Press release

ESG Reporting Software Market Expected to Hit US$ 2,667.1 Million by 2031

IntroductionEnvironmental, Social, and Governance (ESG) reporting has become a critical aspect of corporate strategy as companies are increasingly held accountable for their sustainability and ethical practices. As regulatory requirements intensify and investors demand more transparency on corporate ESG performance, the demand for ESG reporting software has grown substantially. These software solutions enable businesses to measure, manage, and report on their ESG impacts, ensuring compliance with regulations while demonstrating a commitment to sustainability.

The ESG reporting software market is experiencing rapid growth, with an estimated value of US$ 978.6 million in 2024. According to Persistence Market Research, the market is predicted to expand significantly, reaching a value of US$ 2,667.1 million by 2031, growing at a compound annual growth rate (CAGR) of 15.4% during the forecast period. This growth is fueled by the increasing adoption of ESG practices across industries, growing investor interest in sustainable business operations, and the evolving regulatory landscape around corporate responsibility.

Market Projections and Forecast

The ESG reporting software market is poised for substantial growth, with projections indicating that the market will increase from US$ 978.6 million in 2024 to US$ 2,667.1 million by 2031. The market is expected to achieve a robust CAGR of 15.4% over the forecast period, driven by several key factors including tightening regulations on corporate sustainability disclosures, an increase in ESG-conscious investment, and growing organizational demand for integrated ESG solutions.

The increasing focus on sustainability, ethical governance, and social responsibility across sectors has made ESG reporting a key component of business operations. The software solutions designed to meet ESG reporting needs are becoming essential tools for companies aiming to not only comply with regulatory requirements but also align with global sustainability standards.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/34966

Market Dynamics

Drivers of Market Growth

Increasing Regulatory Requirements

One of the primary drivers of the ESG reporting software market is the rise in regulatory frameworks mandating ESG disclosures. Governments and regulatory bodies worldwide are implementing more stringent ESG reporting requirements. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) and the Securities and Exchange Commission's (SEC) push for enhanced ESG disclosure in the U.S. are examples of regulations compelling organizations to adopt comprehensive ESG reporting solutions.

Rising Investor Scrutiny

Investors are increasingly prioritizing ESG factors when making investment decisions, with a growing emphasis on sustainability performance, social responsibility, and governance practices. This trend is being driven by both institutional investors and individual stakeholders, who seek greater transparency in the companies they invest in. As a result, businesses are turning to ESG reporting software to provide accurate, standardized, and easily accessible ESG data to satisfy investor expectations.

Corporate Focus on Sustainability and Ethical Governance

As sustainability becomes a strategic priority for companies, there is a stronger focus on transparency and accountability in corporate governance. ESG reporting software is becoming an integral part of corporate sustainability initiatives, helping companies track and report their environmental and social impacts. This is particularly important as organizations strive to meet their ESG targets and communicate their progress to stakeholders.

Challenges in the Market

While the ESG reporting software market is expanding, there are several challenges that businesses and software providers must address:

Lack of Standardization in ESG Metrics

The absence of universally accepted ESG metrics and reporting standards can make it difficult for companies to ensure compliance with global regulations. Different regions and industries may have varying ESG requirements, creating complexities for businesses in terms of reporting consistency. While software can help streamline this process, a lack of standardization remains a key challenge in the market.

High Implementation Costs

The initial cost of implementing ESG reporting software can be a barrier for smaller organizations or those with limited resources. In addition to the software itself, companies must also invest in training, data integration, and ongoing maintenance. These costs can deter some organizations from adopting ESG solutions, especially in markets where ESG compliance is not yet mandatory.

Data Quality and Availability

The effectiveness of ESG reporting software relies heavily on the quality and accuracy of the data entered into the system. Companies must ensure that they have access to accurate, comprehensive, and up-to-date data across environmental, social, and governance areas. However, collecting and verifying this data can be time-consuming and complex, especially for organizations with global operations or those in industries with less developed ESG data systems.

Market Trends and Technological Innovations

The ESG reporting software market is evolving rapidly, with several key trends and innovations shaping its growth.

AI and Machine Learning Integration

Artificial intelligence (AI) and machine learning (ML) technologies are increasingly being integrated into ESG reporting software to automate data collection, analysis, and reporting. AI can help identify patterns in ESG data, predict future trends, and provide actionable insights for decision-making. By automating time-consuming tasks, AI-powered software solutions enable companies to focus on strategic aspects of ESG management.

Cloud-Based Solutions

Cloud computing is revolutionizing the ESG reporting software market by providing scalable, cost-effective solutions for businesses of all sizes. Cloud-based software allows for real-time updates, remote accessibility, and enhanced collaboration among teams across different locations. As more companies move to the cloud, ESG reporting software solutions are becoming more accessible, reducing the burden of managing on-premises infrastructure.

Customization and Integration with Existing Systems

ESG reporting software is becoming increasingly customizable to meet the specific needs of different industries. Companies are seeking software that can integrate with existing enterprise resource planning (ERP), customer relationship management (CRM), and supply chain management systems. By providing a seamless integration experience, these solutions help businesses improve data accuracy and streamline the ESG reporting process.

Real-Time ESG Data Monitoring

Companies are increasingly focused on real-time ESG data monitoring, which enables them to track progress toward sustainability and governance goals in real time. This trend is driven by the desire for more timely and actionable insights, as well as the growing expectation from stakeholders for up-to-date ESG performance information.

