Press release

Rapid Upsurge in Global Remittance Market: Fueled by Overarching Trends and Emerging Players

"Surging to $832.57 Billion in 2025 and with an anticipated CAGR of 6.4%, the Global Remittance Market is set on a robust growth trajectory driven by dynamic market trends and enterprising key players.

What Is The Projected Market Size Of The Global Remittance Market And Its Growth Rate?

- The remittance market size is expected to grow from $782.54 billion in 2024 to $832.57 billion in 2025 at a compound annual growth rate (CAGR) of 6.4%.

- Factors such as global migration trends, labor mobility, and remittance corridor developments significantly contributed to the robust growth.

- Looking further, the market size is projected to reach $1067.54 billion in 2029 at a CAGR of 6.4%.

- Growth in the forecast period can be attributed to the advent of technology-enabled remittance services, government policies, economic factors, and greater access to banking services.

What Is Driving The Growth In The Remittance Market?

The growth in the remittance market is largely driven by the rise in overseas migration, a process marked by people moving across borders for work and living in a different country. This leads to a rise in remittance transactions as migrant workers send money back to their home countries. For example, according to the Australian Bureau of Statistics, the number of migrant arrivals in Australia saw a stark increase of approximately 170% from 146,000 in 2021 to 395,000 in 2022, underscoring the impact of rising overseas migration on the remittance market.

Request A Free Sample Copy:

https://www.thebusinessresearchcompany.com/sample.aspx?id=11909&type=smp

Who Are The Key Players Driving Remittance Market Growth?

The significant players contributing to the growth of the remittance market are:

- Ria Financial Services Ltd.

- The Kroger Co.

- JPMorgan Chase & Co.

- Citigroup Inc.

- Bank of America Corporation

- Wells Fargo & Company

- Banco Bradesco S.A.

- PayPal Inc.

- U.S. Bancorp

- Absa Group Limited

- UAE Exchange

- Western Union Holdings Inc.

- Instarem

- XE Money Transfer

- MoneyGram International Inc.

What Are The Key Trends In The Remittance Market?

Key trends shaping the remittance market include:

- Digital transformation

- Blockchain and cryptocurrency

- Regulatory changes

- Fintech disruption

- Mobile wallets and payments

What Are The Segments Of The Global Remittance Market?

The global remittance market can be broadly fragmented into the following segments:

- By Type: Inward Remittance, Outward Remittance

- By Channel: Banks, Money Transfer Operators, Online Platforms (Wallets)

- By Application: Consumption, Savings, Investment

- By End User: Business, Personal

Which Region Leads The Remittance Market?

In 2024, North America was the largest region in the remittance market. However, Asia-Pacific is projected to be the fastest-growing region in the forecast period. Other regions covered in the remittance market report include Western Europe, Eastern Europe, South America, the Middle East, and Africa.

Pre-book the Report for Swift Delivery:

https://www.thebusinessresearchcompany.com/report/remittance-global-market-report

What Is Covered In The Remittance Market Global Market Report?

- Market Size Analysis: Analyze the Remittance Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Remittance Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Remittance Market.

- Market Contribution: Evaluate contributions of different segments to the overall Remittance Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Remittance Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Request Customization for This Report:

https://www.thebusinessresearchcompany.com/customise?id=11909&type=smp

Learn More About The Business Research Company:

The Business Research Company offers over 15000+ reports across 27 industries spanning 60+ geographies. The firm's commitment to in-depth secondary research, combined with unique insights from industry leaders backed by 1,500,000 datasets, paves the way for comprehensive, data-rich research insights. Their flagship product, the Global Market Model (GMM), is an intelligent platform offering comprehensive and updated forecasts to bolster informed decision-making.

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rapid Upsurge in Global Remittance Market: Fueled by Overarching Trends and Emerging Players here

News-ID: 3837084 • Views: …

More Releases from The Business research company

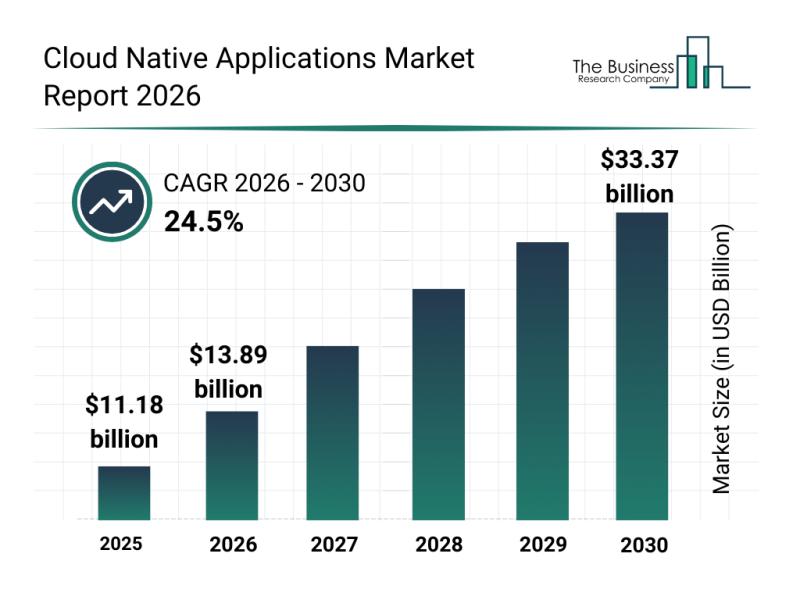

Analysis of Segments and Major Growth Areas in the Cloud Native Applications Mar …

