Press release

Leading Growth Driver in the Group Life Insurance Market in 2025: Impact Of Growing Aging Population On Group Life Insurance Market Driver's Influence

What Are the Market Size and Growth Forecast for the Group Life Insurance Market?The expansion of the group life insurance market has been brisk in past years, with estimations indicating a rise from $132.3 billion in 2024 to $146.27 billion in 2025, reflecting a compound annual growth rate (CAGR) of 10.6%. Factors contributing to this historic growth period include employment growth coupled with corporate benefits, changes in regulations and compliance requirements, the advancing age of populations, the progression of employer-sponsored benefits packages, and a growing level of workforce participation.

The marketplace for group life insurance is predicted to experience swift expansion in the forthcoming years, escalating to $216.48 billion in 2029 with a compound annual growth rate (CAGR) of 10.3%. Factors driving the predicted growth during this period include demographic trends towards an older population, improved customer service efforts, increasing awareness and need for products that provide financial security, a growing worldwide workforce, healthcare cost trends, and expectations for longer life. Dominant trends during this forecast era encompass progress in technology, digital overhaul, customized insurance offerings, the inclusion of Artificial Intelligence, and the utilization of data analytics.

What Are the Main Catalysts for Growth in the Group Life Insurance Market?

The anticipated expansion of the group life insurance market is largely attributed to the rising population of senior citizens. This escalation in the aged populace is due to a combination of falling birth rates, lengthier lifespans and healthcare developments that boost longevity. The term "aging population" signifies an upward shift in the ratio of elderly members in a society. Group life insurance gives financial stability by bestowing death benefits to workers and their families, covering necessary costs and ensuring mental tranquility during periods of grievance. For example, a forecast by the United Nations, an influential US-based diplomatic and political international organization, anticipates a dramatic increase in the global community of individuals 65 years or older, escalating from 10% in 2022 to 16% by 2050. Hence, the upward surge in the aging populace will fuel the expansion of the group life insurance market.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16436&type=smp

Which Key Market Leaders Are Driving Group Life Insurance Industry Growth?

Major companies operating in the group life insurance market are Cigna Corporation, Allianz SE, AXA SA, MetLife Inc., Prudential Financial Inc., Nationwide Mutual Insurance Company, American International Group Inc., Tokio Marine Holdings Inc, Zurich Insurance Group Ltd., The Northwestern Mutual Life Insurance Company, Massachusetts Mutual Life Insurance Company, The Manufacturers Life Insurance Company, Liberty Mutual Insurance Company, The Hartford Financial Services Group Inc., New York Life Insurance Company, Aflac Incorporated, Sun Life Assurance Company of Canada, Principal Financial Group Inc., The Guardian Life Insurance Company of America, Unum Group, Lincoln National Corporation, Mutual of Omaha Insurance Company, Transamerica Corporation, Securian Financial Group Inc., Voya Financial Inc.

What Are the Emerging Trends in the Group Life Insurance Industry?

Leading corporations in the group life insurance market are prioritizing the inclusion of additional benefits, such as group term insurance plans, to optimize operations, elevate customer satisfaction, and enhance efficiency. Group term insurance plans offer life insurance protection to a collective group under one policy, frequently provided by organizations to their workforce. For example, in June 2023, Digit Life Insurance, a company based in India specializing in general insurance, unveiled a thorough group term scheme as its debut product. This scheme provides broad coverage for death, illness, and disability, integrating numerous payout choices, four optional benefits, and a variety of add-ons. The payout alternatives consist of a lump sum guarantee, retirement-linked income, child age-linked income, and income for a decided period of up to 40 years to compensate for family income loss resulting from the insured's death. Both group and personal members have the liberty to select their preferred payout benefits.

What Are the Main Segments in the Group Life Insurance Market?

The group life insurance market covered in this report is segmented -

1) By Type: Contributory Plans, Non-Contributory Plans

2) By Enterprise Size: Large Enterprises, Small And Medium-sized Enterprises

3) By Distribution Channel: Direct Sales, Brokers Or Agents, Banks, Other Distribution Channels

Subsegments:

1) By Contributory Plans: Employee-Paid Contributory Plans, Employer And Employee Shared Contribution Plans

2) By Non-contributory Plans: Employer-Paid Non-Contributory Plans

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/group-life-insurance-global-market-report

Which Geographic Area Leads the Group Life Insurance Market?

