Press release

Thin Wall Packaging Market: A Growing Trend in Efficiency and Sustainability

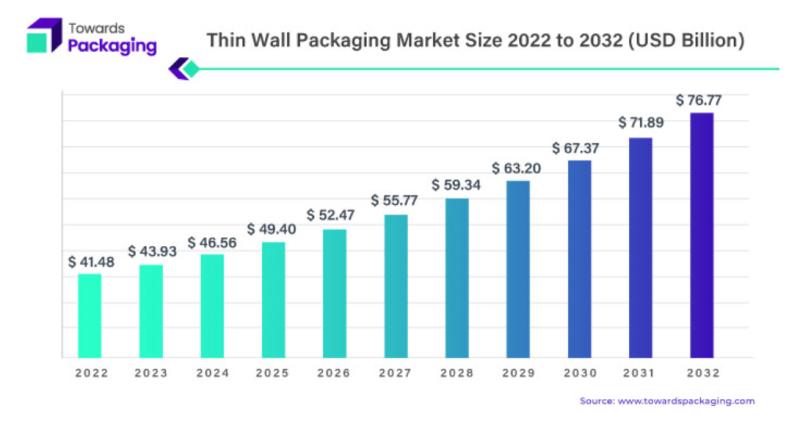

The global thin wall packaging market is on a fast track to significant growth, with the market size projected to soar from USD 41.48 billion in 2022 to an estimated USD 76.77 billion by 2032. This remarkable growth is anticipated to occur at a compound annual growth rate (CAGR) of 6.4% between 2023 and 2032, making thin wall packaging one of the most dynamic segments in the broader packaging industry.A Shift Towards Lightweight, Sustainable Solutions

At the heart of this growth is the growing demand for lightweight and eco-friendly packaging solutions. Thin wall packaging refers to the production and sale of containers and materials that feature an incredibly thin yet strong design. This design is primarily made from plastics, such as polyethylene terephthalate (PET) and polypropylene (PP), which are known for their durability, flexibility, and cost-effectiveness. These packaging solutions are especially prevalent in sectors such as food and beverage, cosmetics, pharmaceuticals, and household goods, where lightweight packaging is highly valued.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5097

One of the main drivers behind the surge in thin wall packaging demand is its contribution to sustainability. With the world increasingly focused on environmental issues, industries are seeking ways to reduce their carbon footprint. Thin wall packaging significantly reduces plastic consumption due to its lighter weight, which in turn decreases transportation energy costs. Additionally, these packaging solutions help reduce the overall environmental impact by optimizing material use, making them an attractive choice for brands aiming to meet eco-conscious consumer preferences.

Global Market Dynamics: Key Players and Regional Insights

The thin wall packaging market is experiencing substantial growth in different regions, with Asia Pacific leading the charge. The region is committed to sustainable packaging solutions, accounting for approximately 43% of the global market share. This commitment reflects a broader regional effort to adopt eco-friendly practices in various industries, from food packaging to consumer goods.

North America also plays a significant role in the global thin wall packaging market, contributing around 30% of the market share. The North American region is known for its advanced technological innovations and strong consumer demand for sustainable packaging options, which is driving the widespread adoption of thin wall packaging solutions.

The Rise of Polypropylene in Thin Wall Packaging

Polypropylene (PP) is emerging as a key material in the thin wall packaging market. As one of the most commonly used polymers in packaging, polypropylene is praised for its lightweight, cost-effective, and durable properties. Over 40% of global polypropylene consumption is attributed to packaging, and the use of PP in rigid packaging is growing annually at a rate of over 8%. This growth is partly driven by the increasing shift from other types of plastics to polypropylene, thanks to its versatility and superior performance in thin wall applications.

The success of polypropylene is underscored by the material's position as one of the leading drivers of the packaging market. Thin wall packaging, particularly those made from polypropylene, provides an ideal solution to meet the growing demand for sustainable, efficient, and affordable packaging options.

The Dominance of Thin Wall Boxes in Dynamic Packaging Solutions

Among the many thin wall packaging solutions, thin wall boxes are taking the lead. These lightweight, space-efficient boxes are used extensively in various sectors, particularly in food and beverage packaging, as well as in other consumer goods. Thin wall boxes offer several advantages, including lower material costs, faster production times, and reduced waste, making them an essential component of modern packaging strategies.