The cloud native applications market is on track for significant expansion as businesses increasingly adopt cloud-first strategies and seek agility in software development. This sector is rapidly evolving with innovations that enable faster delivery, improved security, and seamless management of applications across diverse cloud environments. Let's explore the market's size projections, key players, trends driving growth, and important segmentations shaping its future.

Projected Size and Growth Trajectory of the Cloud Native…

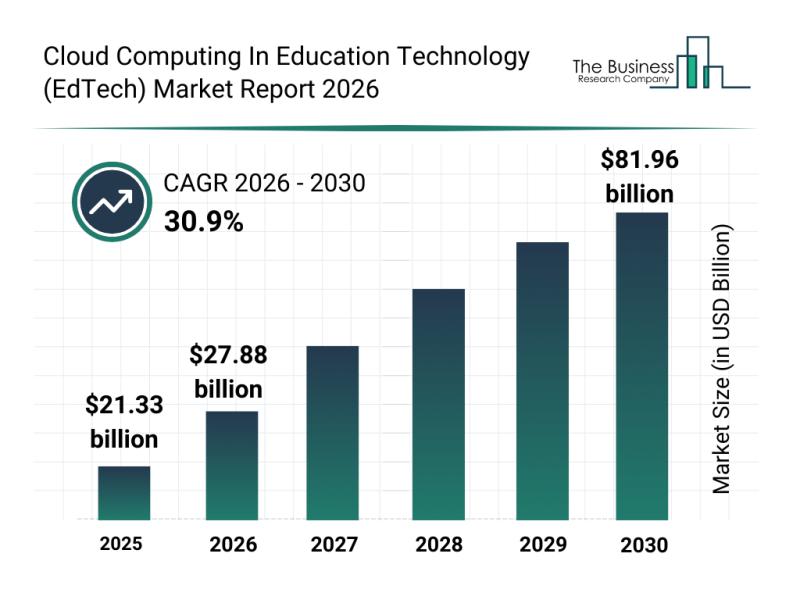

Key Strategic Developments and Emerging Changes Shaping the Cloud Computing Land …

The education technology sector is undergoing a remarkable transformation, largely fueled by the rapid adoption of cloud computing. As institutions embrace digital solutions, the integration of cloud-based tools is reshaping teaching and learning methods. This evolution promises significant market growth and new opportunities through 2030.

Cloud Computing in Education Technology Market Size and Growth Outlook

The cloud computing segment within education technology is projected to experience explosive growth, reaching a…

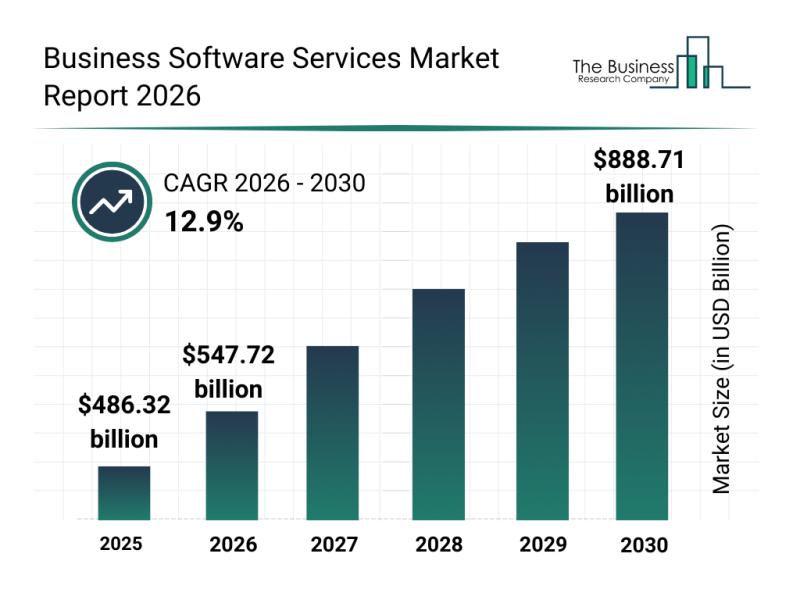

Leading Companies Fueling Growth and Innovation in the Business Software Service …

The business software services sector is on track for remarkable expansion as technological advancements and evolving enterprise needs drive demand. With innovations reshaping how companies operate, this market promises substantial growth and transformation by the end of the decade. Let's explore its current size, key players, emerging trends, and important market segments to understand where this industry is headed.