North America was the largest region in the group life insurance market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the group life insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Group Life Insurance Global Market Report?

- Market Size Analysis: Analyze the Group Life Insurance Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Group Life Insurance Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Group Life Insurance Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Group Life Insurance Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16436

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Leading Growth Driver in the Group Life Insurance Market in 2025: Impact Of Growing Aging Population On Group Life Insurance Market Driver's Influence here

News-ID: 3861243 • Views: …

More Releases from The Business Research Company

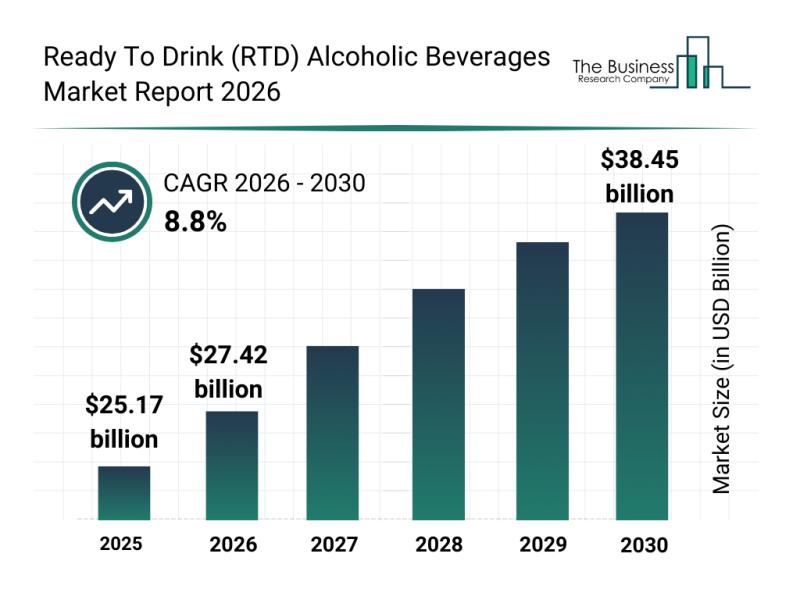

Outlook for the Ready To Drink (RTD) Alcoholic Beverages Market: Major Segments, …

The ready-to-drink (RTD) alcoholic beverages market is on track to experience significant growth over the coming years, driven by evolving consumer preferences and industry innovations. This sector is rapidly expanding as more consumers seek premium, convenient, and sustainable options in their alcoholic beverage choices. Let's explore the market's projected size, key drivers, major players, emerging trends, and segmentation details shaping its future.

Projected Expansion and Market Size of the Ready To…

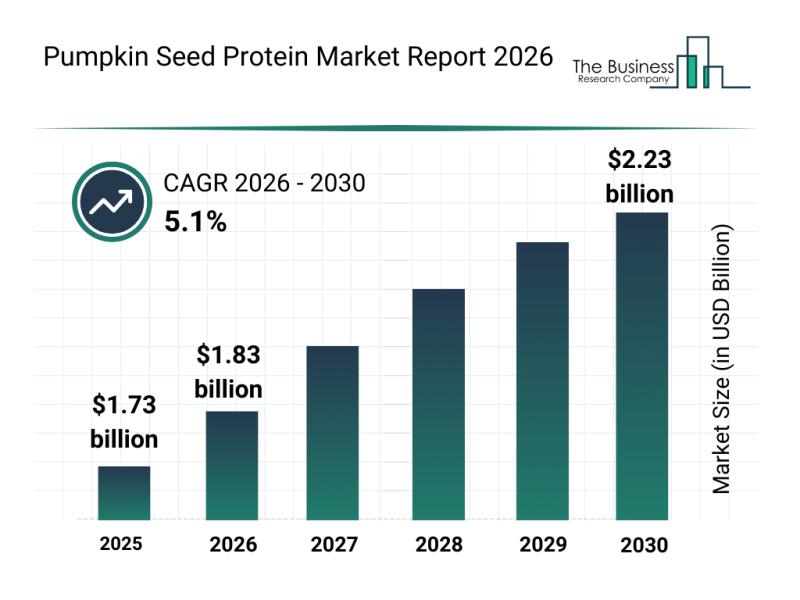

Emerging Sub-Segments Transforming the Pumpkin Seed Protein Market Landscape

The pumpkin seed protein market is emerging as a promising sector within the broader landscape of plant-based proteins. With increasing consumer interest in alternative, allergen-free protein sources and sustainable nutrition, this market is set to witness substantial growth and innovation. Let's explore the market size projections, key players, current trends, and major product segments shaping the future of pumpkin seed protein.

