Press release

Asia-Pacific Digital Remittance Market by Remittance Type (Inward Digital Remittance, Outward Digital Remittance), Remittance Channel (Banks, Money Transfer Operators (MTOs), and Others), and End User (Business and Personal) - Global Opportunity Analysis

Digital remittance involves the transfer of money by foreign migrants cross-border to another person via digital platforms. It serves as a latest service, which makes transferring funds easier, quicker, and enables remote sends. The remittance industry is shifting its focus on being digitally remastered. Factors such as growth in base of customers comfortable with using mobile devices in Asia-Pacific, rise in competition from new entrants, and margin pressures due to a growing global consensus on lowering remittance transaction fees drive the penetration of digital channels. The Asia-Pacific digital remittance market size was valued at $31,234 million in 2016, and is projected to reach at $215,817 million by 2025, growing at a CAGR of 24.2% from 2018 to 2025.The money transfer operator segment dominated the overall market in 2016, and is expected to continue this trend in the near future, as a number of traditional money transfer operators are expanding their digital footprint in the Asia-Pacific region.

Download PDF Report Sample @ https://www.alliedmarketresearch.com/request-sample/4726?utm_source=OPR

The personal segment dominated the overall market in 2016, and is expected to continue this trend in the near future, owing to the introduction of bitcoin and other cryptocurrencies to introduce new mobile applications for migrant labor workforce as well as entry of start-ups and well-established companies in Asia-Pacific due to rise in number of migrant workers.

China dominated the overall market in 2016, due to the factors such as major shift towards digital or mobile payments from traditional banking and card infrastructure at an accelerating rate, rise in focus on the launch of electronic cross-boundary remittance services, ramp-up on wallets, and others. However, Singapore is expected to witness the highest growth rate during the forecasted period.

The report focuses on the growth prospects and restraints of the market based on the analysis of Asia-Pacific digital remittance market trends. The study provides Porters Five Forces analysis of the industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the growth of the market.

The Asia-pacific Digital Remittance Market is segmented into remittance type, remittance channel, end user, and country. Based on remittance type, the market is bifurcated into inward and outward digital remittance. On the basis of remittance channel, it is categorized into banks, money transfer operator, and others. By end user, it is divided into personal and business. Country wise, it is analyzed across China, Japan, India, Hong Kong, Singapore, Taiwan, Indonesia, and rest of Asia-Pacific.

The key players operating in the Asia-Pacific digital remittance market include InstaReM, Remitly, Inc., Flywire, SingX Pte Ltd., Azimo Limited, WorldRemit Ltd., TransferWise Ltd., Ripple, MoneyGram, and TNG Wallet.

Rise in cross-border transactions & mobile-based payment channels, reduced remittance cost & transfer time, and surge in adoption of banking & financial services act as the major drivers of the market. However, slowdown of the remittance industry in Asia-Pacific and lack of awareness towards the use of digital channels to remit money are expected to hamper the market growth during the forecast period.

Rise in cross-border transactions and increase in preference for mobile banking & mobile-based payment solutions dominate payment trends in Asia-Pacific, which are expected to drive the growth of the market. For instance, Malaysia is undergoing major shift from paper to electronic methods of payment to support initiatives taken by the Bank Negara Malaysia to accelerate migration to electronic payment. In addition, in December 2016, Malayan Banking Berhad (Maybank) and Western Union launched the first digital remittance service in Malaysia through its Maybank2u mobile banking app. The service allows Maybank customers to transfer money to more than 500,000 Western Union agent locations in over 200 countries.

Get Customized Report @ https://www.alliedmarketresearch.com/request-for-customization/4726?utm_source=OPR

Adoption of digital transfer network such as mobile phone technology, mobile money, digital currencies, distributed ledgers, electronic identification, and others to remit money has made cross-border payments negligible in cost, instant, auditable, and accessible to everyone. Adoption of digital remittance is projected to reduce the dependency on cash agents in both the sending and receiving countries, which currently contribute to sustaining high transaction fees. In addition, it is projected to address many risks, barriers, and costs associated with know-your-customer (KYC) and security.

