Press release

Serkan Altay on ESG vs. Impact Investing: What Investors Need to Know

Serkan Altay helps investors to make informed investment decisions.Image: https://www.abnewswire.com/upload/2025/02/489648fa2ade393b23aed05885259e0b.jpg

Serkan Altay, an impact investment advisor whose previous experience includes the management of financial assets at prominent foundations such as the Victoria Foundation and Rally Assets, underscores the critical distinction between Impact Investing and Environmental, Social, and Governance (ESG) Investing. While both approaches consider factors beyond financial returns, their goals, methodologies, and outcomes vary significantly. Understanding these differences is key for investors looking to make informed decisions and align their assets with specific values.

Defining the Objectives

Impact investing, according to Serkan Altay [https://newsrooms.ca/2025/01/03/serkan-altay-shares-smart-investment-strategies-every-investor-should-know/], is driven by a dual objective: generating measurable social and environmental benefits alongside financial returns. Investors in this space intentionally direct their capital to address pressing social or environmental challenges, aiming for tangible outcomes like the development of social enterprises, affordable housing, or renewable energy projects. These investments often rally around a mission to create positive change, with a strong focus on measuring and reporting the direct impact achieved.

In contrast, ESG investing is more concerned with enhancing financial performance by factoring in Environmental, Social, and Governance elements into investment decisions. The primary goal is to minimize risk and boost long-term returns by identifying companies with strong sustainability practices. By integrating ESG considerations, ESG investing seeks to support businesses that are less vulnerable to risks like regulatory fines, reputational damage, or environmental liabilities, thereby improving the overall risk-return profile of an investment portfolio.

Approaches and Methodologies

Impact investing is typically targeted and deliberate, focusing on investments in companies, projects, or organizations actively addressing social or environmental issues. A wide range of assets, including public stocks, debt, real estate, and private equity, can be considered in this strategy. Performance measurement in impact investing is centered on assessing the real-world impact on social or environmental outcomes, ensuring that the rally for positive change is both measurable and transparent.

On the other hand, ESG investing incorporates a screening process to evaluate companies based on their ESG performance. This includes both negative screening (excluding companies that don't meet certain ESG standards) and positive screening (focusing on companies with strong ESG profiles). The ultimate aim is to ensure that an investor's assets are aligned with sustainable practices while optimizing financial returns.

Outcomes and Impact

Impact investing directly finances initiatives designed to benefit society or the environment. From renewable energy projects to social enterprises, the goal is clear: create lasting, positive outcomes. Impact investors often prepare detailed reports to showcase the measurable results of their investments, ensuring that the assets allocated for social good are truly making an impact.

ESG investing, however, is more focused on financial performance and risk mitigation. By choosing companies with superior governance and sustainability practices, ESG investors hope to reduce the likelihood of financial setbacks from issues like environmental disasters or poor corporate governance. This approach rallies behind the idea that businesses with strong ESG standards are better positioned for long-term success, which, in turn, benefits investors' bottom lines.

Investor Profiles and Types of Investments

Impact investing typically attracts individuals who are motivated by the desire to drive meaningful social or environmental change. These investors are often willing to take on greater risk in exchange for making a tangible impact. The investment universe for impact funds may be narrower, often avoiding large-cap companies in industries like technology or finance in favor of more mission-driven enterprises.

In contrast, ESG investing [https://www.crunchbase.com/person/serkan-altay-f5ac] appeals to investors focused on optimizing shareholder value while aligning their portfolios with sustainability goals. ESG funds often hold large-cap companies, regardless of sector, and may include well-known names that are actively promoting their ESG initiatives. Larger companies, especially those with the resources to market their ESG practices, are often prominent in ESG portfolios. This can include industries that are traditionally seen as less sustainable, such as fossil fuel companies, which may still receive high ESG rankings due to their corporate governance and sustainability efforts.