The food and beverage sector, in particular, has embraced thin wall packaging solutions, especially for dairy products and frozen foods. The ability to keep products fresh while reducing material waste aligns with growing consumer demands for convenience, efficiency, and sustainability. As the market for ready-to-eat and on-the-go products continues to expand, the role of thin wall packaging in these industries is expected to become even more crucial.

A Bright Future for Thin Wall Packaging

The thin wall packaging market's growth is not just a result of consumer demand for lighter, more sustainable packaging, but also a broader trend toward improving operational efficiencies across the supply chain. As industries continue to prioritize sustainability, thin wall packaging offers an ideal solution that reduces both environmental impact and cost. The ongoing shift from traditional packaging materials to lightweight plastic solutions marks a pivotal moment for the industry.

As we look to the future, the thin wall packaging market is poised to continue its upward trajectory. With innovations in materials, manufacturing processes, and design, thin wall packaging will likely become a cornerstone of global packaging solutions, contributing to sustainability goals and operational efficiencies alike. The increasing emphasis on sustainable packaging, especially within the food and beverage industries, positions thin wall packaging as a key player in the transition towards a more eco-friendly and cost-effective packaging landscape.

In conclusion, the rise of thin wall packaging is not just a market trend but a transformative force in the global packaging industry, driven by sustainability, cost efficiency, and the ongoing demand for innovative packaging solutions. As the market continues to expand, thin wall packaging is set to play an integral role in shaping the future of packaging, offering both environmental benefits and operational advantages for businesses worldwide.

Trends in Thin Wall Packaging

• Advancements in Material Technology

Ongoing innovations in materials science are shaping the future of thin wall packaging. The development of high-performance, lightweight materials with enhanced barrier properties improves product protection, extends shelf life, and meets evolving consumer demands for sustainability and efficiency.

• E-commerce Packaging Optimization

With the rise of e-commerce, thin wall packaging is evolving to meet the unique needs of online retail. The focus is on creating packaging solutions that provide a balance of protection, visual appeal, and cost-effectiveness, while minimizing environmental impact during transit.

• Customization and Branding

As e-commerce continues to grow, packaging is becoming an essential tool for brand identity and consumer experience. Thin wall packaging is being tailored to provide customization options that support branding, while ensuring that the packaging is both functional and aesthetically appealing in the online shopping context.

• Sustainable Packaging Mandate

The drive for sustainability is a significant influence on thin wall packaging trends. In response to consumer preferences and regulatory requirements, companies are increasingly adopting eco-friendly materials and practices. The focus is on reducing material usage, improving recyclability, and positioning thin wall packaging as a leader in meeting sustainability goals.

Asia-Pacific's Commitment to Sustainable Thin Wall Packaging Solutions: Leading the Way in Circular Economy Transition

The Asia-Pacific (APAC) region has long held a dominant position in the global plastics industry, accounting for over half of the world's plastic production. In 2023, the region was responsible for 51% of the total global plastic output, which amounts to a staggering 390.7 million metric tons. This concentration of plastic production highlights the crucial role the APAC region plays in the evolution of packaging solutions worldwide. As one of the leading hubs for plastic manufacturing, the region is now increasingly driving the shift towards a circular economy, particularly within the thin wall packaging sector.

China and India: Key Players in the Plastic Packaging Market

China, which produces 31% of the world's plastics, stands at the forefront of this transition. The country's vast consumer base, particularly in the packaging sector, has fueled a surging demand for plastic packaging. Alongside China, India also represents a major market for plastic packaging in APAC, benefiting from growing consumer demand for packaged goods and products. Japan and other Asian nations contribute significantly, with Japan alone accounting for 3% of global plastic production, and the rest of Asia adding 16% to the global total. The single-use plastic packaging market in APAC is expected to grow at a robust compound annual growth rate (CAGR) of 5.66% until 2030, cementing the region's ongoing influence in the global packaging industry.

China's Commitment to Environmental Sustainability

China has made significant strides in environmental sustainability, as evidenced by its comprehensive five-year action plan introduced in 2021. This plan is designed to reduce plastic pollution, focusing on banning non-biodegradable plastic bags in supermarkets, shopping malls, and food delivery services. This initiative signals a larger shift towards environmentally conscious plastic consumption across the country. These efforts in China, combined with a broader regional focus on sustainable packaging, are helping to position APAC as a leader in the global transition towards more responsible plastic use.