The need for remittance services is on an increase, owing to the growth in adoption of banking and financial services. China and India have experienced the highest adoption rates of FinTech largely, being driven by financial innovation from technology-first players in adjacent sectors, high level of internet & mobile penetration, flexible regulatory environment, access to capital, and less competition from incumbents.

Analyst Review:

The remittance industry shifts its focus on being digitally remastered. Factors such as growth in base of customers comfortable with using mobile devices in Asia-Pacific, rise in competition from new entrants, and margin pressures due to growth in global consensus on lowering remittance transaction fees drive the penetration of digital channels. Existing remittance service providers in Asia-Pacific embrace digital channels to complement their existent services network whilst new entrants such as TerraPay focus on a pure mobile strategy to connect better with users and create greater business value. Numerous benefits of using digital channels for sending money such as high speed, availability of digital channels 24 hours a day, transparency, ease of use, high security, and others create numerous opportunities for the market.

Rise in penetration of digital wallets is expected to boost the Asia-Pacific digital remittance market growth. For instance, in Bangladesh, B-Kash operates 18M wallet accounts and processes an approximate USD 26M in daily transactions. Also, in Philippines around 12M mobile wallet accounts are active. The increase in penetration of international peer to peer transactions and mobile wallets can accelerate the pace of the shift. Due to which many remittance companies leverage the advantages offered by digital to cost-efficiently expand access in Asia-Pacific. For instance, G-Cash which is a leading mobile wallet service provider in Philippines with 47M customers and a 46% share of the mobile telephony market, launched a remittance-linked medical insurance scheme. Asia-Pacific digital remittance market is highly fragmented and competitive, owing to the presence of well-diversified international and regional vendors. However, continuous increase in presence of international vendors in this region impedes the growth of the small domestic players and makes the marketplace highly competitive. Although there is intense innovation, competition, and disruption in the digital remittance market, it has already experienced some consolidation. Furthermore, key players operating in this market adopt business expansion as their key developmental strategies. For instance, in May 2018, Azimo Ltd., a UK-based online money transfer company has raised $20 million by Japanese e-commerce company Rakuten to expand its presence in Asia.

Some of the key players profiled in the report include Amazon InstaReM, Remitly, Inc., Flywire, SingX Pte Ltd., Azimo Limited, WorldRemit Ltd, TransferWise Ltd, Ripple, MoneyGram, and TNG Wallet. These players have adopted various strategies to enhance their service offerings and to increase their market penetration. For instance, in April 2017, MoneyGram launched MoneyGram Sendbot, a smart and convenient platform that allows customers in the U.S. to send money transfers to any of its 350,000 locations.

Access Full Summery @ https://www.alliedmarketresearch.com/asia-pacific-digital-remittance-market?utm_source=OPR

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free (USA/Canada):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1?855?550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asia-Pacific Digital Remittance Market by Remittance Type (Inward Digital Remittance, Outward Digital Remittance), Remittance Channel (Banks, Money Transfer Operators (MTOs), and Others), and End User (Business and Personal) - Global Opportunity Analysis here

News-ID: 1453921 • Views: …

More Releases from Allied Market Research

Eyelash Serum Market Still Has Room to Grow | Grande Cosmetics LLC, JB Cosmetics …

According to a new report published by Allied Market Research, titled, "Eyelash Serum Market," The Eyelash Serum Market Size was valued at $752.10 million in 2020, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 5.7% from 2022 to 2031. There is an increase in number of social media users, owing to rise in internet penetration. Considering this, most key players in the eyelash serum…

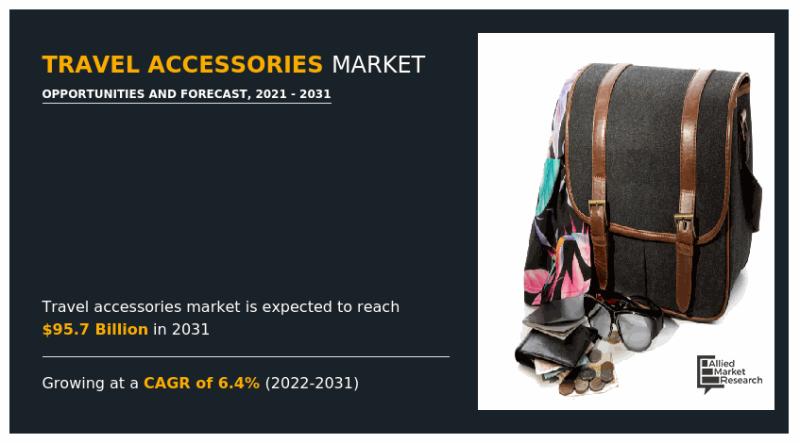

Travel Accessories Industry Performance Metrics: CAGR and USD Comparisons for Co …