Conclusion

When deciding between impact and ESG investing, investors should understand that while both strategies incorporate factors beyond financial returns, their focus, methods, and outcomes are distinct. Impact investing rallies behind measurable social and environmental impact, while ESG investing integrates sustainability considerations to enhance the risk-return profile of a portfolio. By understanding these differences, investors can better align their assets with their financial and ethical goals.

Media Contact

Company Name: Serkan Altay

Contact Person: Serkan Altay

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=serkan-altay-on-esg-vs-impact-investing-what-investors-need-to-know]

City: Toronto

Country: Canada

Website: http://about.me/serkanaltay

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Serkan Altay on ESG vs. Impact Investing: What Investors Need to Know here

News-ID: 3863551 • Views: …

More Releases from ABNewswire

Newman's Brew Proves Smooth, Flavorful Coffee Begins with Ethical Sourcing and P …

Newman's Brew has built its reputation on delivering the smoothest coffee available by combining organic bean sourcing with fresh-per-order roasting. The rapidly expanding company demonstrates that ethical business practices and exceptional product quality are not mutually exclusive, while supporting abandoned animal feeding programs as part of its commitment to positive social impact.

In an industry where freshness is often sacrificed for operational convenience, Newman's Brew has chosen a different path. The…

Playground Play Equipment Innovation Sets New Benchmark for Safe, Engaging Space …

As schools, communities, and commercial venues worldwide continue to invest in healthier and more inclusive outdoor environments, playground play equipment [https://www.indooroutdoorplayground.com/what-makes-playground-play-equipment-truly-safe-and-engaging/] is entering a new era-one defined by higher safety standards, smarter design, and broader community engagement. Golden Times (Wenzhou Golden Times Amusement Toys CO., LTD.) today announced an expanded product and market strategy focused on delivering next-generation playground solutions that balance safety, durability, and creativity.

Industry expectations for playgrounds have…

Time.so Reports 300% Growth in Business Users

Time.so reports 300% growth in business users as global teams rely on its fast world clock, city times, time zones, and weather for planning.

Jan 31, 2026 - Time.so today announced a 300% increase in business users, reflecting rising demand for dependable time data across distributed teams, global customer support, and cross border operations.

The surge follows a clear shift in how companies schedule work. Meetings span continents. Deadlines move with daylight…

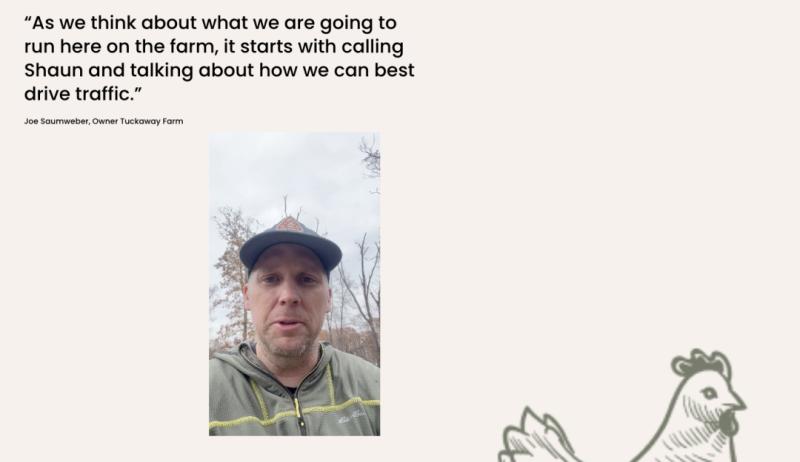

Shaun Savvy Helps Tuckaway Farm in Bentonville, Arkansas Sell Out Two CSA Season …

Buffalo-based SEO consultant Shaun Savvy partnered with Tuckaway Farm in Bentonville, Arkansas to help the farm sell out two consecutive CSA seasons, generating over $80,000 in revenue while spending less than $1,000 on paid advertising through a strategic blend of local SEO, high-intent content, and targeted social media campaigns.

Shaun Savvy, a Buffalo-based SEO and digital marketing consultant, announced a successful local marketing case study showcasing how Tuckaway Farm sold out…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…