Press release

The End-of-Line Packaging Market A Growing Force in Manufacturing and Distribution

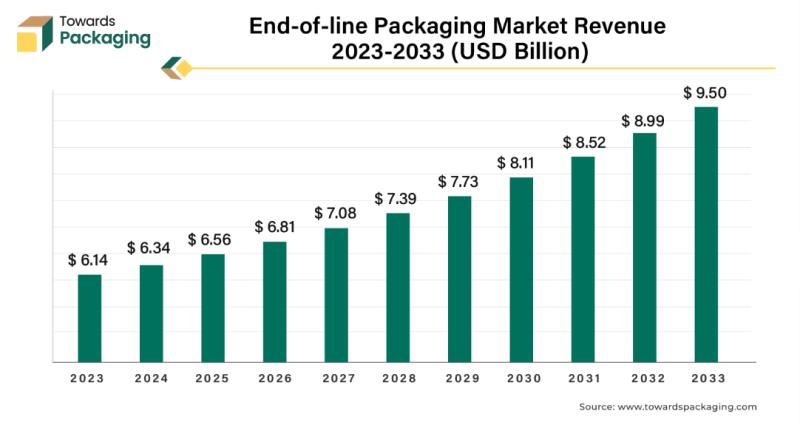

The global end-of-line (EOL) packaging market is experiencing significant momentum, with projections indicating that its value will soar from USD 6.14 billion in 2023 to USD 9.50 billion by 2033. This impressive growth reflects a compound annual growth rate (CAGR) of 4.60% from 2024 to 2033. As industries continue to adapt to rapidly changing market demands and evolving technologies, end-of-line packaging plays a pivotal role in the efficient, secure, and aesthetically appealing preparation of products for sale and distribution.Download Statistical Data: https://www.towardspackaging.com/download-statistics/5248

Understanding End-of-Line Packaging: A Critical Step in Product Preparation

End-of-line packaging refers to the final stages of product packaging, where goods, having completed their manufacturing process, are prepared for shipment or retail. This stage is crucial because it ensures that the product reaches consumers in pristine condition while also meeting regulatory, logistical, and marketing requirements. Several key procedures are involved in EOL packaging, including product inspection, cartoning or case packing, printing, labeling, sealing, and wrapping.

The nature of these processes can vary significantly depending on the scale of production and the specific characteristics of the products being packaged. In high-volume environments, the EOL packaging process is increasingly automated, incorporating robotics, conveyor belts, automated labeling systems, and other technologies to enhance efficiency. However, for smaller production lines or specialized products, manual operations may still be necessary, allowing for flexibility and precision where required.

Technological Advancements Driving Market Growth

A major factor propelling the growth of the end-of-line packaging market is the rising demand for automation across various industries. As labor shortages continue to affect many regions, businesses are turning to automated systems to streamline operations and reduce dependence on human resources. The integration of Industry 4.0 technologies, including robotics and the Internet of Things (IoT), is transforming end-of-line packaging processes, making them faster, more efficient, and more adaptable.

Robotic arms, automated sorting systems, and smart packaging solutions are among the innovations that are revolutionizing this sector. These advancements not only improve the speed and accuracy of packaging processes but also enable manufacturers to achieve higher levels of consistency and quality in their packaging, reducing the likelihood of errors and product defects.

Shifting Consumer Demands and the Expansion of E-Commerce

In addition to technological advancements, the growing demand for packaged food and beverages is another key driver of the end-of-line packaging market. As consumer preferences shift toward convenience and ready-to-eat solutions, the need for efficient and secure packaging has never been greater. The end-of-line packaging process must adapt to accommodate a variety of product types, from fragile items like glass bottles to bulkier goods like packaged snacks and beverages.

The rapid expansion of the e-commerce sector is also contributing to the demand for advanced end-of-line packaging solutions. As online shopping continues to dominate the retail landscape, manufacturers are under increasing pressure to ensure that products are packaged securely to withstand the rigors of transportation. Packaging plays a crucial role in minimizing damage during transit, ensuring that items arrive intact and in optimal condition for consumers.

The Role of Emerging Economies in Driving Market Adoption

The adoption of end-of-line packaging solutions is gaining significant traction in emerging economies, where the manufacturing sector is expanding at a rapid pace. These regions are increasingly investing in automation technologies to enhance production efficiency and meet the growing demand for packaged goods. With labor costs rising in some areas and the need for improved productivity, many manufacturers in developing countries are turning to end-of-line packaging solutions that offer both cost savings and operational flexibility.

