Press release

Key Unsecured Business Loans Market Trend for 2025-2034: Top Lenders Offer Innovative Unsecured Business Loans For MSMEs In India

What Is the Future Outlook for the Unsecured Business Loans Market's Size and Growth Rate?Over the past few years, there has been a swift expansion of the unsecured business loans market. The market size, which is expected to jump from $5005.68 billion in 2024 to $5583.41 billion in 2025, presents a compound annual growth rate (CAGR) of 11.5%. The remarkable growth in the preceding period is a result of the surge in small and medium-sized enterprises (SMEs), the emergence of fintech and alternative lenders, economic conditions, and escalated competition among lenders.

Expectations are high for the unsecured business loans market as it's projected to experience significant expansion in the coming years. The market value is set to reach $8522.08 billion by 2029, with a compound annual growth rate (CAGR) of 11.2%. Numerous factors contribute to this predicted growth, including a higher understanding and acceptance of unsecured business loans, the digitization trend in the industry, enhanced access to capital for small businesses, the implementation of government regulations, and ease of getting credit from financial institutions. Key trends for the forecasted period include advances in fintech and digital transformation, product innovation, cutting-edge loan processing technologies, the use of blockchain technology, and developments in online lending platforms.

What Is Stimulating Growth in the Unsecured Business Loans Market?

The surge in small and medium-sized enterprises (SMEs) is anticipated to stimulate the expansion of the unsecured business loans market in the future. SMEs operate subject to specific restrictions on revenue, assets or employee numbers. This rising number of SMEs comes as a consequence of economic evolution, job creation initiatives, government backing, relevant policies, and the necessities of social and community sectors. Unsecured business loans provide SMEs with the means to cater to their varied financial requirements without the need for collateral, thus empowering them to grow, oversee operations effectively, and deal with financial obstacles. For example, according to the European Commission (EC), a Belgium-based executive arm of the European Union, SMEs in the European Union observed a rise of 2.7% in 2022, with several member states witnessing considerable growth. Hence, the surge in small and medium-sized enterprises (SMEs) is propelling the expansion of the unsecured business loans market.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18762&type=smp

Which Key Market Leaders Are Driving Unsecured Business Loans Industry Growth?

Major companies operating in the unsecured business loans market are Bank of America Corporation, Wells Fargo and Co., Bank of China Limited, American Express Company, Deutsche Bank AG, HDFC Bank Ltd., Standard Chartered PLC, Bajaj Finserv Ltd., Axis Bank Ltd., Bank of Ireland Group PLC, Enova International Inc., Hero FinCorp Ltd., Bluevine Inc., Poonawalla Fincorp Ltd., Starling Bank, Funding Circle Holdings PLC, OnDeck Capital, National Funding Inc., Rapid Finance, Biz2Credit Inc., Clix Capital Services Private Limited

What Are the Emerging Trends in the Unsecured Business Loans Industry?

Leading firms engaged in the unsecured business loans market are focusing on offering innovative lending options, including unsecured business loans, specifically aimed at micro, small, and medium-sized enterprises (MSMEs), in an effort to help them attain their business goals and further economic progress. Unsecured business loans for MSMEs are financing options that do not necessitate any collateral from the borrower. The primary basis for these loans is the business and its owner's financial health and credit standing, rather than any asset pledges. For example, in July 2023, Godrej Capital, a financial services firm based in India, introduced unsecured business loans created specifically for MSMEs. These loans are constructed to meet the distinct funding requirements of a wide variety of businesses, spanning from startups and MSMEs to well-established enterprises. It introduces creative repayment plans that coincide with businesses' cash flow cycles, hence offering more feasible repayment timelines. This move intends to address specific issues faced by these businesses, particularly in accessing adaptable financial options.

What Are the Main Segments in the Unsecured Business Loans Market?

The unsecured business loans market covered in this report is segmented -

1) By Type: Term Business Loan, Overdrafts, Loan On Business Credit Cards, Working Capital Loan, Other Types

2) By Provider: Banks, Non-Banking Financial Company (NBFCs), Credit Unions

3) By Application: Banking, Financial Services, And Insurance (BFSI), Retail, Information Technology (IT) And Telecom, Healthcare, Manufacturing, Energy And Utility, Other Applications

4) By End-User: Small And Medium-Sized Enterprises, Large Enterprises

Subsegments:

1) By Term Business Loan: Short-term Loans, Medium-Term Loans, Long-Term Loans

2) By Overdrafts: Personal Overdrafts, Business Overdrafts, Revolving Overdrafts

3) By Loan On Business Credit Cards: Balance Transfer Credit Cards, Business Line Of Credit Cards, Charge Cards

4) By Working Capital Loan: Seasonal Working Capital Loans, Emergency Working Capital Loans, Fixed Working Capital Loans

5) By Other Types: Merchant Cash Advances, Peer-To-Peer Business Loans, Invoice Financing, Equipment Financing

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/unsecured-business-loans-global-market-report

Which Geographic Area Leads the Unsecured Business Loans Market?