Allied Market Research recently published a report, titled, "Travel Accessories Market by Type (Travel Bags, Electronic Accessories, Travel Pillow and Blanket, Toiletries, Others), by Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Factory Outlets, Online Stores, Others): Global Opportunity Analysis and Industry Forecast, 2021-2031". As per the report, the global travel accessories industry accounted for $48.2 billion in 2021, and is expected to reach $95.7 billion by 2031, growing at a…

Outdoor Kitchen Cabinets Market Dynamics: Exploring CAGR and USD Impacts on Indu …

According to the report published by Allied Market Research, the global outdoor kitchen cabinets market generated $2.9 billion in 2020, and is projected to reach $5.1 billion by 2030, growing at a CAGR of 5.8% from 2021 to 2030.The report provides an in-depth analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive scenario, and wavering market trends.

Increase in expenditure on luxury lifestyle…

Dermocosmetics Market Research Report : Unveiling CAGR and USD Projections for K …

The global dermocosmetics market size was valued at $51.10 billion in 2021, and is projected to reach $130.46 billion by 2030, growing at a CAGR of 11.1% from 2022 to 2030. Dermocosmetics is a combination of two medical branches i.e., cosmetics and dermatology. Dermocosmetics aids all beauty concerns such as oily skin, dry skin, skin conditions like pimples, acne, marks, blemishes, and others. Evolving role of cosmetics in skin care…

More Releases for Asia

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

South East Asia Business Jet Market And Top Key Players are Asia Corporate Jet, …

By 2022, the South East Asia Business Jet Markets estimated to reach US$ XX Mn, up from US$ XX Mn in 2016, growing at a CAGR of XX% during the forecast period. The Global Business Jet Market, currently at 21 million USD, contributes the highest share in the market and is poised to grow at the fastest rate in the future. The three broad categories of business jets are Small,…

LIXIL Asia Presents Asia Pacific Property Awards

Through its power brands GROHE and American Standard, LIXIL Asia signs a three-year deal to become the Headline Sponsor of the Asia Pacific Property Awards from 2019 until 2022.

23rd January 2019: The International Property Awards, first established in 1993, are open to residential and commercial property professionals from around the globe. They celebrate the highest levels of achievement by companies operating within the architecture, interior design, real estate and property…

PEOPLEWAVE WINS ASIA TECH PODCAST PITCHDECK ASIA 2019 AWARDS

15 January 2019, Singapore – Peoplewave, Asia’s leading data-driven HR technology company, won the Asia Tech Podcast (ATP) Pitchdeck Asia 2019 Awards, being awarded “Startup Most Likely to Succeed in 2019".

The 2019 Pitchdeck Asia Awards is an opportunity for the Asian Startup Ecosystem to shine a spotlight on some of its best startups. The awards were decided by a public vote. More than 7,200 votes were cast by registered LinkedIn…

Undersea Defence Technology Asia, UDT Asia 2011

Latest Military Diving Technologies featured in UDT Asia

Equipping Asia’s navies with the latest diving technology for asymmetric warfare and

operations

SINGAPORE, 17 October 2011 - Naval diving and underwater special operations is a field that is

seeing increased attention and investment amongst navies in Asia. Units such as the Indonesian Navy‟s KOPASKA, the Republic of Singapore Navy‟s Naval Diving Unit (NDU), the Royal Malaysian Navy‟s PASKAL are increasingly utilising specialised equipment for conducting…

Asia Diligence – Specialist Investigative Due Diligence for Asia & Beyond

Asia Diligence today announced the opening of its European Customer Services office in the United Kingdom. The office is to be managed by Steve Fowler and will focus on providing services to Asia Diligence’s European customers. Asia Diligence is also planning to open a US office in the near future, which will provide customer service to its US and North American clients.

Asked to comment on the move, Luke Palmer, the…