Sustainability and the Growth of Thin Wall Packaging

The increasing emphasis on sustainability has spurred the growth of thin wall packaging, which is lightweight, durable, and environmentally friendly. In APAC, growing affluence, an expanding middle class, and increased trade activities have driven the demand for thin wall packaging, especially for products like food and beverages. Consumers' shift towards ready-to-consume products has contributed further to the market's expansion.

In line with this trend, Cosmo Films, a prominent Asian packaging manufacturer, launched its new business, Cosmo Plastech, in October 2023. This initiative focuses on offering thin wall sheets and containers, aligning with the growing demand for sustainable packaging solutions in the region.

North America: A Strong Contributor to the Thin Wall Packaging Revolution

While APAC leads the charge in plastic production, North America, particularly the United States, remains a significant player in the thin wall packaging market. The U.S. produced 36.7 million tonnes of plastics in 2022, contributing to 12.2% of municipal solid waste (MSW). This significant volume underscores North America's pivotal role in the global plastic packaging industry.

A major area of focus for North America is developing end-of-life solutions for plastic products, especially in the context of thin wall packaging. The region has made strides in fostering a circular economy, aiming to repurpose spent plastics into new materials. This shift towards recycling and sustainability is crucial in reducing the environmental impact of plastic waste. For instance, approximately 60% of North American plastic production remains within the region, with a significant portion directed toward manufacturing durable goods. With the increasing focus on sustainability, North America's commitment to circular economy principles is shaping the future of the thin wall packaging market.

In January 2023, Sustain Pac and PulPac joined forces to provide Dry Moulded Fibre packaging materials for North America's quick-service restaurant (QSR) market. This partnership exemplifies the region's growing emphasis on eco-friendly packaging solutions for everyday industries.

Polypropylene: The Future of Thin Wall Packaging

Polypropylene (PP) has emerged as one of the most popular materials for thin wall packaging due to its lightweight and affordable nature. PP containers are gaining popularity for their sustainability and hygiene, making them an ideal choice for the food industry. With the help of Thin Wall Injection Molding (TWIM) processes, PP containers are not only versatile but also freezer- and microwave-safe, making them suitable for a wide range of food storage applications.

In Europe, where plastic accounts for approximately 40% of packaging demand, concerns over disposable packaging materials and limited recyclability have led to a growing need for sustainable packaging solutions. Many plastic products end up as marine litter, which further emphasizes the need for responsible waste management and improved recyclability. The adoption of PP containers, which are lighter, more affordable, and reusable, addresses both sustainability and hygiene concerns, offering a potential solution to the growing environmental challenges in Europe.

In September 2023, Sabic collaborated on a bio-sourced in-mould labelling solution, producing mono-PP thin wall containers with in-mould branding through an integrated single-step injection molding process. This innovative approach showcases the potential for enhancing sustainability while improving branding capabilities in the packaging industry.

The Rise of Thin Wall Boxes: Versatility Meets Sustainability

Among the various thin wall packaging products, thin wall boxes have risen to prominence due to their versatility, practicality, and widespread application across different industries. These boxes, typically made from PP through the Thin Wall Injection Molding (TWIM) process, offer a lightweight yet robust solution for packaging a variety of products, including food, consumer goods, and electronics.

In October 2023, Netstal introduced a lightweight ICM thin wall cup made entirely of PP. The popularity of thin wall boxes is driven by their cost-effectiveness, ease of manufacturing, and ability to accommodate complex designs. These boxes efficiently combine durability with material reduction, helping businesses optimize space and reduce transportation costs. Furthermore, thin wall boxes align with sustainability goals by contributing to the reduction of packaging waste and enhancing the overall environmental impact of packaging solutions.

Expanding Applications: Thin Wall Packaging in Dairy, Frozen Foods, and Beyond

The versatility of thin wall packaging is evident in its broad adoption across the food and beverage industry. Thin wall containers are increasingly used for dairy products, frozen foods, fruits, vegetables, bakery items, ready meals, juices, soups, and meats. The lightweight nature of thin wall packaging also makes it an ideal replacement for heavier packaging materials like glass and metal, which are often prone to breakage and require more resources to transport.