North America was the largest region in the unsecured business loans market in 2023. The regions covered in the unsecured business loans market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Unsecured Business Loans Global Market Report?

- Market Size Analysis: Analyze the Unsecured Business Loans Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Unsecured Business Loans Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Unsecured Business Loans Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Unsecured Business Loans Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18762

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Unsecured Business Loans Market Trend for 2025-2034: Top Lenders Offer Innovative Unsecured Business Loans For MSMEs In India here

News-ID: 3866556 • Views: …

More Releases from The Business Research Company

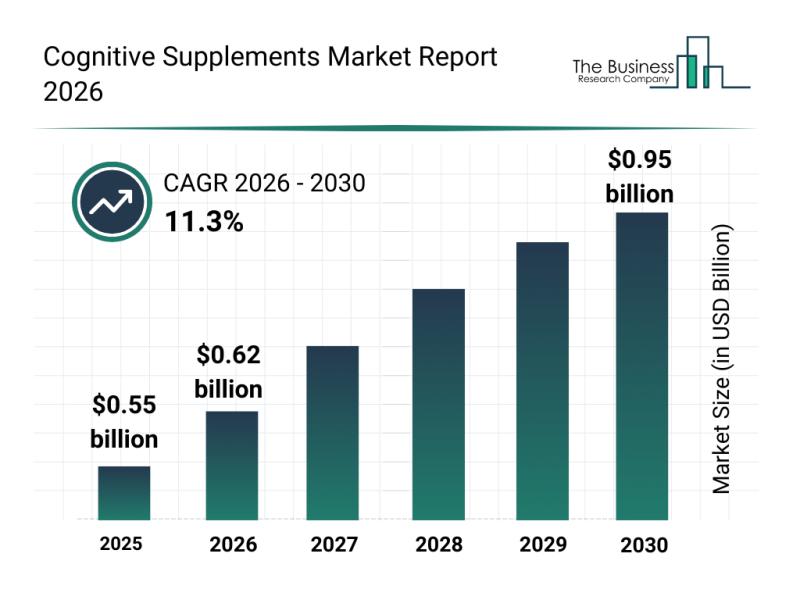

Analysis of Segments and Major Growth Areas in the Cognitive Supplements Market

The cognitive supplements sector is positioned for significant expansion over the coming years, driven by evolving health and wellness priorities. As more consumers seek tailored brain health solutions, the market is responding with innovative products and growing accessibility. Let's explore the anticipated market growth, key players shaping the landscape, emerging trends, and the segmentation defining this dynamic industry.

Forecasted Expansion of the Cognitive Supplements Market to 2030

The cognitive supplements…

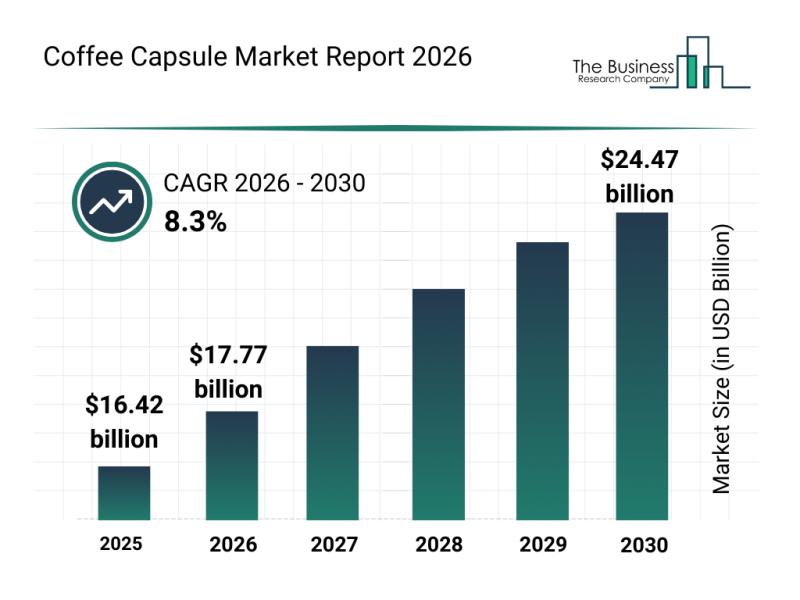

Emerging Growth Trends Driving Expansion in the Coffee Capsule Market

The coffee capsule industry is on track for notable expansion in the coming years, driven by shifting consumer preferences and sustainability efforts. As more people seek convenient yet high-quality coffee experiences, innovation and eco-friendly solutions are becoming key factors shaping this market's future. Here's a detailed overview of the market's size, the major players involved, emerging trends, and segment breakdowns.

