Press release

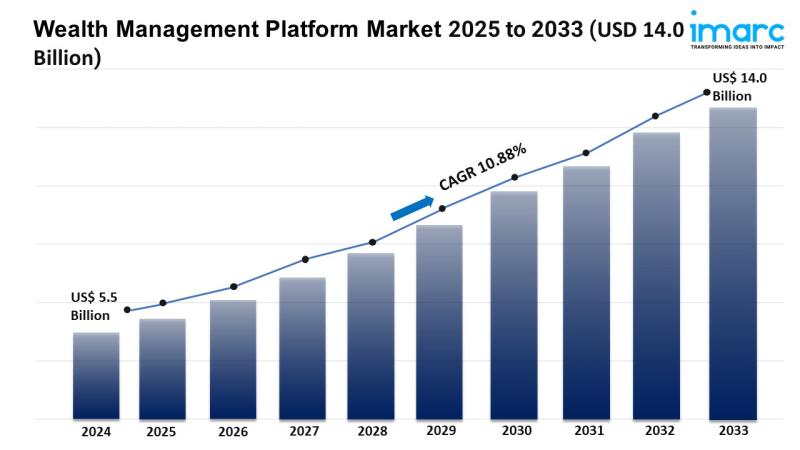

Wealth Management Platform Market Size Worth USD 14.0 Billion by 2033 | Grow CAGR by 10.88%

𝐆𝐥𝐨𝐛𝐚𝐥 𝐖𝐞𝐚𝐥𝐭𝐡 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲: 𝐊𝐞𝐲 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐜𝐬 𝐚𝐧𝐝 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐢𝐧 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟑𝐒𝐮𝐦𝐦𝐚𝐫𝐲:

● The global wealth management platform market size reached USD 5.5 Billion in 2024.

● The market is expected to reach USD 14.0 Billion by 2033, exhibiting a growth rate (CAGR) of 10.88% during 2025-2033.

● North America leads the market, accounting for the largest wealth management platform market share.

● Human advisory accounts for the majority of the market share in the advisory model segment, as they offer tailored strategies, emotional intelligence, and trust, which are difficult to replicate with automated or robo-advisory models.

● Cloud-based holds the largest share in the wealth management platform industry.

● On the basis of the business function, the market has been classified into reporting, performance management, financial advice management, risk and compliance management, portfolio, accounting and trading management, and others.

● Based on the enterprise size, the market has been bifurcated into large enterprises and small and medium-sized enterprises.

● Banks represent the largest market. The rising affluent population is a primary driver of the wealth management platform market.

● The increasing focus on digital transformation is reshaping the wealth management platform market.

𝐆𝐫𝐚𝐛 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/wealth-management-platform-market/requestsample

𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐓𝐫𝐞𝐧𝐝𝐬 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞𝐫𝐬:

● 𝐆𝐫𝐨𝐰𝐢𝐧𝐠 𝐚𝐟𝐟𝐥𝐮𝐞𝐧𝐭 𝐩𝐨𝐩𝐮𝐥𝐚𝐭𝐢𝐨𝐧:

As the number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) is increasing, there is a rise in the demand for advanced wealth management services. These individuals often seek personalized investment strategies, estate planning, and tax optimization, driving the need for sophisticated wealth management platforms that can offer these services. The accumulation of wealth among the affluent population leads to an increase in assets under management (AUM). Wealth management platforms are essential for managing larger portfolios, tracking investments, and optimizing returns for high-value clients. Affluent individuals expect tailored financial solutions that align with their unique goals and risk tolerance. Wealth management platforms that offer customization and personalization features are in high demand to meet these expectations.

● 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐭𝐫𝐚𝐧𝐬𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧:

Digital transformation allows wealth management platforms to offer online and mobile access, making it easier for clients to manage their investments, view portfolios, and conduct transactions anytime and anywhere. This increased accessibility drives higher adoption rates and client satisfaction. Advanced digital tools enable wealth management platforms to provide highly personalized services. Using data analytics and AI, platforms can offer tailored investment recommendations, customized financial plans, and targeted advice based on individual client profiles and preferences. Automation of routine tasks, such as portfolio rebalancing, transaction processing, and report generation, reduces operational costs and enhances efficiency. Digital platforms streamline these processes, allowing wealth managers to focus on more strategic tasks and improve overall service delivery.

● 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐢𝐜𝐚𝐥 𝐚𝐝𝐯𝐚𝐧𝐜𝐞𝐦𝐞𝐧𝐭𝐬:

The integration of artificial intelligence (AI) and machine learning (ML) into wealth management platforms allows for sophisticated data analysis and predictive modeling. These technologies enable platforms to provide personalized investment advice, optimize portfolios, and anticipate market trends more accurately. Technology enables the automation of portfolio management tasks, such as rebalancing and asset allocation. Robo-advisors, which use algorithms to manage investments, are becoming increasingly popular for their efficiency and cost-effectiveness, attracting a wider range of clients. The use of big data analytics allows wealth management platforms to process and analyze vast amounts of data from various sources. This helps in gaining insights into market conditions, client behavior, and investment performance, leading to more informed decision-making and tailored investment strategies.

