Press release

Booming U.S. Private Equity Market Driven by Innovation, Tax Benefits, and Strategic Investments

Booming U.S. Private Equity Market Driven by Innovation, Tax Benefits, and Strategic InvestmentsMordor Intelligence has published a new report on the Booming U.S. Private Equity Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

The United States private equity market is experiencing significant growth, with projections indicating an increase from USD 0.82 trillion in 2025 to USD 1.24 trillion by 2030, reflecting a compound annual growth rate (CAGR) of 8.60% during this period. This expansion is primarily driven by favorable economic conditions, including historically low interest rates and advantageous tax structures, which have made private equity an increasingly attractive investment vehicle.

Report Overview: https://www.mordorintelligence.com/industry-reports/united-states-private-equity-market

Key Trends

Low Interest Rates and Abundant Capital

The prolonged period of low interest rates in the United States has reduced the cost of debt financing, enabling private equity firms to engage in leveraged buyouts more efficiently. This environment has also led to an abundance of capital, as investors seek higher yields compared to traditional fixed-income securities. Consequently, private equity activity has intensified, with firms capitalizing on the low borrowing costs to finance acquisitions and expansions.

Tax Advantages Enhancing Investment Appeal

Private equity funds in the United States are typically structured as partnerships for tax purposes, allowing them to pass income directly to partners and avoid corporate taxes. This structure provides significant tax benefits, making private equity investments more appealing to high-net-worth individuals and institutional investors. The favorable tax treatment has been a critical factor in the increased adoption of private equity strategies across various sectors.

Diversification into Alternative Asset Classes

To mitigate the pressures of heightened competition and compressed returns in traditional private equity deals, firms are diversifying their portfolios into alternative asset classes. This includes investments in infrastructure, real estate, and distressed assets, allowing firms to spread risk and tap into new revenue streams. This strategic shift is reshaping the private equity landscape, fostering innovation in investment approaches.

Market Segmentation

The United States private equity market is segmented based on investment type and application:

By Investment Type:

Large Cap: Investments in companies with substantial market capitalization, typically involving significant capital deployment.

Mid Cap: Targeting medium-sized enterprises with growth potential, balancing risk and return.

Small Cap: Focusing on smaller companies, often with higher growth prospects but increased risk.

By Application:

Add-On: Investments aimed at acquiring additional companies to complement existing portfolio holdings, enhancing value through synergies.

Growth Equity: Providing capital to mature companies seeking to expand operations, enter new markets, or finance significant acquisitions without changing control.

Leveraged Buyouts (LBOs): Acquiring companies primarily through debt financing, enabling investors to make substantial acquisitions with minimal equity.

This segmentation allows investors to align their strategies with specific risk appetites and investment objectives, facilitating targeted capital allocation across various market segments.

Get a Customized Report Tailored to Your Requirements. - https://www.mordorintelligence.com/market-analysis/private-equity

Key Players

The U.S. private equity market is characterized by the presence of several prominent firms that play pivotal roles in shaping industry dynamics:

The Carlyle Group: A global investment firm with a diverse portfolio spanning various industries, known for its strategic investments and value creation initiatives.

Gottenberg Associates: Specializes in middle-market investments, focusing on growth-oriented companies across multiple sectors.

Chicago Capital: Engages in a broad range of private equity activities, emphasizing long-term partnerships with management teams to drive growth.

Vista Equity Partners: Concentrates on enterprise software and technology-enabled businesses, leveraging deep sector expertise to enhance operational performance.

Blackstone: One of the world's leading investment firms, with substantial assets under management across private equity, real estate, and alternative investments.

These firms have established themselves through strategic acquisitions, effective management practices, and a focus on delivering consistent returns to investors.

