market size is estimated at USD 2.48 billion in 2025 and is projected to reach USD 3.02 billion by 2030, growing at a CAGR of 4.05%. The Braze Alloys Industry benefits from increasing use of aluminum-based fillers in automotive heat…

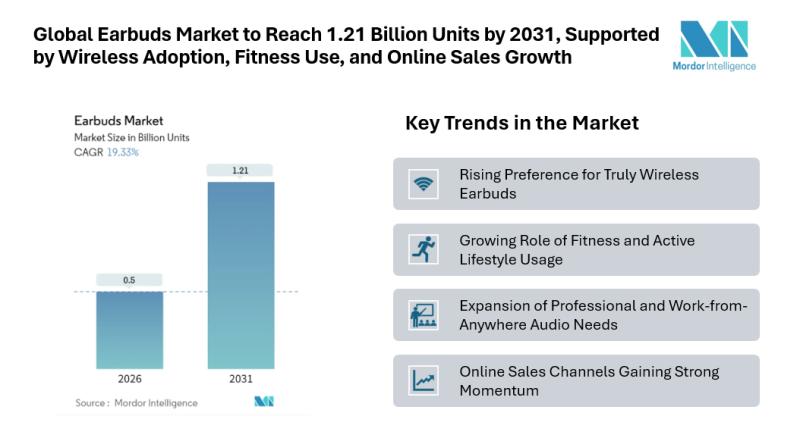

Global Earbuds Market to Reach 1.21 Billion Units by 2031, Supported by Wireless …

Mordor Intelligence has published a new report on the Earbuds Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Earbuds Market Overview

The Earbuds Market continues to gain strong momentum as compact audio devices become a daily companion across entertainment, work, and fitness use cases. According to the latest analysis, the market is expected to expand from 0.42 billion units in 2025 to 0.5 billion units…

Functional Mushroom Market Size to Reach USD 20.74 Billion by 2031 as Supplement …

Functional Mushroom Market Outlook

The global Functional Mushroom Market has transitioned from a niche wellness category into a mainstream segment spanning nutrition, functional foods, and personal care. According to Mordor Intelligence, the market was valued at USD 13.20 billion in 2026 and is projected to reach USD 20.74 billion by 2031, supported by a strong compound annual growth rate during the forecast period.

This growth reflects rising consumer confidence in mushroom-based ingredients…

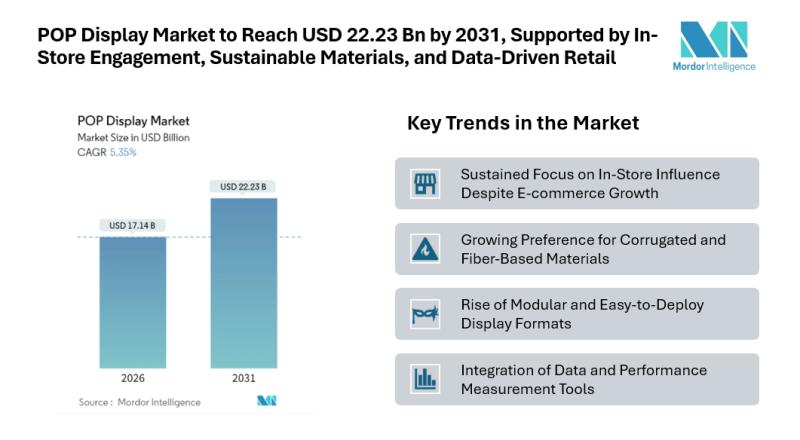

POP Display Market to Reach USD 22.23 Billion by 2031, Supported by In-Store Eng …

Mordor Intelligence has published a new report on the POP Display Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

POP Display Market Overview

The POP Display Market plays a vital role in physical retail by helping brands attract shopper attention and influence buying decisions at the point of purchase. According to Mordor Intelligence, the POP Display Market size is estimated at USD 17.14 billion in 2026,…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…