Furthermore, as global supply chains become more complex, the importance of efficient end-of-line packaging is amplified. Companies across industries are recognizing the need for scalable and adaptable solutions that can support growth while meeting the specific needs of different product categories and market requirements.

Looking Ahead: The Future of End-of-Line Packaging

The global packaging industry, valued at USD 1.20 trillion in 2022, is expected to grow to USD 1.58 trillion by 2032, with a CAGR of 3.16%. This growth reflects a broader trend within the manufacturing and retail sectors, where packaging solutions are becoming increasingly critical to operational success. As consumer preferences evolve, and technological innovations continue to reshape the landscape, end-of-line packaging will remain a central focus for businesses aiming to stay competitive.

The future of the end-of-line packaging market holds significant promise, driven by automation, technological advancements, and an increasingly globalized marketplace. As manufacturers seek ways to enhance operational efficiency and reduce costs while meeting consumer demands for quality and sustainability, end-of-line packaging will continue to evolve and adapt. Companies that embrace these changes will be better positioned to thrive in a fast-paced and ever-changing global market.

Key Trends Shaping the Future of the Packaging Industry

The packaging industry is undergoing a transformative shift, driven by technological advancements, changing consumer demands, and evolving market dynamics. As manufacturers seek ways to improve efficiency, meet sustainability goals, and adapt to the challenges of a rapidly changing global landscape, several key trends have emerged that are reshaping the sector. From automation and digitalization to personalized products and regional growth patterns, these trends are paving the way for a new era of packaging innovation.

The Rise of Robotics in Packaging Automation

One of the most notable trends in the packaging industry is the growing reliance on automation, particularly through the use of robotics. As manufacturers continue to seek ways to enhance efficiency and reduce operational costs, automation has become a critical tool in optimizing the packaging process. Robotics, in particular, is being leveraged to improve overall equipment effectiveness (OEE), ensuring that packaging operations are running at peak performance.

The COVID-19 pandemic played a significant role in accelerating the adoption of fully automated systems. Faced with labor shortages and the need to minimize the risk of contamination, many manufacturers made substantial investments in robotics and automation. For instance, pick-and-place robots are increasingly being used in sectors such as pharmaceuticals and food processing to meet stringent quality standards, reduce contamination risks, and improve productivity. These robots offer unparalleled precision and speed, making them an indispensable part of modern packaging lines.

Industry 4.0: Revolutionizing the Packaging Sector

The packaging industry is also being transformed by the advent of Industry 4.0 technologies. This new industrial revolution is centered around the integration of smart technologies such as cloud computing, machine learning, big data, and machine vision, all of which are revolutionizing manufacturing processes. These technologies enable manufacturers to enhance operational efficiency, optimize production output, and reduce waste, all while improving product quality.

The shift towards Industry 4.0 allows for the digitalization of operations, offering manufacturers the ability to streamline processes, enhance flexibility, and save on operating costs. By implementing digitalization strategies, companies can tackle persistent issues like workforce shortages, offering solutions that increase productivity while reducing reliance on manual labor. As automation becomes more advanced and interconnected, manufacturers will be better equipped to meet the demands of an increasingly fast-paced and competitive market.

Personalized Packaging: A Growing Trend in Consumer Engagement

Another important trend in the packaging industry is the growing emphasis on personalized packaging. As consumer preferences become more diverse, manufacturers are turning to customized packaging solutions to better target specific customer groups. Personalized items are becoming increasingly popular, as they offer a way to engage with consumers on a deeper level and create a more tailored experience.

Examples of personalized packaging include soft drink cans with customers' names on them, small-batch pharmaceuticals designed for patients with specific genetic markers, and promotional packaging tied to high-profile events such as the World Cup or Super Bowl. This shift towards personalization not only caters to consumer desires for uniqueness but also helps brands differentiate themselves in a crowded marketplace. By offering personalized products and packaging, companies can foster stronger connections with consumers and enhance brand loyalty.

Regional Growth Drivers: Asia-Pacific and North America

The global packaging market is experiencing significant growth across various regions, with Asia-Pacific and North America emerging as key players in the sector.