ESG Reporting Software Market Segmentation

By Deployment Type

Cloud-Based

On-Premise

By Application

Environmental Reporting

Social Reporting

Governance Reporting

By End User

Corporations

Financial Institutions

Government Agencies

Non-Profit Organizations

By Region

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

Regional Analysis

North America

North America is expected to be the largest market for ESG reporting software, driven by strong regulatory frameworks, such as the SEC's increasing focus on ESG disclosures, and a growing corporate emphasis on sustainability. The U.S. is home to many global financial institutions and corporations, which are under pressure to provide transparent and accurate ESG data to their investors and stakeholders.

Europe

Europe is another key market for ESG reporting software, with the European Union leading global efforts to implement comprehensive sustainability regulations. The EU's CSRD is expected to increase the demand for ESG reporting solutions as companies are required to comply with stricter reporting standards. Additionally, European businesses are increasingly investing in ESG reporting to stay competitive in the region's environmentally conscious market.

Asia Pacific

The Asia Pacific region is expected to witness significant growth in the ESG reporting software market due to increasing awareness of sustainability issues, particularly in China and India. As companies in this region face rising pressure from investors and governments to adopt sustainable practices, the demand for ESG reporting solutions is expected to rise.

Key Companies Profiled in the Report

SAP

Microsoft

Enablon (Wolters Kluwer)

Measurabl

Intelex Technologies

SIERA (Sustainability, Environment, and Reporting Analysis)

Workiva

EcoReal

Sustainalytics

Future Outlook

The ESG reporting software market is positioned for robust growth, driven by an increasing demand for transparency, accountability, and sustainability in business operations. As global regulatory frameworks become more stringent and investors continue to prioritize ESG factors, the market for ESG reporting software will expand significantly. Technological advancements, such as AI and machine learning, will further enhance the capabilities of these software solutions, making them more efficient and actionable for organizations of all sizes.

The market's future is also tied to the broader adoption of sustainability practices across industries, with businesses seeking to not only comply with regulatory requirements but also demonstrate their commitment to ethical governance and social responsibility. As ESG becomes an integral part of business strategy, the demand for comprehensive, accurate, and real-time ESG reporting solutions will continue to rise.

Conclusion

The ESG reporting software market is set for substantial growth in the coming years, with the global market expected to reach US$ 2,667.1 million by 2031. Driven by regulatory pressure, investor demand, and a growing focus on sustainability, the market presents significant opportunities for software providers and businesses alike. As companies seek to align with global sustainability standards and showcase their ESG performance, ESG reporting software will play a central role in ensuring transparency and driving positive change in corporate governance practices.

Read More Trending "PMR Exclusive Article":

• https://www.linkedin.com/pulse/how-floor-screed-market-revolutionizing-construction-ajaykumar-patil-jxvjf

• https://www.linkedin.com/pulse/smart-water-management-market-key-technologies-ajay-patil-1w64f/

• https://www.linkedin.com/pulse/outboard-engines-market-driving-growth-recreational-boating-xyf9f

• https://www.linkedin.com/pulse/paints-coatings-market-innovations-anti-corrosion-durability-patil-y2agf/

• https://www.linkedin.com/pulse/quantum-computing-its-impact-future-technology-pratibha-shinde-fqqsf/

• https://www.linkedin.com/pulse/understanding-nickel-alloy-market-its-impact-industries-zuy2f/

• https://www.linkedin.com/pulse/system-integration-improved-security-risk-management-pratibha-shinde-nx5xf/

• https://www.linkedin.com/pulse/recycled-plastics-market-plastic-waste-management-ajay-patil-aewtf/

• https://www.linkedin.com/pulse/recycled-pet-market-impact-global-plastic-7liqf/

• https://www.linkedin.com/pulse/plastic-rubber-composite-market-potential-design-ajaykumar-patil-qyttf

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ESG Reporting Software Market Expected to Hit US$ 2,667.1 Million by 2031 here

News-ID: 3784670 • Views: …

More Releases from Persistence Market Research

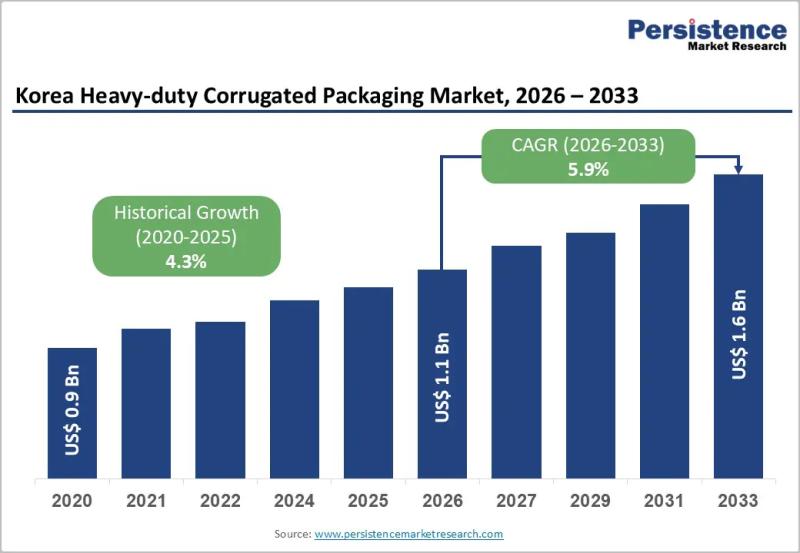

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…