Press release

Personal Loans Global Market Report 2025: Tremendous Growth Projected with CAGR of 10.4% and Key Emerging Trends

Increasing Demand and Emergence of Fintech Lenders Driving the Global Personal Loans Market Towards Impressive CAGR of 10.4%.What Is The Projected Market Size Of The Personal Loans Global Market and Its Growth Rate?

The personal loans market has displayed impressive growth dynamics in recent years and is set to continue this trend. Key statistics include:

•Market worth of $774.58 billion in 2024.

•Expected growth to $855.13 billion in 2025 at a CAGR of 10.4%.

•Further growth expected to $1278.63 billion in 2029 at a CAGR of 10.6%.

What Is Driving The Growth In The Personal Loans Global Market Report 2025?

The growth of the personal loans market is primarily driven by the increased demand for lending channels. This increased demand refers to a stronger desire and need for various avenues through which individuals and businesses can access loans or credit. The growth of online lending platforms and fintech firms has led to a swell in demand for personal loan lending channels, allowing individuals to finance expenses, consolidate debt, or handle unexpected financial challenges without having to provide collateral. A key statistical highlight is the report from TransUnion, which indicates that total personal loan balances hit a record $192 billion in Q2 2022, marking a 31% rise from the previous year.

Request A Free Sample Copy:

https://www.thebusinessresearchcompany.com/sample.aspx?id=10789&type=smp

Who Are the Key Players Driving Personal Loans Global Market Report 2025 Growth?

The primary industry players driving the growth of the personal loans market include:

- Wells Fargo & Company

- Marcus by Goldman Sachs

- The Goldman Sachs Group Inc.

- Barclays PLC

- Truist Financial Corporation

- DBS Bank Ltd

- Discover Financial Services

- Citizens Financial Group Inc.

- Navy Federal Credit Union

- Rocket Loans

What Are The Key Trends In The Personal Loans Global Market Report 2025?

The personal loans market is expected to witness several key trends in the coming years, including:

- Digitalization of lending.

- Use of alternative data for credit scoring.

- Emergence of personalized loan products.

- Rise of peer-to-peer (P2P) lending.

- Focus on financial inclusion initiatives.

What Are The Segments Of The Global Personal Loans Global Market Report 2025?

The global personal loans market report is categorized into various segments including:

- By Type: P2P Marketplace Lending, Balance Sheet Lending.

- By Loan Tenure: Long Term Loans, Medium Term Loans, Short Term Loans.

- Tenure Period: Fewer than 2 Years, 2 Years To 4 Years, Over 4 Years.

- By Application: Debt Consolidation, Home Improvement, Education, Other Applications.

- By End User: Employed Individuals, Professionals, Students, Entrepreneur, Other End Users.

Which Region Leads The Personal Loans Global Market Report 2025?

North America held the largest share of the personal loans market in 2024. However, during the forecast period, Asia-Pacific is expected to emerge as the fastest-growing region. The personal loans market report covers other regions including Western Europe, Eastern Europe, South America, the Middle East, and Africa.

Pre-book the Report for Swift Delivery:

https://www.thebusinessresearchcompany.com/report/personal-loans-global-market-report

What Is Covered In The Personal Loans Global Market Report 2025 Global Market Report?

- Market Size Analysis: Analyze the Personal Loans Global Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Personal Loans Global Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Personal Loans Global Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Personal Loans Global Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Request Customisation for This Report:

https://www.thebusinessresearchcompany.com/customise?id=10789&type=smp

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Personal Loans Global Market Report 2025: Tremendous Growth Projected with CAGR of 10.4% and Key Emerging Trends here