Asia-Pacific, in particular, is expected to lead the charge with the fastest-growing compound annual growth rate (CAGR) of 6.32% during the forecast period. This growth is driven by a combination of factors, including the rapid expansion of manufacturing activities, increasing industrialization, and the growth of the e-commerce sector. Additionally, rising consumer demand for packaged goods is fueling the need for more efficient packaging solutions in the region. As emerging economies continue to develop and urbanize, the demand for packaged products is expected to rise, further propelling the growth of the packaging industry.

North America also holds a significant share of the global packaging market, accounting for 29.84% in 2023. The region benefits from a high adoption rate of advanced technologies and automation, which has helped optimize production processes and improve efficiency. Furthermore, North America is home to major e-commerce hubs and manufacturing centers, making it a key player in the global packaging landscape. Packaging regulations in the region also play a crucial role in shaping the market, as companies must adhere to strict standards to ensure product safety and compliance.

Looking Ahead: The Future of Packaging

As the packaging industry continues to evolve, it will be shaped by the ongoing integration of automation, digitalization, and personalization. These trends are not only enhancing efficiency and productivity but also driving innovation in product offerings. Manufacturers that embrace these changes will be better positioned to meet the growing demands of consumers while staying competitive in an increasingly globalized marketplace.

The growing adoption of robotics and Industry 4.0 technologies is expected to transform the way products are packaged, offering greater flexibility, higher quality, and reduced operational costs. Additionally, the rise of personalized packaging will allow brands to connect with consumers in more meaningful ways, creating unique and engaging experiences. With strong growth prospects in regions like Asia-Pacific and North America, the packaging industry is poised for continued expansion and innovation in the coming years. As these trends continue to unfold, the packaging industry will remain a critical component of global manufacturing and distribution networks, shaping the future of consumer goods around the world.

Key Segment Analysis of the End-of-Line Packaging Market

As the end-of-line (EOL) packaging market continues to evolve, various segments within the industry are experiencing significant growth, driven by advancements in technology and changing industry needs. The key segments within the market-categorized by technology and function-highlight the diverse approaches manufacturers are taking to meet the demands of modern packaging. Below, we delve deeper into the dynamics shaping these segments and the factors contributing to their growth.

Technology Segment: The Dominance of Automation

In 2023, the automatic technology segment held a commanding share of 58.16% of the end-of-line packaging market. This substantial market share reflects the growing shift towards automation in packaging operations across various industries. The trend towards fully automated packing systems is not just a passing phase; it represents a fundamental change in the way products are packaged and distributed.

Automated packaging systems offer a range of benefits that are driving their widespread adoption. One of the primary advantages is the significant increase in productivity. Unlike manual processes, which are dependent on human labor, automated systems can operate continuously, processing hundreds of items per minute. This increased speed translates to faster processing times and greater production capacity, which is particularly valuable in industries with high-volume production demands, such as food and beverages, pharmaceuticals, and consumer goods.

Moreover, automation reduces the dependency on human labor, leading to lower labor costs. As labor shortages and rising wages continue to challenge manufacturers, automating the packaging process presents a viable solution. Automated systems also ensure better quality consistency. With minimal human intervention, the risk of errors-such as placing the wrong quantity of products into packages-is drastically reduced, resulting in more precise and reliable packaging. This consistency in quality is crucial for maintaining brand reputation and consumer trust, particularly in industries where product safety is paramount, such as food, pharmaceuticals, and healthcare.

Given these advantages, the automatic segment is expected to experience robust growth in the coming years. As more industries seek to optimize their operations, reduce costs, and improve output, automation will remain a key driver of innovation in end-of-line packaging.

Function Segment: The Role of Stand-Alone Systems

In the function segment, the stand-alone category took a substantial share of 64.21% of the market in 2023. Stand-alone systems are typically automatic or semi-automatic machines that operate independently from the rest of the packaging line. These systems are highly valued for their flexibility and scalability, making them particularly appealing to new players in the packaging industry who may have limited capital to invest in larger, more complex systems.

For many manufacturers, stand-alone machinery offers a cost-effective way to integrate automation into their packaging processes. These systems can be configured to perform specific functions such as packing, labeling, capping, or filling, depending on the specific needs of the production line. In many cases, manufacturers may not require a fully automated end-to-end system but instead seek targeted solutions for one or more individual tasks. Stand-alone systems provide the flexibility to meet these needs without the need for a large-scale investment in a full automation suite.