Projected Market Size and Growth Drivers in Business Software Services

The…

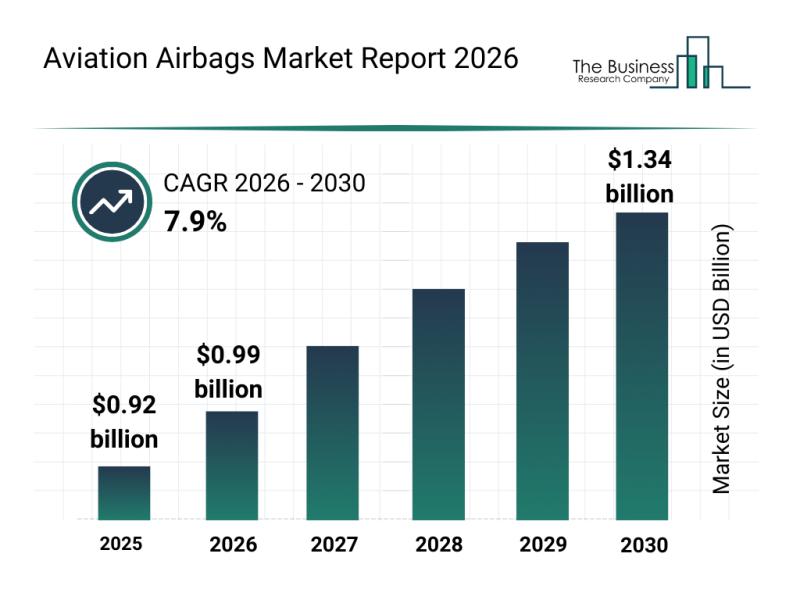

Aviation Airbags Market Overview: Major Segments, Strategic Developments, and Le …

The aviation airbags market is positioned for significant expansion as safety regulations tighten and air travel continues to increase globally. Innovations and evolving demands within the aviation sector are driving the development of advanced airbag technologies designed to improve passenger safety and aircraft integrity. Let's explore the market size projections, leading players, emerging trends, and detailed segment classifications shaping this industry's future.

Projected Growth and Market Size of the Aviation Airbags…

More Releases for Remittance

Mobile Remittance Service Market Report 2024 - Mobile Remittance Market Trends A …

"The Business Research Company recently released a comprehensive report on the Global Mobile Remittance Service Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The mobile remittance service…

The Rise of Digital Remittance: Transforming the Global Money Remittance Landsca …

The global remittance industry has made headlines recently, with stunning figures that defy expectations in the midst of a global pandemic and a war in Ukraine. Despite the economic turmoil caused by COVID-19, remittance flows to low- and middle-income nations (LMICs) have remained robust, quickly recovering from a brief dip at the outset of the crisis. In fact, certain nations saw significant increases in remittances during the pandemic, including Mexico,…

Asia-Pacific Digital Remittance Market by Remittance Type (Inward Digital Remitt …

Digital remittance involves the transfer of money by foreign migrants cross-border to another person via digital platforms. It serves as a latest service, which makes transferring funds easier, quicker, and enables remote sends. The remittance industry is shifting its focus on being digitally remastered. Factors such as growth in base of customers comfortable with using mobile devices in Asia-Pacific, rise in competition from new entrants, and margin pressures due to…

Asia-Pacific Digital Remittance Market by Remittance Type (Inward Digital Remitt …

Digital remittance involves the transfer of money by foreign migrants cross-border to another person via digital platforms. It serves as a latest service, which makes transferring funds easier, quicker, and enables remote sends. The remittance industry is shifting its focus on being digitally remastered. Factors such as growth in base of customers comfortable with using mobile devices in Asia-Pacific, rise in competition from new entrants, and margin pressures due to…

Asia-Pacific Digital Remittance Market by Remittance Type (Inward Digital Remitt …

Digital remittance involves the transfer of money by foreign migrants cross-border to another person via digital platforms. It serves as a latest service, which makes transferring funds easier, quicker, and enables remote sends. The remittance industry is shifting its focus on being digitally remastered. Factors such as growth in base of customers comfortable with using mobile devices in Asia-Pacific, rise in competition from new entrants, and margin pressures due to…

Asia-Pacific Digital Remittance Market by Remittance Type (Inward Digital Remitt …

According to a recent report published by Allied Market Research, titled, Asia-Pacific digital remittance market by Remittance Type, Remittance Channel, and End User: Global Opportunity Analysis and Industry Forecast, 2018-2025, the Asia-Pacific digital remittance market was valued at $31,234 million in 2016, and is projected to reach at $215,817 million by 2025, growing at a CAGR of 24.2% from 2018 to 2025.

Get the sample report: https://www.alliedmarketresearch.com/request-sample/4726

Rise in cross-border transactions &…