Conclusion

The United States private equity market is poised for substantial growth, driven by favorable economic conditions, tax advantages, and strategic diversification into alternative assets. As firms navigate an increasingly competitive landscape, the emphasis on innovative investment strategies and operational excellence will be critical to sustaining momentum. Investors are advised to remain cognizant of market dynamics

Industry Related Reports

Private Equity Market: The report provides an overview and industry analysis of the global private equity market, segmented by fund type, sector, investments, and geography. The fund type segment includes buyout, venture capital (VCs), real estate, infrastructure, and other categories such as distressed PE and direct lending. The market is also categorized by sector, covering technology (software), healthcare, real estate and services, financial services, industrials, consumer & retail, energy & power, media & entertainment, telecom, and other sectors like transportation. Investments are classified into large cap, upper middle market, lower middle market, and real estate. Geographically, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/global-private-equity-market

Europe Private Equity Market: The Europe private equity market report is segmented by investment type, application, and geography. Investment types include large cap, mid cap, and small cap categories. Based on application, the market is classified into early-stage venture capital, private equity, and leveraged buyouts. Geographically, the report covers Italy, Germany, France, Switzerland, the United Kingdom, and the rest of Europe.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/europe-private-equity-market

Asia-Pacific Private Equity Market: The Asia-Pacific private equity market report is segmented by investment type and country. Investment categories include real estate, private investment in public equity (PIPE), buyouts, and exits. Geographically, the report covers China, India, Japan, Australia, Singapore, Hong Kong, and other countries in the region.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/asia-pacific-private-equity-market

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Booming U.S. Private Equity Market Driven by Innovation, Tax Benefits, and Strategic Investments here

News-ID: 3860159 • Views: …

More Releases from Mordor Intelligence

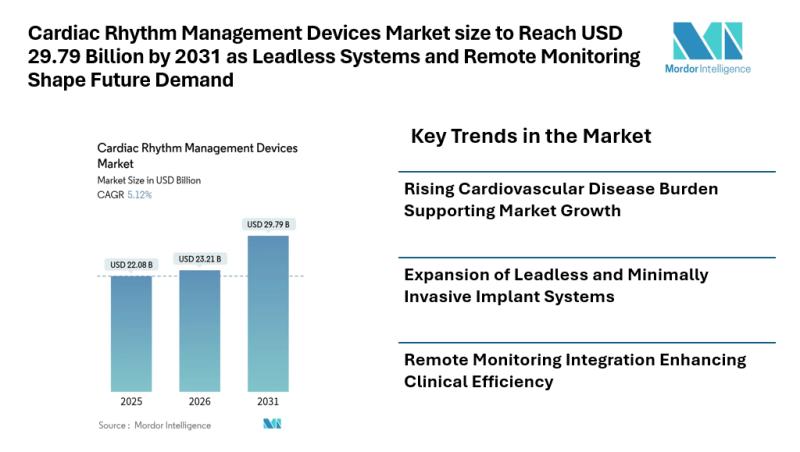

Cardiac Rhythm Management Devices Market size to Reach USD 29.79 Billion by 2031 …

Mordor Intelligence has published a new report on the cardiac rhythm management devices market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Cardiac Rhythm Management Devices Market Overview

According to Mordor Intelligence, the cardiac rhythm management devices market is set to expand from USD 22.08 billion in 2025 to USD 23.21 billion in 2026 and is projected to reach USD 29.79 billion by 2031, registering a…

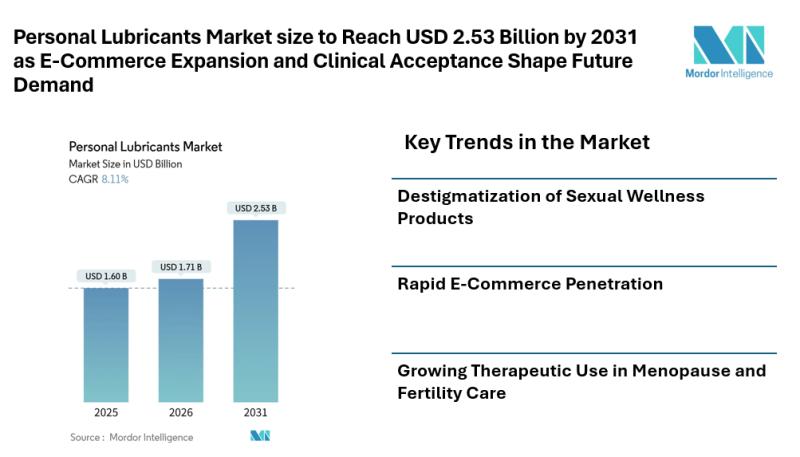

Personal Lubricants Market size to Reach USD 2.53 Billion by 2031 as E-Commerce …