Stand-alone machines are particularly useful in industries where flexibility and customization are important. For instance, smaller companies or those that produce a variety of products in smaller batches can benefit from stand-alone packaging solutions that can be easily reconfigured or upgraded as needed. Furthermore, stand-alone systems are adaptable across different sectors, including food and beverage, pharmaceuticals, cosmetics, and more. Whether it's labeling or case packing, manufacturers can select the stand-alone equipment that best suits the unique demands of their products.

The Growing Demand for Tailored Solutions

Both the automatic and stand-alone segments are witnessing increased demand for customized solutions that can address the specific needs of different industries. Manufacturers are now looking for ways to enhance efficiency, reduce operational costs, and ensure product quality-all of which are achievable through the use of advanced end-of-line packaging systems. While the automatic segment is geared towards high-volume, high-speed production environments, the stand-alone segment provides a more flexible and cost-effective solution for smaller operations or those with specialized packaging needs.

The shift toward automation and stand-alone systems is also influenced by broader trends in the manufacturing sector. As industries face increasing pressure to reduce operational costs and improve efficiency, the demand for packaging technologies that can streamline processes, minimize waste, and enhance production capacity is on the rise.

Looking Forward: The Future of End-of-Line Packaging

As the end-of-line packaging market continues to expand, both the automatic and stand-alone segments will play crucial roles in shaping the future of packaging. The automatic segment is set to lead the way in terms of innovation, driving higher productivity and quality consistency through advanced automation technologies. Meanwhile, the stand-alone segment will continue to provide manufacturers with flexible, cost-effective solutions that cater to a wide range of industry needs.

Source: https://www.towardspackaging.com/insights/end-of-line-packaging-market-sizing

Baner

Buy Premium Global Insight: https://www.towardspackaging.com/price/5248

Review the Full TOC for the End-of-line Packaging Market Report: https://www.towardspackaging.com/table-of-content/end-of-line-packaging-market-sizing

Get the latest insights on packaging industry segmentation with our Annual Membership - https://www.towardspackaging.com/get-an-annual-membership

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

Towards Healthcare: https://www.towardshealthcare.com

Towards Automotive: https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The End-of-Line Packaging Market A Growing Force in Manufacturing and Distribution here

News-ID: 3813554 • Views: …

More Releases from Towards Packaging

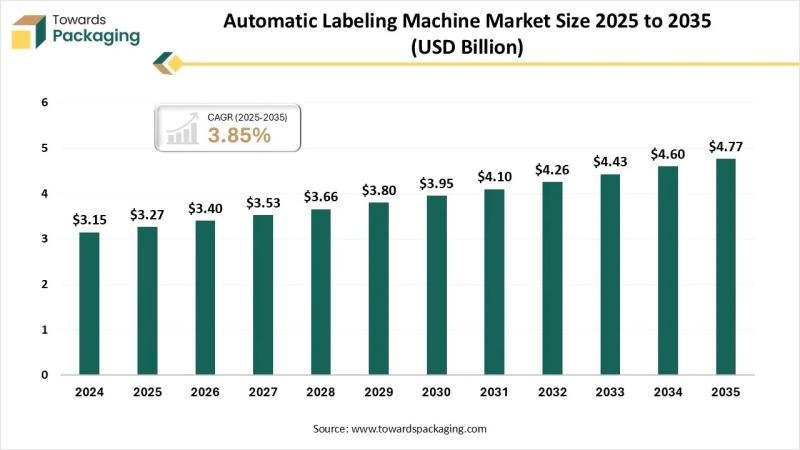

Automatic Labeling Machine Market Set for Strong Growth Through 2035

The global automatic labeling machine market is poised for steady expansion, rising from USD 3.4 billion in 2026 to USD 4.77 billion by 2035 at a CAGR of 3.85%. Demand is being driven by rapid automation in packaging lines, stringent labeling regulations, and the shift toward high-speed, error-free production across industries.