𝐁𝐮𝐲 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/checkout?id=5096&method=502

𝐖𝐞𝐚𝐥𝐭𝐡 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧:

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐀𝐝𝐯𝐢𝐬𝐨𝐫𝐲 𝐌𝐨𝐝𝐞𝐥:

● Hybrid

● Robo Advisory

● Human Advisory

Human advisory represents the largest segment. Human advisors offer personalized, trust-based financial advice that remains highly valued by clients, especially for complex wealth management needs.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐃𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭 𝐌𝐨𝐝𝐞:

● On-premises

● Cloud-based

Cloud-based accounts for the majority of the market share as cloud-based platforms offer scalability, flexibility, and cost-efficiency, making them the preferred choice for wealth management firms.

𝐁𝐫𝐞𝐚𝐤𝐮𝐩 𝐁𝐲 𝐑𝐞𝐠𝐢𝐨𝐧:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America enjoys the leading position in the wealth management platform market on account of its large concentration of high-net-worth individuals (HNWIs) and strong adoption of advanced financial technologies.

𝐓𝐨𝐩 𝐖𝐞𝐚𝐥𝐭𝐡 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐋𝐞𝐚𝐝𝐞𝐫𝐬:

The wealth management platform market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

● Avaloq (NEC Corporation)

● Backbase

● Broadridge Financial Solutions Inc.

● Comarch SA

● Crealogix AG

● Fidelity National Information Services Inc.

● Fiserv Inc.

● Infosys Limited

● Profile Systems and Software S.A.

● Prometeia S.p.A

● SEI Investments Company

● SS&C Technologies Inc.

● Tata Consultancy Services Limited

● Temenos Headquarters SA.

𝐀𝐬𝐤 𝐀𝐧𝐚𝐥𝐲𝐬𝐭 𝐟𝐨𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/request?type=report&id=5096&flag=C

𝐈𝐟 𝐲𝐨𝐮 𝐫𝐞𝐪𝐮𝐢𝐫𝐞 𝐚𝐧𝐲 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐭𝐡𝐚𝐭 𝐢𝐬 𝐧𝐨𝐭 𝐜𝐨𝐯𝐞𝐫𝐞𝐝 𝐜𝐮𝐫𝐫𝐞𝐧𝐭𝐥𝐲 𝐰𝐢𝐭𝐡𝐢𝐧 𝐭𝐡𝐞 𝐬𝐜𝐨𝐩𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭, 𝐰𝐞 𝐰𝐢𝐥𝐥 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐭𝐡𝐞 𝐬𝐚𝐦𝐞 𝐚𝐬 𝐚 𝐩𝐚𝐫𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wealth Management Platform Market Size Worth USD 14.0 Billion by 2033 | Grow CAGR by 10.88% here

News-ID: 3796871 • Views: …

More Releases from IMARC Group

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

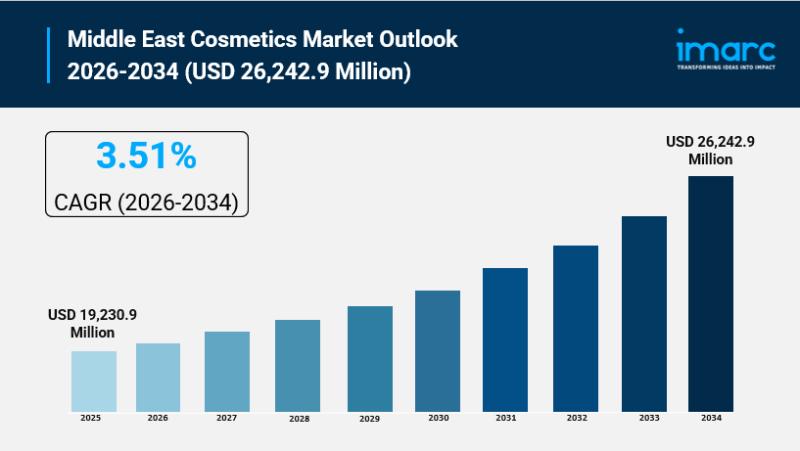

Middle East Cosmetics Market Size to Surpass USD 26,242.9 Million by 2034, at a …

Middle East Cosmetics Market Overview

Market Size in 2025: USD 19,230.9 Million

Market Size in 2034: USD 26,242.9 Million

Market Growth Rate 2026-2034: 3.51%

According to IMARC Group's latest research publication, "Middle East Cosmetics Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East cosmetics market size reached USD 19,230.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 26,242.9 Million by 2034, exhibiting a growth rate…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…