Projected Growth and Market Size of the Coffee Capsule Industry …

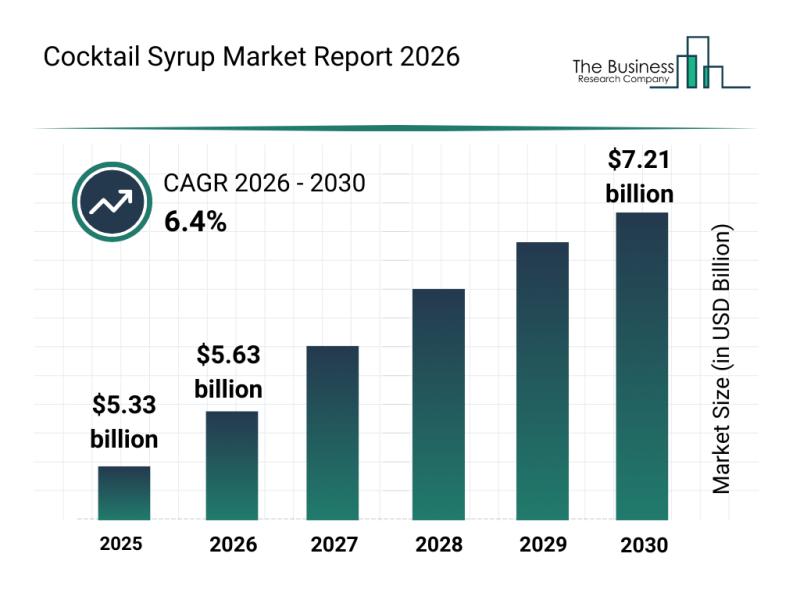

Market Segmentation, Dynamics, and Competitive Landscape in the Cocktail Syrup I …

The cocktail syrup market is gaining significant traction as consumers increasingly seek unique and premium beverage options. With evolving tastes and growing interest in non-alcoholic cocktails, this sector is set for notable expansion. Let's explore the market's size, key players, emerging trends, and segmentation to understand its future trajectory.

Projected Size and Growth Outlook for the Cocktail Syrup Market

The cocktail syrup market is anticipated to experience substantial growth, reaching…

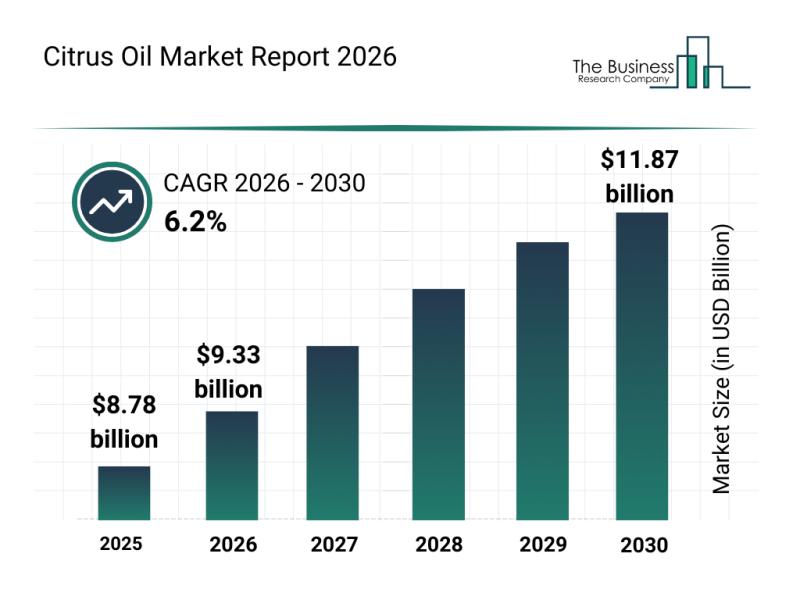

Segment Evaluation and Major Growth Areas in the Citrus Oil Market

The citrus oil industry is set to experience impressive growth in the coming years, driven by evolving consumer preferences and expanding applications across various sectors. As demand for natural and sustainable ingredients continues to rise, the market is adapting and innovating to meet new challenges and opportunities. Let's explore the current market size, key players, trends, and segments shaping the future of citrus oils.

Projected Expansion of the Citrus Oil Market…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…