News-ID: 3845052 • Views: …

More Releases from The Business Research Company

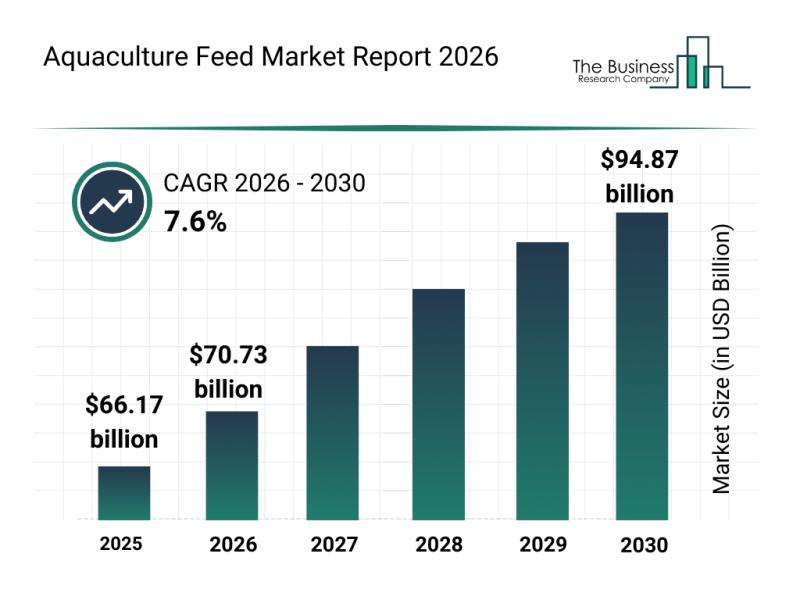

Competitive Analysis: Leading Companies and New Entrants in the Aquaculture Feed …

The aquaculture feed sector is poised for significant expansion in the coming years as it responds to evolving industry demands and sustainability goals. With advancements in feed formulations and growing investments in nutrition research, this market is set to experience remarkable growth by 2030. Below, we explore the market size projections, key players, trends shaping the industry, and detailed market segmentation.

Projected Growth and Market Size of the Aquaculture Feed Industry…

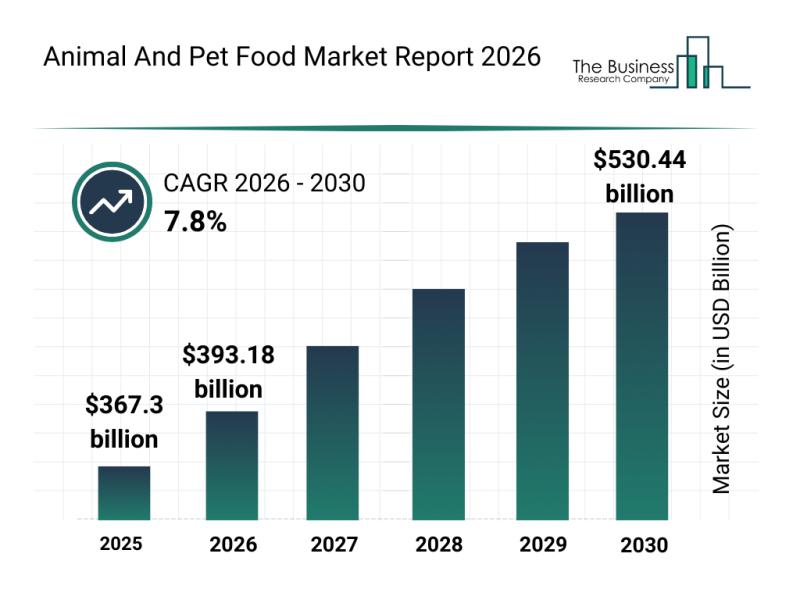

Future Perspectives: Key Trends Shaping the Animal and Pet Food Market Until 203 …

The animal and pet food market is on a trajectory of significant expansion, driven by evolving consumer preferences and advancements in nutrition science. As pet owners become more conscious of health and sustainability, the market is adapting with innovative products and ingredients. Below, we explore the market size, leading companies, emerging trends, and key segments shaping this vibrant industry.