In October 2022, OQ, an Oman-based company, expanded its product line with the introduction of Luban HP2151T, a high-flow reactor-grade PP homopolymer designed specifically for thin wall packaging applications. This highlights the growing demand for high-quality materials tailored for specific packaging needs.

Furthermore, thin wall packaging is also gaining traction in the non-food sector, with open-top containers and lids being used across industries like cosmetics, pharmaceuticals, and paint. These containers provide an adaptable, sustainable packaging solution that meets the specific needs of diverse products.

Competitive Landscape and Key Developments

• The thin wall packaging market is highly competitive, with several key players shaping its development. Major companies such as Amcor, Greiner Packaging, Berry Global, Sem Plastik, and Plastipak Industries are focused on innovation, product development, and expanding their market presence. These companies are driving the evolution of the thin wall packaging sector through mergers, acquisitions, and collaborations.

• Recent developments in the sector include the October 2023 acquisition of Bergen Plastics AS and Heger AS by Skanem AS, and the June 2022 collaboration between Heinz, Tesco, and Berry Global to recycle soft plastics. These developments underscore the industry's commitment to sustainability and circular economy principles.

Source: https://www.towardspackaging.com/insights/thin-wall-packaging-market-size

Baner

Buy Premium Global Insight: https://www.towardspackaging.com/price/5097

Review the Full TOC for the Thin Wall Packaging Market Report: https://www.towardspackaging.com/table-of-content/thin-wall-packaging-market-size

Get the latest insights on packaging industry segmentation with our Annual Membership - https://www.towardspackaging.com/get-an-annual-membership

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

Towards Healthcare: https://www.towardshealthcare.com

Towards Automotive: https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Thin Wall Packaging Market: A Growing Trend in Efficiency and Sustainability here

News-ID: 3803033 • Views: …

More Releases from Towards Packaging

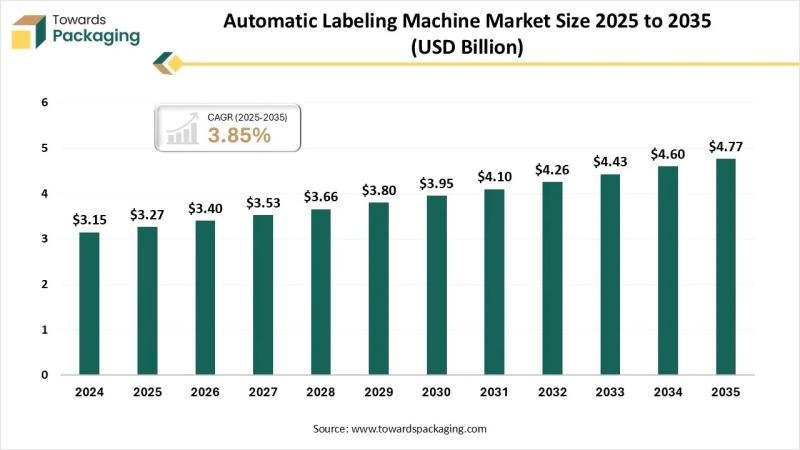

Automatic Labeling Machine Market Set for Strong Growth Through 2035

The global automatic labeling machine market is poised for steady expansion, rising from USD 3.4 billion in 2026 to USD 4.77 billion by 2035 at a CAGR of 3.85%. Demand is being driven by rapid automation in packaging lines, stringent labeling regulations, and the shift toward high-speed, error-free production across industries.

Download Sample: https://www.towardspackaging.com/download-sample/5882

Self-adhesive labeling systems currently hold the largest share at 39%, supported by their versatility and cost efficiency. Meanwhile,…

Unleashing Growth in the Liquid Packaging Market with Strategic Innovations

The liquid packaging industry is experiencing remarkable growth, with projections indicating an increase from USD 397.36 billion in 2025 to USD 645.43 billion by 2034. This growth, at a compound annual growth rate (CAGR) of 5.7%, signifies the expanding demand for liquid packaging solutions across a variety of sectors. As we delve into the market dynamics, it becomes clear that the liquid packaging sector is evolving rapidly, with several key…

Advancements in Hot-Fill Food Packaging Paving the Way for a Sustainable Future

The global hot-fill food packaging market is experiencing a steady rise, with an expected market value of USD 71.26 billion by 2033, up from USD 49.85 billion in 2023. This growth is projected to follow a compound annual growth rate (CAGR) of 3.76% from 2024 to 2033, reflecting the increasing demand for innovative packaging solutions in the food and beverage sector.