Projected Market Valuation and Growth Expectations for Pumpkin Seed Protein…

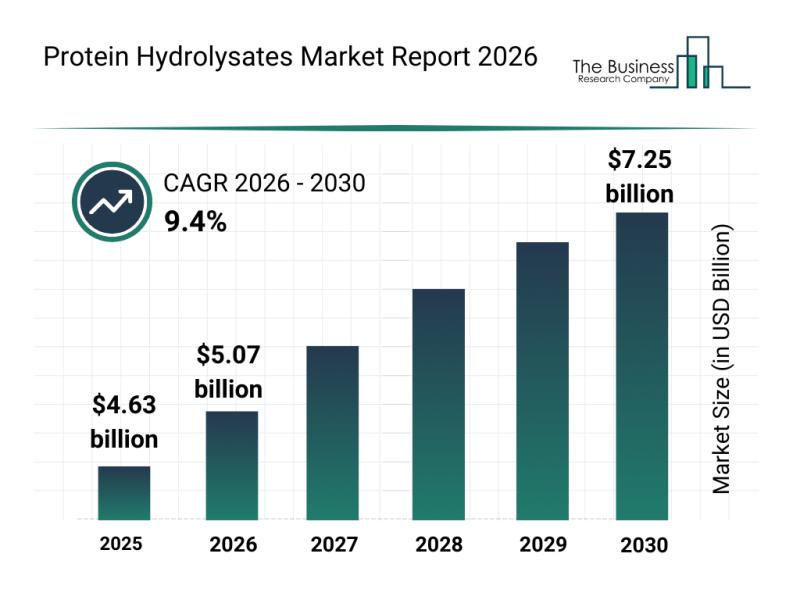

Top Players and Market Competition in the Protein Hydrolysates Industry

The protein hydrolysates market is positioned for significant expansion in the coming years as consumer preferences and nutritional science continue to evolve. With increasing attention on tailored nutrition solutions and the rise of plant-based options, this market is gearing up for robust growth and innovation.

Protein Hydrolysates Market Size Projections Through 2030

The protein hydrolysates market is forecasted to grow substantially, reaching a value of $7.25 billion by 2030. This…

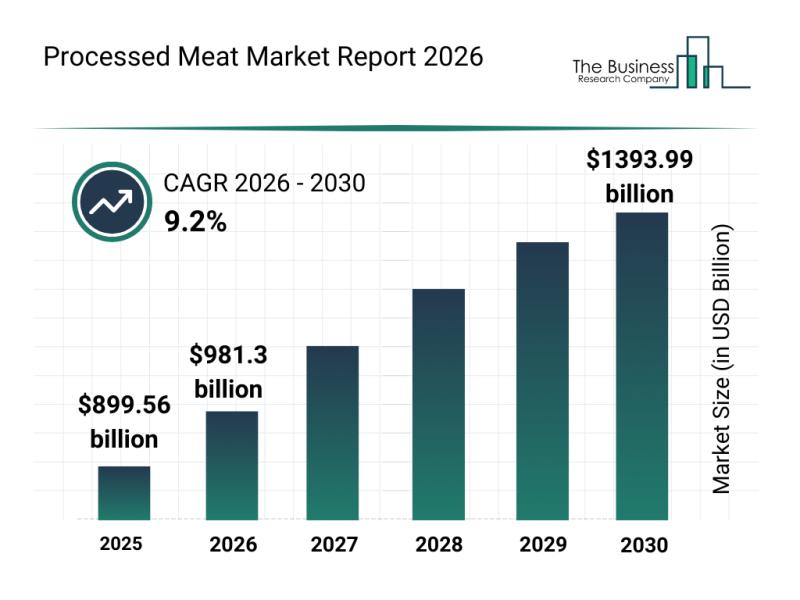

Processed Meat Market Overview: Major Segments, Strategic Developments, and Lead …

The processed meat industry is positioned for substantial expansion over the coming years, driven by evolving consumer preferences and technological advancements. As the market adapts to changing demands and regulatory landscapes, it is expected to reach impressive valuation milestones. Let's explore the current market size, key players, emerging trends, and detailed segment analyses shaping this sector's future.

Forecasted Market Size and Growth Trajectory of the Processed Meat Market

The processed…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…