Projected Market Size and Growth of the Animal and Pet Food Market…

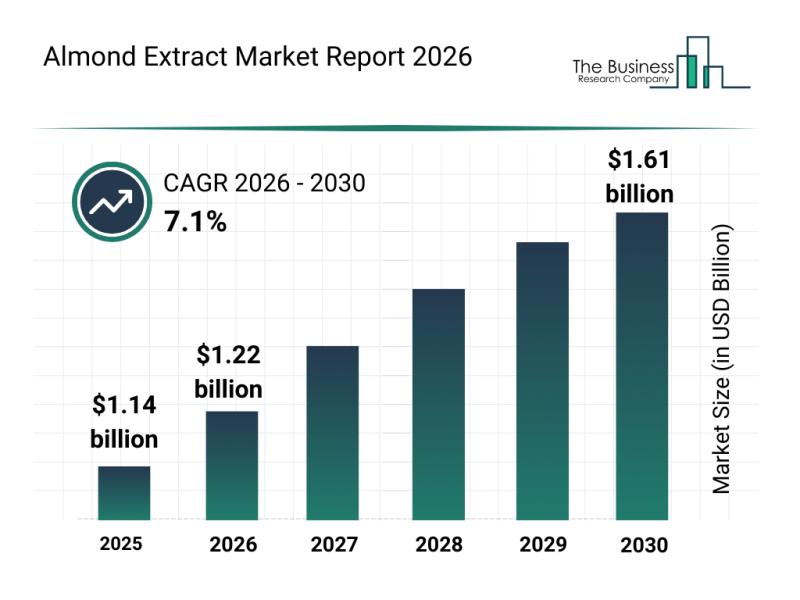

Segmentation, Major Trends, and Competitive Overview of the Almond Extract Marke …

The almond extract market is poised for significant expansion over the coming years, driven by evolving consumer preferences and innovative product offerings. This report delves into the market's expected growth, key players, and segmentation to provide a comprehensive understanding of its current landscape and future potential.

Projected Growth and Size of the Almond Extract Market by 2030

The almond extract market is forecasted to achieve substantial growth, reaching a value…

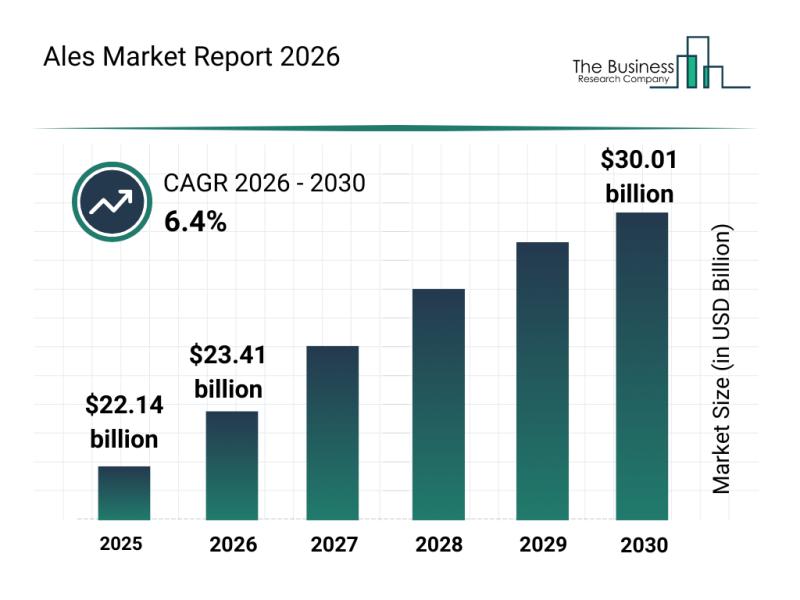

Competitive Landscape: Key Market Leaders and New Entrants in the Ales Market

The ales market is positioned for significant expansion in the coming years, driven by evolving consumer preferences and industry innovations. As demand for high-quality and unique alcoholic beverages grows, this sector continues to attract investment and creativity. Let's explore the market's size, key players, emerging trends, and the primary segments shaping its future.

Projected Growth and Size of the Ales Market by 2030

The ales market is anticipated to reach…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…