Mordor Intelligence has published a new report on the personal lubricants market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the personal lubricants market size is estimated at USD 1.71 billion in 2026 and is projected to reach USD 2.53 billion by 2031, registering a CAGR of 8.11% during the forecast period. These steady personal lubricants market growth reflects wider…

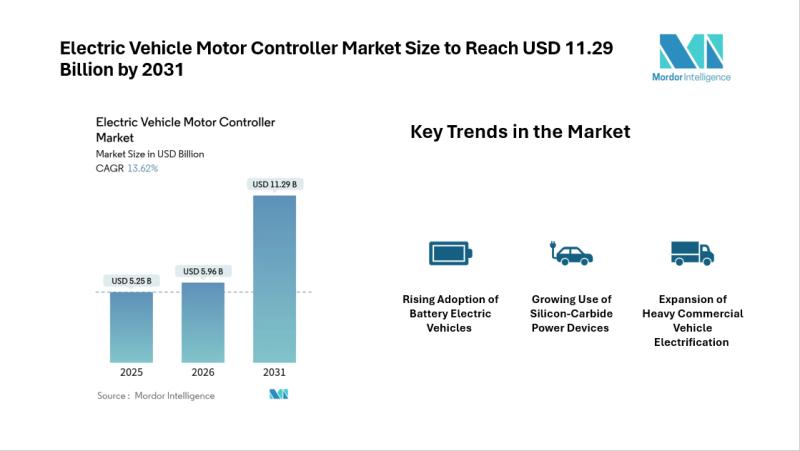

Electric Vehicle Motor Controller Market Size to Reach USD 11.29 Billion by 2031 …

Electric Vehicle Motor Controller Market Overview

According to Mordor Intelligence, the electric vehicle motor controller market size is projected to reach USD 11.29 billion by 2031, growing from USD 5.96 billion in 2026 at a CAGR of 13.62% during the forecast period. The electric vehicle motor controller market forecast reflects steady expansion supported by stricter emission regulations, rising battery electric vehicle adoption, and the increasing use of silicon-carbide power devices.…

Beverage Market Size to Reach USD 2.67 Trillion by 2031, Driven by Health and Su …

Introduction: Beverage Market Growth Outlook

According to a research report by Mordor Intelligence, the global Beverage Market is projected to grow from an estimated USD 2.03 trillion in 2026 to USD 2.67 trillion by 2031, reflecting a steady CAGR of 5.65% over the forecast period. This growth is supported by increasing consumer awareness around health, wellness, and sustainable consumption, along with the rising demand for premium and functional beverages. Non-alcoholic…

More Releases for Equity

Shah Equity Launches the World's First Integrated Global Private Equity & Hedge …

Shah Equity, a leading innovator in financial services, proudly announces the launch of the world's first integrated Global Private Equity & Hedge Fund. With a strategic focus on Commercial Real Estate, Healthcare, Home Services, and a robust Hedge Fund, Shah Equity is dedicated to maximizing value and fueling sustainable growth, all while expertly hedging investment risks.

In an era where traditional investment models face unprecedented challenges, Shah Equity steps forward with…

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Establishment Consultation,Chinese private equity company,

Pandacu China is a leading private equity firm that specializes in making long-term investments in small and medium-sized enterprises (SMEs) in China. The company was founded in China by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the private equity and venture capital industry.

https://boomingfaucet.com/

China Private Equity Establishment Consultation

E-mail:nolan@pandacuads.com

SMEs are the backbone of the Chinese economy, and they…