Download a Brochure of Hot-fill Food Packaging Market: https://www.towardspackaging.com/download-brochure/5266

Hot-Fill…

Driving Growth and Innovation in the Plastic Bag Market

The plastic bag market is undergoing significant growth, with its value reaching an estimated US$ 25.10 billion in 2023. Projections suggest that this market could hit a substantial US$ 35.41 billion by 2033, marking a steady compound annual growth rate (CAGR) of 3.5% from 2024 to 2034. This growth is largely driven by the expanding needs of various industries for efficient and cost-effective packaging solutions.

Download a Brochure of Plastic Bag…

More Releases for Pac

Global Industrial PAC Market Research Report 2023-2029

Global Leading Market Research Publisher QYResearch announces the release of its latest report "Global Industrial PAC Market Report, History and Forecast 2018-2029, Breakdown Data by Manufacturers, Key Regions, Types and Application". Based on current situation and impact historical analysis (2018-2022) and forecast calculations (2023-2029), this report provides a comprehensive analysis of the global Industrial PAC market, including market size, share, demand, industry development status, and forecasts for the next few…

Insulated Box Liner Market 2031 Space Information | Key Players: Sealed Air Corp …

The New Report "Insulated Box Liner Market" published by Fact.MR, covers the competitive landscape analysis and its growth prospects over the coming years. An in-depth study of some new and prominent industry trends, analysis of engagement, and regional analysis that is very detailed have been included in the report of the Insulated Box Liner market for the analysis period of 2021 – 2031.

Get In-depth Insights Request for Sample here: https://www.factmr.com/connectus/sample?flag=S&rep_id=3950…

Polyanionic Cellulose (PAC) Market 2021 | Detailed Report

According to Market Study Report, Polyanionic Cellulose (PAC) Market provides a comprehensive analysis of the Polyanionic Cellulose (PAC) Market segments, including their dynamics, size, growth, regulatory requirements, competitive landscape, and emerging opportunities of global industry. An exclusive data offered in this report is collected by research and industry experts team.

Get Free Sample PDF (including full TOC, Tables and Figures) of Polyanionic Cellulose (PAC) Market @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=4196236

The report provides a…

PAC Pallets For Bricks, block & Paver

We are the leading manufacturer of Fly Ash Brick Pallet. We are manufacturing from 12mm to 21mm thickness as per parties requirements in good quality and at economical cost.

Rajratan Industries Private Limited: PAC board manufacturer in Indore | Fly Ash Brick Pallet Udaipur| PVC Block Pallet In Pune| Paver Block Pallet In Indore| Plastic Brick Pallet In Indore| Composite Brick Pallet In Indore| PVC Pallet In Indore | Fork Lift…

PAC Programming Software Market Is Booming Worldwide|

The report titled “Global PAC Programming Software Market Size, Status and Forecast 2019-2025” summaries topmost manufactures like (Schneider Electric, Opto 22, AutomationDirect, Mitsubishi Electric Corporation, Siemens AG, KINGSTAR, ABB Ltd., Panasonic Electric Works Europe AG, Lamonde Automation Ltd., Phoenix Contact (I) Pvt. Ltd.) in United States, Europe, Japan, Asia pacific and China, this report investigates and analyzes the Company Profiles, Product Picture and Specification, Capacity, Production, Price, Cost, Revenue. The primary section…

Contour Pouches Market By Top KEy Players- Omniplast, SWISS PAC PVT LTD, Smart P …

"Contour Pouches Market: Global Industry Analysis 2013-2017 and Opportunity Assessment 2018-2028" recent intelligence study by MarketResearchReports.Biz.

Global Contour Pouches – Market Overview:

In recent years there has been an increase in the usage of pouches and is expected to grow over the forecast period. The contour pouch has an unusual shape and is highly recognizable. It is suitable for products and industries which have very high demands on functionality and aesthetics. The…