Download Sample: https://www.towardspackaging.com/download-sample/5882

Self-adhesive labeling systems currently hold the largest share at 39%, supported by their versatility and cost efficiency. Meanwhile,…

Unleashing Growth in the Liquid Packaging Market with Strategic Innovations

The liquid packaging industry is experiencing remarkable growth, with projections indicating an increase from USD 397.36 billion in 2025 to USD 645.43 billion by 2034. This growth, at a compound annual growth rate (CAGR) of 5.7%, signifies the expanding demand for liquid packaging solutions across a variety of sectors. As we delve into the market dynamics, it becomes clear that the liquid packaging sector is evolving rapidly, with several key…

Advancements in Hot-Fill Food Packaging Paving the Way for a Sustainable Future

The global hot-fill food packaging market is experiencing a steady rise, with an expected market value of USD 71.26 billion by 2033, up from USD 49.85 billion in 2023. This growth is projected to follow a compound annual growth rate (CAGR) of 3.76% from 2024 to 2033, reflecting the increasing demand for innovative packaging solutions in the food and beverage sector.

Download a Brochure of Hot-fill Food Packaging Market: https://www.towardspackaging.com/download-brochure/5266

Hot-Fill…

Driving Growth and Innovation in the Plastic Bag Market

The plastic bag market is undergoing significant growth, with its value reaching an estimated US$ 25.10 billion in 2023. Projections suggest that this market could hit a substantial US$ 35.41 billion by 2033, marking a steady compound annual growth rate (CAGR) of 3.5% from 2024 to 2034. This growth is largely driven by the expanding needs of various industries for efficient and cost-effective packaging solutions.

Download a Brochure of Plastic Bag…

More Releases for Industry

Hydro Lubricants Market Size, Analysis, and Forecast Report 2018 to 2026(By Indu …

The rising demand for hydro lubricants from manufacturing sector is also multiplying at a faster rate, on the back of their competency in upgrading the service-life of machinery. The hydro lubricants market is primarily driven on account of its low-friction attributes, which makes it highly likely to outshine the synthetic variants. Moreover, the demand for hydro lubricants for machinery assemblies is on the rise, as they facilitate in minimizing…

Hydro Lubricants Market Insights, Trends & Future Development Status Recorded du …

The rising demand for hydro lubricants from manufacturing sector is also multiplying at a faster rate, on the back of their competency in upgrading the service-life of machinery. The hydro lubricants market is primarily driven on account of its low-friction attributes, which makes it highly likely to outshine the synthetic variants. Moreover, the demand for hydro lubricants for machinery assemblies is on the rise, as they facilitate in minimizing…

Global Pyrite Market 2019 | Applications: Jewelry Industry, Sulfur Compounds Ind …

The major factor driving the pyrite market is the rising demand of jewelry and sulfur compounds market. This report researches the worldwide Pyrite market size (value, capacity, production, and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions. This study categorizes the global Pyrite breakdown data by manufacturers, region, type, and application, also analyzes the market status, market share, growth rate, future trends, market…

Lipase Enzymes Market Future Forecast Indicates Impressive Growth Rate (Segmenta …

Market Outlook

Increased consumption of processed food and dairy products among consumers has fuelled the demand and supply of lipase enzymes over the years. Lipase is an enzyme that catalyzes the hydrolytic reaction of fats, and reduces the formation of glycerol and fatty acids in all living organisms. It plays a vital role in the process of digestion by transporting and processing the ester bonds in triglycerides. Due to the varied…

Big Bag Connection System Market Segmented By technology Automatic, Semi-Automat …

Global Big Bag Connection System Market: An Overview

The key advancement in automation encourages manufacturers to adopt smart systems to increase productivity and to facilitate timely production. Owing to the perception of consumers as well as manufacturers regarding health and hygiene of product, the big bag connection system market is anticipated to propel during the forecast period. Big bag connection system ensure dust -free docking of big bags and provide flexibility…

Europe Plastic Pallet Market Size, Shares, Forecast Report 2016 : Food Industry, …

This report studies sales (consumption) of Plastic Pallet in Europe market, especially in Germany, UK, France, Russia, Italy, Benelux and Spain, focuses on top players in these countries, with sales, price, revenue and market share for each player in these Countries, covering

ShangHai Pallet Plastic Industry Co., Ltd.

Shanghai Lika Plastic Manufacturing Co., Ltd.

Guangzhou Plastic Industrial Corporation Ltd

Shandong Liyang Plastic Molding Co.,Ltd

Xinding Plastic

ZheJiang Primacy Plastic Industry Co., Ltd

Shanghai Qinghao Plastic Pallet Manufacture…